Illinois financial services background checks are comprehensive evaluations mandated by the IDFPR that examine credit history, criminal records, and professional qualifications to ensure only qualified individuals work in sensitive financial positions. These checks, particularly under the Residential Mortgage License Act (RMLA), require minimum credit scores of 650, clean criminal records, and verified financial responsibility to maintain industry integrity and consumer protection.

Key Takeaways

- Illinois financial services background checks are mandatory IDFPR requirements covering credit history (7-10 years), criminal records, professional licensing, employment verification, and character assessments for banking, mortgage, insurance, and investment roles.

- RMLA compliance demands a minimum 650 credit score, no felony convictions, verified financial responsibility, and professional competency for mortgage industry positions in Illinois.

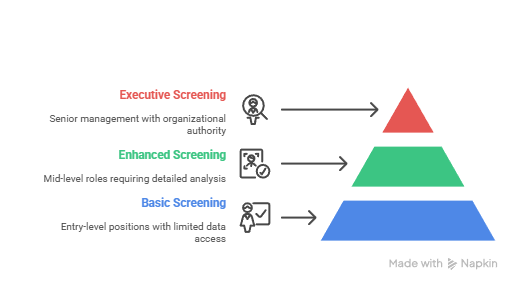

- Three-tier IDFPR screening levels range from basic credit/criminal checks (Level 1) to enhanced professional reference reviews (Level 2) to comprehensive executive screening with international checks (Level 3).

- Job seekers must prepare by obtaining credit reports, gathering documentation, addressing discrepancies proactively, and preparing transparent explanations for any employment gaps or financial issues.

- Legal protections under FCRA and Illinois law guarantee free annual credit reports, dispute rights, pre-adverse action notices, and ban-the-box protections that prevent early criminal history inquiries.

- Comprehensive background check costs range from $300-$500, with additional IDFPR licensing fees, renewal costs, and potential third-party service charges that employers must cover under Illinois law.

Introduction

Understanding Illinois financial services background checks is essential for banking, mortgage, insurance, and investment careers. The Illinois Department of Financial and Professional Regulation (IDFPR) requires comprehensive screening processes. These checks evaluate financial responsibility, criminal history, and professional qualifications. The Residential Mortgage License Act (RMLA) sets specific requirements for mortgage professionals. Job seekers and HR professionals must understand these requirements for success in Illinois's regulated financial sector.

Understanding Illinois Financial Background Check Requirements

Illinois financial background checks assess individual suitability for financial services positions. The IDFPR requires these checks to verify financial responsibility and professional integrity. Candidates must have clean legal standing for roles involving money management and client confidentiality. These screenings cover 7-10 years of financial and criminal history.

The screening process includes multiple verification layers. Credit history analysis covers financial responsibility. State and federal criminal record searches check legal standing. Professional licensing verification confirms credentials. Employment history confirmation validates experience. Educational background checks verify qualifications. Character assessments use professional references. Each component builds a comprehensive candidate profile.

Financial institutions must conduct background checks before hiring employees. Mortgage companies, insurance agencies, and investment firms follow these requirements. Employees handle sensitive financial information and client assets. Employee misconduct can cause significant consumer harm and regulatory violations. Understanding these requirements helps navigate the screening process effectively.

IDFPR Background Check Process and Timeline

Application Submission and Initial Review

The IDFPR background check process begins with detailed application submission including personal information, employment history, educational credentials, and financial disclosures. Applicants must provide government-issued identification, Social Security verification, complete residential history, and signed consent forms authorizing comprehensive background screening. Initial application processing typically requires 1-2 business days for completeness verification and fee processing.

Documentation requirements include:

- Personal Information: Government-issued ID, Social Security card, residential address history

- Financial Records: Credit report authorization, bankruptcy filings, tax lien documentation

- Professional Credentials: Educational transcripts, professional certifications, employment verification

- Legal Disclosures: Criminal history forms, regulatory action statements, character affidavits

Missing or incomplete documentation represents the primary cause of processing delays, making thorough preparation essential for timely application processing.

Background Review and Verification Process

IDFPR conducts comprehensive background reviews over 10-15 business days. Investigators verify submitted information through multiple databases. They contact sources directly for verification. The process includes credit bureau reports and criminal record searches. Professional licensing verification confirms credentials. Employment confirmation contacts previous employers. Educational authentication uses accredited institutions. Additional documentation requests can add 3-5 business days.

The verification process uses the Illinois State Police CHIRP system for criminal checks. National credit reporting agencies provide financial history. Direct contact verifies educational credentials and employment. IDFPR maintains strict quality control standards. Multiple source verification is required for critical information. All findings receive thorough documentation.

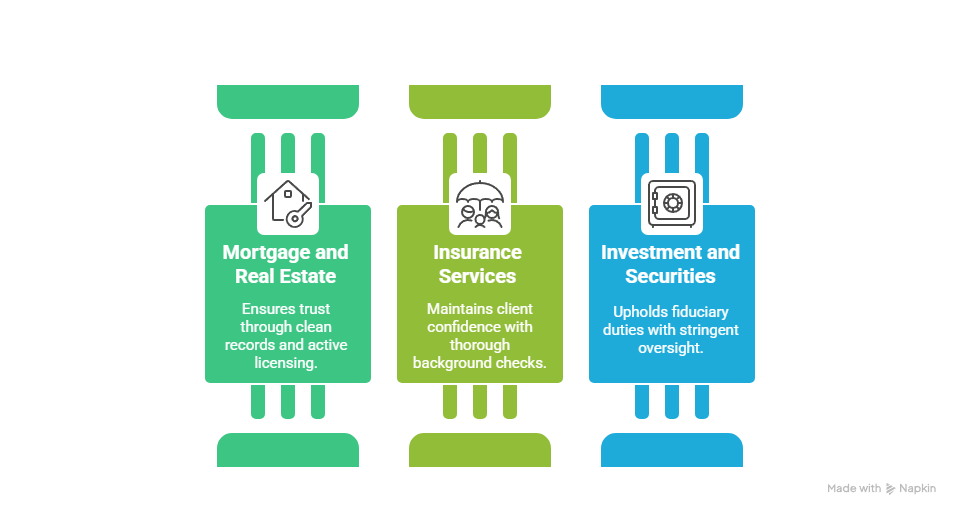

Industries Requiring Financial Background Checks in Illinois

Illinois law requires comprehensive background checks across financial services sectors. Each sector has specific regulatory requirements and screening protocols. Banking and credit union positions need extensive evaluation. Credit history, criminal screening, and employment verification are mandatory. Employees access customer financial information and institutional assets. Commercial bank employees and loan officers undergo Level 1 or Level 2 screening.

Mortgage and Real Estate Finance positions follow RMLA requirements. Clean financial and criminal records ensure client trust. Loan originators and mortgage brokers need active licensing. Professional competency and financial responsibility must be verified.

Insurance services including agents and claims adjusters require background checks. These roles involve significant decision-making authority affecting client outcomes.

Investment and Securities professionals face the most stringent requirements. IDFPR oversight includes comprehensive Level 3 background checks for senior positions. Investment advisors and securities brokers undergo extensive screening. Their fiduciary responsibilities and financial impact on clients require thorough evaluation.

Residential Mortgage License Act (RMLA) Compliance Standards

RMLA Background Check Requirements

The Residential Mortgage License Act establishes specific standards for mortgage industry professionals, requiring minimum credit scores of 650, clean criminal records with no felony convictions, and verified financial responsibility through documented payment history and debt management. Professional competency requirements include relevant education, industry certifications, and demonstrated experience in mortgage lending or related financial services. Character and fitness assessments evaluate professional references, regulatory compliance history, and ethical conduct through previous employment verification.

RMLA compliance verification includes:

- Credit Score Verification: Minimum 650 FICO score with stable payment history

- Criminal Background Screening: No felony convictions, limited misdemeanor exceptions

- Financial Responsibility Documentation: Debt-to-income ratios, bankruptcy history, tax compliance

- Professional Competency Assessment: Education credentials, industry certifications, experience verification

Common RMLA Disqualifying Factors

Financial disqualifiers under RMLA have specific criteria. Recent bankruptcy filings within 7 years disqualify candidates. Foreclosure history raises red flags. Significant unpaid tax liens indicate poor financial management. Patterns of delinquent debt payments suggest inability to provide sound financial advice.

Criminal disqualifiers are strictly enforced. Any felony convictions disqualify applicants. Fraud, theft, or financial crimes are particularly serious. Pending criminal charges prevent approval. Unresolved regulatory violations from previous employment also disqualify candidates.

Recent legislative updates expanded RMLA oversight. Social media background checks are now included. Enhanced character reference requirements reflect evolving standards. Applicants with disqualifying factors may seek waivers. Documented rehabilitation evidence is required. Character references from industry professionals help. Demonstrated financial recovery over time may qualify for exceptions.

IDFPR Background Check Levels and Screening Types

The IDFPR uses three distinct screening levels. Position responsibilities and risk assessment determine the level required.

Level 1 Basic Screening targets entry-level positions. These roles have limited access to sensitive financial data. Standard credit and criminal record reviews are sufficient. Bank tellers and customer service representatives typically require Level 1. This screening assesses basic suitability for routine financial transactions.

Level 2 Enhanced Screening applies to mid-level management positions. Client-facing roles require detailed financial analysis. Professional reference verification is mandatory. Financial advisors and loan officers undergo enhanced screening. Comprehensive professional reference checks are included. Disciplinary record reviews verify professional conduct. Detailed employment history verification confirms experience.

Level 3 Executive Screening is the most comprehensive evaluation. Senior management and executives require this level. Positions with substantial organizational authority need thorough screening. International record searches are included. Extensive public records review covers all aspects. Multiple professional and personal references provide character assessment. Bank presidents and compliance officers typically undergo Level 3 screening.

Preparing for Your Illinois Financial Background Check

Effective preparation starts with credit report review. Obtain reports from all three major credit bureaus. Identify and correct any inaccuracies before employer screening. Credit report errors occur frequently. They can significantly impact employment decisions. Request free annual reports through annualcreditreport.com. Dispute incorrect information immediately. Resolution can take 30-60 days.

Document organization is a critical preparation step. Assemble all relevant paperwork in advance. Include identification documents and educational transcripts. Professional certifications and employment verification records are essential. Legal disclosure forms must be completed accurately. Maintain organized files with easy access. This prevents processing delays and demonstrates professionalism.

Address employment gaps with clear explanations. Career transitions need supporting documentation. Education records can explain time away from work. Volunteer work verification shows productive activity. Family care documentation provides context for employment breaks. Clear explanations and supporting documents help employers understand your background.

- Credit Report Review: Obtain reports from Experian, Equifax, and TransUnion; dispute inaccuracies immediately

- Document Assembly: Organize ID, transcripts, certifications, employment records, legal disclosures

- Gap Explanations: Prepare clear narratives for employment breaks with supporting documentation

- Reference Preparation: Contact character and professional references; provide contact information and context

- Legal Issue Disclosure: Gather court documents showing resolution of any criminal or civil matters

Transparency and honesty throughout the preparation process demonstrate integrity and professional responsibility, qualities highly valued in financial services hiring decisions.

Legal Rights and Consumer Protections

Fair Credit Reporting Act (FCRA) Rights

The Fair Credit Reporting Act provides comprehensive consumer protection during background check processes, guaranteeing free annual credit reports from major credit bureaus and establishing dispute resolution procedures for incorrect information. Employers must obtain written consent before conducting background checks and provide pre-adverse action notices if negative findings might influence hiring decisions. These protections ensure transparency and provide opportunities for candidates to address potential issues before final employment decisions.

FCRA requirements include:

- Free Annual Credit Reports: Access to reports from Experian, Equifax, TransUnion

- Dispute Resolution Rights: 30-day investigation periods for challenged information

- Pre-Adverse Action Notices: Advance warning of potential negative hiring decisions

- Background Report Copies: Right to receive copies of all background check reports used in hiring decisions

Illinois State Employment Protections

Illinois employment law provides additional protections beyond federal FCRA requirements, including ban-the-box provisions preventing early criminal history inquiries and restrictions on credit check usage unless financial responsibility represents an essential job function. The Illinois Right to Privacy in the Workplace Act limits employer access to personal information and requires secure handling of background check data. These state-level protections create a more equitable hiring environment by ensuring qualifications-based initial evaluation rather than background-based elimination.

State protections encompass salary history inquiry restrictions in Chicago, expanded notice requirements for adverse employment actions, and enhanced data security standards for personal information handling during background check processes. Understanding these rights empowers job seekers to ensure fair treatment and enables employers to maintain compliant hiring practices.

Common Background Check Challenges and Solutions

Credit report errors represent the most frequent challenge in Illinois financial services background checks, with studies showing inaccuracies in up to 25% of consumer credit files. Proactive error identification and dispute resolution through formal credit bureau procedures typically resolve these issues within 30-60 days when supported by proper documentation. The Fair Credit Reporting Act mandates that credit bureaus investigate disputed information promptly and correct verified inaccuracies, making early preparation essential for avoiding hiring delays.

Employment gaps often raise concerns during background screening, but transparent explanations supported by documentation can address employer questions effectively. Whether due to education, family responsibilities, health issues, or career transitions, honest communication about gap periods demonstrates integrity and professional responsibility. Prepare concise explanations accompanied by relevant documentation such as educational transcripts, medical records, or volunteer work verification to provide context for employment interruptions.

Minor criminal history issues may not automatically disqualify candidates, particularly when accompanied by evidence of rehabilitation and character growth. Obtain court documents showing case resolution, completion of required programs, and character references from credible sources who can attest to personal and professional development since any legal issues occurred. Many financial institutions evaluate criminal history within the context of job relevance, rehabilitation evidence, and overall character assessment rather than applying automatic disqualification policies.

Cost Structure and Fee Information

Comprehensive Illinois financial services background checks typically cost between $300-$500, covering credit reports, criminal history searches, and professional credential verification required for most financial services positions. However, Illinois law under 820 ILCS 175/30 prohibits employers from requiring job applicants to pay any portion of background check costs, making these employer-paid expenses rather than candidate responsibilities. This protection ensures equal access to employment opportunities regardless of individual financial circumstances.

| Cost Category | Typical Range | Employer Responsibility |

| Basic Background Check | $50-$150 | Required to pay |

| Comprehensive Financial Screening | $300-$500 | Required to pay |

| IDFPR Licensing Fees | $100-$300 | Varies by agreement |

Additional fees may include IDFPR licensing costs for initial applications and renewals, penalties for late renewal submissions, and third-party services for credit monitoring or international background checks. These supplementary costs vary based on specific position requirements and employer policies, but comprehensive screening investments typically provide long-term value through reduced turnover, improved compliance, and enhanced consumer trust.

Best Practices for Employers and Staffing Agencies

Implementing compliant background check procedures requires understanding federal FCRA requirements and Illinois-specific regulations including the Job Opportunities for Qualified Applicants Act (ban-the-box law) and employment discrimination protections. Establish standardized procedures applying consistent screening protocols to all candidates for similar positions, maintaining detailed documentation of consent, findings, and decision-making processes. Regular staff training on evolving regulations ensures ongoing compliance and reduces legal risks associated with discriminatory practices.

Effective communication throughout the screening process builds candidate trust and demonstrates organizational professionalism. Clearly explain background check procedures, expected timelines, and candidate rights under federal and state law. Provide pre-adverse action notices when required and offer opportunities for candidates to explain or contest negative findings before making final hiring decisions.

Technology integration through AI-powered screening tools and blockchain-based verification systems can improve accuracy, reduce processing time, and enhance data security in background check operations. However, maintain human oversight for complex cases requiring nuanced evaluation of character, rehabilitation, or extenuating circumstances that automated systems cannot adequately assess.

Conclusion

Illinois financial services background checks represent essential safeguards protecting consumers and maintaining industry integrity through comprehensive evaluation of candidate qualifications, financial responsibility, and professional conduct. Understanding IDFPR requirements, RMLA compliance standards, and legal protections enables both job seekers and employers to navigate the screening process effectively while ensuring full regulatory compliance. Proper preparation, transparent communication, and adherence to best practices create successful outcomes for all parties involved in the hiring process. As technology and regulations continue evolving, staying informed about current requirements and emerging trends remains crucial for maintaining compliant, effective background screening programs in Illinois's dynamic financial services sector.

Frequently Asked Questions

What does a background check show in Illinois?

A background check in Illinois typically includes criminal records, employment history, education verification, credit history, driving records, and professional licenses. The scope depends on the position and employer requirements.

How do I check my background in Illinois?

You can check your background in Illinois by requesting a report through the Illinois State Police CHIRP system or using authorized background check services. You'll need government-issued identification and may pay applicable fees.

What is the background check for the Illinois bar?

The Illinois bar requires character and fitness evaluation including criminal records review, financial responsibility assessment, and professional conduct investigation. This ensures integrity of future attorneys practicing law in Illinois.

What is a level 2 background check in Illinois?

A level 2 background check in Illinois involves fingerprint-based screening often required for positions with vulnerable populations, such as education or healthcare, providing more comprehensive criminal history verification.

What background check do most employers use?

Most employers use comprehensive checks covering criminal records, employment and education verification, credit history (when job-relevant), and professional reference verification tailored to specific position requirements.

How much is a background check in Illinois?

Background check costs in Illinois range from $30-$100 for basic checks to $300-$500 for comprehensive financial services screening, though employers must pay these costs under state law.

How long does a background check take in Illinois?

Background checks in Illinois typically take 1-4 weeks depending on the scope, with IDFPR financial services checks requiring 10-15 business days for comprehensive review and verification.

Can an employer run a background check without my permission in Illinois?

No, Illinois employers must obtain written consent before conducting background checks and must inform you if negative findings influence their hiring decision under FCRA requirements.

What can disqualify you from working in Illinois due to a background check?

Disqualifying factors may include relevant felony convictions, financial crimes, professional licensing violations, or other issues directly related to job responsibilities and public safety concerns.

Do traffic violations show up on an Illinois background check?

Minor traffic violations typically don't appear on employment background checks, but serious violations like DUI convictions may appear and could impact positions requiring driving or demonstrating good judgment.

Additional Resources

- Illinois Department of Financial and Professional Regulation (IDFPR) Official Website

https://idfpr.illinois.gov - Illinois State Police Criminal History Record Information (CHIRP) System

https://www.isp.state.il.us/crimhistory/ - Fair Credit Reporting Act (FCRA) Consumer Rights Guide

https://www.consumer.ftc.gov/articles/pdf-0096-fair-credit-reporting-act.pdf - Illinois Residential Mortgage License Act Complete Text

https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=2357 - Annual Credit Report Request Service (Official Federal Site)

https://www.annualcreditreport.com - Illinois Human Rights Commission Employment Discrimination Guidelines

https://www2.illinois.gov/dhr/Pages/default.aspx - IDFPR Background Check Processing Timeline and Requirements

https://idfpr.illinois.gov/licenselookup/ - Illinois Job Opportunities for Qualified Applicants Act (Ban the Box)

https://www2.illinois.gov/idol/Laws-Rules/FLS/Pages/ban-the-box.aspx

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Which ATS Ecosystems Speed Up Compliance? 10 Background Screening Workflows Compared

20 Jan, 2026 • 18 min read

Pharmaceutical Industry Hiring Compliance: A 2026 Guide to Risk-Intelligent Screening

20 Jan, 2026 • 19 min read

How to Background Check Substitute Teachers: 2026 Strategic Framework

19 Jan, 2026 • 18 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.