California financial sector background checks are comprehensive screening processes mandated by federal and state regulations to ensure employee trustworthiness in handling sensitive financial data and consumer information. These background checks typically include criminal history, credit reports, employment verification, and regulatory database searches, with specific compliance requirements under the Fair Credit Reporting Act (FCRA) and California Consumer Privacy Act (CCPA).

Key Takeaways

- California financial institutions must conduct thorough background checks that comply with both federal FCRA requirements and state-specific privacy regulations.

- Financial sector background screenings typically include criminal history, credit checks, employment verification, and searches of industry-specific databases like FINRA BrokerCheck.

- Employers must provide proper disclosure and obtain written consent before conducting background checks, with additional notification requirements for adverse hiring decisions.

- Certain financial crimes and convictions may permanently disqualify candidates from positions involving fiduciary responsibilities or access to customer data.

- The background check process for financial sector positions typically takes 5-10 business days, depending on the scope of verification required.

- California's "ban the box" legislation affects how employers can inquire about criminal history during the initial application process.

What is a California Financial Sector Background Check?

A California financial sector background check represents a comprehensive screening process designed specifically for employees and job candidates in banking, investment, insurance, and other financial services industries. These specialized background investigations go beyond standard employment screenings to meet strict regulatory requirements established by federal agencies such as the Federal Deposit Insurance Corporation (FDIC), Securities and Exchange Commission (SEC), and Financial Industry Regulatory Authority (FINRA). The complexity of these checks reflects the high level of trust and responsibility inherent in financial sector positions.

Financial sector background checks serve multiple critical purposes within California's robust financial services industry, which employs over 750,000 people across the state as of 2024. They protect consumers from fraud and financial crimes while ensuring compliance with federal banking regulations that have become increasingly stringent following major financial scandals and data breaches. Additionally, these screenings help financial institutions maintain their reputations and avoid costly regulatory penalties that can reach millions of dollars for compliance failures.

The scope of financial background screening extends to various positions within the industry, each requiring different levels of scrutiny based on risk exposure and regulatory requirements. Entry-level bank tellers, loan officers, investment advisors, insurance agents, and senior executives all undergo different levels of scrutiny based on their access to sensitive information and fiduciary responsibilities. Even support staff who handle customer data or have access to financial systems may require specialized screening procedures to ensure comprehensive security.

Types of Financial Institutions Subject to Enhanced Screening

California's diverse financial landscape includes numerous institution types, each with specific background check requirements. Commercial banks, credit unions, investment firms, insurance companies, mortgage brokers, and fintech companies all operate under different regulatory frameworks but share common screening obligations. The emergence of digital banking and cryptocurrency platforms has expanded the scope of financial sector background checks to include technology-focused roles that handle sensitive financial data.

State-chartered institutions follow California Department of Financial Protection and Innovation guidelines, while federally chartered banks must comply with Office of the Comptroller of the Currency requirements. This dual regulatory structure creates complexity for multi-state financial institutions operating in California, requiring careful coordination of screening procedures across different jurisdictions.

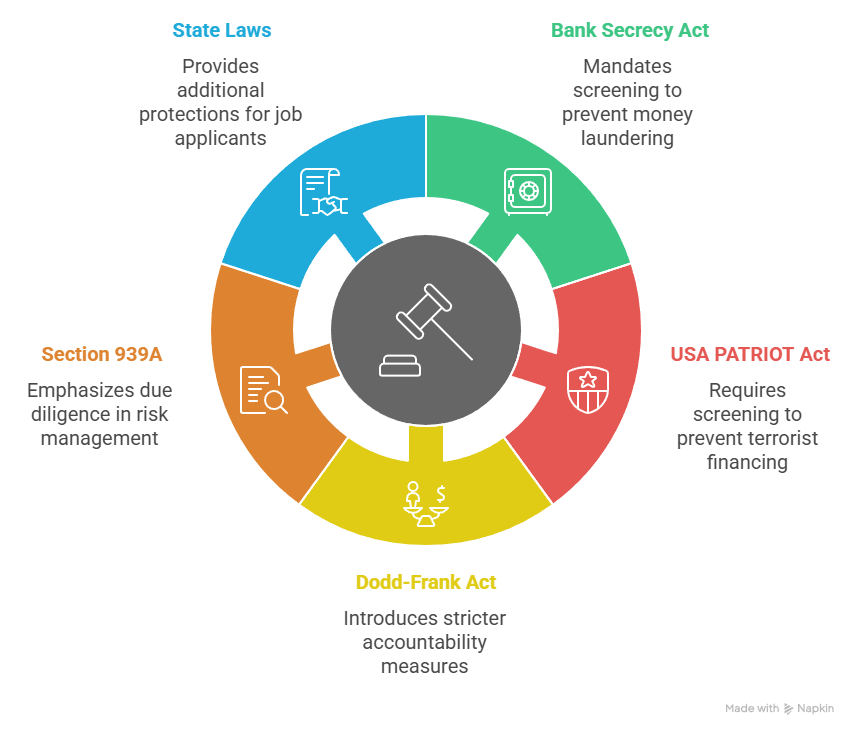

Legal Requirements for Financial Background Checks in California

California financial institutions must navigate a complex web of federal and state regulations when conducting employee background screenings. The Fair Credit Reporting Act (FCRA) establishes baseline requirements for all consumer reporting, while California's additional privacy laws create more stringent protections for job applicants. Understanding these overlapping requirements is essential for maintaining compliance and avoiding costly legal challenges.

- Federal regulations require financial institutions to conduct background checks on employees with access to customer information or involvement in financial transactions

- The Bank Secrecy Act and USA PATRIOT Act mandate specific screening procedures to prevent money laundering and terrorist financing, with updated guidance issued annually by the Financial Crimes Enforcement Network (FinCEN)

- The Dodd-Frank Wall Street Reform Act introduced enhanced accountability measures for financial institutions, including stricter background check requirements for executives and key personnel

- Section 939A of Dodd-Frank specifically addresses due diligence requirements for financial institutions, emphasizing the importance of thorough background screening in risk management

- Federal requirements apply uniformly across all states, including California, but state laws can provide additional protections for job applicants

- California institutions must demonstrate compliance with federal mandates while respecting state privacy rights and fair hiring practices

These federal requirements create a comprehensive framework for financial sector screening that serves as the foundation for all background check procedures. California institutions must build upon these federal mandates while incorporating additional state-level protections and requirements.

State-Specific Compliance Requirements

California's regulatory environment adds several layers of complexity to financial sector background checks, requiring employers to balance federal requirements with state consumer protections:

- California Consumer Privacy Act (CCPA): Provides additional data protection rights for job applicants, including the right to know what personal information is collected and how it's used

- Fair Employment and Housing Act (FEHA): Prohibits discrimination based on protected characteristics and requires individualized assessments of criminal history

- Ban the Box legislation: Restricts initial criminal history inquiries during application process, delaying such questions until conditional job offers

- California Civil Code Section 1786: Governs investigative consumer reports used in employment decisions, with stricter consent and disclosure requirements than federal law

- Assembly Bill 1008: Limits the use of credit reports in employment decisions, with specific exceptions for financial sector positions

Regulatory Agency Oversight

Multiple agencies oversee different aspects of financial sector background checks in California, creating a complex compliance landscape that requires careful navigation. The California Department of Financial Protection and Innovation regulates state-chartered banks and credit unions, issuing guidance on acceptable screening practices and investigating compliance violations. The Department of Insurance oversees insurance industry background check requirements, with specific focus on agent licensing and consumer protection.

Meanwhile, federal agencies like the Office of the Comptroller of the Currency maintain jurisdiction over nationally chartered banks, creating potential conflicts between state and federal requirements. The Federal Reserve supervises bank holding companies and state member banks, while the FDIC oversees state non-member banks and savings associations. Each agency may have slightly different interpretations of background check requirements, necessitating careful legal review of screening procedures.

Components of Financial Sector Background Screening

Financial sector background checks encompass multiple verification components designed to assess candidate trustworthiness and regulatory compliance. Each component serves specific purposes in evaluating fitness for positions involving financial responsibilities, with the scope and depth of screening varying based on the position level and access to sensitive information. The comprehensive nature of these screenings reflects the unique regulatory environment and fiduciary responsibilities inherent in financial services positions.

- Criminal history verification: Comprehensive searches of county, state, and federal criminal databases, court records, arrest histories, and pending charges to identify disqualifying convictions

- Sex offender registry searches: Mandatory screening required by federal anti-terrorism legislation and banking security regulations to protect vulnerable populations

- Terrorist watch list screening: Verification against federal databases to comply with USA PATRIOT Act requirements and prevent security threats

- Credit and financial history assessment: Review of personal credit reports, payment histories, debt levels, and bankruptcy records to evaluate financial responsibility

- Employment history verification: Confirmation of previous positions, job responsibilities, performance, and reasons for leaving through direct employer contact

- Education and credential verification: Authentication of degrees, certifications, professional licenses, and specialized training relevant to financial sector positions

- Professional licensing checks: Verification of current license status and identification of any disciplinary actions or regulatory violations

- Reference interviews: Direct contact with former supervisors, colleagues, and professional references to assess character and work performance

The criminal background verification process must account for California's complex legal landscape regarding criminal history in employment decisions, including Fair Chance Act requirements for individualized assessments. These comprehensive screening components work together to provide financial institutions with the detailed information necessary to make informed hiring decisions while maintaining regulatory compliance.

Credit and Financial History Assessment

Credit reports play a crucial role in financial sector background checks, providing insights into candidates' personal financial management skills and potential vulnerability to financial pressure or fraud. Employers review credit histories to identify patterns of financial irresponsibility, excessive debt, or past bankruptcies that might indicate increased risk for fraud or theft. However, California's restrictions on credit report use require careful justification of business necessity.

| Credit Check Component | Purpose | Regulatory Basis | California Considerations |

| Payment History | Assess financial responsibility | FCRA compliance | Must demonstrate job relevance |

| Debt-to-Income Ratio | Evaluate financial stress indicators | Risk management | Privacy protection requirements |

| Bankruptcy Records | Identify past financial difficulties | Federal banking regulations | Time limitations may apply |

| Credit Utilization | Measure financial management skills | Industry best practices | Individual assessment required |

Financial institutions must balance the legitimate business need for credit information against California's restrictions on using credit reports for employment decisions. The process requires proper FCRA disclosures and candidate consent, with additional state-required notifications about the specific reasons for credit report use. Employers must also consider alternative assessment methods for candidates who lack traditional credit histories.

Employment and Education Verification

Thorough verification of employment history and educational credentials helps ensure candidates possess claimed qualifications and experience while identifying potential red flags such as unexplained gaps or inconsistencies. Financial institutions verify previous positions, job responsibilities, reasons for leaving, and supervisor feedback through direct contact with former employers. This process often reveals discrepancies between application information and actual work history.

Educational verification confirms degrees, certifications, and professional licenses relevant to financial sector positions, with particular attention to finance, accounting, and business-related credentials. The rise of diploma mills and fraudulent educational credentials has made this verification increasingly important for financial institutions. Professional licensing verification is particularly important for roles requiring specific credentials, such as insurance agents, investment advisors, and mortgage loan originators.

The employment verification process has become more challenging as employers increasingly limit the information they provide about former employees. Many companies now only confirm dates of employment and job titles, requiring background check companies to use alternative verification methods. This trend has led to increased reliance on payroll records, tax documents, and third-party verification services.

Industry-Specific Database Searches

Financial sector background checks include searches of specialized databases not typically accessed during standard employment screening. These industry-specific resources help identify candidates with regulatory violations or professional misconduct histories that might not appear in traditional criminal background checks. The comprehensive nature of these searches reflects the unique regulatory environment of the financial services industry.

FINRA BrokerCheck provides comprehensive information about current and former registered securities professionals, including employment history, regulatory actions, customer complaints, and criminal charges. This database contains records dating back several decades and includes both formal disciplinary actions and pending investigations. Investment firms and broker-dealers routinely search BrokerCheck as part of their hiring process, as federal regulations require disclosure of certain regulatory violations.

The Nationwide Multistate Licensing System (NMLS) maintains records for mortgage industry professionals, including loan originators, mortgage brokers, and company licenses. This database helps identify individuals with past violations of mortgage lending regulations or consumer protection laws, which became particularly important following the 2008 financial crisis. NMLS records include license status, disciplinary actions, and criminal background check results submitted by state regulators.

Insurance Industry Database Searches

Insurance companies utilize the National Insurance Producer Registry (NIPR) to verify agent licensing and identify disciplinary actions taken by state insurance departments. This centralized database provides real-time access to licensing information across all 50 states, helping employers verify credentials and identify potential regulatory issues. The System for Electronic Rates and Forms Filing (SERFF) provides additional regulatory information for insurance professionals, including market conduct examination results and consumer complaint patterns.

Banking institutions access the Federal Reserve's enforcement action database to identify individuals subject to regulatory sanctions or prohibition orders. These searches help identify former financial institution employees who have been permanently barred from the industry due to serious misconduct. The Office of the Comptroller of the Currency maintains similar records for nationally chartered banks, while the FDIC publishes enforcement actions against insured depository institutions and their personnel.

Emerging Database Resources

The financial services industry continues to develop new database resources to combat fraud and ensure regulatory compliance. The Financial Services Information Sharing and Analysis Center (FS-ISAC) maintains threat intelligence databases that help identify individuals associated with cybersecurity incidents or financial crimes. Blockchain-based verification systems are emerging as potential tools for verifying professional credentials and employment history.

Artificial intelligence and machine learning technologies are increasingly used to analyze patterns across multiple databases and identify potential risks that might not be apparent through individual searches. These advanced analytics help financial institutions make more informed hiring decisions while reducing the time required for comprehensive background checks.

Background Check Process and Timeline

The California financial sector background check process typically begins during the conditional job offer stage, following initial interviews and candidate selection. This timing helps ensure compliance with California's fair hiring laws while allowing employers to invest in comprehensive screening only for preferred candidates. Employers must provide proper FCRA disclosures and obtain written authorization before initiating background screening, with additional state-required notifications about the specific nature and scope of the investigation.

Initial database searches and basic verifications usually complete within 3-5 business days for straightforward cases involving candidates with stable employment histories and residence within California. However, comprehensive financial sector screenings often require 7-10 business days due to the extensive nature of regulatory database searches and professional reference checks. Complex cases involving international background verification or detailed regulatory reviews may extend timelines to 2-3 weeks, particularly for senior executive positions requiring enhanced due diligence.

The screening process involves multiple parallel verification tracks to maximize efficiency while ensuring thoroughness. Criminal history searches begin immediately upon receiving proper authorization, while employment and education verification may require additional time to contact references and confirm information. Credit reports are typically available within 24-48 hours, but regulatory database searches may take longer depending on system availability and the complexity of the candidate's professional history.

Documentation and Consent Requirements

California employers must provide clear, standalone disclosure documents explaining the background check process and candidate rights under FCRA and state law. These disclosures must be separate from employment applications and written in plain language that candidates can easily understand, avoiding legal jargon or complex regulatory references. The disclosure must specifically identify the types of background information that will be obtained and the business purposes for conducting the investigation.

Candidates must provide written consent authorizing the background check and confirming their understanding of the process. Electronic signatures are acceptable provided they meet California's digital consent requirements under the Uniform Electronic Transactions Act. Employers must retain consent documentation throughout the employment relationship and for at least three years after employment ends, as required by federal record-keeping regulations.

Quality Assurance and Verification Procedures

Financial institutions implement quality assurance procedures to ensure accuracy and completeness of background check results. This includes secondary verification of critical information, particularly criminal history records and regulatory violations that could disqualify candidates. Many employers require manual review of all background check results by qualified personnel before making final hiring decisions.

The verification process includes cross-referencing information across multiple databases to identify potential discrepancies or missing information. Advanced screening programs may include international background checks for candidates with foreign residence or employment history, requiring coordination with overseas investigative services and understanding of foreign legal systems.

Disqualifying Factors and Red Flags

Financial sector positions involve significant trust and fiduciary responsibilities, leading to stricter standards for disqualifying criminal convictions and other red flags compared to other industries. Federal banking regulations prohibit employing individuals convicted of crimes involving dishonesty, breach of trust, or money laundering without specific regulatory approval through the Federal Deposit Insurance Corporation's Section 19 waiver process.

Automatic disqualifications typically include felony convictions for fraud, embezzlement, identity theft, money laundering, and other financial crimes within the past seven years. Misdemeanor convictions for theft, forgery, or dishonesty-related offenses may also result in disqualification depending on the specific position and time elapsed since conviction. The severity of disqualifying factors often correlates with the level of access to customer funds and sensitive financial information.

Recent regulatory guidance emphasizes the importance of considering the totality of circumstances when evaluating criminal history, including evidence of rehabilitation, character references, and the relationship between the conviction and job responsibilities. However, certain convictions involving breach of fiduciary duty or financial crimes may result in permanent industry exclusion regardless of rehabilitation efforts.

Financial Red Flags and Risk Indicators

Beyond criminal history, financial sector background checks identify various risk indicators that may disqualify candidates or require additional scrutiny:

- Excessive debt or poor credit management: Indicates potential susceptibility to financial pressure and increased risk of fraud or theft

- Recent bankruptcy or foreclosure: Suggests possible financial distress that could motivate inappropriate conduct

- Unexplained employment gaps: May indicate undisclosed issues, terminations for cause, or other problems

- Discrepancies in application information: Raises questions about honesty and integrity, fundamental requirements for financial sector positions

- Regulatory sanctions or license suspensions: Demonstrates past professional misconduct and potential ongoing compliance risks

- Pattern of job-hopping: May indicate performance issues or inability to maintain stable employment relationships

Time-Based Considerations and Rehabilitation Factors

California's employment laws consider the nature and age of criminal convictions when evaluating job applicants, requiring individualized assessments that account for rehabilitation and the relationship between past conduct and job requirements. The seven-year reporting period for most criminal convictions under FCRA provides some limitation on historical background information, but financial sector positions may justify longer lookback periods for serious financial crimes.

Factors supporting rehabilitation include completion of restitution payments, participation in counseling or treatment programs, stable employment history since conviction, and positive character references from employers, community leaders, or probation officers. Educational achievements, professional certifications, and community service may also demonstrate positive changes since past misconduct.

Employer Obligations and Best Practices

California financial institutions must establish comprehensive background check policies that balance regulatory compliance with fair employment practices. These policies should clearly define screening procedures, disqualifying factors, and appeal processes for candidates who receive adverse decisions. Written policies help ensure consistent application of screening standards and provide legal protection against discrimination claims.

Proper FCRA compliance requires employers to follow specific procedures when background checks reveal potentially disqualifying information. The pre-adverse action process includes providing candidates with copies of background reports and summary of rights before making final hiring decisions. Employers must allow reasonable time for candidates to dispute inaccurate information, typically 5-10 business days depending on the circumstances.

The adverse action process requires additional notifications if employers ultimately decide not to hire candidates based on background check results. These notifications must include specific reasons for the adverse decision, contact information for the background check company, and information about candidates' rights to dispute inaccurate information. Failure to follow proper adverse action procedures can result in significant legal liability under both federal and state laws.

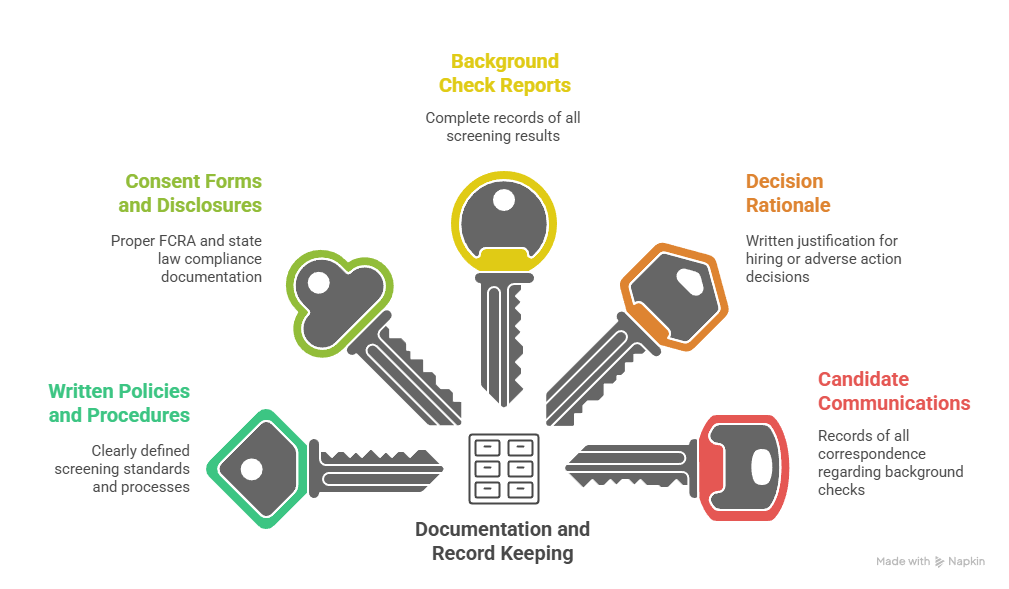

Documentation and Record Keeping

Financial institutions must maintain detailed records of background check procedures and decisions to demonstrate regulatory compliance and defend against potential discrimination claims. Documentation should include:

- Written policies and procedures: Clearly defined screening standards and processes that comply with federal and state requirements

- Consent forms and disclosures: Proper FCRA and state law compliance documentation with candidate signatures and dates

- Background check reports: Complete records of all screening results, including database searches and verification attempts

- Decision rationale: Written justification for hiring or adverse action decisions, particularly for cases involving criminal history

- Candidate communications: Records of all correspondence regarding background checks, including pre-adverse action notices and final decisions

Regular policy reviews and staff training ensure consistent application of background check procedures across the organization. Legal counsel should review policies annually to address changing regulations and court decisions that may affect screening practices. Training programs should emphasize the importance of treating all candidates fairly while maintaining necessary security standards.

Training and Compliance Programs

Effective background check programs require ongoing training for human resources personnel, hiring managers, and other staff involved in the screening process. Training should cover legal requirements, company policies, and proper procedures for handling sensitive background information. Regular updates address changes in regulations, court decisions, and industry best practices.

Compliance monitoring includes regular audits of background check procedures, documentation reviews, and assessment of vendor performance. Financial institutions should track key metrics such as screening completion times, dispute resolution outcomes, and legal compliance rates to identify areas for improvement.

Cost Considerations and Vendor Selection

Financial sector background checks typically cost more than standard employment screening due to their comprehensive nature and specialized database access requirements. Basic screenings may cost $50-100 per candidate, while comprehensive financial sector checks can range from $150-300 depending on the scope of verification required. Executive-level screenings with enhanced due diligence procedures may cost $500-1,000 or more, reflecting the extensive investigation required for senior positions.

Cost factors include the number of databases searched, geographic scope of verification, complexity of employment history, and turnaround time requirements. Rush processing typically adds 25-50% to standard pricing, while international background checks can significantly increase costs due to the complexity of overseas verification procedures. Financial institutions must balance cost considerations with regulatory requirements and risk management objectives.

Vendor selection requires careful evaluation of screening companies' capabilities, compliance expertise, and technology platforms. Financial institutions should prioritize vendors with specific experience in FCRA compliance, regulatory database access, and financial sector screening requirements. Vendor qualifications should include appropriate insurance coverage, security certifications, and demonstrated expertise in handling sensitive financial industry investigations.

Technology and Automation Benefits

Modern background check platforms offer automation features that streamline the screening process while maintaining compliance standards. Electronic consent collection, automated database searches, and integrated reporting systems reduce processing time and administrative burden while improving accuracy and consistency.

| Technology Feature | Benefit | Cost Impact | Compliance Advantage |

| Automated Database Searches | Faster turnaround times | Reduces labor costs by 30-40% | Ensures consistent search procedures |

| Electronic Consent Management | Improved compliance tracking | Minimizes administrative overhead | Maintains proper documentation |

| Integrated Reporting Dashboards | Enhanced decision-making tools | Increases operational efficiency | Provides audit trails |

| Mobile-Optimized Platforms | Improved candidate experience | Reduces processing delays | Facilitates proper consent procedures |

Cloud-based screening platforms provide scalability for growing financial institutions while maintaining security standards required for handling sensitive background check information. These platforms typically include automatic software updates, disaster recovery capabilities, and enhanced data security features that would be costly for individual employers to implement independently.

Contract Negotiations and Service Level Agreements

Effective vendor relationships require detailed contracts that specify service levels, turnaround times, accuracy standards, and compliance requirements. Service level agreements should include penalties for missed deadlines, accuracy guarantees, and procedures for handling disputes or errors. Financial institutions should negotiate favorable terms for volume pricing, priority processing, and customized reporting formats.

Contract terms should address data security requirements, including encryption standards, access controls, and breach notification procedures. Vendors should provide evidence of appropriate cybersecurity measures and compliance with relevant data protection regulations.

Employee Rights and Dispute Resolution

California job applicants and employees have significant rights regarding background check procedures and results, extending beyond federal FCRA protections to include additional state-specific safeguards. The FCRA provides federal baseline protections, while California law offers additional rights and remedies for individuals affected by employment screening decisions. Understanding these rights helps both employers and candidates navigate the background check process appropriately.

Candidates have the right to receive copies of background check reports used in employment decisions and summaries of their rights under applicable laws. When background checks reveal potentially disqualifying information, employers must follow pre-adverse action procedures that allow candidates to review and dispute inaccurate information. This process includes providing specific information about the source of negative information and contact details for the background check company.

The dispute resolution process typically involves candidates contacting background check companies directly to challenge inaccurate information. Screening companies must investigate disputes within 30 days and correct or remove inaccurate data from their records. Employers must delay final hiring decisions until dispute investigations are complete, though they are not required to hold positions indefinitely during extended dispute processes.

Legal Remedies and Enforcement

Violations of FCRA or California background check laws can result in significant penalties and legal liability for employers. Candidates may pursue actual damages for financial losses, statutory damages up to $1,000 per violation, and attorney fees for willful noncompliance with screening requirements. Successful class action lawsuits against major employers have resulted in multimillion-dollar settlements for improper background check procedures.

The California Department of Fair Employment and Housing investigates discrimination complaints related to background check practices, with authority to impose penalties and require corrective actions. Federal agencies like the Equal Employment Opportunity Commission also enforce fair hiring practices in the financial sector, often coordinating with state agencies on complex cases involving multiple jurisdictions.

Conclusion

California financial sector background checks represent a critical component of regulatory compliance and risk management for banking, investment, and insurance companies operating in the state. These comprehensive screening processes must balance federal regulatory requirements, state privacy protections, and fair employment practices while protecting consumers and maintaining industry integrity. The evolving regulatory landscape requires ongoing attention to legal developments, technology improvements, and best practices that support both compliance and fair hiring. Employers who invest in proper background check procedures, vendor relationships, and compliance training will be better positioned to navigate the complex regulatory environment while building trustworthy teams. Success in financial sector hiring requires a commitment to thorough screening procedures that respect candidate rights while meeting the stringent requirements of one of the most heavily regulated industries in the economy.

Frequently Asked Questions

How long does a California financial sector background check take?

Most California financial sector background checks take 5-10 business days to complete. The timeline depends on the scope of verification required, with comprehensive screenings for senior positions potentially taking up to 2-3 weeks. Delays may occur if candidates have lived in multiple states or countries, requiring additional verification time.

What crimes disqualify someone from financial sector employment in California?

Federal banking regulations automatically disqualify individuals convicted of crimes involving dishonesty, breach of trust, or money laundering without regulatory approval. Common disqualifying offenses include fraud, embezzlement, identity theft, forgery, and other financial crimes. Some misdemeanor theft or dishonesty convictions may also result in disqualification.

Can employers check credit reports for all financial sector positions?

California law restricts credit report use for employment decisions, but financial sector positions involving fiduciary responsibilities or access to customer financial information may qualify for exceptions. Employers must demonstrate legitimate business necessity and provide proper FCRA disclosures before accessing credit information.

What databases are searched during financial sector background checks?

Financial sector background checks include searches of criminal databases, FINRA BrokerCheck, NMLS (for mortgage professionals), insurance licensing databases, terrorist watch lists, and federal enforcement action databases. The specific databases searched depend on the position and regulatory requirements.

How much do California financial sector background checks cost?

Comprehensive financial sector background checks typically cost $150-300 per candidate, significantly more than basic employment screening. The higher cost reflects specialized database access, regulatory compliance requirements, and detailed verification procedures required for financial industry positions.

What rights do candidates have if background check information is incorrect?

Candidates have the right to receive copies of background reports, dispute inaccurate information, and have errors corrected within 30 days. Employers must follow pre-adverse action procedures, allowing candidates to review and challenge negative information before making final hiring decisions. Legal remedies are available for FCRA violations.

Do financial sector background checks include social media screening?

While not universally required, many financial institutions include social media screening as part of comprehensive background checks. This helps identify potential reputational risks, illegal activities, or behaviors inconsistent with professional standards expected in financial services roles.

How far back do California financial sector background checks go?

Criminal history searches typically cover seven years under FCRA guidelines, but financial sector positions may justify longer lookback periods for serious financial crimes. Professional licensing and regulatory action searches often have no time limitations, particularly for positions with fiduciary responsibilities.

Additional Resources

- Fair Credit Reporting Act (FCRA) Compliance Guidelines

https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act - California Department of Fair Employment and Housing - Background Check Guidelines

https://www.dfeh.ca.gov/resources/frequently-asked-questions/employment-faqs/background-check-faqs/ - FINRA BrokerCheck Database

https://brokercheck.finra.org/ - Nationwide Multistate Licensing System (NMLS)

https://www.nmlsconsumeraccess.org/ - California Consumer Privacy Act (CCPA) Compliance Guide

https://oag.ca.gov/privacy/ccpa - Federal Deposit Insurance Corporation - Background Check Requirements

https://www.fdic.gov/regulations/laws/rules/5000-3100.html - Society for Human Resource Management - Background Screening Resources

https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/backgroundchecks.aspx - Professional Background Screening Association (PBSA)

https://www.professionalbackground.org/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.