Nevada's financial institutions operate under a uniquely complex regulatory framework where traditional banking oversight intersects with gaming-adjacent financial services and progressive cryptocurrency legislation. Compliance officers must navigate overlapping requirements from the Nevada Division of Financial Institutions (NDFI), Gaming Control Board, and federal FinCEN regulations while implementing screening programs that address the state's emerging digital asset sector and casino-linked financial services ecosystem.

Key Takeaways

- Nevada financial institutions face tri-regulatory oversight requiring background checks that simultaneously satisfy NDFI, Gaming Control Board, and federal FinCEN standards, creating more comprehensive screening obligations than most other states.

- Financial services employees in gaming-adjacent roles may require Nevada Gaming Control Board registration in addition to standard banking clearances, particularly for positions involving casino credit, cage operations, or race and sports book financial services.

- The state's progressive cryptocurrency legislation demands that digital asset businesses implement background screening programs meeting both traditional financial institution standards and anti-money laundering protocols specific to virtual currency operations.

- Credit unions, banks, and alternative financial services providers must conduct fingerprint-based FBI background checks for employees in positions of trust, with results reviewed against both federal and Nevada-specific disqualifying criteria.

- Nevada's multi-jurisdictional landscape requires continuous monitoring programs rather than one-time screening, particularly for institutions operating across county lines where different local gaming regulations may apply.

- FCRA compliance remains critical even within regulatory-mandated screening, as employers must still provide proper disclosure, obtain authorization, and follow adverse action procedures for employment decisions based on background check results.

- Emerging fintech and cryptocurrency businesses often underestimate Nevada's stringent requirements, mistakenly assuming their non-traditional business model exempts them from established financial institution screening protocols.

- Re-screening intervals vary by position classification and regulatory jurisdiction, with some gaming-adjacent financial roles requiring annual updates while traditional banking positions may allow longer intervals between comprehensive background reviews.

Understanding Nevada's Tri-Regulatory Financial Services Landscape

Nevada's financial services sector operates within a regulatory environment unlike any other state in the nation. The convergence of traditional banking oversight, gaming-related financial services, and progressive cryptocurrency legislation creates a compliance framework requiring specialized knowledge. Financial institutions operating in Nevada must satisfy requirements from three distinct regulatory spheres that frequently overlap in practice.

The Nevada Division of Financial Institutions regulates banks, credit unions, and various alternative financial services providers. Gaming operations create unique complications when banking services intersect with casino operations. Meanwhile, federal FinCEN regulations impose requirements on all financial institutions regardless of charter type, creating layers of compliance obligations that demand careful coordination.

Nevada Division of Financial Institutions Oversight Authority

The Nevada Division of Financial Institutions (NDFI) regulates state-chartered banks, credit unions, savings and loan associations, trust companies, and alternative financial services providers. This agency enforces background check requirements for employees occupying positions of trust, including executive officers, lending personnel, compliance staff, and individuals with access to sensitive customer financial information. NDFI examination procedures specifically review hiring practices and screening documentation during routine compliance audits.

State-chartered institutions must implement screening programs identifying individuals with criminal histories involving financial crimes, fraud, embezzlement, or violations of trust. Nevada Revised Statutes Chapter 645B establishes baseline requirements, though institutions typically implement more comprehensive screening to satisfy federal expectations. The division coordinates with federal regulatory agencies to ensure state-chartered institutions meet equivalent standards to federally-chartered competitors.

Gaming Control Board Financial Service Intersections

Nevada's gaming industry creates unique complications for financial institution background checks when banking services intersect with casino operations. The Nevada Gaming Control Board maintains jurisdiction over various financial services directly supporting gaming operations. Employees providing these services may require registration or licensing through the Gaming Control Board even when employed by traditional financial institutions.

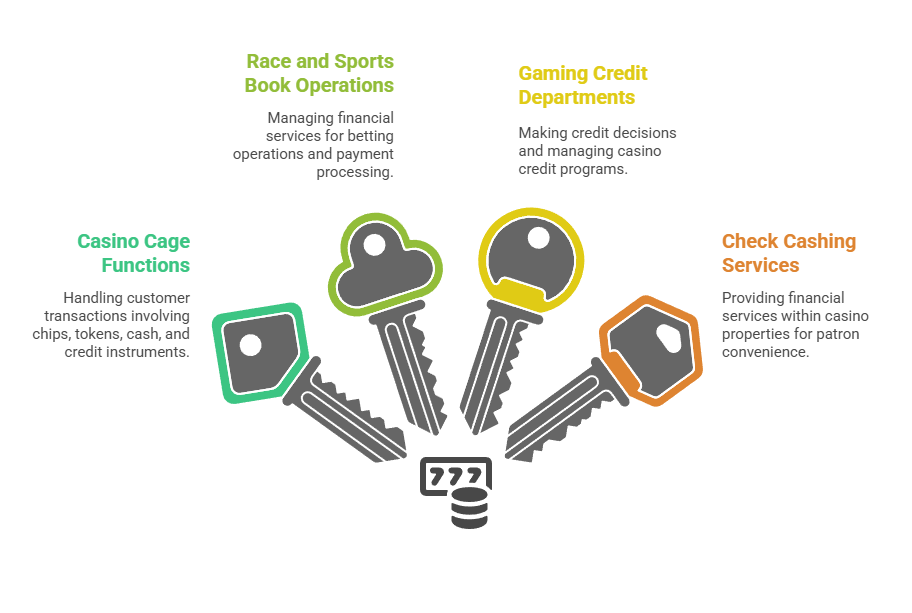

Key gaming-adjacent financial services requiring specialized screening include:

- Casino cage functions: Handling customer transactions involving chips, tokens, cash, and credit instruments within gaming establishments

- Race and sports book operations: Managing financial services for betting operations and payment processing for wagering transactions

- Gaming credit departments: Making credit decisions and managing casino credit programs that extend funds to gaming patrons

- Check cashing services: Providing financial services within casino properties that facilitate gaming activities and patron convenience

This intersection becomes particularly relevant for banks operating branches within casino properties or credit unions serving predominantly gaming industry employees. Background screening for these positions must meet Gaming Control Board standards, which typically exceed traditional banking requirements. Gaming-adjacent financial roles may face disqualification for offenses that wouldn't necessarily prevent employment in standard banking positions.

Federal FinCEN and Anti-Money Laundering Requirements

Federal Financial Crimes Enforcement Network (FinCEN) regulations impose background check requirements on all financial institutions regardless of charter type. These federal mandates establish minimum screening standards for Bank Secrecy Act compliance officers and anti-money laundering personnel. Nevada institutions must ensure their screening programs satisfy both state-specific requirements and federal expectations, implementing the more stringent standard when regulations differ.

The federal framework becomes particularly important for Nevada's growing cryptocurrency and digital asset businesses. FinCEN has clarified that many cryptocurrency exchanges, wallet providers, and digital asset businesses qualify as money services businesses subject to Bank Secrecy Act registration. These businesses must implement background screening programs comparable to traditional financial institutions, despite their non-traditional business models and technology-focused operations.

Required Background Check Components for Nevada Financial Institutions

Nevada financial institution background checks must include multiple verification and screening components to satisfy the tri-regulatory framework governing the state's financial services sector. The specific elements required vary based on position classification, regulatory jurisdiction, and institutional risk assessment. However, certain core components apply across most financial services employment categories.

Fingerprint-Based Criminal History Searches

Fingerprint-based FBI criminal background checks represent the gold standard for financial institution screening in Nevada. State and federal regulations require this level of scrutiny for positions involving access to customer funds or sensitive financial information. Unlike name-based criminal searches that rely on matching personal identifiers, fingerprint-based searches provide definitive identification and access to the most comprehensive criminal history databases available.

Nevada financial institutions typically submit fingerprint cards through approved channeling agencies that transmit data to both the Nevada Department of Public Safety and the FBI. Results include criminal history from all participating jurisdictions nationwide, though reporting completeness varies. Financial services employers must review results against position-specific disqualifying criteria established by applicable regulations and internal risk management policies.

Credit History and Financial Background Reviews

Credit history reviews serve dual purposes in financial institution background screening: assessing trustworthiness with financial responsibilities and identifying potential vulnerabilities to internal fraud. Nevada regulations and federal guidance recognize that employees experiencing severe financial distress may present elevated risks in positions involving access to funds. However, employers must balance legitimate risk management concerns against FCRA requirements and anti-discrimination principles.

Financial institutions must provide proper FCRA disclosure and obtain written authorization before obtaining credit reports for employment purposes. The review should focus on patterns indicating financial irresponsibility rather than single incidents. Nevada employers must also consider the state's progressive approach to employment discrimination, which limits the circumstances under which credit history alone can disqualify candidates.

Professional License and Certification Verification

Many financial institution positions require specific professional licenses or certifications that must be verified during the background screening process. Banking executives may hold certifications from organizations like the American Bankers Association. Compliance officers frequently maintain Certified Regulatory Compliance Manager (CRCM) credentials. Investment professionals require securities licenses administered by FINRA.

Verification becomes particularly important in Nevada's gaming-adjacent financial services roles, where Gaming Control Board registration or licensing may be required. These gaming credentials involve their own extensive background investigation process. Financial institutions must coordinate timing between their internal screening processes and Gaming Control Board application procedures to avoid delays in placing qualified candidates into critical positions.

Position-Specific Screening Requirements and Risk Classification

Nevada financial institutions must tailor background screening depth and frequency to position-specific risk profiles, regulatory requirements, and operational responsibilities. Not all positions require identical screening intensity, though baseline checks apply across most financial services employment categories. Developing a position classification system aligned with regulatory expectations allows institutions to allocate screening resources effectively while maintaining comprehensive compliance coverage.

Executive Leadership and Board Member Screening

Executive officers and board members face the most intensive background screening requirements due to their fiduciary responsibilities and potential impact on institutional stability. Nevada Division of Financial Institutions regulations require comprehensive background investigations for institution executives. Federal regulatory agencies expect equivalent scrutiny regardless of charter type.

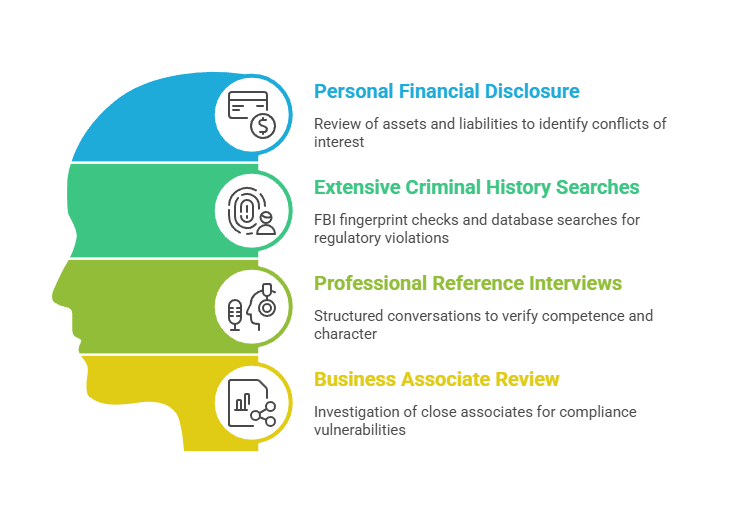

Required screening components for executive positions include:

- Personal financial disclosure: Comprehensive review of assets, liabilities, and financial relationships that might create conflicts of interest

- Extensive criminal history searches: FBI fingerprint checks supplemented by searches of regulatory violation databases and professional misconduct records

- Professional reference interviews: Structured conversations with former supervisors, colleagues, and business associates verifying competence and character

- Business associate review: Investigation of close family members and business partners who might create compliance vulnerabilities or conflicts

Gaming-adjacent institutions may face additional Nevada Gaming Control Board investigation requirements for executives with decision-making authority over gaming-related financial services operations. These investigations often extend scrutiny beyond the individual executive to encompass family members and close associates who might influence institutional decisions.

Compliance Officers and BSA Personnel

Bank Secrecy Act compliance officers and anti-money laundering personnel require specialized background screening addressing their critical regulatory responsibilities. These positions demand individuals with unquestionable integrity. Background checks must include criminal history searches specifically examining financial crimes, regulatory violations, and any history suggesting susceptibility to compromise or coercion.

Nevada institutions should implement enhanced screening for compliance personnel that exceeds minimum regulatory requirements. This enhanced approach might include more frequent re-screening intervals and continuous criminal monitoring services. The compliance function's independence and effectiveness depend fundamentally on personnel integrity, justifying additional investment in screening depth and ongoing monitoring.

Customer-Facing and Operational Staff

Tellers, customer service representatives, and operational staff require comprehensive but less intensive screening than executive or compliance positions. Standard criminal history checks, employment verification, educational credential confirmation, and reference checks typically satisfy regulatory expectations for these roles. However, Nevada's gaming-adjacent environment may create additional requirements when customer-facing staff work in casino branch locations.

Financial institutions must establish clear screening standards that apply consistently across similar position classifications. A teller position in a rural Nevada community bank branch faces different risk considerations than a similar role in a Las Vegas casino property branch. Documentation of risk assessment methodology and position-specific screening requirements protects institutions during regulatory examinations and demonstrates thoughtful compliance program design.

Nevada's Cryptocurrency and Digital Asset Screening Requirements

Nevada's progressive approach to cryptocurrency regulation creates unique background screening obligations for digital asset businesses. Senate Bill 195, enacted in 2017, prohibits Nevada governmental entities from taxing blockchain use or requiring licenses specifically for blockchain use. However, this blockchain-friendly posture doesn't exempt cryptocurrency businesses from financial institution regulations when their activities qualify as money transmission or money services business operations.

Digital Asset Business Regulatory Classification

Many cryptocurrency exchanges, wallet providers, and digital asset businesses operating in Nevada meet the regulatory definition of money services businesses. This classification triggers comprehensive background check requirements comparable to traditional financial institutions, despite these businesses' technology-focused operations. Determining whether a specific digital asset business requires money services business registration depends on detailed functional analysis of services offered and customer relationship structures.

| Business Type | Regulatory Classification | Screening Requirements |

| Cryptocurrency Exchanges | Money Services Business | Full MSB compliance including executive and compliance officer background checks |

| Hosted Wallet Providers | Money Services Business | FinCEN registration with comprehensive personnel screening requirements |

| Unhosted Wallet Software | Generally Not Regulated | No mandatory screening unless providing transmission services |

| Mining Operations | Generally Not Regulated | No mandatory financial institution screening requirements |

| DeFi Protocol Developers | Case-by-Case Analysis | Depends on control level and customer fund access |

Nevada's Secretary of State maintains the money transmitter license registry, while NDFI provides regulatory oversight for licensed entities. The licensing process requires comprehensive background investigations of business owners and executive officers. These investigations examine criminal history, financial background, business experience, and personal character through multiple verification methods.

Anti-Money Laundering Program Personnel Standards

Digital asset businesses subject to Bank Secrecy Act compliance must appoint qualified anti-money laundering compliance officers meeting federal personnel standards. FinCEN guidance emphasizes that cryptocurrency businesses face equivalent AML compliance obligations as traditional money services businesses. These screening requirements apply regardless of whether the business considers itself a "technology company" rather than a financial services provider.

Nevada cryptocurrency businesses must implement screening programs addressing the unique money laundering and terrorist financing risks associated with digital asset transactions. Compliance personnel background checks should specifically examine any history of sanctions violations or money laundering involvement. The pseudonymous nature of many cryptocurrency transactions and cross-border movement ease create elevated risk profiles demanding particularly careful compliance personnel screening.

Gaming-Adjacent Financial Services Compliance Complexities

Nevada's gaming industry creates distinctive compliance challenges for financial institutions providing services to casinos, gaming equipment manufacturers, and gaming industry employees. These gaming-adjacent financial services often require coordination between Nevada Division of Financial Institutions oversight, Gaming Control Board jurisdiction, and federal banking regulations. Understanding where these regulatory spheres intersect becomes essential for developing compliant background screening programs.

Casino Cage and Credit Operations Background Checks

Financial services personnel working in casino cage operations or gaming credit departments typically require both traditional financial institution screening and Gaming Control Board registration. Casino cage cashiers handle customer transactions involving chips, tokens, cash, and credit instruments within gaming establishments. Gaming Control Board regulations establish specific background check requirements for these positions that generally exceed traditional banking standards.

Critical screening elements for casino financial service positions include:

- Gaming-specific criminal history review: Examination of gambling-related offenses, illegal bookmaking activities, and point-shaving involvement not typically scrutinized in traditional banking background checks

- Moral turpitude assessment: Evaluation of crimes indicating character deficiencies that might affect gaming operation integrity or public trust in casino financial services

- Financial investigation: More extensive credit and financial background review than standard banking positions, including personal gambling habits and debt levels that might create vulnerability

- Association analysis: Investigation of relationships with individuals involved in illegal gambling or organized crime that might compromise cage operation security

Financial institutions providing credit services to casinos or managing casino credit programs must ensure their employees meet Gaming Control Board suitability standards. The Gaming Control Board may conduct independent background investigations even when employees work for financial institutions rather than directly for casino operators. This dual oversight creates coordination requirements between financial institution human resources departments and Gaming Control Board licensing divisions.

Race and Sports Book Financial Service Providers

Nevada's legal sports betting industry creates another gaming-adjacent financial services category requiring specialized background screening. Financial institutions providing cash management, payment processing, or related services to race and sports book operations may face Gaming Control Board jurisdiction. The rapid expansion of mobile sports betting following federal law changes has complicated these jurisdictional determinations, particularly for payment processors facilitating online wagering transactions.

Background screening for personnel supporting sports betting financial services should address both traditional financial institution concerns and gaming-specific risk factors. This includes examining any history of sports betting violations or bookmaking activities. Nevada employers must recognize that Gaming Control Board suitability standards specifically consider gambling-related conduct that might not appear in standard criminal background checks, potentially requiring supplementary investigative procedures beyond typical financial institution screening.

FCRA Compliance Within Regulatory Background Screening

Nevada financial institutions must navigate the intersection between regulatory-mandated background screening requirements and Fair Credit Reporting Act (FCRA) compliance obligations. Many compliance officers mistakenly assume that regulatory requirements to conduct background checks exempt them from FCRA procedures. However, federal courts and the Federal Trade Commission have consistently rejected this interpretation. Financial institutions must satisfy both regulatory screening mandates and FCRA consumer protection requirements simultaneously.

Disclosure and Authorization Requirements

FCRA requires employers to provide clear, standalone disclosure before obtaining consumer reports for employment purposes. The disclosure document must consist solely of the disclosure and cannot be included within broader employment applications. Nevada financial institutions must provide this disclosure even when conducting regulatory-required background checks, as FCRA applies regardless of whether screening is voluntary or mandated by regulation.

The authorization form should specifically identify the types of consumer reports the institution may obtain. While regulatory requirements mandate certain screening components, FCRA still requires informed consent from the individual subject to investigation. Financial institutions should maintain signed disclosure and authorization forms throughout the employment relationship and for any legally required retention period thereafter.

Adverse Action Procedures for Employment Decisions

When background check results contribute to an adverse employment decision, FCRA requires specific adverse action procedures. Financial institutions must provide pre-adverse action notice including a copy of the consumer report and the FTC's Summary of Consumer Rights. After allowing reasonable time for the individual to dispute report accuracy, employers must provide final adverse action notice identifying the consumer reporting agency.

These FCRA procedures apply even when Nevada regulations or federal banking rules mandate background screening and establish disqualifying criteria. Compliance officers cannot bypass adverse action procedures by citing regulatory requirements. Financial institutions should document the specific report information supporting adverse decisions and maintain clear policies connecting background check findings to position requirements.

Continuous Monitoring and Re-Screening Compliance

Many Nevada financial institutions implement continuous criminal monitoring or periodic re-screening programs to identify emerging risk factors during employment. These ongoing screening activities trigger FCRA compliance obligations separate from initial hiring background checks. Employers must obtain specific authorization for continuous monitoring at employment commencement, clearly explaining that background checks may continue throughout the employment relationship.

When continuous monitoring identifies new criminal activity, financial institutions must follow FCRA adverse action procedures before taking employment action. The requirement to provide report copies and dispute opportunities applies equally to ongoing monitoring hits and initial pre-employment screening results. Nevada employers should implement clear policies establishing when re-screening occurs and what triggers monitoring alerts warrant review.

Implementation Best Practices for Nevada Financial Institutions

Developing effective background screening programs for Nevada financial institutions requires balancing comprehensive risk management, regulatory compliance, efficient operations, and fair employment practices. The state's unique tri-regulatory environment demands more sophisticated approaches than generic background check programs. Successful implementation depends on clear policies, consistent procedures, ongoing training, and regular program evaluation.

Establishing Position-Based Screening Matrices

Financial institutions should develop detailed screening matrices that specify required background check components for each position classification. These matrices should reference applicable regulatory requirements from NDFI, Gaming Control Board, federal banking agencies, and FinCEN. Clear documentation demonstrates thoughtful program design during regulatory examinations and provides consistent guidance to human resources personnel.

| Position Level | Criminal Check | Credit Check | License Verification | Re-screening Interval |

| Executive Officers | FBI Fingerprint | Comprehensive | Professional + Gaming | Annual |

| Compliance Officers | FBI Fingerprint | Comprehensive | CRCM/Professional | Annual |

| Lending Staff | FBI Fingerprint | Standard | State License | Every 2 Years |

| Tellers (Standard) | FBI Fingerprint | Limited | None Required | Every 3 Years |

| Tellers (Casino Cage) | FBI + Gaming Board | Comprehensive | Gaming Registration | Annual |

The screening matrix should address initial hiring procedures, re-screening intervals, continuous monitoring applicability, and procedures for employees transferring between positions. Nevada's gaming-adjacent environment creates particular complexity when employees move between traditional banking roles and positions requiring Gaming Control Board registration. The matrix should establish clear triggers for additional screening when position changes create new regulatory obligations.

Third-Party Screening Vendor Management

Most Nevada financial institutions engage specialized background screening vendors rather than conducting investigations internally. Vendor selection requires careful evaluation of capabilities specific to Nevada's regulatory environment. Vendors must qualify as consumer reporting agencies under FCRA and maintain compliance with both federal and Nevada consumer protection laws.

Financial institutions retain ultimate responsibility for background screening compliance even when outsourcing investigation activities. Vendor management programs should include contract provisions addressing FCRA compliance and data security requirements. Regular vendor performance evaluation should examine accuracy rates and compliance with authorization and disclosure procedures.

Training and Quality Assurance Programs

Human resources personnel, hiring managers, and compliance officers require comprehensive training on Nevada's financial institution background screening requirements. Training should address the tri-regulatory framework and position-specific screening requirements. Regular refresher training ensures personnel remain current as regulations evolve and institutional policies are updated.

Quality assurance procedures should include periodic file reviews examining compliance with disclosure and authorization requirements. These internal audits identify compliance gaps before regulatory examinations. Nevada financial institutions should document quality assurance findings, corrective actions, and program improvements resulting from internal reviews.

Conclusion

Nevada financial institutions operate within a uniquely complex regulatory environment requiring sophisticated background screening programs. The state's progressive cryptocurrency legislation adds another compliance layer as digital asset businesses navigate their classification as financial institutions. Successful compliance demands understanding how these regulatory frameworks intersect and developing position-specific screening protocols. Financial institutions that invest in comprehensive background screening programs tailored to Nevada's distinctive tri-regulatory landscape protect themselves from regulatory sanctions while building trustworthy teams.

Frequently Asked Questions

What background checks are required for Nevada financial institution employees?

Nevada financial institutions must conduct fingerprint-based FBI criminal history checks for employees in positions of trust, including executives, compliance officers, and lending personnel. Additional requirements may include credit history reviews, professional license verification, and employment history confirmation depending on position classification. Gaming-adjacent roles may require Nevada Gaming Control Board registration with separate background investigation processes.

Do cryptocurrency businesses in Nevada need to conduct banking-level background checks?

Yes, cryptocurrency exchanges, wallet providers, and digital asset businesses classified as money services businesses under federal FinCEN regulations must implement background screening programs comparable to traditional financial institutions. This includes comprehensive checks for owners, executives, and compliance personnel. The screening requirements apply regardless of whether the business considers itself a technology company rather than a financial services provider.

How do Gaming Control Board requirements affect financial institution background checks?

Financial institution employees working in gaming-adjacent roles such as casino cage operations or gaming credit departments may require Nevada Gaming Control Board registration in addition to standard banking clearances. Gaming Control Board background investigations typically exceed traditional banking requirements and examine gambling-related conduct not necessarily covered in standard screening. These positions face additional disqualifications for gambling-related offenses or moral turpitude crimes.

What disqualifies someone from financial institution employment in Nevada?

Disqualifying factors typically include felony convictions for financial crimes, fraud, embezzlement, money laundering, or breach of trust. Regulatory violations in previous financial services employment and falsification of application materials also create disqualifications. Gaming-adjacent positions face additional disqualifications for gambling-related offenses, while severe financial irresponsibility suggesting vulnerability to internal fraud may prevent employment in positions involving fund access.

How often must Nevada financial institutions re-screen employees?

Re-screening frequency varies by position classification and regulatory jurisdiction. Gaming-adjacent financial roles may require annual background updates, while traditional banking positions typically allow longer intervals between comprehensive reviews. Many institutions implement continuous criminal monitoring for high-risk positions to identify issues emerging between scheduled re-screening cycles.

Do FCRA requirements apply to regulatory-mandated background checks?

Yes, Fair Credit Reporting Act disclosure, authorization, and adverse action requirements apply even when background checks are mandated by Nevada or federal financial institution regulations. Financial institutions must provide standalone disclosure documents and obtain written authorization. Employers must also follow adverse action procedures when background check results contribute to employment decisions, regardless of regulatory screening mandates.

What screening is required for financial institution board members in Nevada?

Board members face comprehensive background investigations including extensive criminal history searches, personal financial disclosure, and professional reference interviews. Nevada Division of Financial Institutions and federal banking agencies examine board member backgrounds during licensing processes. Regulatory violation database checks ensure appropriate oversight capability and fiduciary responsibility for institutional governance.

Can Nevada employers reject financial institution applicants based on credit history?

Nevada employers may consider credit history for financial institution positions where financial responsibility directly relates to job duties. However, they must balance legitimate risk management concerns against FCRA requirements and anti-discrimination principles. Credit history reviews should focus on patterns indicating financial irresponsibility rather than single incidents. Employers must document the relationship between credit concerns and specific position requirements for defensible employment decisions.

Additional Resources

- Nevada Division of Financial Institutions - Regulated Institutions Directory

https://fid.nv.gov/Financial_Institutions/Regulated_Institutions/ - Nevada Gaming Control Board - Licensing Information

https://gaming.nv.gov/index.aspx?page=3 - FinCEN - Bank Secrecy Act Compliance Guidance

https://www.fincen.gov/resources/statutes-and-regulations/guidance - Federal Trade Commission - Fair Credit Reporting Act Compliance Guide

https://www.ftc.gov/business-guidance/resources/employment-background-screening - FDIC - Financial Institution Employee Background Screening Guidelines

https://www.fdic.gov/regulations/laws/rules/ - Nevada Revised Statutes Chapter 645B - Financial Institutions

https://www.leg.state.nv.us/nrs/nrs-645b.html - NCUA - Credit Union Employee Background Check Requirements

https://www.ncua.gov/regulation-supervision/rules-regulations