As remote work becomes a standard fixture in the modern workplace, companies and employees alike face unique challenges regarding compliance and taxation. Specifically, Washington State presents intricate scenarios with out-of-state remote workers, requiring astute attention to remote work background checks and multi-state tax nexus matters.

This guide delves into everything you need to know about Washington remote work checks, from understanding the complexities of multi-state tax nexus to ensuring compliance with telecommuting regulations. Whether you're an employer managing a remote team or an employee working from across state lines, navigating these waters with clarity and precision is crucial.

Key Takeaways

- Remote work checks in Washington require navigating both state and multi-state regulations to ensure compliance with different hiring laws.

- Multi-state tax nexus can create unexpected tax obligations if not monitored, especially when employees work across state lines.

- Effective out-of-state screening needs to balance thorough background checks with respect for privacy laws that differ by state.

- Implement structured telecommuting policies and regular audits to maintain compliance and address issues proactively.

- Learn from real-world case studies to improve your company's remote work compliance strategies and avoid common pitfalls.

Introduction

Remote work is on the rise, and Washington is no exception. As businesses adapt, remote work checks have become increasingly vital. Organizations need to ensure that they're not merely complying with traditional hiring standards but also addressing the added intricacies of overseeing employees who work across state lines.

Background checks are more than a formality. They're a crucial step in safeguarding a companyâs operations and reputation. When dealing with remote workers, especially those in multiple states, these checks become more complex. You must account for variations in state laws, taxation rules, and compliance requirements, which can vary significantly. Understanding these differences is fundamental to preventing legal and financial problems down the line.

Think about your current processes. Are they robust enough to handle these challenges? Are you confident that all legal and background checks for remote workers are thorough? These are essential questions that only you can answer, but getting them right is key to success in our growing remote work landscape.

Understanding Washington Remote Work Checks

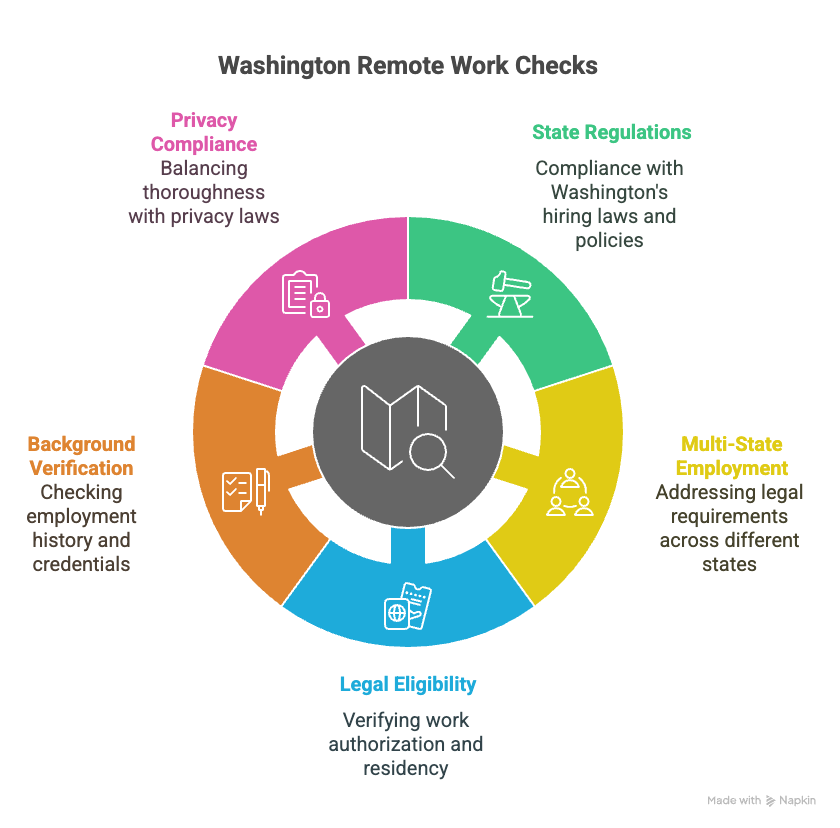

Remote work checks in Washington mean verifying a remote workerâs qualifications and legal standing, much like traditional background checks but with added layers. Unlike checks that focus solely on local hires, remote work checks must account for regulations not just within Washington but across state lines. So, what makes them unique?

Washington remote work checks require attention to both state regulations and the specific needs of multi-state employment. This involves verifying an applicantâs legal eligibility to work in Washington as well as their current residence state. Why? Because each state has its own hiring laws, and employers must meet these standards to avoid penalties.

State-specific regulations play a significant role. Employers based in Washington need to comply with Washington's policies, but they must also consider the regulatory frameworks of an employee's location. Federal guidelines by the EEOC provide a baseline for background checks but can vary state by state. Failure to adhere to these nuances could lead to compliance issues.

Key components of Washington remote work checks should include verifying legal eligibility to work by checking immigration status, previous employment, and educational background. Criminal history checks and credit reports might also be necessary, depending on the nature of the job. Past employment verification ensures that what an applicant claims matches their history, reducing potential risks.

You want to be thorough, but not intrusive. Striking that balance can be tricky, especially when privacy laws vary across states. As an employer or HR professional, how do you ensure these checks are compliant? Have you considered if your current process respects both federal guidelines and specific state laws where your employees reside?

Understanding these essentials lays the groundwork for compliant hiring. With remote work here to stay, keeping these practices updated ensures a solid foundation for multi-state operations.

Multi-State Tax Nexus and Its Implications

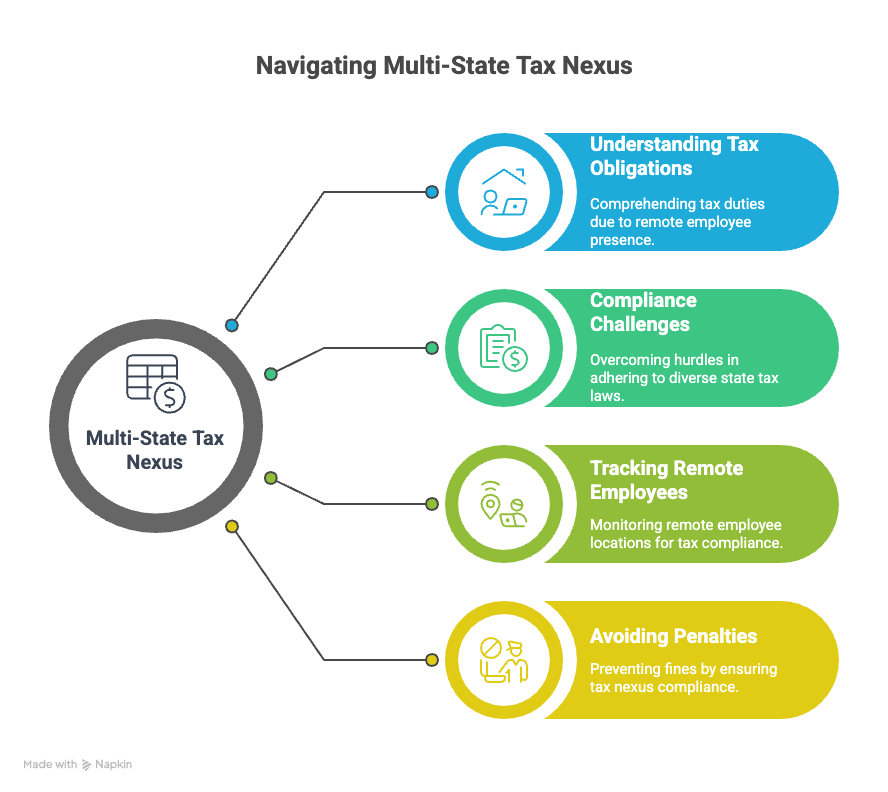

Tax nexus refers to a business's physical or economic presence that creates a tax obligation in that state. When employees work across state lines, the concept of nexus becomes crucial. Companies must understand whether having remote workers in different states triggers tax responsibilities.

When looking at Washington, things can get tricky. Suppose you hire remote employees who reside outside Washington. In that case, you may face tax obligations related to income tax withholding or sales tax collection depending on where your employees live and work. These tax liabilities arise because the presence of employees can establish a taxable presence or nexus in their state.

Consider the example of an employee working from Oregon while being employed by a Washington-based company. This setup might create tax obligations in Oregon for the employer, even if the company's operations are primarily in Washington. Such scenarios require careful tracking and administration to avoid potential issues.

Compliance with tax laws across different states can be challenging. Each state has its tax rules, thresholds for nexus, and obligations. Without proper attention, a company might find itself non-compliant, leading to fines or penalties. Staying informed about the tax laws in states where remote employees operate is critical. Consulting with a tax professional specializing in multi-state issues can save you from many headaches.

Does your business track where all your remote employees are physically working? If not, it's time to start. Not knowing could mean missing new tax nexus obligations. Understanding and managing these implications ensures smooth operations for your remote teams without unintended financial complications.

WA Out-of-State Screening

Washington out-of-state screening demands thoroughness and consistency. When screening remote workers located outside Washington, you need to ensure that all is in line with statewide policies while acknowledging differences in each employeeâs state.

Start with understanding WA-specific requirements. This includes compliance with local laws that may not apply out-of-state. You might be comfortable with Washington rules, but other states have different requirements.

Consistent validation of a candidateâs work history, education, and legal background is crucial. This isn't about ticking boxes but ensuring accuracy and legitimacy. Conduct reference checks meticulously. Cross-check details from previous employers and institutions. Fabrication in resumes is more common than you'd think, even with remote positions.

Keep privacy laws on your radar. Each state has its own set of privacy rules. Be aware of restrictions on accessing certain information. For instance, one state might allow credit checks, while another may restrict them.

Handling of results must be sensitive and confidential across all borders. Always follow up on discrepancies, but do so by respecting both Washington and the distant stateâs guidelines. Are you aware of the Fair Credit Reporting Act? It's essential for navigating how you use screening results.

WA out-of-state screening might seem intricate. But with careful attention and a structured approach, it becomes manageable. Is your current screening process up to par with these standards?

Telecommuting Compliance Strategies

Crafting the right telecommuting policy is more than a checkbox exercise. First, you need to define roles clearly. Document who can work remotely and under what conditions. This helps avoid ambiguity and sets clear expectations for everyone involved.

Regular audits can keep you on the right side of compliance. Schedule periodic checks of your telecommuting arrangements to identify and correct any lapses in policy adherence. These audits should also assess your compliance with both state and federal laws, especially concerning wage and hour regulations.

Managing remote workers requires more than just a good internet connection. Develop a communication strategy that includes regular check-ins and performance assessments. Use these meetings to address any issues before they become significant problems. Tools like Slack or Microsoft Teams can streamline these interactions and ensure that everyone stays informed.

When it comes to background checks, technology can be your best friend. Invest in reputable platforms that offer automated checks, which can save time and reduce errors. They provide a comprehensive look at potential hires, faster than traditional methods.

Tax compliance tools are invaluable when dealing with multi-state tax nexus issues. Software solutions can automatically calculate and withhold the right taxes based on the employee's work location. This minimizes your risk of tax compliance errors and the hefty fines they can bring.

Ultimately, it's about marrying people practices with process efficiency. Keeping your remote team compliant requires attention to detail and a commitment to regular updates and education. Consider training sessions for both management and remote workers on the latest regulations and best practices. This proactive approach can spare you costly mistakes and enhance overall productivity.

Navigating Legal and Compliance Challenges

Understanding EEOC guidelines is crucial for conducting remote work checks. They outline what employers need to know about the legality of using background information in employment decisions. This includes respecting anti-discrimination laws and ensuring the process is fair and consistent.

It's common to encounter discrepancies in background checks. Address these promptly by verifying information with previous employers or educational institutions. For disputes, provide clear communication and a path for candidates to explain or rectify discrepancies.

Confidentiality is non-negotiable when handling personal data. Use secure systems for storing background check information, limit access to authorized personnel, and ensure compliance with state and federal privacy laws. These practices protect both the organization and the employees, fostering trust and reducing potential legal risks.

Case Studies and Real-World Examples

Success Stories

Consider TechCo, a software company based in Seattle. They faced the challenge of managing a diverse remote workforce spread across eight different states. Their approach involved implementing a centralized HR system to handle background checks and tax nexus assessments efficiently. By collaborating with a tax advisory firm, they pinpointed their tax obligations in each state, ensuring compliance. The result? TechCo not only avoided hefty penalties but also streamlined their onboarding process, reducing hiring time by 30%.

Another example comes from HealthServ, a healthcare provider. As their workforce went remote, they faced privacy law variations across states. HealthServ tackled this by training HR staff on state-specific laws and adopting secure, encrypted platforms for data management. This initiative led to zero data breaches last year, safeguarding their reputation and building trust with employees.

Lessons Learned

Not every journey is smooth. Retail Corp expanded its remote retail consultant teams rapidly, but neglected to account for the multi-state tax nexus. This oversight led to unexpected tax liabilities and penalties in three states. Acting swiftly, Retail Corp revamped their procedure to include tax experts in their compliance checks. The lesson? Understanding tax obligations from the start is non-negotiable.

A similar situation occurred with FinServe, a financial advisory firm. Their initial background checks lagged because they failed to adapt their processes for out-of-state hires. Delays were common, and candidates opted for competitors instead. In response, FinServe updated their background check protocols to be more flexible and timely, using digital tools to track progress and coordinate with external teams. This change cut their vetting time by half, improving their competitive position dramatically.

These examples offer a pragmatic look at remote compliance. They underscore the value of proactive strategies and illustrate that even well-intentioned efforts can falter without thorough planning and execution. How can your business learn from these successes and setbacks? Are your current processes equipped to handle the intricacies of a remote workforce?

Conclusion

Washington remote work checks and multi-state tax nexus demand careful attention and informed action. As you navigate the landscape of remote work compliance, itâs essential to remember the unique requirements presented by this evolving work environment. Ensure that your background check processes are thorough and consistent, accounting for both state-specific and federal guidelines. When dealing with tax nexus issues, stay updated on both Washington's rules and those of any state where your employees reside. Compliance isnât just about avoiding penalties; it positions your company for stable growth.

Looking ahead, remote work will continue to be a significant component of corporate strategy. Adapt your practices to meet these changes proactively, and prioritize compliance to minimize risk. Being informed and prepared is crucial for success, both legally and financially. As remote work remains a dynamic field, staying vigilant and adaptable will ensure your business thrives. For ongoing guidance and more in-depth information, consider exploring additional resources and expert insights.

Frequently Asked Questions (FAQs)

Do WA checks apply to remote workers in other states?

If you hire remote workers in other states, WA background checks may not be required by law. However, it's wise to consult with legal counsel to ensure compliance with both WA and the employee's state laws.

How to verify education for remote hires in WA?

You can verify education by contacting the educational institutions directly. Third-party verification services can also be helpful, and you should obtain the candidate's permission before proceeding.

Can WA employers require drug tests for remote workers?

Yes, WA employers can require drug tests for remote workers if it aligns with company policy and complies with both state and federal laws. Make sure you apply the policy consistently to all employees.

Are WA companies liable for other statesâ laws?

Yes, WA companies can be liable for other states' laws when employing remote workers in those states. Be sure to understand local labor laws and consider consulting with legal professionals.

How to handle county-specific checks for WA remote hires?

For county-specific checks, reach out to the relevant county authorities or use background check services that include county-level information. Ensure you follow all privacy and legal guidelines when performing these checks.

Can remote workers sue WA employers for FCRA violations?

Yes, remote workers can sue WA employers for FCRA violations if the violations pertain to how background checks are conducted. Make sure you follow FCRA guidelines carefully.

Do international remote workers fall under WA laws?

International remote workers are primarily governed by their local laws. However, certain WA laws may still apply, especially if the company's operations are based in WA. Consult international labor law experts.

Are gig workers considered remote employees in WA?

Gig workers are typically classified as independent contractors rather than employees. This distinction affects the application of labor laws and benefits, so ensure you classify workers correctly.

Whatâs the cost of multi-state checks in Washington?

The cost varies based on the scope and depth of the checks. Third-party services offer packages that range from basic to comprehensive, affecting the overall cost.

Does WA require I-9 verification for remote hires?

Yes, all employers, including those in WA, must complete I-9 verification for remote hires. This process confirms the employeeâs eligibility to work in the U.S.

Do WA companies need to follow federal laws for remote workers outside the U.S.?

Yes, WA companies must comply with federal laws that apply to all U.S. employers, even for remote workers located internationally. Be aware of international labor restrictions and adjust practices accordingly.

Can WA remote workers claim state benefits if they live elsewhere?

Remote workers typically qualify for benefits in their home state, not in WA. However, some exceptions may exist depending on specific circumstances and agreements.

How do WA tax regulations affect remote workers in other states?

WA has no income tax, but remote workers in other states are subject to their local tax laws. Employers should be mindful of withholding taxes based on the employee's location.

What happens if a remote worker relocates to WA?

If a remote worker relocates to WA, they may be subject to WA state laws and regulations. Itâs advisable to re-evaluate employment terms and update any necessary documentation in compliance with WA laws.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.