In today's fast-paced hiring environment, ensuring that a candidate is who they say they are is vital. Social Security Number (SSN) Trace and credit checks are crucial tools for verifying identities and assessing financial reliability. This guide delves into the relationship between SSN traces and credit checks and why they're significant across various industries like staffing, healthcare, and technology.

We'll discuss the process, applications, legal considerations, and frequently asked questions surrounding SSN trace credit checks. Whether you're a business owner in hospitality, a recruiter in transportation, or a job seeker exploring non-profit opportunities, this guide aims to demystify the process and help inform your decisions.

Key Takeaways

- Background checks have evolved into essential tools for verifying a candidate's identity and reliability through SSN traces and credit checks.

- SSN traces provide a detailed view of a candidate's identity and address history, helping uncover potential discrepancies.

- Credit checks offer insights into a candidate's financial behavior, crucial for roles involving financial responsibilities or sensitive data.

- Compliance with legal requirements like the Fair Credit Reporting Act (FCRA) is crucial to ensure ethical hiring practices.

- Using SSN traces and credit checks effectively aids in making informed hiring decisions and minimizing risks associated with new hires.

Introduction

In today's employment market, background checks are no longer just a box to tickâÂÂthey are a gateway to understanding who you're bringing into your organization. With job markets bustling and roles demanding increasingly varied skills, knowing the true identity and reliability of candidates is critical. Enter SSN trace and credit checks: potent tools that help demystify the initial façade a candidate might present.

A Social Security Number (SSN) Trace operates as the backbone of identity verification, revealing names and address histories associated with an SSN to ensure that everything aligns. Alongside this, credit checks offer insights into a person's financial behavior, shedding light on their fiscal responsibility. When used together, they provide a comprehensive picture that can makeâÂÂor breakâÂÂa hiring decision.

This guide will serve business owners, HR professionals, and job seekers across diverse sectors, including hospitality, healthcare, retail, and technology. It'll lay out what you need to know about SSN traces and credit checks, helping you navigate the murky waters of background checks with confidence. Whether you're looking to protect your business or make yourself a more appealing candidate, understanding these processes is your first step.

Understanding SSN Trace and Credit Checks

In the realm of background checks, two key components often stand out: the SSN Trace and credit checks. Let's break them down.

As an HR professional, I've found background check stories are more telling than resumes we read through. I once read an SSN trace filled with a history of addresses a candidate hadn't reportedâÂÂwhen I asked, it was a story of determination in hardship and rebuilding after loss. It was a reminder identity verification isn't merely complianceâÂÂit's about understanding behind the forms. SSN traces and credit reports, when applied ethically, are not only protection to business but also reveal a candidateâÂÂs narrative. In employment, diligence and compassion must meet.

What is an SSN Trace?

An SSN Trace acts as a linchpin in verifying one's identity. It involves running the applicant's Social Security Number through various databases to map out their name, age, and extensive address history. This process isn't just about confirming an identity; it's about uncovering patterns, movements, and potential inconsistencies in the applicant's history. If there's a discrepancy between the addresses provided by the applicant and those revealed by the SSN Trace, it's a red flag that might need closer inspection.

How Credit Checks Work

Credit checks dive into the financial landscape of an individual. By reviewing a candidate's credit report, employers can gauge their financial responsibility and see a snapshot of their financial behavior. This doesn't just include credit scores but also loan histories, outstanding debts, and payment punctuality. Such insights can be crucial, especially for positions involving fiscal responsibilities. It's not about prying into personal lives; it's about assessing reliability through financial behaviors.

The Connection

SSN trace and credit checks are like two sides of a coin in the background screening domain. Together, they provide a more complete view of a candidate. While the SSN Trace confirms identity and history, the credit check offers insight into a candidate's financial integrity. Combining these two checks allows for a balanced approach to background screening, elevating the assurance that the candidate is genuine and financially trustworthy. For industries where trust and accuracy are non-negotiable, understanding and utilizing this connection can be vital in making informed hiring decisions.

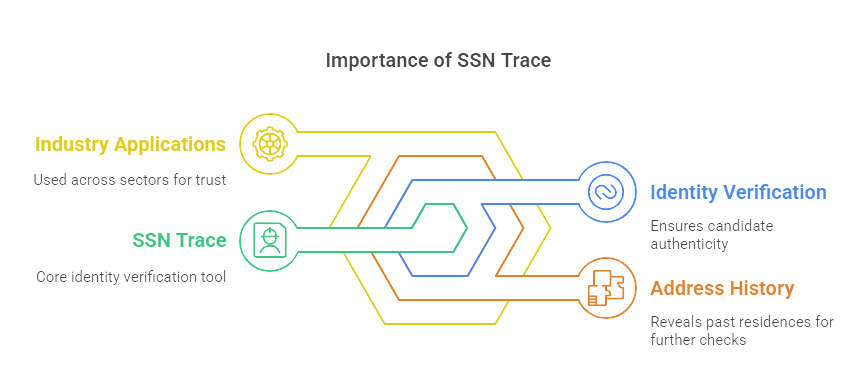

Importance of SSN Trace in Background Checks

When it comes to background checks, the SSN trace is your linchpin for identity verification. In a world where identity fraud is rampant, ensuring that a candidate is genuinely who they claim to be can't be overstressed. The SSN trace functions like a blueprint of an individual's identity, matching their social security number to a name and date of birth. This basic check roots out inconsistencies early, helping to prevent costly mistakes.

Uncovering address history through an SSN trace acts like putting together pieces of a puzzle. It reveals where an individual has lived, which isn't just about confirming if they were in a specific city at a given time. ItâÂÂs about painting a history that can guide further background investigations. An unexpected address might signal the need for additional exploration or indicate potential red flags, like unreported aliases or undisclosed locations of residence.

Industries everywhere find SSN traces indispensable, whether itâÂÂs a restaurant hiring servers or a hospital onboarding medical staff. In hospitality, it increases trust between the business and clients who expect secure and pleasant service environments. In healthcare, where patient safety is paramount, knowing every professional's verified identity is crucial. Essentially, regardless of where you operateâÂÂa bank, logistics firm, or charityâÂÂthe SSN trace is a non-negotiable part of hiring that underscores accountability and trust.

Why Credit Checks Are Essential

Understanding financial responsibility is critical in today's job market, where trust is a currency all its own. Credit checks open a window into a candidate's fiscal reliability, offering insights that go beyond what's written on a resume. These checks reveal patterns of behaviorâÂÂlike timely bill payments or outstanding debtsâÂÂthat hint at a person's ability to manage responsibilities and stress.

For businesses, credit checks serve as a vital component in assessing hiring risks, particularly for positions involving direct financial dealings or sensitive data management. By examining an individual's credit history, companies can gauge the likelihood of financial missteps that could impact their operations.

Different industries have specific needs when it comes to credit checks. In retail, they ensure that employees handling transactions won't falter under financial pressure. Technology firms may use credit checks to safeguard against potential security vulnerabilities. Wherever there's money or sensitive information involved, understanding financial behaviors is crucialâÂÂnot as a means to judge, but to protect both parties from unforeseen risks.

Legal and Compliance Considerations

When it comes to background checks, staying within the legal lanes is non-negotiable. Different states have their own rules, and two places where this counts are Pennsylvania and Ohio. In these states, there are particular laws about what you can and can't do with background checks. So, if your hiring takes you through either state, make sure you're up to speed with the local directives. A couple of handy resources that can guide you through the compliance jungle are the Professional Background Screening Association (PBSA) and the Consumer Finance Protection Bureau (CFPB). Both sites are worth bookmarking.

On the federal level, you've got the Fair Credit Reporting Act (FCRA) keeping things in check. The FCRA sets the ground rules for how credit reports can be used in hiring. In a nutshell, itâÂÂs all about transparency and consent. Before running a credit check, you've got to inform and get permission from the person you're checking out. Plus, if something in that report makes you think twice about hiring them, they have a right to know why.

Non-profits and small businesses have their own hurdles to navigate. The regulatory framework can feel like a maze, but tailored compliance strategies are possible. It's all about streamlining processes without cutting corners. Whether you're a tiny start-up or an organization stretched thin on resources, understanding these nuances can help dodge legal pitfalls while maintaining ethics in the hiring process.

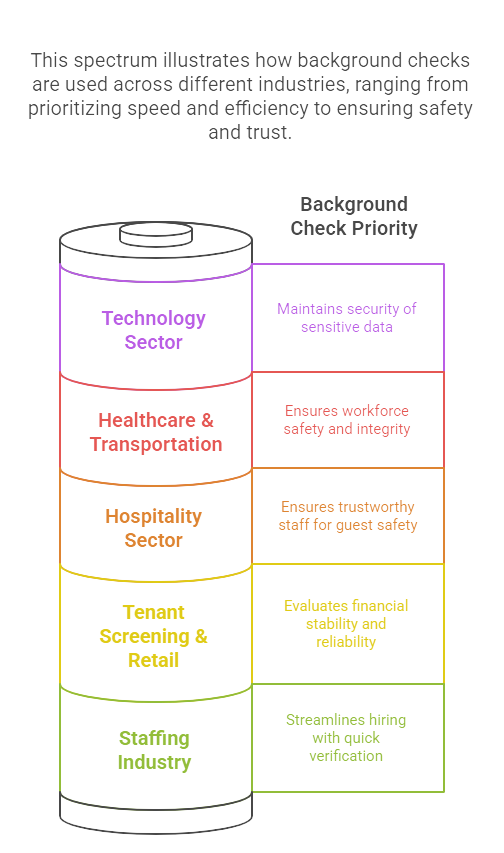

Integrating Background Checks for Business Operations

In the staffing industry, speed is of the essence. Integrating SSN trace and credit checks into the hiring process streamlines candidate verification and placement, making it a breeze to match the right person to the right job, fast. These tools cut down on the time spent sorting through applicants by weeding out inconsistencies right off the bat.

When it comes to healthcare and transportation, the stakes are even higher. Background screenings in these fields are critical for ensuring the safety and integrity of the workforce. SSN traces help verify identities in sectors where even a minor oversight can lead to major consequences. Credit checks here aren't just about fiscal responsibility; they're about building a trustworthy team.

Over in tenant screening and retail, the focus is mainly on financial stability. Credit checks help landlords and retail businesses evaluate potential tenants or employees with an eye toward reliability and financial prudence. It's about making sure everyone is putting their best foot â and wallet â forward.

The technology and hospitality sectors face their own unique hurdles. Tech industries, often privy to sensitive data, demand rigorous SSN and credit checks to maintain security. Meanwhile, in hospitality, ensuring a trustworthy staff means guests can relax knowing they're in good hands. In both cases, these screenings aren't just optional; they're essential.

Frequently Asked Questions (FAQs)

BackgroundàscreeningàraisesàmoreàquestionsàthanàanswersâÂÂbothàforàpotentialàcandidates,àasàwellàas employers.àTheàensuingàsection addressesàmanyàquestionsàasked in a bidàtoàdemystifyàwhatàhappens,àsetàrealisticàexpectations, andàhaveàeveryoneàclear-eyedàaboutàwhatàdecisionsàareàbeing made.

Do background checks include drug tests?

No, background checks and drug tests are separate processes. While they are both used to evaluate a candidate's suitability, background checks usually focus on verifying identity, employment history, and financial status. If a company includes drug testing in its hiring process, it is typically a separate evaluation.

What happens if you fail a drug test?

Failing a drug test can lead to the withdrawal of a job offer or even termination if you're already employed. Policies vary by company, but most organizations have clear guidelines on this issue. It's advisable to understand a company's drug testing policies during the recruitment process.

Background check for self

Conducting a background check on yourself is a smart move. You can catch and correct inaccuracies, ensuring there are no surprises when an employer checks. Services like annualcreditreport.com offer free credit reports, and third-party companies provide comprehensive self-background checks.

Will a DUI come up on a background check?

Yes, a DUI can appear on your background check, especially if the position involves driving. It might influence hiring decisions based on the roleâÂÂs requirements, so be upfront and ready to address how youâÂÂve moved forward from past incidents.

Background checks for nonprofits and small businesses

Nonprofits and small businesses face unique challenges with limited resources but can adopt cost-effective strategies like prioritizing checks for key roles or using simplified background check services tailored for smaller organizations. Prioritizing transparency and compliance ensures fair practices without overstretching budgets.

Conclusion

In today's employment landscape, the link between SSN traces and credit checks stands as a critical component in conducting effective background screenings. These tools not only aid in verifying identity, uncovering address history, and assessing financial responsibility but also provide a comprehensive view of a candidate's integrity and reliability. This connection ensures employers make informed decisions, minimizing potential risks associated with new hires.

For professionals navigating the job market, understanding these screenings means acknowledging the level of transparency expected in financial and personal histories. Job seekers should consider how these aspects of background checks could impact employment opportunities, and, where necessary, take steps to improve their profiles.

For businesses, compliance with regulations like the Fair Credit Reporting Act (FCRA) is paramount. Maintaining diligence in screening processes ensures safe hiring practices and protects against potential liabilities. Adhering strictly to legal standards not only safeguards the company but also builds trust with prospective employees, contributing to a secure and productive workplace environment.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.