Texas financial services background checks are governed by strict regulatory frameworks including the Texas Department of Finance (TDF) requirements and federal SAFE Act provisions, which mandate comprehensive screening processes for roles involving sensitive financial information. Understanding these requirements is essential for both employers conducting screenings and job seekers preparing for the application process in Texas's highly regulated financial sector.

Key Takeaways

- Mandatory screening requirements apply to specific financial roles under TDF oversight including bank tellers, loan officers, and credit union employees, with additional federal requirements for FDIC-insured institutions.

- SAFE Act compliance is required for all mortgage professionals, including loan originators and brokers, with background checks processed through the Nationwide Multistate Licensing System (NMLS).

- Credit score thresholds typically range from 620-680 for most financial positions, with higher standards for roles involving significant monetary responsibilities or decision-making authority.

- Disqualifying criminal offenses include financial crimes such as embezzlement, fraud, and money laundering, though rehabilitation efforts and case-specific factors may be considered.

- Background check timeline generally spans 5-15 business days, depending on the complexity of verification requirements and regulatory database searches.

- Job seeker protections under the Fair Credit Reporting Act (FCRA) and Texas "ban-the-box" legislation provide important rights regarding consent, disclosure, and dispute resolution processes.

Understanding Texas Financial Services Background Check Requirements

Financial institutions in Texas operate under a comprehensive regulatory framework that mandates background screening for positions with access to sensitive financial data. The Texas Department of Finance (TDF) sets specific standards for state-chartered banks and credit unions, while federal regulations through the SAFE Act govern mortgage industry professionals. These requirements ensure that only qualified and trustworthy individuals handle consumers' financial information and transactions.

The regulatory landscape involves multiple oversight bodies, each with distinct jurisdictions and requirements. State-chartered banks fall under TDF authority, while nationally chartered banks answer to the Office of the Comptroller of the Currency (OCC). Credit unions may be regulated at either state or federal levels, depending on their charter type. Additionally, mortgage companies must comply with both state licensing requirements and federal SAFE Act mandates, creating a complex web of compliance obligations.

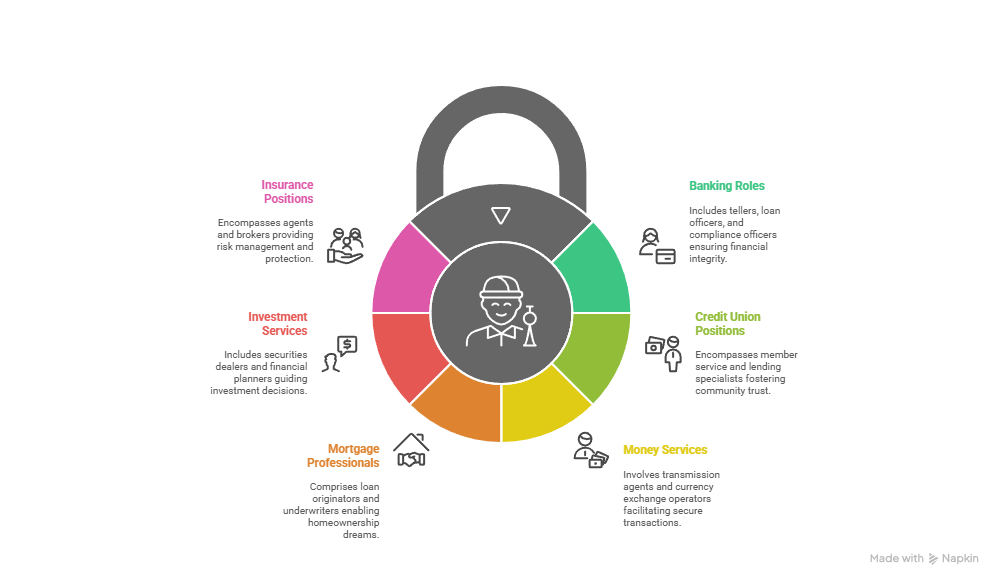

Positions Requiring Background Checks:

- Banking roles: Bank tellers, loan officers, branch managers, compliance officers, and vault custodians

- Credit union positions: Member service representatives, lending specialists, executive staff, and investment advisors

- Money services: Transmission agents, check cashers, currency exchange operators, and MSB compliance officers

- Mortgage professionals: Loan originators, brokers, processors, underwriters, and closing agents

- Investment services: Securities dealers, investment advisors, financial planners, and registered representatives

- Insurance positions: Licensed agents, brokers, adjusters, and agency principals

The screening intensity varies significantly based on position sensitivity and regulatory requirements. Entry-level teller positions may undergo standard credit and criminal checks, while executive roles require comprehensive investigations including financial stability analysis, regulatory enforcement history, and character references. Understanding these gradations helps candidates prepare appropriately for their target positions.

Federal vs. State Regulatory Authority

The dual banking system creates overlapping jurisdictions that impact background check requirements. Federally chartered institutions must comply with OCC, FDIC, and Federal Reserve guidelines, which often exceed state minimums. State-chartered banks follow TDF requirements but may face additional federal oversight if they're FDIC-insured or Fed members.

This regulatory complexity means that identical positions at different institutions may have varying screening standards. A loan officer at a national bank faces stricter federal requirements than one at a state-chartered community bank, though both must meet minimum TDF standards for Texas operations.

Key Components of Financial Background Screenings

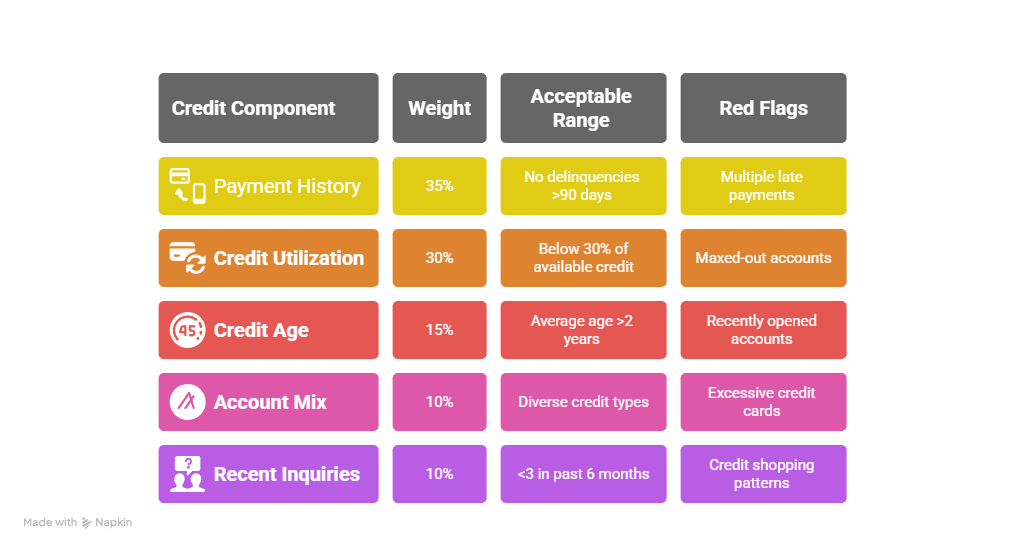

Credit Report Analysis

Employers examine multiple aspects of your credit history to assess financial responsibility and potential risk factors. Payment history receives the heaviest weighting, as consistent on-time payments demonstrate reliability with financial obligations. Debt-to-income ratios, outstanding balances, and recent credit inquiries also factor into the evaluation process.

Credit reports used for employment purposes differ from consumer versions, excluding credit scores while providing detailed payment histories and account statuses. Employers focus on patterns rather than isolated incidents, looking for evidence of financial stress that could create temptation for misconduct. Recent improvements carry significant weight, especially when accompanied by documentation of financial counseling or debt management programs.

Credit Evaluation Factors:

Bankruptcy filings within the past seven years may disqualify candidates from certain positions, though older bankruptcies or those resulting from medical emergencies may receive more favorable consideration. Chapter 13 bankruptcies often receive better treatment than Chapter 7 filings, as they demonstrate commitment to repaying debts. Credit counseling participation and debt consolidation efforts can demonstrate proactive financial management to potential employers.

Criminal History Review

Background investigators focus primarily on financial crimes and offenses involving dishonesty or breach of trust. Embezzlement, fraud, identity theft, and money laundering convictions typically result in automatic disqualification from financial services roles. Violent crimes, drug offenses, and other non-financial criminal activity receive case-by-case evaluation based on severity, recency, and job relevance.

The investigation scope extends beyond convictions to include arrests, charges, and pending cases. While arrest records alone cannot disqualify candidates under FCRA guidelines, they may trigger additional scrutiny and require explanation. Employers must demonstrate job-relatedness when making adverse decisions based on criminal history, considering factors like offense nature, time elapsed, and rehabilitation evidence.

Criminal History Evaluation Matrix:

| Offense Category | Automatic Disqualification | Consideration Period | Mitigating Factors |

| Financial Crimes | Yes | Permanent for most roles | Exceptional circumstances only |

| Violent Felonies | Position-dependent | 7-10 years | Rehabilitation, character references |

| Drug Offenses | Position-dependent | 5-7 years | Treatment completion, clean record |

| Property Crimes | Case-by-case | 5-7 years | Restitution, steady employment |

The seven-year lookback period applies to most criminal history searches under FCRA guidelines, though certain serious felonies may be reportable indefinitely. Employers must follow state and federal guidelines when making adverse employment decisions based on criminal history, including providing opportunity for explanation and dispute resolution.

Employment and Education Verification

Previous employment verification confirms job titles, dates of employment, and reasons for separation through direct contact with former employers or third-party verification services. Employers pay particular attention to terminations for cause, especially those involving financial misconduct, policy violations, or integrity issues. Gaps in employment history trigger additional questioning and may require supporting documentation.

Educational credentials undergo systematic verification to ensure accuracy of claimed degrees, certifications, and professional licenses. The verification process extends beyond diploma mills to include accreditation status, degree completion dates, and academic standing. Professional licenses require active status confirmation through regulatory databases, with attention to any disciplinary actions or restrictions.

Verification Components:

- Employment chronology: Complete work history for past 7-10 years with no unexplained gaps

- Job responsibilities: Verification of claimed duties, especially those involving financial oversight

- Compensation levels: Confirmation of salary ranges and bonus structures where relevant

- Disciplinary actions: Internal warnings, suspensions, or performance improvement plans

- Professional references: Character assessments from supervisors, colleagues, and subordinates

- Educational transcripts: Grade point averages, graduation dates, and honors received

- Continuing education: Professional development courses, industry certifications, and training records

Discrepancies between application information and verification results require immediate attention. Minor inconsistencies in dates or job titles may be overlooked, but material misrepresentations about responsibilities, education, or reasons for leaving previous positions often result in application rejection regardless of other qualifications.

TDF (Texas Department of Finance) Requirements

The Texas Department of Finance establishes comprehensive screening standards for state-chartered financial institutions, including banks, credit unions, and specialty finance companies. TDF regulations require thorough vetting of employees who will have access to customer information, handle monetary transactions, or make lending decisions. These requirements ensure compliance with state banking laws and consumer protection statutes while maintaining public confidence in Texas's financial system.

TDF's regulatory framework emphasizes risk-based screening, with more stringent requirements for positions involving greater responsibility or access to sensitive information. Executive officers undergo enhanced due diligence including financial condition analysis, business experience evaluation, and character assessments. Mid-level managers face standard screening protocols, while entry-level positions require basic credit and criminal background checks.

TDF-Regulated Institution Requirements:

- Credit history analysis: Minimum 7-year lookback period focusing on payment patterns and debt management

- Criminal background screening: Texas-specific and multi-state database searches through official channels

- Employment verification: Previous 5-7 years of work history with emphasis on financial services experience

- Education verification: Degree and certification validation through accredited institutions

- Regulatory database checks: NMLS Consumer Access, FinCEN, and state enforcement action searches

- Reference checks: Professional and personal character assessments from credible sources

TDF mandates that employers maintain detailed documentation of their background check processes, including adverse action notices and dispute resolution procedures. Institutions must establish written policies outlining screening criteria, decision-making processes, and appeals procedures. These policies require board approval and periodic review to ensure continued compliance with evolving regulatory standards.

Documentation and Compliance Requirements

TDF requires comprehensive record-keeping for all background check activities, including maintenance of screening reports, adverse action notices, and candidate communications. Documentation must demonstrate compliance with fair lending practices and equal opportunity employment requirements. Regular audits ensure ongoing adherence to state regulatory requirements and consumer protection standards.

The documentation requirements extend to ongoing monitoring of existing employees, particularly those in sensitive positions. Annual updates may be required for certain roles, while others need screening only upon promotion or transfer to positions with increased responsibilities. Employers must balance regulatory compliance with privacy rights and employment law considerations.

SAFE Act Requirements for Mortgage Professionals

The Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) establishes federal standards for mortgage loan originator licensing and registration throughout the United States. All mortgage professionals must complete comprehensive background checks through the Nationwide Multistate Licensing System (NMLS) before obtaining or renewing their licenses. The Act aims to enhance consumer protection by ensuring mortgage originators meet minimum competency and character standards while providing a unified regulatory framework.

The SAFE Act's scope extends beyond traditional mortgage brokers to include bank employees who originate mortgage loans, credit union lending officers, and independent contractors performing mortgage origination activities. Even clerical staff involved in loan processing may require NMLS registration depending on their specific duties and employer policies.

SAFE Act Background Check Components:

| Requirement | Details | Timeline | Cost |

| FBI Criminal Check | Fingerprint-based national search | 3-5 business days | $36.25 |

| Credit Report | 7-year financial history review | 1-2 business days | $15-25 |

| Administrative Actions | NMLS database searches | Same day | Included |

| State Licensing Check | Multi-state regulatory review | 2-3 business days | Varies |

NMLS processes all background check requests and maintains ongoing monitoring of licensed professionals through automated systems. Credit reports must demonstrate satisfactory financial responsibility, typically defined as absence of recent bankruptcies, tax liens, or patterns of delinquent payments. The system flags concerning changes in financial condition or new criminal activity for regulatory review.

Criminal history evaluations focus specifically on financial crimes, with automatic disqualification for certain felony convictions involving dishonesty or breach of trust. The SAFE Act provides limited exceptions for older convictions or unique circumstances, but the burden of proof lies with the applicant to demonstrate rehabilitation and current fitness for licensing.

Ongoing Monitoring and Compliance

NMLS maintains continuous monitoring of licensed mortgage professionals through automated database checks and periodic manual reviews. License holders must report significant changes in financial condition, criminal charges, or regulatory actions within specified timeframes. Failure to report material changes can result in license suspension or revocation regardless of the underlying issue's severity.

Continuing education requirements ensure mortgage professionals stay current with industry developments and regulatory changes. NMLS tracks completion of required courses and can restrict license renewal for non-compliance. The system also monitors professional conduct through consumer complaints and regulatory enforcement actions across all states where individuals hold licenses.

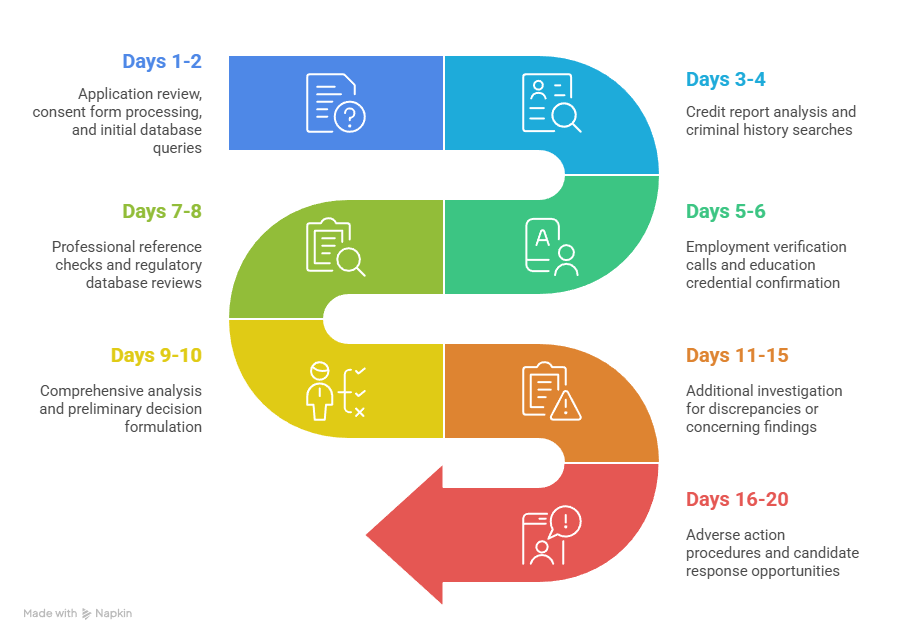

Background Check Process and Timeline

The financial services background check process begins after a conditional job offer, with employers obtaining written consent before initiating screening procedures. Most checks take 5-10 business days to complete, though complex cases involving multiple jurisdictions, international history, or discrepancies may require additional time. Understanding the typical timeline helps candidates plan their job search and transition schedules accordingly while managing expectations for both parties.

The process involves multiple parallel investigations conducted by specialized vendors and internal compliance teams. Credit reports and criminal history searches typically complete within 2-3 business days, while employment and education verification may take longer due to contact difficulties and response delays. Regulatory database searches complete quickly but may reveal issues requiring additional investigation.

Detailed Process Timeline:

- Days 1-2: Application review, consent form processing, and initial database queries

- Days 3-4: Credit report analysis and criminal history searches across relevant jurisdictions

- Days 5-6: Employment verification calls and education credential confirmation

- Days 7-8: Professional reference checks and regulatory database reviews

- Days 9-10: Comprehensive analysis and preliminary decision formulation

- Days 11-15: Additional investigation for discrepancies or concerning findings

- Days 16-20: Adverse action procedures and candidate response opportunities

Common delays include incomplete application information, difficulty contacting previous employers during peak hiring seasons, or discrepancies requiring additional documentation. International employment or education history significantly extends timelines due to verification challenges and language barriers. Candidates can minimize delays by providing complete, accurate information and maintaining organized records of their background.

Expediting the Process

Candidates can take proactive steps to accelerate background screening by preparing comprehensive documentation packages in advance. This includes gathering employment records, educational transcripts, professional licenses, and financial documents before beginning job searches. Pre-screening personal background reports helps identify and address potential issues before employer investigations begin.

Some employers offer expedited processing for critical hires, utilizing premium verification services and dedicated resources to reduce timelines. However, regulatory requirements cannot be circumvented, and certain aspects like FBI background checks have fixed processing times regardless of urgency or expense.

Credit Requirements and Financial Responsibility Standards

Financial institutions expect employees to demonstrate sound money management skills through their personal credit histories as a predictor of professional behavior and integrity. While specific credit score requirements vary by employer and position, most financial services roles require scores above 620, with management positions often requiring scores above 680. Credit evaluation extends beyond numerical scores to include payment patterns, debt management capabilities, and overall financial stability indicators.

The evaluation process considers multiple factors that contribute to financial responsibility assessment. Debt-to-income ratios above 40% may raise concerns about financial stress that could impact job performance or create temptation for misconduct. Recent bankruptcies, tax liens, or foreclosures typically require detailed explanations and evidence of financial rehabilitation efforts through counseling or structured repayment programs.

Credit Score Thresholds by Position Level:

| Position Category | Minimum Score | Preferred Score | Additional Requirements |

| Entry-level Teller | 580-620 | 650+ | No recent bankruptcies |

| Loan Officer | 620-650 | 680+ | Stable debt-to-income ratio |

| Branch Manager | 650-680 | 720+ | No tax liens or judgments |

| Senior Executive | 680+ | 750+ | Comprehensive financial review |

Improving Your Financial Profile:

- Payment consistency: Establish unbroken payment history across all credit accounts for minimum 12 months

- Debt reduction strategies: Focus on high-interest accounts while maintaining minimum payments on all obligations

- Credit utilization optimization: Keep individual account balances below 10% of limits while maintaining overall utilization under 30%

- Account management: Avoid closing old accounts that contribute to credit age calculations

- Error correction: Dispute inaccuracies immediately and maintain documentation of resolution efforts

- Financial counseling: Complete certified credit counseling programs to demonstrate commitment to improvement

Transparency about past financial difficulties often works in candidates' favor, especially when accompanied by evidence of corrective actions and improved money management practices. Employers appreciate candidates who proactively address concerns and demonstrate learning from past mistakes rather than those who attempt to hide or minimize financial problems.

Industry-Specific Considerations

Different financial services sectors emphasize various aspects of credit history based on job responsibilities and risk exposure. Investment advisors face scrutiny regarding sophisticated financial products and debt instruments, while bank tellers primarily need to demonstrate basic money management skills. Insurance professionals may have different standards based on state licensing requirements and fiduciary responsibilities.

Mortgage professionals face unique challenges due to SAFE Act requirements that specifically address financial responsibility standards. Recent changes in financial condition must be reported promptly, and significant deterioration can result in license suspension regardless of job performance or other qualifications.

Criminal Background Considerations

Certain criminal offenses can immediately disqualify candidates from financial services employment, particularly crimes involving financial fraud, embezzlement, or breach of trust. The nature, severity, and recency of criminal activity all factor into employment decisions, with Texas employers required to balance regulatory compliance requirements with fair hiring practices when evaluating candidates with criminal histories.

The evaluation process considers multiple factors beyond conviction records, including arrest patterns, pending charges, and civil enforcement actions. Financial regulators maintain databases of prohibited individuals who cannot work in financial services regardless of employer willingness to hire them. These permanent bars typically result from serious financial crimes or patterns of misconduct across multiple employers or jurisdictions.

Disqualifying Offenses:

- Financial crimes: Embezzlement, fraud, money laundering, tax evasion, and securities violations

- Identity crimes: Identity theft, credit card fraud, check forgery, and account takeover schemes

- Fiduciary breaches: Breach of trust, misappropriation of funds, and abuse of confidential information

- FDIC prohibitions: Any crimes involving dishonesty or breach of trust as defined by federal banking regulations

- Regulatory violations: Previous enforcement actions by financial regulators or professional licensing boards

Potentially Mitigating Factors:

- Time elapsed: Offenses older than 7-10 years receive diminished weight in most evaluations

- Rehabilitation evidence: Completion of counseling programs, community service, and educational achievements

- Employment stability: Consistent work history following conviction demonstrates rehabilitation success

- Character references: Professional and personal testimonials to current character and integrity

- Victim impact: Consideration of offense severity and harm caused to victims or institutions

- Cooperation: Evidence of cooperation with law enforcement and restitution to victims

Employers often consider the relationship between past offenses and specific job responsibilities when making hiring decisions. A drug-related misdemeanor may have minimal impact on employment prospects for administrative positions but could be more concerning for roles involving cash handling or customer interactions.

Appeals and Exemption Processes

Some regulatory agencies provide appeal processes for individuals with disqualifying criminal histories who can demonstrate rehabilitation and current fitness for employment. These procedures typically require extensive documentation, character references, and evidence of sustained behavioral changes over significant time periods.

The burden of proof lies entirely with the candidate to demonstrate that their employment would not pose risks to consumers, institutions, or the financial system. Success rates for these appeals remain low, particularly for serious financial crimes or recent offenses, making prevention and early intervention crucial for career preservation.

Rights and Protections for Job Seekers

The Fair Credit Reporting Act (FCRA) provides comprehensive protections for job seekers undergoing background checks, establishing clear procedures that employers must follow when using consumer reports for employment decisions. Employers must obtain written consent before conducting screenings and provide copies of reports when making adverse employment decisions. Candidates have fundamental rights to dispute inaccurate information and receive corrected reports before final hiring determinations.

Texas's "ban-the-box" legislation delays criminal history inquiries until later in the hiring process, giving candidates opportunity to present their qualifications before criminal background disclosure. This protection applies to employers with 15 or more employees and helps ensure fair consideration of candidates with criminal histories while balancing public safety and rehabilitation goals.

Your Rights During Background Screening:

- Informed consent: Right to know what information will be checked and which agencies will conduct investigations

- Report access: Copy of background report if it influences hiring decisions, including source information and dispute procedures

- Dispute process: Ability to challenge inaccurate or incomplete information through formal procedures with time limits

- Adverse action notice: Written explanation if employment is denied based on background check results with specific reasons cited

- Reasonable time: Opportunity to respond to negative findings before final decisions with adequate time for investigation

- Privacy protection: Assurance that background information will be used only for employment purposes and protected appropriately

Understanding these protections empowers job seekers to advocate for fair treatment throughout the screening process while ensuring compliance with applicable laws and regulations. Candidates should exercise these rights proactively rather than waiting for problems to develop.

Enforcement and Remedies

Violations of FCRA requirements can result in significant penalties for employers, including actual damages, statutory damages up to $1,000 per violation, and attorney fees for successful plaintiffs. The Consumer Financial Protection Bureau and Federal Trade Commission actively enforce these requirements through investigations and enforcement actions.

State attorney general offices also investigate background check violations and can impose additional penalties under state consumer protection laws. Candidates who believe their rights have been violated should document the circumstances and consider consulting with employment attorneys who specialize in background check issues.

Preparing for Your Background Check

Successful preparation begins with gathering comprehensive documentation and conducting self-assessment of potential issues before employers initiate screening procedures. Obtain copies of your credit reports from all three major bureaus and review them for accuracy, disputing any errors well in advance of job applications. Order criminal background checks on yourself through official channels to identify any unexpected issues that may arise during employment screening.

The preparation process should include creating organized files of employment records, educational transcripts, professional licenses, and financial documents. This organization demonstrates professionalism while ensuring quick response to verification requests. Consider preparing written explanations for any negative information, focusing on lessons learned and positive changes implemented since incidents occurred.

Comprehensive Preparation Checklist:

- Personal documentation: Social Security card, driver's license, passport, and birth certificate in secure, accessible location

- Employment history: Pay stubs, tax returns, employment contracts, performance reviews, and separation notices for past 10 years

- Educational records: Diplomas, transcripts, professional certifications, and continuing education certificates with institution contact information

- Financial documentation: Recent credit reports from all three bureaus, loan documents, and bankruptcy papers if applicable

- Legal records: Court documents, probation completion certificates, and rehabilitation program certificates with official seals

- Professional references: Current contact information for supervisors, colleagues, and character witnesses with their consent to be contacted

Honesty and transparency throughout the process build trust with potential employers and demonstrate integrity that may outweigh past difficulties. If negative information exists in your background, prepare clear, concise explanations that focus on accountability, lessons learned, and positive changes made since incidents occurred.

Professional Presentation Strategies

Develop a professional approach to discussing background issues that emphasizes growth and learning rather than making excuses or minimizing problems. Practice explaining situations concisely while taking responsibility and demonstrating how experiences have contributed to personal and professional development.

Consider working with career counselors or employment attorneys who specialize in background check issues, particularly if your situation involves complex legal or financial matters. Professional guidance can help frame explanations appropriately while ensuring compliance with disclosure requirements and legal obligations.

Conclusion

Navigating Texas financial services background checks requires thorough understanding of both state TDF requirements and federal SAFE Act provisions that govern industry hiring practices. Success depends on comprehensive preparation, complete transparency, and detailed knowledge of your rights throughout the screening process. While credit history, criminal background, and employment verification all play crucial roles in hiring decisions, candidates who demonstrate financial responsibility, professional growth, and commitment to ethical conduct can overcome past challenges and build successful careers in financial services. Understanding these complex requirements empowers both job seekers and employers to navigate the screening process effectively while maintaining strict compliance with applicable regulations and protecting consumer interests.

Frequently Asked Questions

What does a Texas financial services background check include?

A Texas financial services background check typically includes criminal history searches, credit report analysis, employment verification, education confirmation, and regulatory database searches through NMLS Consumer Access and FinCEN systems.

How long do financial services background checks take in Texas?

Most financial services background checks in Texas take 5-10 business days to complete, though complex cases involving multiple jurisdictions or discrepancies may require up to 15 business days for thorough investigation.

What credit score is required for financial services jobs in Texas?

Most financial services positions in Texas require credit scores above 620, with management and high-responsibility roles often requiring scores above 680, though requirements vary by employer and specific job duties.

Can criminal history disqualify you from financial services employment in Texas?

Yes, certain criminal offenses including financial crimes, embezzlement, fraud, and identity theft can disqualify candidates from financial services employment, though rehabilitation efforts and case-specific factors may be considered.

What are SAFE Act requirements for mortgage professionals in Texas?

SAFE Act requirements include FBI fingerprint-based criminal background checks, credit history analysis, and NMLS database searches for all mortgage loan originators, with ongoing monitoring and continuing education requirements.

Does Texas follow the 7-year rule for background checks?

Yes, Texas generally follows the 7-year rule under FCRA guidelines, meaning most negative information cannot be reported after seven years, though exceptions exist for high-salary positions and certain serious felonies.

What rights do job seekers have during background checks in Texas?

Job seekers have rights under FCRA including written consent requirements, access to background reports, dispute processes for inaccurate information, and adverse action notices if employment is denied based on screening results.

Are background checks required for all financial services jobs in Texas?

Not all financial services jobs require background checks, but positions involving customer information access, monetary transactions, or lending decisions typically mandate comprehensive screening under TDF and federal regulations.

Can you challenge background check results in Texas?

Yes, candidates can challenge inaccurate background check information by contacting the reporting agency, providing corrective documentation, and requesting investigations to correct errors before final employment decisions.

What is the NMLS and why is it important for mortgage professionals?

The NMLS (Nationwide Multistate Licensing System) is a centralized database that processes background checks, tracks licensing, and monitors continuing education for mortgage professionals under SAFE Act requirements.

Additional Resources

- Texas Department of Banking - Regulatory Guidelines

https://www.dob.texas.gov/ - Federal Trade Commission - Fair Credit Reporting Act

https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act - NMLS Resource Center - SAFE Act Compliance

https://www.nmls.org/ - FinCEN - Financial Crimes Enforcement Network

https://www.fincen.gov/ - Consumer Financial Protection Bureau - Credit Reports and Scores

https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/ - Annual Credit Report - Free Credit Report Access

https://www.annualcreditreport.com/ - Texas Workforce Commission - Background Check Rights

https://www.twc.texas.gov/ - FDIC - Guidelines for Background Investigations

https://www.fdic.gov/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.