Illinois tenant screening laws create a complex regulatory framework where Chicago's strict municipal ordinances and Cook County's progressive anti-discrimination protections significantly exceed baseline state requirements. Property managers operating in Chicago and Cook County may face potential penalties ranging from $500 to $10,000 per violation if they fail to comply with the intersection of the Residential Landlord and Tenant Ordinance (RLTO) screening fee limits, the Cook County Human Rights Ordinance protections, and Illinois Fair Housing Act provisions. Landlords should verify current requirements with legal counsel, as local ordinances change frequently and their application depends on specific property circumstances.

Key Takeaways

- Chicago caps screening fees at $20 per applicant under the RLTO (Chicago Municipal Code § 5-12-170), significantly lower than the $50-75 fees common in other Illinois jurisdictions, with violations potentially subject to fines of $200-500 per occurrence plus actual damages.

- Cook County prohibits discrimination based on source of income under the Cook County Human Rights Ordinance, including Housing Choice Vouchers (Section 8), and restricts criminal history considerations to recent convictions for specific serious offenses.

- Landlords are generally required to provide adverse action notices within 7 business days of denying applications based on screening results, including specific reasons for denial and contact information for the screening company used, per federal Fair Credit Reporting Act requirements.

- Chicago requires written disclosure of all screening criteria before accepting applications under RLTO provisions, including minimum credit scores, income requirements, and criminal history policies, with failure to provide advance disclosure potentially invalidating denial decisions.

- Criminal background check limitations in Cook County restrict consideration to convictions for violent felonies and drug distribution offenses within approximately the past 3 years for unincorporated county properties, with prohibition on denials based solely on arrest records without conviction.

- Illinois law generally mandates landlords obtain written consent before running background checks and provide applicants with copies of reports used in decision-making, aligning with Fair Credit Reporting Act (FCRA) federal requirements (15 U.S.C. § 1681b).

- Cook County's progressive enforcement has resulted in significant fair housing settlements in recent years, with the Commission on Human Rights actively investigating screening discrimination complaints through testing programs and complaint procedures.

- Properties spanning multiple jurisdictions create compliance complexity, with legal counsel typically recommending landlords apply the most restrictive applicable standard across their entire portfolio to ensure consistent compliance.

Understanding the Three-Tier Regulatory Framework in Illinois

Illinois establishes baseline tenant screening protections through the Illinois Human Rights Act (775 ILCS 5/) and specific provisions within state landlord-tenant law. However, Chicago and Cook County add layers of requirements that substantially exceed state standards. Property owners must navigate these overlapping jurisdictions carefully to maintain compliance.

| Jurisdiction Level | Primary Laws | Key Protections |

| State (Illinois) | Illinois Human Rights Act (775 ILCS 5/) | Fair housing protections, arrest record prohibition, written consent requirements |

| Cook County | Cook County Human Rights Ordinance | Source of income protection, 3-year criminal history lookback, enhanced enforcement |

| Chicago | Residential Landlord Tenant Ordinance (§ 5-12-170) | $20 screening fee cap, written criteria mandate, specific refund timelines |

Understanding which requirements apply to your properties determines your compliance obligations. Property managers with portfolios spanning multiple jurisdictions face the most complex scenarios.

State-Level Protections Under Illinois Law

At the state level, the law prohibits discrimination based on race, color, religion, sex, national origin, ancestry, age, marital status, disability, military status, sexual orientation, and unfavorable military discharge. The Illinois Department of Human Rights enforces these provisions and investigates complaints of discriminatory screening practices. Illinois law generally requires landlords to obtain written authorization before conducting criminal background checks or credit reports on prospective tenants.

This authorization requirement aligns with the federal Fair Credit Reporting Act (15 U.S.C. § 1681b), which governs how consumer reporting agencies collect and disseminate applicant information. Property owners using third-party screening services typically must provide applicants with disclosure notices and, if adverse action is taken, specific documentation explaining the decision. Legal counsel often recommends maintaining documentation of all authorization and disclosure procedures to demonstrate compliance if questions arise.

Cook County's Enhanced Anti-Discrimination Framework

Cook County implemented progressive tenant screening protections through its Human Rights Ordinance amendments. The ordinance designates source of income as a protected class, meaning landlords generally cannot refuse to rent to applicants because they receive Housing Choice Vouchers, Veterans Affairs Supportive Housing (VASH) vouchers, or other government rental assistance. Criminal history considerations face substantial restrictions in unincorporated Cook County areas.

The ordinance generally limits consideration to convictions (not arrests) for violent felonies or drug manufacturing/distribution offenses within approximately the previous three years. This lookback period represents one of the shortest timeframes in the nation. The ordinance specifically prohibits blanket policies that automatically disqualify applicants with any criminal record, requiring individualized assessment of circumstances. The Cook County Commission on Human Rights enforces these provisions through complaint investigations and compliance reviews.

Chicago's Municipal Ordinance Requirements

The Chicago Residential Landlord and Tenant Ordinance (Chicago Municipal Code § 5-12-170) creates screening requirements applicable to most rental properties within city limits. Notable exceptions include owner-occupied buildings with six or fewer units and certain other exemptions. Chicago's screening fee cap of $20 per applicant stands substantially below market rates for comprehensive background and credit checks.

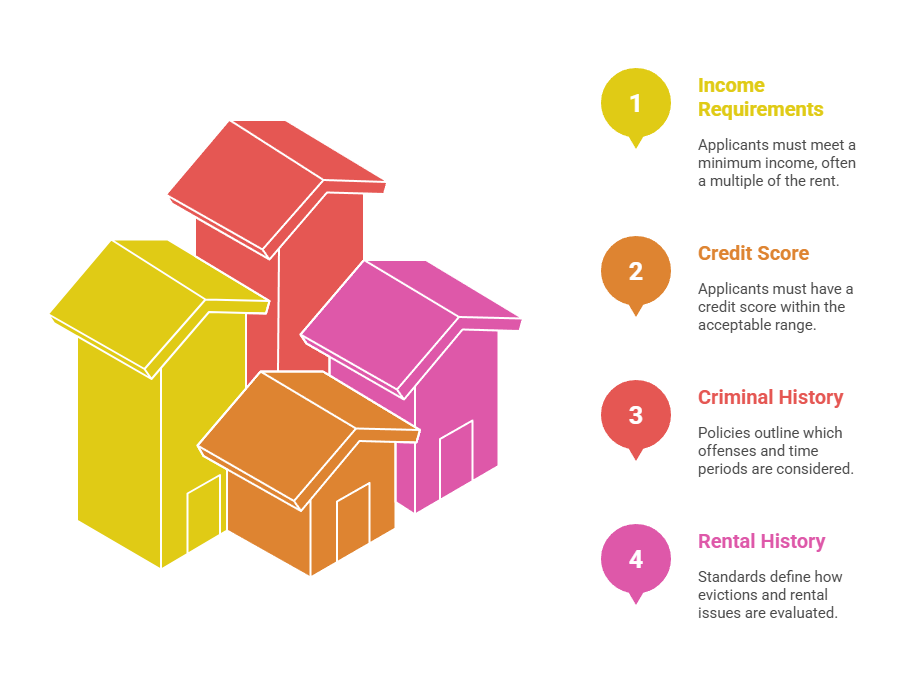

Chicago generally requires landlords to provide written screening criteria to all applicants before accepting applications or collecting fees. These criteria typically specify:

- Minimum income requirements: Usually expressed as a multiple of monthly rent (such as 3x rent)

- Acceptable credit score ranges: Specific numeric thresholds that apply to all applicants

- Criminal history policies: Types of offenses and lookback periods considered

- Rental history standards: Timeframes for considering evictions or other rental issues

The RLTO establishes specific timelines for application processing and refund obligations. Chicago's Department of Business Affairs and Consumer Protection (BACP) enforces RLTO provisions and may impose fines ranging from $200 to $500 per violation under Chicago Municipal Code § 5-12-170, with each affected applicant potentially constituting a separate violation.

Comparison of Requirements Across Illinois Jurisdictions

Understanding how requirements differ across jurisdictions helps property owners develop compliant screening policies. The table below summarizes key differences between Chicago, Cook County, and other Illinois locations. These variations require careful attention, especially for landlords managing properties in multiple areas.

| Requirement | Chicago (RLTO) | Cook County (Unincorporated) | Other Illinois |

| Screening Fee Cap | $20 maximum (§ 5-12-170) | No specific cap (reasonableness standard) | No specific cap (reasonableness standard) |

| Written Criteria | Required before accepting applications | Recommended best practice | Recommended best practice |

| Source of Income Protection | Protected class (cannot refuse Section 8) | Protected class (cannot refuse Section 8) | Not protected at state level |

| Criminal History Lookback | General fair housing principles apply | Approximately 3 years for specific offenses | General fair housing principles apply |

| Arrest Record Consideration | Prohibited under IL law (775 ILCS 5/2-103) | Prohibited under IL law | Prohibited under IL law |

| Enforcement Agency | Chicago BACP | Cook County Commission on Human Rights | IL Dept of Human Rights |

| Penalty Range | $200-500 per violation | Up to $10,000 per violation plus damages | Varies by violation type |

Property owners should consult legal counsel licensed in Illinois and verify current ordinance provisions, as local laws change frequently. Their application depends on specific circumstances including property type, location, and exemption status.

Screening Fee Regulations and Cost Recovery Limitations

Chicago's $20 Fee Cap and Practical Implications

Chicago's $20 screening fee cap under Municipal Code § 5-12-170 creates operational challenges for landlords seeking comprehensive tenant evaluation. Professional screening services typically charge $30-75 for combined credit reports, criminal background checks, and eviction history searches. The ordinance defines screening fees as any amount charged to process rental applications, including administrative costs, preventing separate "application fees" to supplement screening costs.

Property owners generally must maintain documentation showing actual screening costs to justify retaining any portion of the $20 fee. If screening costs less than the amount charged, the difference typically must be refunded. This requirement necessitates detailed record-keeping for each application processed.

Some property managers have adapted by using tiered screening approaches. Initial evaluation might include only credit and eviction checks within the $20 cap, with more comprehensive criminal background searches conducted for applicants who meet preliminary criteria. However, any tiered approach should be carefully structured to avoid creating opportunities for inconsistent application across applicant groups.

Cost Recovery Rules in Other Illinois Jurisdictions

Outside Chicago city limits, Illinois landlords generally have greater flexibility in screening fee structures. They remain bound by reasonableness standards under consumer protection principles. Many suburban landlords charge $50-75 per applicant to cover comprehensive screening from professional services. Even in these jurisdictions, charges typically should reasonably correspond to actual expenses incurred.

Illinois case law establishes that collecting fees generally obligates landlords to conduct actual screening activities. Transparency serves as recommended practice across all Illinois jurisdictions. Providing applicants with information about screening fee components demonstrates good faith and supports defensible decision-making.

Criminal Background Check Restrictions and Best Practices

Cook County's Lookback Period and Offense Limitations

Cook County's criminal conviction lookback restriction represents one of the most applicant-friendly standards in the United States. The ordinance generally limits consideration to specific categories within defined timeframes. Background check reports often include arrest information and aged convictions that cannot legally be considered in unincorporated Cook County rental decisions.

The ordinance generally permits consideration of:

- Violent felonies: Murder, armed robbery, aggravated battery, sexual assault

- Drug distribution offenses: Manufacturing and distribution (not possession)

- Timeframe: Approximately 36 months from the application date

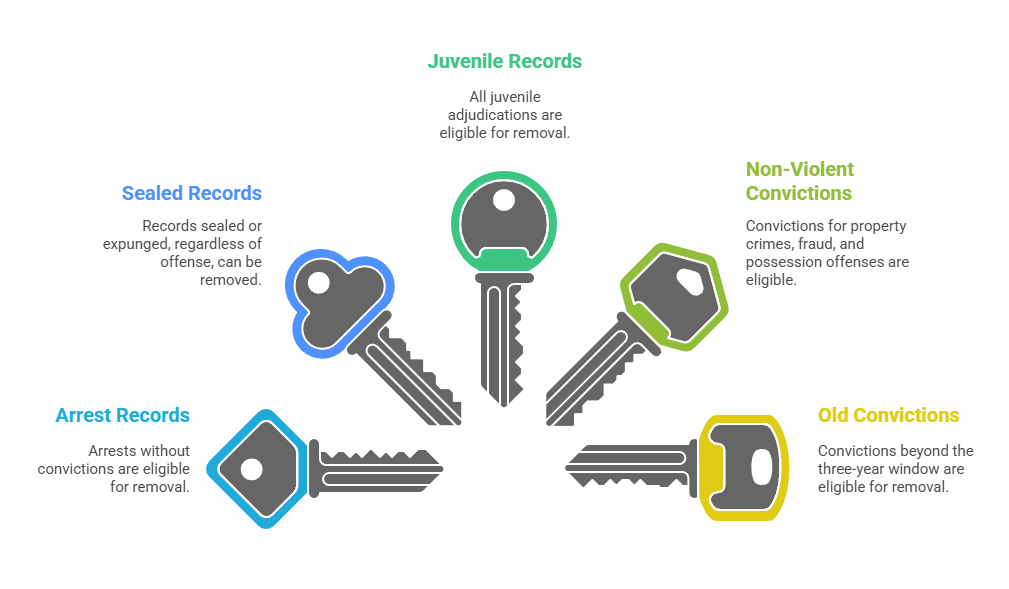

The ordinance explicitly prohibits consideration of:

- Arrest records: Without resulting conviction

- Sealed or expunged records: Regardless of offense type

- Juvenile adjudications: All juvenile records

- Non-violent convictions: Property crimes, fraud, possession offenses

- Old convictions: Beyond the approximate three-year window

Using automated screening services that flag disqualifying information requires manual review to ensure only permissible convictions influence decisions. Individualized assessment requirements prevent blanket policies that automatically disqualify applicants with any criminal history.

Chicago and Statewide Criminal History Considerations

Chicago does not impose the same strict lookback limitation as unincorporated Cook County areas. However, landlords operating within city limits remain bound by fair housing principles that generally require individualized assessment of criminal history. U.S. Department of Housing and Urban Development (HUD) guidance establishes that blanket policies categorically excluding applicants with any criminal history may violate the Fair Housing Act through disparate impact on protected classes.

Illinois law prohibits discrimination based on "arrest record" under 775 ILCS 5/2-103(A) as a standalone basis for denial. Landlords may consider conviction records but legal counsel often recommends evaluating the relationship between the criminal conduct and rental housing responsibilities. Convictions for property damage, theft, fraud, or violence present more direct relevance to tenancy concerns than convictions for offenses unrelated to housing.

Recommended practices include written criminal history policies that specify which offense types create potential concerns. Rather than stating "no criminal history," defensible policies might indicate consideration of specific serious offenses within defined timeframes, with individualized assessment based on offense nature, time elapsed, and evidence of rehabilitation. This approach demonstrates individualized consideration while establishing clear decision-making frameworks.

Required Adverse Action Procedures

When a landlord denies an application based on information in a consumer report, federal FCRA law (15 U.S.C. § 1681b(b)(3)) and Illinois provisions generally require specific adverse action notices. These notices typically must be provided within seven business days. They must include several key elements to satisfy legal requirements.

Required notice elements include:

- Consumer reporting agency information: Name, address, and phone number

- Agency non-responsibility statement: Clarification that the agency didn't make the decision

- Dispute rights: Notice of the applicant's right to dispute report accuracy

- Free report rights: Information about obtaining a free copy of the report

- Specific denial reasons: Clear explanation of which criteria were not met (Chicago requirement)

Chicago's RLTO adds municipal requirements for adverse action communications. Compliant notices typically provide specific reasons for application denial, not generic statements like "failed to meet screening criteria." Property owners should maintain documentation of all adverse action notices sent, including delivery dates and methods, to demonstrate compliance if questions arise.

Source of Income Protections and Section 8 Compliance

Cook County's designation of source of income as a protected class makes refusing Housing Choice Voucher holders a potential violation of the County's Human Rights Ordinance throughout unincorporated areas. Chicago similarly prohibits sources of income discrimination under the Chicago Human Rights Ordinance. Both jurisdictions require careful attention to how income is verified and calculated.

Landlords generally cannot take the following actions:

- Advertise properties as unavailable to Section 8 or voucher applicants

- Refuse to participate in voucher programs based solely on voucher status

- Apply different criteria to voucher holders than other applicants

- Require employment income specifically when total rent is covered by voucher plus tenant contribution

- Impose additional screening steps not required of non-voucher applicants

Property owners typically must evaluate voucher holders using the same screening criteria applied to other applicants. Income calculations generally should include the voucher payment amount plus the tenant's contribution rather than solely the tenant's personal income. Property owners should consult local housing authorities for specific program guidelines on income verification and calculation methods, as approaches may vary.

Many landlords express concerns about Housing Authority inspection requirements and payment timing. While these may constitute legitimate business considerations, they generally do not justify refusing to accept vouchers under Cook County's ordinance. Landlords may establish reasonable criteria for all applicants but compliant practices avoid imposing additional or different standards on voucher holders.

Credit and Financial Screening Parameters

Establishing Reasonable Income Requirements

Income verification represents a standard component of tenant screening across Illinois. Most landlords require applicants to demonstrate monthly income of 2.5 to 3 times the monthly rent amount. These ratios help assess whether tenants can reasonably afford rent while maintaining other financial obligations.

Documentation requirements typically include recent pay stubs, employment verification letters, tax returns for self-employed applicants, or bank statements showing consistent deposits. Chicago and Cook County regulations generally require landlords to state income requirements clearly in written screening criteria provided before application submission. The stated multiple typically should be applied consistently to all applicants.

Alternative income documentation may be necessary for applicants with non-traditional employment. Clear policies for evaluating various documentation types support consistent decision-making. Flexibility in documentation requirements, applied consistently, expands the applicant pool while maintaining financial screening integrity.

Credit Score Standards and Reporting Requirements

Credit score requirements vary widely among Illinois landlords. Typical thresholds range from 580 to 650 for standard market-rate housing. Property owners generally should disclose minimum credit score requirements in written screening criteria and apply them consistently.

When adverse action is taken based on credit report information, FCRA compliance (15 U.S.C. § 1681b(b)(3)) generally requires landlords to provide applicants with pre-adverse action notices before finalizing denial decisions. This notice gives applicants an opportunity to review the credit report, identify errors, and provide explanations for negative information. Medical debt, identity theft, or isolated late payments during documented hardship periods may warrant reconsideration when explained. Cook County's enforcement climate encourages landlords to consider whether credit requirements genuinely predict rental payment behavior.

Required Disclosures and Documentation Standards

Chicago's RLTO (Municipal Code § 5-12-170) generally requires landlords to provide written screening criteria to every applicant before accepting applications or collecting fees. This document typically includes specific, measurable standards for all evaluation components. Vague statements like "good credit required" may not meet specificity standards.

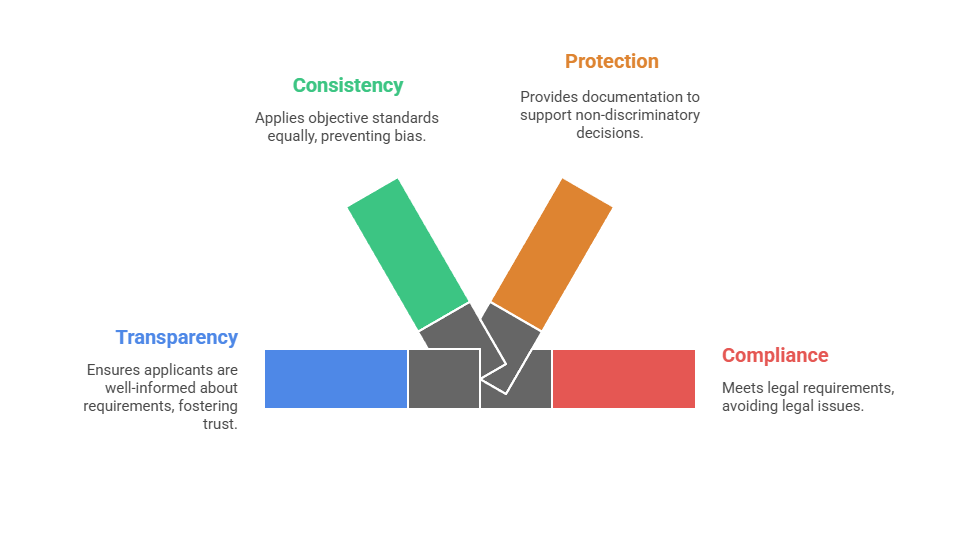

The written criteria serve multiple purposes:

- Transparency: Applicants understand requirements before applying

- Consistency: Objective standards apply equally to all applicants

- Protection: Documentation supports non-discriminatory decision-making

- Compliance: Meets RLTO legal requirements

Illinois law generally requires landlords to obtain written authorization before conducting background checks, credit reports, or other consumer report inquiries. Application forms should include clear consent language explaining what information will be obtained, from which sources, and how it will be used in rental decisions. FCRA requirements (15 U.S.C. § 1681b(b)(2)) mandate disclosure documents informing applicants that consumer reports will be obtained for rental screening purposes.

Application forms typically should avoid questions about protected characteristics. Chicago specifically prohibits questions about arrest history, and Cook County's source of income protections may effectively limit questions designed to identify voucher holders before evaluating their applications. Questions should focus on rental history, employment, income, and emergency contacts.

Maintaining comprehensive documentation of the entire screening process provides important protection if discrimination complaints arise. Recommended records include copies of advertisements, written screening criteria, all applications received, screening reports obtained, adverse action notices sent, and notes documenting decision rationale. The Illinois statute of limitations for fair housing complaints extends three years at the state level (775 ILCS 5/7A-102(D-5)), with federal complaints possible within specified timeframes.

Compliance Best Practices and Risk Management

Comprehensive written screening policies serve as the foundation for consistent decision-making. These policies should address all evaluation components including income requirements, credit standards, rental history criteria, criminal background limitations (specific to jurisdiction), and source of income provisions. For landlords operating across Chicago, Cook County, and suburban areas, applying the most restrictive applicable standards represents commonly recommended practice.

Policy development should involve review by attorneys licensed in Illinois and familiar with local ordinances. Employee training represents a critical implementation component. Leasing agents, property managers, and administrative staff who interact with applicants should understand both specific policy requirements and underlying fair housing principles.

Third-party screening services offer efficiency but require careful vendor selection. Reports should distinguish arrests from convictions, identify conviction dates to enable proper timeframe calculations, and flag sealed or expunged records. Automated screening systems that generate recommendations based on programmed criteria generally require human review to ensure individualized assessment where appropriate. Digital application platforms should incorporate required disclosures and consent forms compliant with Illinois law.

Applications that meet some but not all screening criteria create scenarios requiring careful documentation. Documented decision-making processes support defensible practices. When exercising discretion to approve a borderline application, notes should explain the business rationale. Similarly, denials should show clear connection to stated criteria. Consistency reviews help identify potential patterns before complaints arise.

Property owners should consult legal counsel licensed in Illinois for guidance on complex scenarios, verification of current ordinance requirements, and development of compliant policies. Local ordinances change frequently, and their application depends on specific circumstances including property type, location, and exemption status.

Conclusion

Navigating Illinois tenant screening laws requires understanding how Chicago's municipal ordinances and Cook County's anti-discrimination protections create compliance obligations substantially exceeding baseline state requirements. Property managers operating in these jurisdictions face screening fee caps, criminal history lookback periods, source of income protections, and documentation requirements that differentiate the Chicago metropolitan area from other Illinois locations. Compliance approaches typically involve developing comprehensive written policies, training staff on fair housing principles, maintaining detailed screening records, and consulting with attorneys licensed in Illinois for policy review and verification of current requirements. Laws change frequently and their application depends on specific circumstances, making ongoing legal guidance important for property managers seeking to maintain compliant practices while managing risk effectively.

Frequently Asked Questions

Can landlords charge more than $20 for tenant screening in Chicago if actual costs exceed this amount?

No, Chicago Municipal Code § 5-12-170 caps screening fees at $20 per applicant regardless of actual costs incurred. Property owners generally must absorb expenses exceeding this amount or use more economical screening methods. Charging amounts above $20 may constitute RLTO violations potentially subject to fines of $200-500 per occurrence plus refund of excess fees collected. Some landlords adapt by using tiered screening approaches, though any tiered approach should be structured carefully to ensure consistent application.

What criminal convictions can landlords legally consider when screening tenants in unincorporated Cook County?

Cook County's Human Rights Ordinance generally limits consideration to convictions (not arrests) for violent felonies or drug manufacturing and distribution offenses within approximately the past three years from the application date. Violent felonies typically include crimes such as murder, armed robbery, aggravated battery, and sexual assault. The ordinance prohibits blanket policies automatically disqualifying applicants with any criminal history. Property owners should consult attorneys licensed in Illinois and verify current ordinance requirements, as specific provisions and interpretations may vary.

Are landlords required to accept Section 8 vouchers in Chicago and Cook County?

Both Chicago and Cook County designate source of income as a protected class, generally making it a potential violation to refuse Housing Choice Voucher holders or advertise properties as unavailable to voucher applicants. Property owners typically must evaluate voucher holders using the same screening criteria applied to other applicants. While landlords may apply reasonable criteria regarding credit, rental history, and criminal background (within legal limits), compliant practices avoid imposing additional or different standards on voucher holders.

How long should landlords maintain tenant screening records in Illinois?

Recommended practice involves maintaining tenant screening records for at least three years to cover Illinois Human Rights Act statute of limitations periods (775 ILCS 5/7A-102(D-5)) and potential federal Fair Housing Act complaints. Records typically should include advertisements, written screening criteria, all applications received, screening reports obtained, adverse action notices sent, and documentation of decision-making rationale. Organized record-keeping supports responses to compliance reviews from Chicago BACP or Cook County Commission on Human Rights.

What information must landlords provide when denying rental applications in Chicago?

Chicago generally requires landlords to provide specific reasons for application denial rather than generic statements. Adverse action notices typically should identify which stated criteria the applicant did not meet, such as specific credit score thresholds or income requirements expressed as multiples of rent. Federal FCRA requirements (15 U.S.C. § 1681b(b)(3)) add obligations to include the consumer reporting agency's name and contact information, state that the agency did not make the denial decision, and inform applicants of their right to dispute report accuracy.

Do screening requirements differ between Chicago city limits and unincorporated Cook County areas?

Yes, Chicago's RLTO creates screening requirements unique to properties within city limits, including the $20 fee cap (§ 5-12-170), mandatory written screening criteria disclosure, and specific refund timelines. Unincorporated Cook County areas are governed by county ordinances without RLTO provisions but include criminal history lookback limitations and source of income protections. Property managers with portfolios spanning both jurisdictions typically are advised to apply the most restrictive applicable standard across all properties.

Can landlords use automated tenant screening services that generate approval recommendations?

Landlords may use automated screening services, but human review typically is recommended to ensure individualized assessment and compliance with local restrictions. Automated systems often flag all criminal records and may not distinguish between arrests and convictions, identify conviction dates for proper timeframe calculations, or recognize sealed records. Screening service agreements should clarify that final rental decisions remain the property owner's responsibility.

What potential penalties do landlords face for violating Chicago or Cook County tenant screening laws?

Potential penalties vary based on violation type and enforcing agency. Chicago RLTO violations may result in fines of $200-500 per occurrence through BACP enforcement under Municipal Code § 5-12-170. Cook County Human Rights Ordinance violations may result in civil penalties and compensatory damages to affected applicants. Federal Fair Housing Act and Illinois Human Rights Act violations may expose landlords to civil lawsuits with potential actual damages, punitive damages, and attorney fee awards.

Additional Resources

- Chicago Residential Landlord and Tenant Ordinance - Official Municipal Code

https://codelibrary.amlegal.com/codes/chicago/latest/chicago_il/0-0-0-2447897 - Cook County Commission on Human Rights - Ordinance and Complaint Information

https://www.cookcountyil.gov/service/human-rights-ordinance - Illinois Human Rights Act - Full Text (775 ILCS 5/)

https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=2266&ChapterID=64 - Illinois Department of Human Rights - Fair Housing Information and Resources

https://www2.illinois.gov/dhr/Pages/default.aspx - U.S. Department of Housing and Urban Development - Criminal Records Screening Guidance

https://www.hud.gov/program_offices/fair_housing_equal_opp/criminal_records - Federal Trade Commission - Fair Credit Reporting Act Full Text and Compliance Resources

https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act - Chicago Housing Authority - Housing Choice Voucher Program Landlord Information

https://www.thecha.org/doing-business/landlord-information

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.