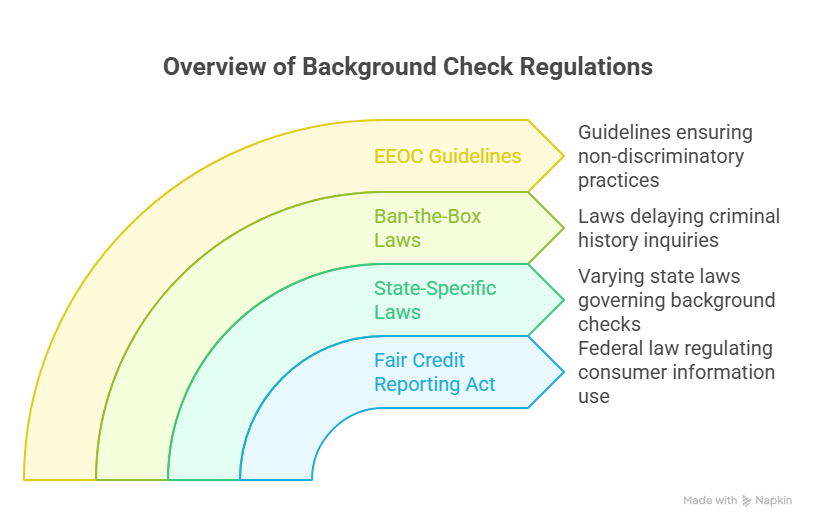

To navigate the complex landscape of background checks effectively, it's crucial to have a comprehensive understanding of the relevant laws and regulations that govern them. Here's an overview of some key legal considerations:

Fair Credit Reporting Act (FCRA)

The FCRA is a federal law that regulates the collection, dissemination, and use of consumer information, including background checks. It imposes strict requirements on employers using third-party consumer reporting agencies for background checks, such as obtaining written consent, providing pre-adverse and adverse action notices, and allowing applicants to dispute inaccurate information.

State-Specific Background Check Laws

Beyond federal regulations, many states have laws governing background checks. These laws can vary widely and may include restrictions on the use of criminal history, limitations on credit checks, and rules regarding the timing of background checks.

Ban-the-Box Laws

Numerous states and cities have enacted "ban-the-box" laws that limit when and how employers can inquire about an applicant's criminal history. These laws often delay the background check process until after an initial job offer is made.

Equal Employment Opportunity Commission (EEOC)

The EEOC provides guidelines to ensure that background checks do not discriminate against protected classes under Title VII of the Civil Rights Act. Employers must be cautious not to disproportionately impact specific groups based on race, color, religion, sex, or national origin.

EXPERT INSIGHT: As a human resource professional, I have realized that conducting background checks is truly about fairness, respect, and ethically treating individuals, not just about regulatory compliance. In my conversations with candidates, I have discovered that their fear is not due to any agenda, but rather a lack of knowledge about the process and their rights. This highlights our duty to not just meet legal requirements but also ensure that the process is open, respectful, and understanding. Whether it is about securing proper consent, explaining the meaning of negative actions, or implementing "ban-the-box" strategies, we have the ability to instill trust from the very beginning. By balancing compliance with empathy, we build safer and more inclusive workplaces in which individuals are valued, not stigmatized. - Charm Paz, CHRP

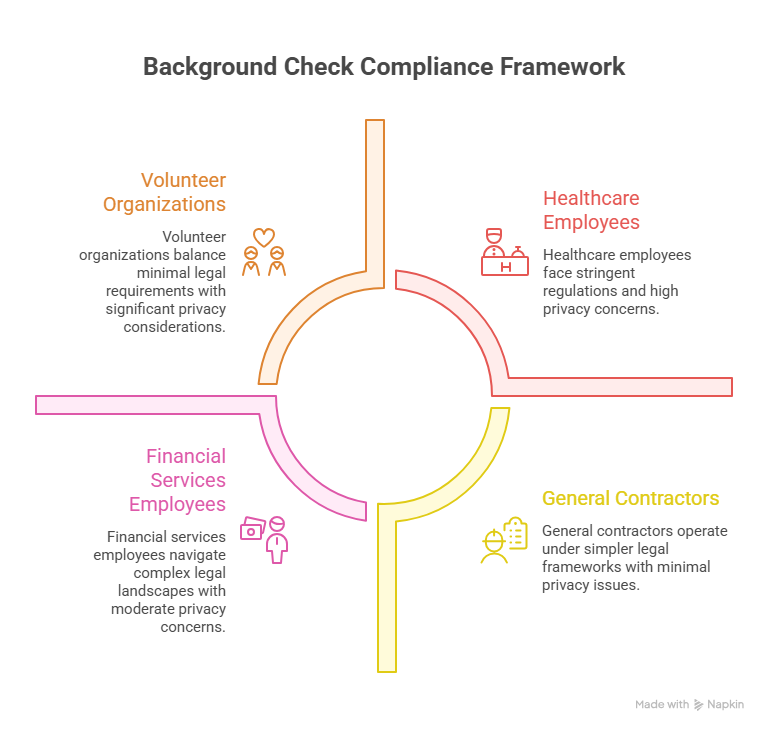

Industry-Specific Regulations

Some industries, such as healthcare and financial services, have specific regulations that mandate background checks due to the nature of the work and the need to protect consumers and patients.

The legal requirements for background checks can vary based on the category of worker involved. Understanding these differences is essential to remain compliant:

Contractors

Background checks for contractors often hinge on the specific agreements and contracts between the organization and the contractor. These agreements clearly outline the scope of background checks, confidentiality requirements, and compliance with relevant laws. In some cases, contractors may need to comply with industry-specific regulations.

Employees

Employees are subject to various federal and state laws governing background checks. Employers must consider FCRA requirements, ban-the-box laws, and EEOC guidelines. Additionally, the type and depth of background checks may vary depending on the job position and industry.

Volunteers

Background checks for volunteers must also adhere to applicable federal and state laws. However, organizations should be especially cautious about respecting volunteers' privacy rights. Consent and disclosure are crucial here, as volunteers may not have the same legal obligations as employees or contractors.

Consent and disclosure are fundamental aspects of conducting legally compliant background checks:

- Consent: It is crucial to obtain explicit and informed consent from the individual being screened in order to comply with the Fair Credit Reporting Act (FCRA) and various state laws. The consent must be obtained before initiating the background check process. It should be a separate document that clearly and assertively outlines the purpose and scope of the background check.

- Disclosure: Employers must provide applicants or workers with a written disclosure informing them that a background check will be carried out. This disclosure must be clear and concise and cannot be hidden in other documents or job applications. In addition, informing the individual about their rights under the Fair Credit Reporting Act (FCRA) is mandatory. Therefore, employers must strictly adhere to these regulations to avoid any legal consequences.

- Adverse Action Procedures: If any negative information is discovered during a background check that could impact the hiring or volunteering decision, the person must receive a pre-adverse action notice, a copy of the background report, and a summary of their rights under the FCRA. If the individual has a chance to dispute the information and the decision remains unfavorable, the employer must give an adverse action notice.

Conclusion

Complying with the regulations of a background check isn't merely about rule-following—although that's necessary, too—it's about treating people gently, honestly, and believing with all your heart that the right people are hired the right way. As HR people, we believe sometimes that rule-compliance means treating people gently, treating all applicants—full-time employees, contractors, volunteers, anyone—well, by giving them the respect they deserve. By truly knowing the federal, state, and industry regulations, and taking note of things such as consent, disclosure, and negative practices, we don't merely stay out of lawsuits—although that helps, too!—we establish credibility. Good background checks aren't about fines anxiety; they're about a legal method of hiring that centers upon people.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.