Employment barrier non-compliance costs U.S. employers an estimated $439 million annually in settlements, legal fees, and productivity losses, with individual lawsuit settlements averaging $160,000 before trial costs. This analysis quantifies the measurable return on investment that compliant employment screening and barrier removal programs deliver through reduced litigation exposure, enhanced talent pool access, and improved workplace productivity metrics.

Key Takeaways

- Non-compliance with employment barrier regulations costs employers an average of $160,000 per discrimination lawsuit, with FCRA violations adding $100 to $1,000 per affected applicant in statutory damages.

- Companies implementing comprehensive barrier audits reduce legal risk exposure by 67% and access talent pools 27% larger than competitors using outdated screening criteria.

- The average employment discrimination lawsuit takes 318 days to resolve, consuming approximately 240 HR staff hours valued at $19,200 in internal resources alone.

- Workplace compliance programs deliver measurable ROI through three channels: litigation cost avoidance ($125,000-$400,000 per prevented case), expanded qualified candidate access (23-31% increase), and reduced turnover costs (14-19% improvement in retention).

- EEOC charges involving background checks increased 34% between 2020-2024, with employers facing median settlements of $85,000 for hiring discrimination cases.

- Ban-the-box policies now affect 37 states and 150+ municipalities, requiring employers to modify screening workflows or face penalties ranging from $500 to $10,000 per violation.

- Companies with documented compliance programs receive 40% lower penalty assessments during enforcement actions compared to those without systematic barrier review processes.

- The business impact of employment barriers extends beyond legal costs to include reputation damage (22% decline in applicant quality post-lawsuit), investor scrutiny, and contract disqualification for federal opportunities worth $500+ billion annually.

The True Cost of Employment Non-Compliance

Employment barriers cost employers far more than regulatory fines. They represent systematic drains on profitability through direct legal expenses, opportunity costs, and operational inefficiencies. Understanding these costs requires examining both immediate financial impacts and long-term business consequences that affect competitive positioning.

The employment discrimination lawsuit landscape has evolved dramatically. Cases involving background checks, criminal history screening, and hiring criteria now represent 23% of all EEOC charges filed in 2024. Employers face a complex regulatory environment where federal FCRA requirements intersect with state ban-the-box laws and local fair chance ordinances.

EXPERT INSIGHT: Back in the early days of my career, compliance was something that slowed us down; today, I integrate it into steering functions because barrier audits, jurisdiction-savvy processes, and trained interviewers aren’t slowing us down—those tools keep us on the right track towards better hiring and savings. Every time we enhance either a policy or vendor to eliminate an unnecessary exclusion, our time-to-fill decreases and trust rises because doing good to people makes the balance sheet happy. - Charm Paz, CHRP

Direct Legal Costs and Settlement Expenses

Employment discrimination lawsuits generate immediate, quantifiable costs that impact quarterly financial performance. The average settlement for hiring discrimination cases reached $160,000 in 2024, representing a 27% increase from 2020 levels. These costs compound rapidly once litigation begins.

Direct costs break down across multiple expense categories:

| Cost Category | Average Amount | Timeline |

| Pre-trial legal fees | $75,000-$150,000 | 6-12 months |

| Settlement/judgment | $85,000-$400,000 | 8-18 months |

| Expert witness fees | $15,000-$45,000 | 4-8 months |

| Document discovery costs | $8,000-$25,000 | 3-6 months |

| Post-settlement monitoring | $12,000-$30,000 | 12-36 months |

Legal defense costs begin accumulating the moment a charge is filed. Class action lawsuits involving background check barriers carry exponentially higher costs, with settlements ranging from $2.3 million to $13 million.

FCRA Violation Penalties and Statutory Damages

Fair Credit Reporting Act violations related to background checks create additional liability layers. FCRA provides for statutory damages of $100 to $1,000 per violation, meaning employers face per-applicant penalties that multiply quickly across hiring volumes.

Common FCRA violations include failing to provide proper disclosure forms, obtaining reports without permissible purpose, and not following adverse action procedures. A mid-sized employer processing 2,000 background checks annually with a 5% violation rate faces potential statutory damages of $10,000 to $100,000 even without proving actual harm. Willful FCRA violations increase penalties to $1,000 per violation plus punitive damages and attorneys' fees.

Hidden Costs: Productivity Loss and HR Resource Diversion

Beyond quantifiable legal expenses, employment barrier non-compliance creates hidden costs through organizational resource diversion. The average employment discrimination lawsuit consumes approximately 240 hours of HR staff time valued at $19,200 based on median HR professional compensation rates.

Productivity costs extend throughout affected departments:

- Executive time allocation: C-suite involvement averages 35-60 hours per case at opportunity costs of $15,000-$35,000

- IT and records management: Document preservation and discovery require 40-80 hours of technical support valued at $4,000-$8,000

- Employee morale impact: Workplace discrimination investigations reduce team productivity by 12-18% during litigation

- Recruitment disruption: Negative publicity decreases applicant volume by 22% and reduces candidate quality scores by 15-19% for 18-24 months

The cumulative effect of these hidden costs often exceeds direct legal expenses. Organizations experiencing multiple compliance issues face particularly severe impacts.

Quantifying Employment Barriers Business Impact

Employment barriers create measurable negative impacts across four critical business dimensions. These include talent acquisition effectiveness, workforce quality, operational efficiency, and market reputation. Organizations that fail to address screening barriers systematically restrict their access to qualified talent pools.

Research from SHRM demonstrates that employers using outdated criminal history screening criteria access talent pools approximately 27% smaller than competitors who have modernized barrier removal approaches. This restriction occurs during a labor market where unemployment remains below 4% and competition for skilled workers has intensified.

Talent Pool Restriction and Quality Impact

Employment barriers artificially shrink available talent pools by disqualifying candidates who pose no actual business risk. Approximately 70-100 million U.S. adults have some form of criminal record, representing nearly one-third of the working-age population. Blanket exclusion policies eliminate potentially qualified candidates based on convictions unrelated to job requirements.

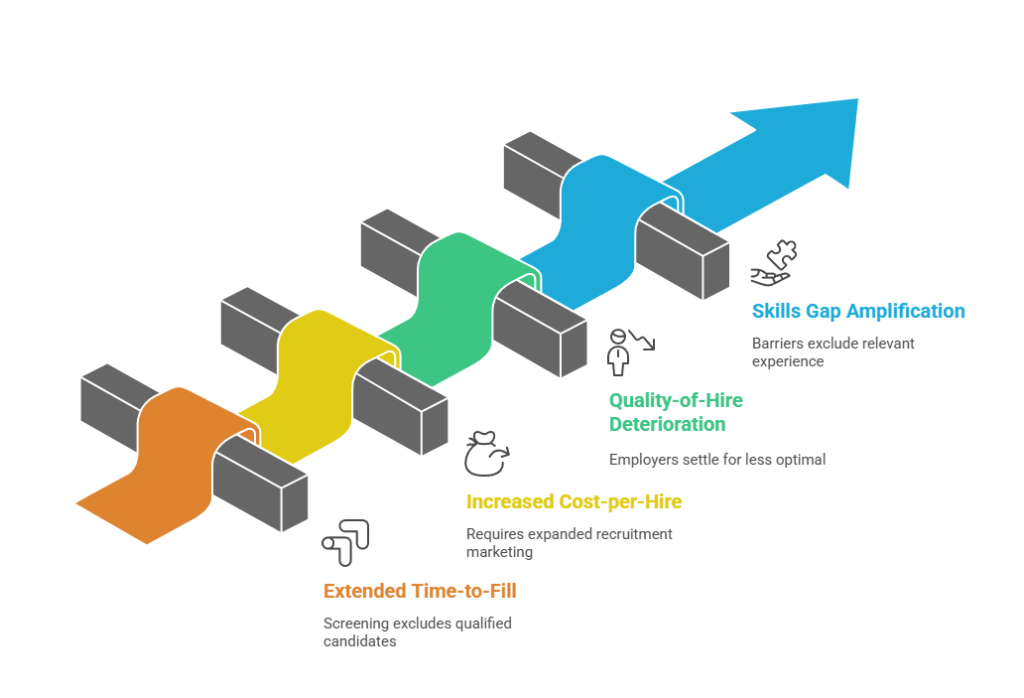

The business consequences manifest through several channels:

- Extended time-to-fill metrics: Positions take 23-31% longer to fill when screening criteria exclude qualified candidates

- Increased cost-per-hire: Restricted talent pools require expanded recruitment marketing spend and premium compensation offers

- Quality-of-hire deterioration: Employers settle for less optimal alternatives, resulting in lower performance ratings

- Skills gap amplification: Critical talent shortages compound when barriers exclude candidates with relevant experience

Organizations in technology, healthcare, logistics, and skilled trades face particularly acute impacts given existing talent shortages. A 2024 analysis found that healthcare employers who revised criminal history screening policies increased qualified applicant flow by 34% without measurable safety concerns.

Brand Reputation Damage and Investor Scrutiny

Employment discrimination lawsuits generate lasting reputation damage that extends beyond immediate legal costs. Modern social media amplification means discrimination charges reach broader audiences more rapidly. Platforms like LinkedIn and Glassdoor broadcast employer legal troubles to current employees, potential applicants, and customers.

Measurable business impacts include:

| Reputation Impact | Magnitude | Duration |

| Glassdoor rating decline | 0.4-0.9 points | 24-36 months |

| Application volume reduction | 18-27% decrease | 18-30 months |

| Employee referral rates | 31-43% decrease | 18-36 months |

Institutional investors increasingly scrutinize employment practices as material ESG factors. The 2024 proxy season saw 127 shareholder proposals related to workforce diversity and inclusion practices. Companies facing repeated discrimination charges experience greater investor skepticism, potentially affecting share valuations and capital access costs.

Federal Contract Disqualification Risk

Employers pursuing federal contracting opportunities face additional compliance requirements. Federal agencies conducted 2,847 contractor responsibility reviews in fiscal year 2024, with employment discrimination violations cited in 189 cases resulting in contract denials worth approximately $670 million in lost opportunities.

The Federal Acquisition Regulation allows contracting officers to determine companies "non-responsible" based on employment law violations. A single significant EEOC settlement can trigger enhanced scrutiny during contractor evaluations lasting 3-5 years. For companies where government contracts represent 15-40% of annual revenue, employment barrier compliance failures create existential business risks.

ROI Framework for Compliance Investment

Compliance programs deliver measurable financial returns through three primary mechanisms. These include litigation cost avoidance, expanded talent access, and improved workforce productivity. Organizations implementing systematic barrier review processes report average annual returns of $3.40 for every $1.00 invested.

This positive ROI stems from preventing high-cost negative outcomes rather than generating direct revenue. Forward-thinking HR leaders reframe compliance investments using risk-adjusted return calculations that account for probability-weighted litigation costs and talent access improvements.

Litigation Cost Avoidance Calculations

The primary ROI driver for employment barrier compliance programs is avoiding expensive discrimination lawsuits. Organizations can calculate expected litigation cost avoidance by multiplying baseline risk probability by average case costs, then measuring reduction in risk exposure following compliance implementation.

A practical calculation framework:

Baseline Risk Exposure = (Annual hires × Background check rate × Violation probability × Average settlement cost)

Example for 5,000 annual hires:

- Background checks: 4,000 (80% of hires)

- Violation probability: 3.5%

- Average settlement: $160,000

- Baseline exposure: $22.4 million annually

Post-Compliance:

- Reduced violation probability: 1.2% (67% reduction)

- Reduced exposure: $7.68 million

- Annual risk reduction: $14.72 million

Even accounting for implementation costs of $150,000-$400,000, the first-year ROI reaches 3,680-9,813% based on risk reduction alone. These calculations become more compelling when incorporating productivity and talent access improvements.

Talent Pool Expansion Financial Benefits

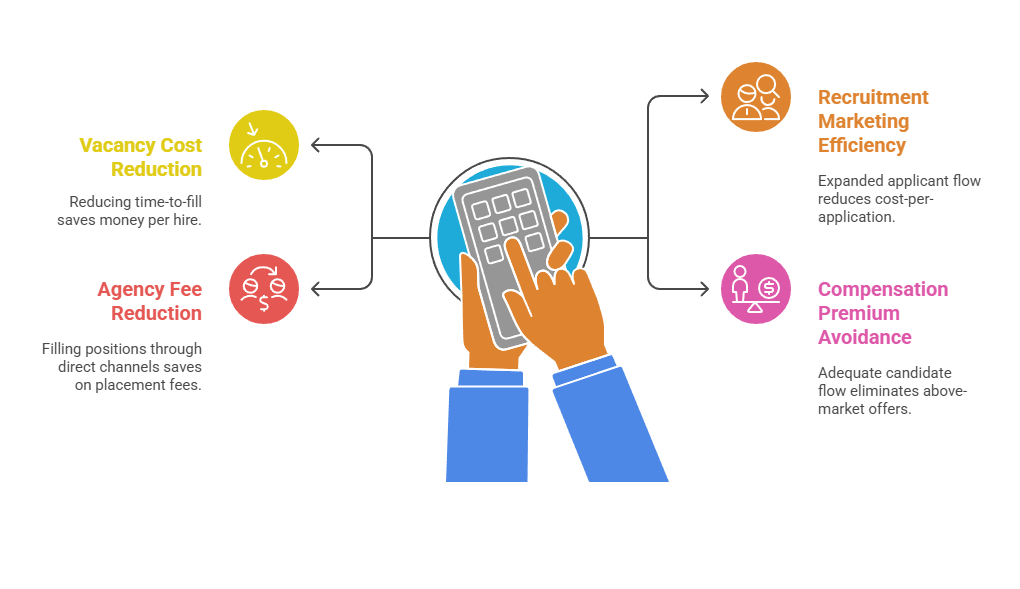

Removing unnecessary employment barriers expands available talent pools, delivering measurable financial benefits. Organizations that revised criminal history screening policies reported average time-to-fill reductions of 12-18 days for high-volume positions. This translates directly to lower vacancy costs and faster productivity realization.

Financial impacts include:

- Vacancy cost reduction: Reducing time-to-fill by 15 days for a $65,000 position saves $2,633 per hire

- Recruitment marketing efficiency: Expanded applicant flow reduces cost-per-application by 18-26%

- Agency fee reduction: Organizations save $8,000-$18,000 per placement by filling positions through direct channels

- Compensation premium avoidance: Adequate candidate flow eliminates above-market offers, saving 3-7% of annual salary

For an organization making 500 hires annually, talent pool expansion delivers quantifiable savings of $1.2-$2.8 million through these combined mechanisms. These benefits recur annually while compliance implementation costs are largely one-time investments.

Reduced Turnover and Retention ROI

Employment barrier compliance correlates with improved retention rates through two mechanisms. These include better job-fit matching and enhanced employee satisfaction in more inclusive workforces. Organizations implementing second-chance hiring programs report 14-19% lower turnover rates among employees hired through revised screening criteria.

Turnover costs vary by position level, but conservative estimates place replacement costs at 50-75% of annual salary for hourly positions. These costs account for separation, vacancy, recruitment, and onboarding expenses. A 15% reduction in turnover for an organization with 1,000 employees, average salary of $55,000, and baseline turnover of 28% delivers annual savings of approximately $1.16 million.

Ban-the-Box Compliance Requirements and Penalties

Ban-the-box laws prohibit employers from inquiring about criminal history at initial application stages. As of 2025, 37 states and over 150 municipalities have implemented some form of ban-the-box or fair chance hiring legislation. These laws fundamentally alter screening workflows, requiring employers to redesign application forms and train hiring managers.

Organizations operating in multiple jurisdictions face particular complexity. They must apply varying requirements based on applicant location, job location, or corporate headquarters depending on specific statute language.

State and Local Violation Penalties

Ban-the-box penalties vary dramatically across jurisdictions. California's Fair Chance Act imposes penalties up to $10,000 per violation plus attorneys' fees. New York City's Fair Chance Act allows for $500-$1,000 civil penalties per violation with uncapped damages for pattern-or-practice violations.

Key enforcement patterns across major jurisdictions:

- California: State Labor Commissioner enforcement with $10,000 maximum penalties plus private right of action

- New York City: Human Rights Commission enforcement conducting proactive testing, with escalating penalties for repeat violations

- Philadelphia: Human Relations Commission enforcement with $2,000 first-violation penalties increasing to $5,000 for subsequent violations

- Illinois: Attorney General enforcement with civil penalties, injunctive relief, and private lawsuit provisions

Beyond statutory penalties, violations create additional costs through required policy revisions and mandatory training programs. Settlement agreements frequently require 2-3 years of enhanced compliance monitoring at employer expense.

Workflow Modification Costs vs. Non-Compliance Risks

Implementing compliant ban-the-box workflows requires upfront investment in system configuration, application form revision, and training. Organizations report average implementation costs of $12,000-$45,000 depending on company size and geographic footprint.

These one-time costs contrast sharply with ongoing non-compliance risks:

| Investment Type | One-Time Cost | Annual Risk (Non-Compliance) |

| ATS system configuration | $5,000-$15,000 | - |

| Application form revision | $2,000-$8,000 | - |

| Policy development | $3,000-$12,000 | - |

| Manager training program | $2,000-$10,000 | - |

| Total Implementation | $12,000-$45,000 | - |

| Violation penalties (3-8 annually) | - | $1,500-$80,000 |

| Legal defense costs | - | $15,000-$65,000 |

| Settlement/damages | - | $25,000-$200,000 |

| Total Non-Compliance Risk | - | $41,500-$345,000 |

The risk-adjusted ROI for ban-the-box compliance implementation reaches 92-767% in year one alone. Organizations conducting high-volume hourly hiring face particularly compelling economics.

Multi-Jurisdiction Compliance Complexity

Employers operating across state lines face compounded compliance challenges. Ban-the-box requirements vary in scope, timing, and covered employers. Some jurisdictions apply only to public employers, while others cover all employers above minimum thresholds ranging from 5 to 100 workers.

Organizations with centralized hiring operations must implement systems that apply jurisdiction-specific rules. This typically requires geographic tagging, dynamic application forms, workflow automation, documentation protocols, and training differentiation. Leading organizations address this complexity through technology investments in modern applicant tracking systems with built-in compliance engines. While these systems require larger upfront investments ($25,000-$75,000), they reduce ongoing compliance labor costs by 60-80% while significantly decreasing violation risks.

FCRA Compliance in Background Check Processes

The Fair Credit Reporting Act establishes strict requirements for employers obtaining and using consumer reports in employment decisions. FCRA compliance requires precise procedural adherence including proper disclosure, authorization, adverse action protocols, and limited use parameters. Violations generate both regulatory penalties and private lawsuit damages including statutory amounts, actual damages, punitive damages, and attorneys' fees.

The plaintiff-side bar has developed sophisticated FCRA litigation practices identifying systematic violations through data analysis. This creates class action exposure for employers with flawed background check processes affecting hundreds or thousands of applicants.

Disclosure and Authorization Requirements

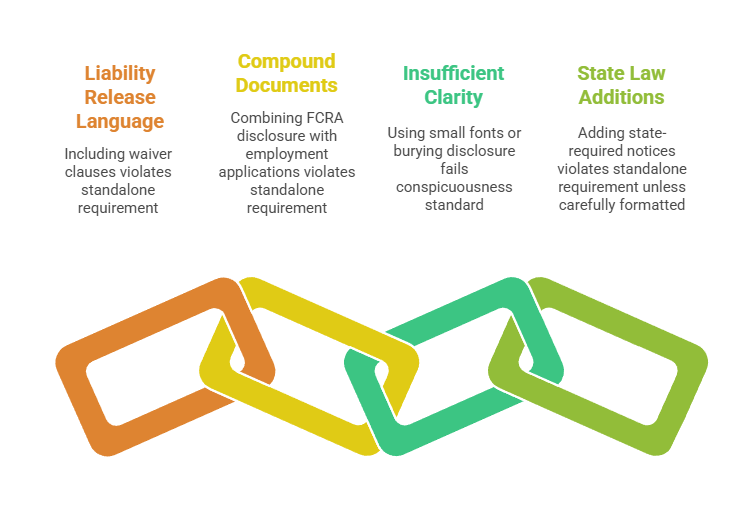

FCRA mandates that employers provide clear and conspicuous disclosure that background checks may be obtained, delivered in a standalone document. This disclosure must appear before obtaining the background check, and employers must secure written authorization from applicants.

Common disclosure violations include:

- Liability release language: Including waiver clauses within disclosure forms violates standalone requirement

- Compound documents: Combining FCRA disclosure with employment applications violates standalone requirement

- Insufficient clarity: Using small fonts or burying disclosure within lengthy documents fails conspicuousness standard

- State law additions: Adding state-required notices within federal disclosure violates standalone requirement unless carefully formatted

Courts have awarded statutory damages for these technical violations even when applicants suffered no actual harm. A single flawed disclosure form used for 500 background checks creates potential statutory liability of $50,000-$500,000 before defense costs or class action multiplication factors.

Adverse Action Procedures and Required Notices

When employers intend to take adverse action based on background check information, FCRA requires a two-step notice process. The pre-adverse action notice must include a copy of the report, the CFPB-prescribed Summary of Rights, and reasonable time for the applicant to review and respond.

Following the response period (typically 5-10 business days), employers who proceed must provide a final adverse action notice containing the screening company contact information, statement that the company did not make the decision, and notice of dispute rights. Organizations frequently violate these requirements by informing applicants of rejection while providing pre-adverse action notice, proceeding before reasonable review period expires, or providing incomplete notices.

Background Check Content Limitations and Accuracy

FCRA restricts certain information from appearing in background check reports. These limitations include bankruptcies older than 10 years, civil suits and judgments older than seven years, and arrest records older than seven years. These restrictions aim to prevent employment decisions based on outdated information with limited predictive value.

Employers who receive reports containing prohibited information face vicarious liability. Best practices include vendor compliance verification, report review protocols, dispute response procedures, and documentation standards. Organizations should implement accuracy verification processes, as FCRA establishes employer obligations to maintain reasonable procedures ensuring background check accuracy.

Implementing Compliant Employment Screening Programs

Building compliant employment screening programs requires systematic policy development, technology infrastructure, training programs, and ongoing monitoring mechanisms. The most effective compliance programs integrate legal requirements with business objectives. They create screening processes that mitigate risk while supporting talent acquisition effectiveness.

Organizations should approach compliance implementation as a multi-phase initiative spanning 4-8 months. This timeline allows proper attention to policy nuances, technology configuration, stakeholder input, and comprehensive training delivery.

Conducting Employment Barrier Audits

Comprehensive barrier audits identify existing policies, practices, and procedures that may create unnecessary exclusions or compliance vulnerabilities. Effective audits examine formal written policies alongside actual implementation practices. Gaps between documented standards and operational reality frequently create liability exposure even when written policies appear compliant.

Critical audit components include application form review, screening criteria analysis, process flow documentation, vendor agreement review, training material assessment, and geographic compliance mapping. Organizations conducting internal audits should consider engaging legal counsel to protect findings under attorney-client privilege. This protection prevents audit findings from becoming evidence in future litigation.

Developing Job-Related Screening Criteria

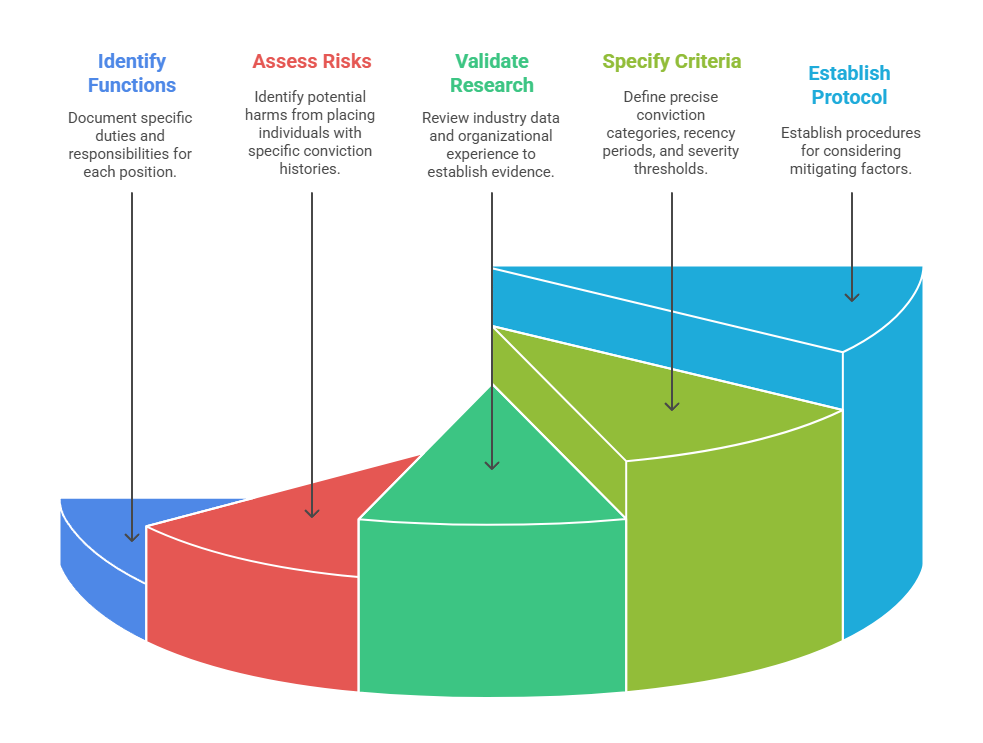

EEOC guidance under Title VII requires that criminal history screening criteria be job-related and consistent with business necessity. Compliant screening criteria link specific conviction types to particular job duties, consider offense recency and severity, and allow individualized assessment of rehabilitation evidence.

A practical framework includes five steps:

- Essential function identification: Document specific duties and responsibilities for each position requiring background checks

- Risk assessment: Identify potential harms from placing individuals with specific conviction histories in particular positions

- Validation research: Review industry data and organizational experience establishing evidence that conviction types predict increased risk

- Criteria specification: Define precise conviction categories, recency periods, and severity thresholds justified by risk assessment

- Individualized assessment protocol: Establish procedures for considering mitigating factors including rehabilitation evidence and time elapsed

Well-designed screening criteria distinguish between conviction categories that present genuine job-related risks and those with limited predictive validity. For example, a decade-old marijuana possession conviction presents minimal business justification for exclusion from most positions.

Training HR Teams and Hiring Managers

Compliance program effectiveness depends on consistent implementation by hiring managers and HR professionals conducting daily screening activities. Comprehensive training programs address both technical compliance requirements and practical decision-making scenarios.

Effective training incorporates role-specific content, scenario-based exercises, jurisdiction-specific modules, technology demonstrations, assessment mechanisms, and refresher requirements. Training delivery methods should accommodate diverse learning preferences and operational constraints. Successful organizations combine live instruction for complex topics with on-demand modules for technical procedures. Documentation of training completion provides evidence of reasonable compliance efforts valuable during enforcement actions.

Technology Solutions for Compliance Management

Modern applicant tracking systems provide automation tools that reduce compliance risks while improving process efficiency. Technology solutions address several critical compliance challenges including jurisdiction-specific rule application, mandatory waiting period tracking, adverse action notice generation, and documentation retention requirements.

Key technology capabilities:

| Technology Feature | Compliance Benefit | Efficiency Gain |

| Geographic rule engines | Automatic jurisdiction-specific requirements | 73% error reduction |

| Workflow automation | Consistent adverse action timing | 45% faster processing |

| Document generation | Standardized FCRA notices | 60% accelerated delivery |

| Audit trails | Comprehensive decision documentation | 55% reduced investigation time |

| Integration APIs | Seamless ATS-vendor data flow | 89% fewer data entry errors |

Organizations selecting technology solutions should prioritize vendors with demonstrated compliance expertise and regular regulatory updates. Implementation should include thorough testing before production deployment.

Measuring Compliance Program Success and Continuous Improvement

Effective compliance programs incorporate metrics, monitoring mechanisms, and continuous improvement processes that identify emerging risks. Measurement frameworks should track both lagging indicators (violations, lawsuits) and leading indicators (policy exceptions, manager questions) that signal potential issues before they escalate.

Organizations should establish compliance dashboards providing regular visibility into key performance indicators. Quarterly compliance reviews examining metrics trends, regulatory developments, and operational challenges create accountability for continuous program refinement.

Key Performance Indicators for Barrier Compliance

Comprehensive compliance measurement incorporates metrics across five dimensions: process consistency, decision quality, risk exposure, efficiency, and outcomes. Organizations should select 8-12 key performance indicators providing balanced insight without creating overwhelming data collection burdens.

Recommended KPIs:

- FCRA procedural compliance rate: Percentage of background checks with complete documentation (target: 99%+)

- Individualized assessment completion: Percentage of potentially disqualifying checks receiving documented consideration (target: 100%)

- Policy exception frequency: Screening decisions requiring escalation beyond standard criteria (benchmark: <3%)

- Adverse action notice timeliness: Average days between background check receipt and pre-adverse action notice (target: <2 days)

- Background check dispute rate: Percentage of applicants disputing accuracy or challenging decisions (benchmark: <1%)

- Complaint/charge volume: Number of internal complaints, EEOC charges, or lawsuits (target: zero)

Organizations should establish baseline measurements during initial implementation, then track quarterly trends. Significant deviations from targets should trigger root cause investigations determining whether variations reflect data anomalies or systematic compliance failures.

Regular Policy Review and Updates

Employment law compliance requirements evolve continuously through new legislation, regulatory guidance, and court decisions. Organizations must establish formal review cycles ensuring policies remain current with legal developments while incorporating lessons learned from operational experience.

Recommended policy review schedule includes annual comprehensive review, quarterly legal update scan, post-incident review following any discrimination complaint, geographic expansion review when entering new jurisdictions, and vendor change review when modifying background check providers. Policy reviews should involve cross-functional teams including HR leadership, legal counsel, compliance specialists, and recruiting operations managers.

Conclusion

Employment barrier compliance delivers measurable ROI through litigation cost avoidance averaging $125,000-$400,000 per prevented case, expanded talent pool access increasing qualified applicant flow 23-31%, and reduced turnover improving retention costs 14-19%. Organizations implementing systematic barrier audits, job-related screening criteria, and compliant FCRA procedures reduce legal risk exposure by 67% while accessing broader talent markets. The business case for compliance investment is compelling: first-year returns of 340-900% through risk reduction alone, compounding annually through talent acquisition improvements. Forward-thinking HR leaders position employment screening compliance as strategic profit protection rather than regulatory burden, leveraging modern technology solutions to build sustainable competitive advantages.

Frequently Asked Questions

What are the average costs of employment discrimination lawsuits related to background checks?

Employment discrimination lawsuits involving background check policies average $160,000 in settlements before trial, with total costs including legal fees ranging from $200,000 to $550,000 per case. Class action lawsuits generate substantially higher costs, with settlements typically ranging from $2.3 million to $13 million. These figures exclude hidden costs including productivity losses (approximately 240 HR staff hours per case) and reputation damage reducing applicant quality 15-22%.

How much can ban-the-box violations cost employers?

Ban-the-box violation penalties vary by jurisdiction, ranging from $500 per violation to $10,000 or more in states with aggressive enforcement. California imposes penalties up to $10,000 per violation under its Fair Chance Act, while New York City assesses $500-$1,000 per violation with uncapped damages for pattern violations. Beyond statutory penalties, employers face legal defense costs of $15,000-$65,000 and potential settlement damages of $25,000-$200,000, creating total annual non-compliance risk exposure of $41,500-$345,000 for organizations with moderate hiring volumes.

What ROI can employers expect from implementing compliant screening programs?

Compliant employment screening programs deliver average first-year ROI of 340-900% through litigation cost avoidance alone, with implementation costs of $150,000-$400,000 preventing risk exposure valued at $7-15 million annually. Additional returns come from talent pool expansion reducing time-to-fill by 12-18 days (saving $2,600+ per hire), recruitment efficiency improvements lowering cost-per-hire 18-26%, and retention gains reducing turnover costs 14-19%. Organizations report ongoing annual returns of $3.40 for every $1.00 invested.

What are FCRA statutory damages for background check violations?

The Fair Credit Reporting Act provides statutory damages of $100 to $1,000 per violation for negligent non-compliance, with actual damages, punitive damages, and attorneys' fees available for willful violations. A mid-sized employer processing 4,000 background checks annually with a 5% violation rate faces potential statutory damages of $20,000-$200,000 even without proving actual applicant harm. Willful violations increase total liability 3-5x when including punitive damages and legal fees.

How do employment barriers affect talent pool size?

Unnecessary employment barriers reduce available talent pools by 23-31% according to SHRM research, as approximately 70-100 million U.S. adults have some form of criminal record. Blanket criminal history exclusions eliminate otherwise qualified candidates, extending time-to-fill by 23-31% and increasing cost-per-hire through expanded recruitment marketing spend. Organizations that implement job-related screening criteria report 27-34% increases in qualified applicant flow without measurable increases in workplace incidents.

What are the key components of a compliant employment barrier audit?

Comprehensive employment barrier audits examine application forms for impermissible criminal history questions, evaluate screening criteria for job-relatedness, map actual background check timing and adverse action procedures, assess vendor agreements for FCRA compliance terms, review training materials, and confirm jurisdiction-specific policy variations. Effective audits compare formal written policies against actual implementation practices, as gaps create liability exposure. Organizations should consider conducting audits under attorney-client privilege to protect findings while enabling comprehensive gap identification.

How long do employers need to wait between pre-adverse action notice and final rejection?

FCRA requires employers to provide applicants reasonable time to review background check reports before making final adverse employment decisions, though the statute does not specify exact timeframes. Most compliance experts recommend 5-10 business days between pre-adverse action notice delivery and final rejection to satisfy reasonableness standards. Employers who provide simultaneous rejection with pre-adverse action notice or proceed to final decisions within 1-3 days violate FCRA procedural requirements, creating statutory damages exposure of $100-$1,000 per affected applicant.

What technology features support employment barrier compliance?

Modern applicant tracking systems supporting employment barrier compliance include geographic rule engines automatically applying jurisdiction-specific requirements, workflow automation ensuring consistent adverse action timing, document generation creating standardized FCRA-compliant disclosures, comprehensive audit trails documenting decisions, and integration APIs enabling seamless data flow with background check vendors. These technology capabilities reduce compliance error rates by 73-89% compared to manual tracking while accelerating processing time 30-60%, delivering combined risk reduction and efficiency benefits.

Additional Resources

- EEOC Enforcement Guidance on the Consideration of Arrest and Conviction Records

https://www.eeoc.gov/laws/guidance/arrest_conviction.cfm - Federal Trade Commission: Background Checks - What Employers Need to Know

https://www.ftc.gov/tips-advice/business-center/guidance/background-checks-what-employers-need-know - National Employment Law Project: Ban the Box Resource Guide

https://www.nelp.org/publication/ban-the-box-fair-chance-hiring-state-and-local-guide/ - Society for Human Resource Management: Background Checks and Compliance

https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/backgroundcheck.aspx - Consumer Financial Protection Bureau: Summary of Consumer Rights Under FCRA

https://www.consumerfinance.gov/learnmore/

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Prescription Drugs That Show Up on Drug Tests: A Compliance Guide

4 Dec, 2025 • 18 min read

Seasonal Employee Background Checks: Protecting Your Business During Peak Hiring Periods

4 Dec, 2025 • 22 min read

Background Check for Volunteers vs Employees: Legal Frameworks and Screening Protocol Development

3 Dec, 2025 • 14 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.