Searching for a new place to live in New York can be a daunting task. As potential tenants endure the hustles and bustles of the city, they also encounter an inevitable step in the renting process: the landlord background check. For landlords, conducting these checks is a critical part of tenant screening, ensuring they select reliable tenants and mitigate potential risks. This guide will walk you through everything you need to know about New York landlord background check rules and processes, equipping both landlords and tenants with essential knowledge.

Key Takeaways

- Landlord background checks in New York aim to ensure tenants are reliable, pay rent on time, and maintain peaceful living conditions.

- Landlords must inform tenants of their rights and obtain consent before conducting background checks to comply with New York regulations.

- The process includes gathering credit reports, criminal records, rental history, and employment verification, requiring landlords to evaluate this data without bias.

- Adhering to the Fair Housing Act and Fair Credit Reporting Act is crucial for landlords to avoid discrimination and legal issues.

- Tenants should review their credit history, understand their rights, and address any inaccuracies to make informed, confident applications.

Introduction

In the fast-paced rental market of New York, understanding the nuances of landlord background checks is crucial. Picture this: you're on the hunt for a new apartment, excitement tinged with anxiety about which one will be your next home. But what happens after you submit an application? That's where the landlord background check comes in.

A landlord background check is the landlord's way of ensuring they know who's moving in. It involves looking into your financial reliability, past tenancies, and sometimes, your criminal history. For landlords, it's about choosing tenants who will pay rent on time, take care of the property, and coexist peacefully with other tenants.

This guide aims to unpack these checks from both sides of the lease. Whether you're a tenant wanting to understand what you're stepping into, or a landlord ensuring you're on solid ground with your tenant choice, knowing the rules and processes helps both parties navigate the rental market confidently. Understanding these checks removes the mystery and promotes a fairer, more transparent rental process.

What Are Landlord Background Checks?

A landlord background check is a tool used by landlords to evaluate potential tenants. It helps in verifying a tenant's history and reliability before entering into a lease agreement. Think of it as a way to ensure both landlord and tenant can count on a positive renting experience.

Why are these checks important? They play a critical role in maintaining a safe and secure rental environment. Landlords seek tenants who pay rent on time, take care of the property, and coexist peacefully with their neighbors. A background check can help identify these traits.

Typical components of a background check include credit history, criminal records, and rental history. Credit checks provide insight into a tenant's financial responsibility. A look into criminal records aims to ensure the safety of other tenants and the property. Rental history tells landlords about the tenant's past behavior in rental agreements.

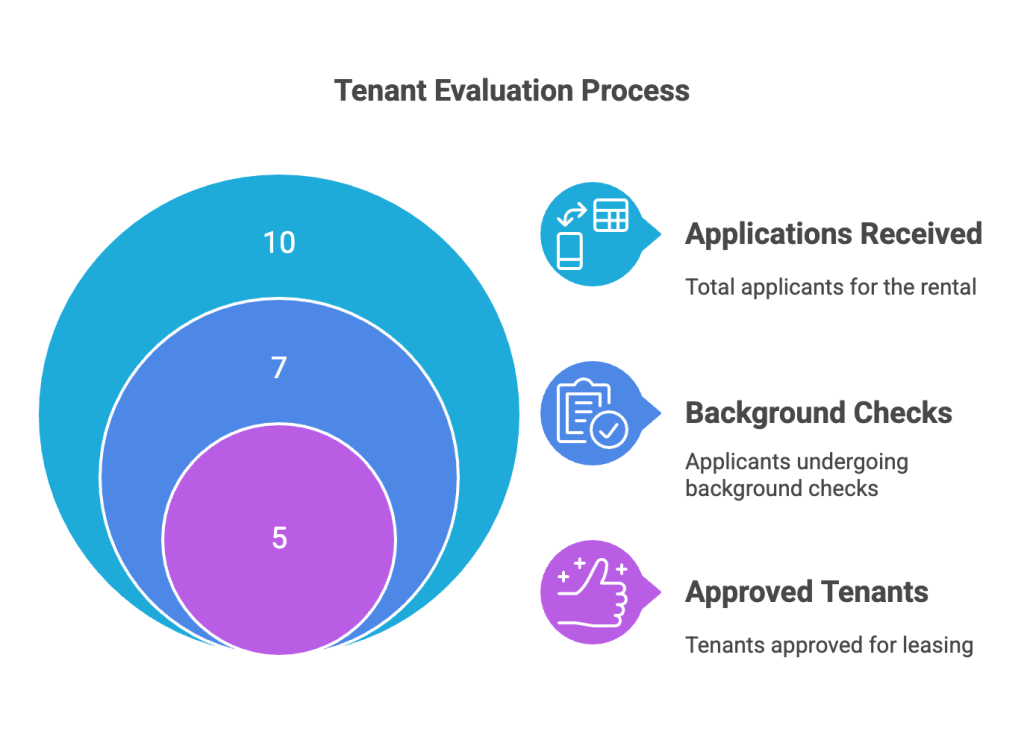

For example, consider a landlord faced with multiple applicants for a single apartment. A background check helps distinguish between them, revealing key factors like whether an applicant has been consistently reliable or if they have had issues with previous landlords.

Are you prepared for what a landlord might find in your background check? Understanding this process can empower you as both a renter and a property owner.

New York Specific Regulations

New York has its own set of rules when it comes to landlord background checks. One of the primary regulations is that landlords must obtain tenant consent before conducting any background checks. This involves informing tenants of their rights, particularly under the New York State Human Rights Law, which prohibits discrimination based on race, gender, age, and other protected categories. Landlords are responsible for ensuring that any decision to deny a rental is based on objective criteria and not discriminatory practices.

Recent legislative changes have also tightened the rules around how background checks are conducted. The Housing Stability and Tenant Protection Act of 2019, for example, limits fees related to background or credit checks to $20. This ensures affordability and transparency for tenants. Additionally, tenant screening reports must comply with the New York Fair Credit Reporting Act, which offers tenants certain rights, such as the right to dispute inaccuracies.

New York City, in particular, has instituted more stringent measures. It requires landlords to disclose if the housing is rent-stabilized or not, adding another layer of transparency. This ensures tenants are fully informed of their potential rental situation. Understanding these regulations helps you undertake background checks in a way that is compliant with laws and respectful of tenant rights. Are you prepared to incorporate these into your screening process?

The Process of Conducting a Background Check

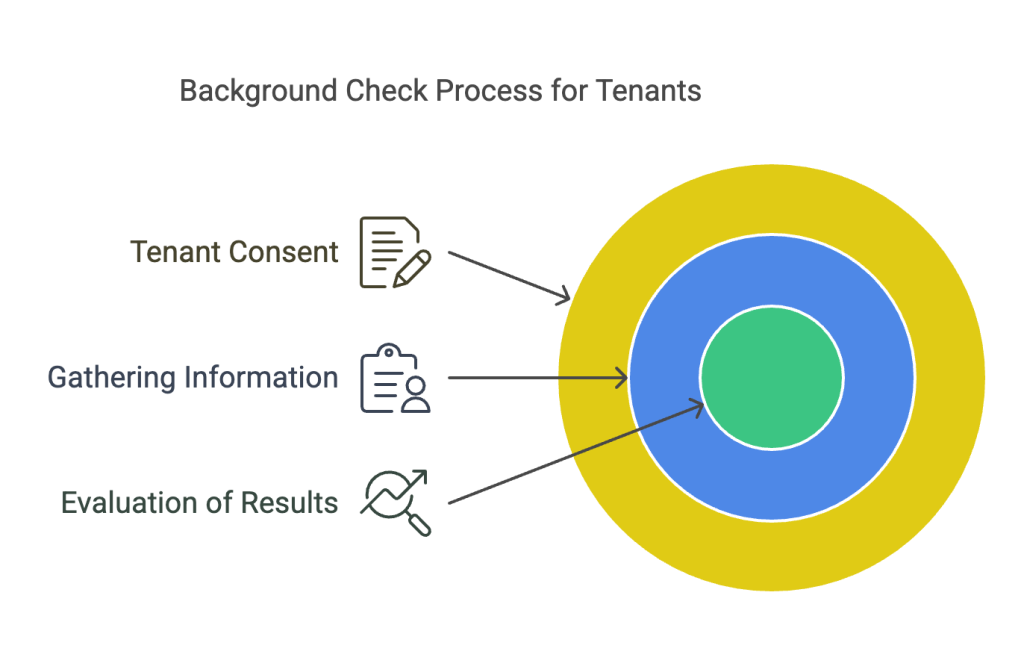

Landlords initiate the background check process by obtaining a prospective tenant's written consent. This step is non-negotiable and must comply with both federal and state laws. Skipping this makes landlords vulnerable to legal action. Informing tenants about the nature of information being collected is crucial. It builds transparency and ensures trust.

The information landlords typically seek includes credit reports, criminal records, rental history, and employment verification. Credit reports help landlords gauge the tenant's financial responsibility. They look for timely payments and outstanding debts. Criminal records are checked to ensure community safety. Rental history reveals a tenant's past rental behavior and reliability. Employment verification offers insight into the tenant's current financial stability. Each piece of information helps paint a broader picture of the applicant.

Once all necessary data is gathered, evaluating the results is the next step. Here, adherence to New Yorkâs legal framework is essential. Landlords must evaluate the information without bias, ensuring that decisions don't violate anti-discrimination laws. For example, rejecting an application because of a past criminal conviction without considering the nature of the crime or its relevance to tenancy could be problematic.

It's your responsibility to apply consistent evaluation criteria. Personal biases or assumptions should not influence your decision. Setting clear, written standards for what constitutes a satisfactory background check result can aid in maintaining fairness. Consider involving a third-party screening service to ensure a neutral assessment process. Have you thought about how your procedures align with state regulations? Ensuring they do not only protects you legally but also demonstrates your commitment to fair housing principles.

Legal and Ethical Considerations

Compliance with the Fair Housing Act is crucial when conducting tenant screenings. This federal law prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. As a landlord, make sure your screening criteria are applied consistently. Always ask yourself: Are my criteria fair to every applicant?

New York landlords must also adhere to the Fair Credit Reporting Act (FCRA). This act mandates that if you use a third-party service for background checks, you must first inform the tenant and obtain written permission. Transparency is non-negotiable. If a decision is based on the report, you are obliged to provide a copy to the tenant along with a summary of their rights under the FCRA. This allows them the opportunity to dispute inaccuracies.

Tenant rights focus on privacy and nondiscrimination. Consider the tenant's right to privacy; only request information pertinent to their ability to pay rent and maintain a peaceful living environment. For instance, requesting extensive personal details unrelated to tenancyâlike medical historyâcrosses the line.

By respecting these laws and ethical guidelines, you not only protect your business from legal troubles but also support a fairer rental market. Are your practices aligned with both legal mandates and ethical standards?

Challenges Faced by Landlords

Conducting background checks presents several hurdles for landlords. A primary challenge is accessing reliable data. With various databases and reports available, identifying accurate sources can be tricky. For instance, discrepancies in criminal records or misreported credit details often occur. These inaccuracies might lead landlords to make ill-informed decisions, potentially resulting in legal issues or tenant disputes.

Interpreting the results is another obstacle. Understanding credit scores, criminal history, and rental history requires careful analysis. A minor infraction or a single late payment doesn't always indicate a bad tenant. Misjudging these elements can cause landlords to miss out on potentially responsible tenants. For example, a tenant with a recent job switch might have a temporary financial setback, which could be mistakenly perceived as poor financial responsibility.

Legal compliance adds another layer of complexity. Laws and regulations, such as the Fair Housing Act, require landlords to conduct screenings without discrimination. Adhering to these legal requirements demands thorough knowledge and consistent application of the law. Landlords must ensure that their actions do not inadvertently breach any tenant rights, such as privacy or nondiscrimination. Missteps here can result in hefty penalties or lawsuits.

To tackle these challenges, landlords can adopt some best practices. Partnering with reputable background check services ensures access to accurate and comprehensive data. These providers can offer insights into interpreting results, helping landlords assess tenant applications more effectively. Regular training on legal obligations ensures that landlords remain compliant with evolving regulations. Additionally, establishing a consistent screening process for every applicant minimizes bias and promotes fairness. By standardizing procedures and staying informed, landlords can navigate the intricacies of background checks smoothly.

Tips for Tenants

Facing a background check doesn't have to be stressful if you're prepared. Hereâs how you can make sure you're ready:

Start by reviewing your credit history. Youâre entitled to one free credit report each year from the three major credit reporting agencies. Make sure all the information is accurate. Clear any minor debts and address errors with the credit bureaus.

Understand your rights. Know that landlords must seek your permission before running a background check. They're bound by the Fair Credit Reporting Act (FCRA) which ensures your privacy and mandates that the information they gather must be relevant to a rental decision.

If you're denied a rental, you're not left without options. First, request a copy of the background check report from the landlord or the screening company. They must provide it if that was the basis of the decision. Review the report for inaccuracies or outdated information. If you find errors, file a dispute with the reporting agency. This can lead to a correction and potentially change the landlordâs decision.

Always be proactive. Communicate any issues in your history upfront. Whether it's a past eviction or a criminal record, a short explanation can work in your favor. Many landlords appreciate honesty and the willingness to discuss past issues.

Remember, informed tenants have the upper hand. Use this information to ensure youâre treated fairly during the rental application process.

Resources and Support

You don't need to navigate the complexities of landlord background checks alone. Several resources can provide support and guidance. The Professional Background Screening Association (PBSA) is a trusted organization where you can learn more about industry standards and practices. Their website offers a wealth of information on background screening processes and compliance.

For those craving insights and tips, resources like blogs of background check companies offer valuable perspectives. These platforms often delve into the nuances of tenant screening, share updates on legal changes, and suggest ways to effectively manage background checks.

Leveraging these resources can equip both landlords and tenants with the knowledge to approach the background check process confidently and effectively.

Conclusion

Understanding the rules and processes of landlord background checks in New York is essential for both landlords and tenants. It's not just about ticking boxes; it's about creating a secure living environment and fostering trust. Landlords who adhere to these guidelines make informed decisions, ensuring they choose tenants who are a good fit. Tenants, armed with knowledge about their rights and the process, can approach the rental journey with confidence. Both parties benefit from clarity and transparency, leading to smoother interactions and fewer disputes. Keep exploring, stay informed, and take charge of your experience in the rental market.

Frequently Asked Questions (FAQs)

Can landlords do background checks in NYC?

Yes, landlords in NYC can conduct background checks on prospective tenants. This often includes checking credit reports, rental history, and criminal records to ensure reliability and ability to pay rent.

What is the background check policy in New York?

New York allows landlords to perform background checks as part of the tenant screening process. They must comply with the Fair Credit Reporting Act (FCRA), ensuring the checks are fair and with tenant consent.

What background check do most landlords use?

Most landlords use a combination of credit checks, eviction history, rental references, and criminal background checks to assess tenants. This provides a comprehensive view of the applicant's reliability.

What does NYS look for in a background check?

In New York State, a background check commonly includes credit history to gauge financial responsibility, criminal records for safety concerns, and rental history for reliability as a tenant.

What is Article 23 A of the New York State Correction Law?

Article 23 A prohibits discrimination based on an individual's criminal record. It requires landlords to consider factors such as the seriousness of the offense, time elapsed, and evidence of rehabilitation.

Can a tenant dispute a background check result?

Yes, tenants can dispute any inaccuracies in their background check. They should contact the screening company to correct errors or provide clarification for contested items.

How long does a background check take for renting?

Typically, background checks for renting take 3 to 10 days, depending on the comprehensiveness of the check and response times from various agencies.

Do landlords in NYC require a minimum credit score?

Landlords often look for a credit score of 620 or higher, though requirements can vary. A higher score generally indicates better creditworthiness.

Are eviction records considered in NYC background checks?

Yes, eviction history is often included in background checks. Landlords prefer tenants with a clean rental history to minimize the risk of rental disruptions.

Definitions

Employment Verification

Employment verification confirms a tenant's current job status and income. Landlords request this to ensure the applicant has a stable source of income to pay rent. This may involve contacting the tenantâs employer or reviewing recent pay stubs and tax documents. Consistent income helps demonstrate financial reliability.

Lease Agreement

A lease agreement is a legally binding contract between a landlord and a tenant. It outlines the terms of the rental, including rent amount, payment schedule, duration, and rules for the property. Both parties must follow the terms, and breaking the lease can result in penalties. Having everything in writing protects both the landlord and the tenant.

Fair Housing Act

The Fair Housing Act is a federal law that prohibits housing discrimination. Landlords cannot reject applicants based on race, color, national origin, religion, sex, disability, or familial status. Violating this law can lead to serious legal consequences. Landlords must ensure their rental decisions are based on objective criteria.

Credit Report

A credit report provides a summary of a personâs financial history, including debt, payment history, and credit score. Landlords use this to assess a tenantâs ability to make rent payments on time. A poor credit report may signal financial instability, while a strong one suggests reliable payment habits. Tenants should check their reports for errors before applying.

Tenant Rights

Tenant rights refer to the legal protections renters have under local, state, and federal laws. These include the right to privacy, protection from unfair eviction, and the ability to dispute incorrect background check information. Understanding these rights helps tenants ensure fair treatment and avoid rental disputes.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.