Remote work has reshaped the employment landscape dramatically, bringing with it new challenges and opportunities. For Michigan-based companies hiring out-of-state employees or remote workers within the state, understanding the intricacies of background checks and tax implications is crucial. This guide aims to provide employers and HR professionals with a comprehensive understanding of Michigan remote work background checks and the multi-state tax issues that accompany these arrangements.

Key Takeaways

- Remote work in Michigan demands careful navigation of background checks and tax obligations to avoid legal troubles.

- Understanding state-specific rules, such as Michigan's employment and educational verification requirements, is critical for conducting compliant background checks.

- Hiring out-of-state employees introduces complexities that can be mitigated by using integrated background check platforms that handle multi-state regulations.

- Companies must establish clear telecommuting policies and contracts to manage remote teams effectively and prevent legal challenges.

- Multi-state tax challenges, such as nexus and tax withholding issues, require strategic planning and collaboration with a knowledgeable tax professional to ensure compliance and optimize tax strategies.

Introduction

Remote work isn't just a trend; it's become a core component of how we do business. In Michigan, companies are increasingly facing the challenges and opportunities that come with hiring remote workers. One of the main complexities in this new landscape involves conducting thorough background checks while also considering the tax implications across state lines.

Why does this matter? Because compliance with these checks and understanding tax obligations are crucial for companies looking to avoid legal troubles. If you're hiring remotely, you must navigate an environment filled with varied state regulations and tax rules.

This guide will help you unpack the essentials of Michigan remote work background checks and examine the multi-state tax intricacies involved. By equipping yourself with this knowledge, you can streamline your hiring process and safeguard your business from potential pitfalls.

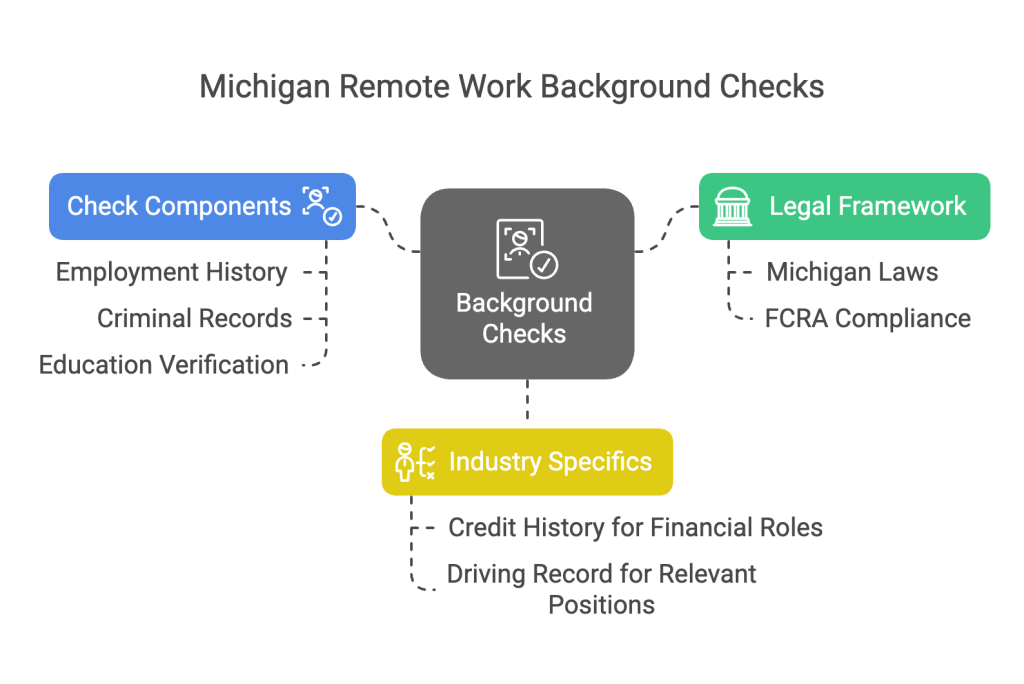

Understanding Michigan Remote Work Background Checks

When we talk about Michigan remote work background checks, we mean the process of vetting potential employees who work remotely, whether they reside in Michigan or elsewhere. These checks are crucial for ensuring that the people you hire are trustworthy and qualified for the role.

Michigan has its own set of rules and regulations for background checks, but these are also influenced by federal laws like the Fair Credit Reporting Act (FCRA) enforced by the Federal Trade Commission. This act ensures that any information gathered during these checks is accurate, relevant, and collected fairly.

The components of a background check for remote workers can vary, but typically include employment history, criminal records, and education verification. Employment history checks confirm that the candidates have the experience they claim. Criminal background checks help identify any issues that might pose a risk to your business. Education verification ensures that the academic qualifications listed by the candidate are legitimate.

Consider the specifics of your industry and the role when deciding which background check components are essential. Do you need to check credit history for a financial position? Is a driving record important for your role? Tailor the process to your needs but keep it compliant with Michigan and federal laws. Balancing thoroughness with respect for privacy will give you the best outcomes in this critical aspect of hiring.

MI Out-of-State Employee Screening

Hiring out-of-state employees requires a careful approach to screening. Each state has unique regulations concerning background checks, which can complicate the process for a Michigan-based employer. For example, some states have restrictions on accessing criminal records or require specific consent forms. Understanding these variations is crucial for compliance and effectiveness.

Technology plays a vital role here. Platforms like GCheck offer seamless solutions, integrating multiple states' requirements. These tools streamline your screening process, allowing you to focus on finding the right talent without getting bogged down by legal hurdles.

Consider the case of a software company in Grand Rapids. They expanded their workforce by hiring remote developers from various states. By leveraging a background check platform that aligns with multi-state regulations, they avoided legal setbacks and ensured a smooth onboarding process.

What about your hiring strategy? Are you ready to navigate the complexities of cross-state legalities? Selecting the right tools can spare you from unwanted legal headaches and keep your hiring process robust.

Telecommuting Compliance in Michigan

Telecommuting compliance in Michigan is a significant aspect of remote work arrangements. Companies must ensure they adhere to legal requirements and establish clear policies to manage remote teams effectively. Without proper compliance, businesses risk facing legal challenges and potential financial penalties.

Work-from-home policies are crucial. They should clearly outline expectations for remote employees, including work hours, communication protocols, and performance metrics. A solid policy ensures everyone is on the same page, reducing misunderstandings and promoting a productive work environment. Have you considered if your current policy effectively addresses these areas?

Employment contracts for remote jobs should include specific clauses related to telecommuting. These might cover data security, equipment usage, and reimbursement of expenses. Such clauses protect both the employer and the employee by setting clear boundaries and expectations.

Thinking through these compliance elements can save your company from unnecessary headaches. Are your contracts and policies up to date with current remote work trends and legal requirements? Staying proactive and informed makes a significant difference in navigating the complexities of telecommuting.

Challenges in Michigan Remote Work

Remote work has introduced complexities in tax liabilities that were previously unheard of. When employees work remotely across state lines, both employers and employees face new multi-state tax challenges. It's crucial to understand these implications to avoid unforeseen tax liabilities.

Nexus is fundamental here. It determines whether a state has the right to tax a business. If you hire a remote worker in another state, that state may assert nexus, expecting you to file taxes there. This creates extra obligations, from income to employment taxes.

Scenarios

Consider a Michigan-based company hiring a remote worker in Ohio. Ohio likely demands that company file state tax returns, potentially altering their tax planning. Every state has unique rules, and failing to comply could result in penalties.

There can also be tax withholding challenges. An employee might need to pay taxes in both the state they're based in and the state your business operates from. For instance, a Michigan company with a New York remote worker might have to withhold taxes for both states, depending on each state's laws and any reciprocal agreements.

Scenarios like these highlight the importance of carefully navigating state-specific tax rules. It's not just about compliance; understanding these rules can help optimize your tax strategies and keep you on the right side of the law. Consulting with a tax professional knowledgeable in multi-state issues is often worth the investment, ensuring you adapt to these changes with minimal disruption.

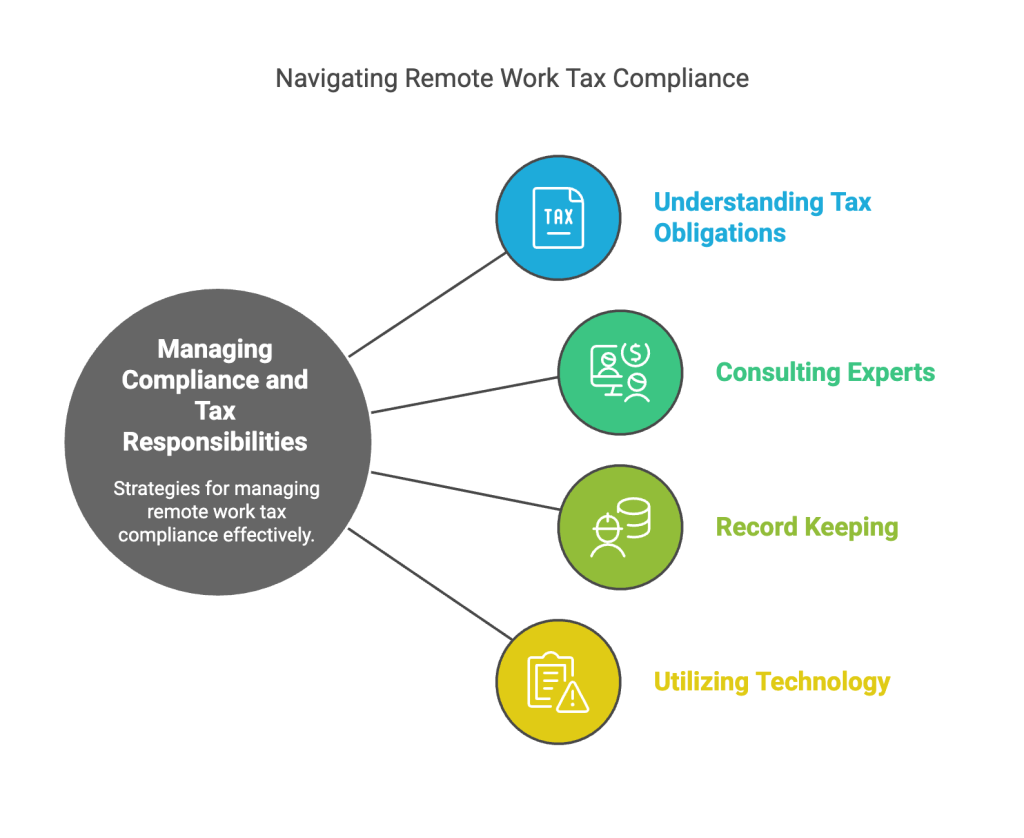

Managing Compliance and Tax Responsibilities

Let's cut to the chase: managing compliance and tax responsibilities in a remote work world can be a tough gig. But there's good news. With the right strategies, you can stay on top of things without losing sleep.

Start with understanding. Know your federal and state tax obligations. Every state has different rules, and this can influence where your remote workers pay taxes. For Michigan-based employers hiring out-of-state, understanding nexus is vital. Nexus determines if you have to pay state taxes, and this can be triggered by having employees in other states.

Second, talk to the experts. A seasoned tax advisor or legal expert can provide clarity. They monitor changing laws and ensure your company stays compliant. This is especially true for remote work situations that involve multiple states.

Focus on record keeping. Itâs not just about collecting documentation; itâs about doing it right. Keep accurate and detailed records of where employees are working. Document your tax filings and background checks, and be prepared if questions arise.

Utilize technology to your advantage. Tools for managing documents and tracking compliance can be lifesavers. They help keep track of employee locations, payroll taxes, and necessary filings across states.

By taking these steps, youâll be in a better position to manage your compliance and tax responsibilities effectively. Always be prepared and proactive. It's the best way to handle the complexities that come with remote work.

Conclusion

Michigan remote work background checks and multi-state tax implications are areas where attention to detail pays off. Companies need to navigate these aspects carefully to avoid pitfalls. With many firms opening up to remote work, understanding and adapting to these challenges is more important than ever.

Start by recognizing the crucial role of background checks for remote employees. This process ensures you hire trustworthy personnel, regardless of where they reside. Verify employment history, conduct criminal records checks, and confirm educational qualifications. Doing so mitigates risks and safeguards your company's interests.

Taxation, however, adds another layer of complexity. Hiring out-of-state workers could subject your business to various state tax laws. Know the concept of nexusâhow your employee's location can create tax obligations for your company in different states. This requires strategic planning and often, the input of a tax professional.

Embrace these challenges with a proactive approach. Keep communication lines open with legal and tax experts, and maintain meticulous records. Doing so secures a path to compliant remote operations. Stay aware, stay prepared, and position your company to thrive in the evolving work-from-home environment.

Frequently Asked Questions (FAQs)

Do MI background checks apply to remote workers in other states?

Michigan-based companies must check state laws for remote workers residing outside Michigan. These workers will be subject to the background check requirements of their residing state.

How to verify education for remote hires in MI?

You can verify education through services that contact educational institutions on your behalf. Alternatively, request original transcripts or diplomas directly from the candidate.

Can MI employers require drug tests for remote workers?

Yes, Michigan employers can require drug tests, but they need to comply with the laws of the state where the remote worker resides.

Are MI companies liable for other statesâ laws?

Yes, if a remote employee works in another state, the employer must follow that stateâs employment laws, including wage, labor, and safety regulations.

How to handle county-specific checks for MI remote hires?

For remote hires residing in different counties, conduct checks in their specific counties of residence to meet local requirements.

Can remote workers sue MI employers for FCRA violations?

Yes, remote workers can sue Michigan employers if they violate the Fair Credit Reporting Act during background checks.

Do international remote workers fall under MI laws?

No, international laws govern remote workers who are based outside of the United States. However, immigration and contract compliance may still apply.

Are gig workers considered remote employees in MI?

No, gig workers are independent contractors and not classified as employees. Different rules apply to them regarding benefits and labor protections.

Whatâs the cost of multi-state checks for MI employers?

The cost can vary widely based on the number of states involved and the types of checks required. Contact background check providers for specific quotes.

Does MI require I-9 verification for remote hires?

Yes, Michigan employers must comply with federal law, which requires I-9 verification for all employees, including remote hires.

What guidelines should MI employers follow for remote worker privacy?

Ensure compliance with both federal privacy laws and those of the employee's residing state. Implement clear policies and secure data handling procedures.

How can MI employers monitor remote worker productivity?

Use productivity software to track work hours and output. However, maintaining transparency with employees about monitoring practices is crucial.

Can MI remote workers access unemployment benefits?

Eligibility for unemployment benefits depends on the laws of the state where the remote worker resides and works.

Is it mandatory for MI employers to provide equipment for remote work?

It depends on company policy and job requirements. Some employers provide necessary equipment, while others may require employees to use personal devices.

Definitions

Background Check

A background check is the process employers use to confirm a candidate's history before hiring. This may include verifying employment history, education, and criminal records. For remote roles, checks must follow both Michigan and federal laws like the Fair Credit Reporting Act (FCRA). Always get clear consent and tailor the scope of the check to match the job responsibilities.

Employment History Verification

This confirms that a candidateâs past work record matches what theyâve listed on their resume. Employers often ask previous employers to verify job titles, dates, and reasons for leaving. It helps filter out false claims and ensures you're hiring someone with real experience.

Nexus

Nexus refers to the legal connection between a business and a state that creates tax obligations in that state. For example, having a remote employee based in another state may trigger nexus. That state could then require your business to pay income or employment taxes there. Understanding where youâve created nexus helps you stay compliant and avoid penalties.

Employment Contract

This is a written agreement between an employer and employee that lays out job duties, compensation, and work conditions. For remote jobs, contracts often include clauses about work-from-home expectations, equipment use, and data security. A well-written contract reduces confusion and protects both parties.

Work-from-Home Policy

A work-from-home policy outlines how remote work should be handled at your company. It sets expectations for work hours, communication, availability, and performance. It also helps manage productivity and gives employees clear guidelines. Question to ask: Does your current policy cover whatâs expected in a remote setting?

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.