Navigating the maze of hiring regulations can feel like threading a needle through a haystack. With the Fair Credit Reporting Act (FCRA) and its specific implications for Georgia, compliance is crucial to avoid costly legal pitfalls. This guide delves into how employers in Georgia can ensure their hiring practices comply with FCRA regulations, especially amidst evolving legal and technological landscapes.

Key Takeaways

- Employers in Georgia must comply with both federal FCRA regulations and local state laws when conducting background checks during hiring.

- Clear communication with candidates about background checks is crucial to ensure transparency and compliance with FCRA requirements.

- Mishandling the adverse action process can lead to legal consequences; careful adherence to the prescribed steps is necessary.

- Regular training for HR staff on FCRA regulations can prevent violations and ensure that hiring practices remain current and compliant.

- Utilizing technology can streamline compliance tasks, improving both efficiency and accuracy in processing candidate information.

Understanding FCRA Compliance in Georgia

What is the FCRA?

The Fair Credit Reporting Act (FCRA) is a federal law with the primary aim of ensuring the accuracy, fairness, and privacy of consumer information held by credit reporting agencies. For employers, it governs how they can use consumer reports—like credit checks and background checks—in hiring decisions. This law mandates that employers must inform candidates if they intend to obtain such reports and secure their explicit consent beforehand.

How does the FCRA play out differently on the national stage versus in Georgia? At the federal level, the FCRA sets baseline requirements for the use of consumer reports. Employers must provide clear and conspicuous disclosure, obtain written consent, and follow certain procedures if they decide not to hire based on the report.

But Georgia also has its nuances. State-specific regulations can modify how the FCRA is applied, especially when it comes to criminal background checks. For instance, Georgia has adopted 'ban the box' legislation, which delays inquiries into a candidate's criminal history until later in the hiring process.

Navigating these intersecting requirements can be tricky. Understanding both the federal expectations and Georgia’s approach is essential for compliance. Have you reviewed your hiring processes to ensure they meet both sets of standards? If not, now is the time to do so. Compliance is not just a legal necessity but a step towards transparent and fair hiring practices.

Why FCRA Compliance Matters?

Violating the Fair Credit Reporting Act (FCRA) can have significant consequences for employers. The legal repercussions can be severe, both financially and reputationally.

Consider the costs: fines, legal fees, and settlements can stack up quickly. For instance, in past Georgia lawsuits, companies faced hefty penalties for neglecting FCRA guidelines. These cases illustrate the importance of compliance, as even unintentional oversights can lead to costly legal battles.

Legal troubles aside, think about your business reputation. Today's job seekers are more informed than ever. Just one publicized lawsuit can tarnish your company's image, making it less attractive to potential hires. Compliance isn't just about avoiding penalties—it's about building trust with current and future employees.

Ask yourself: Is your company prepared to handle the fallout of a non-compliance case? Are you willing to risk the damage to your brand and the loss of potential top talent?

Staying compliant with FCRA isn't just a legal requirement; it's crucial for maintaining a respected and reliable company brand. By adhering to these standards, you demonstrate integrity and a commitment to fair hiring processes, which can set you apart in a competitive market.

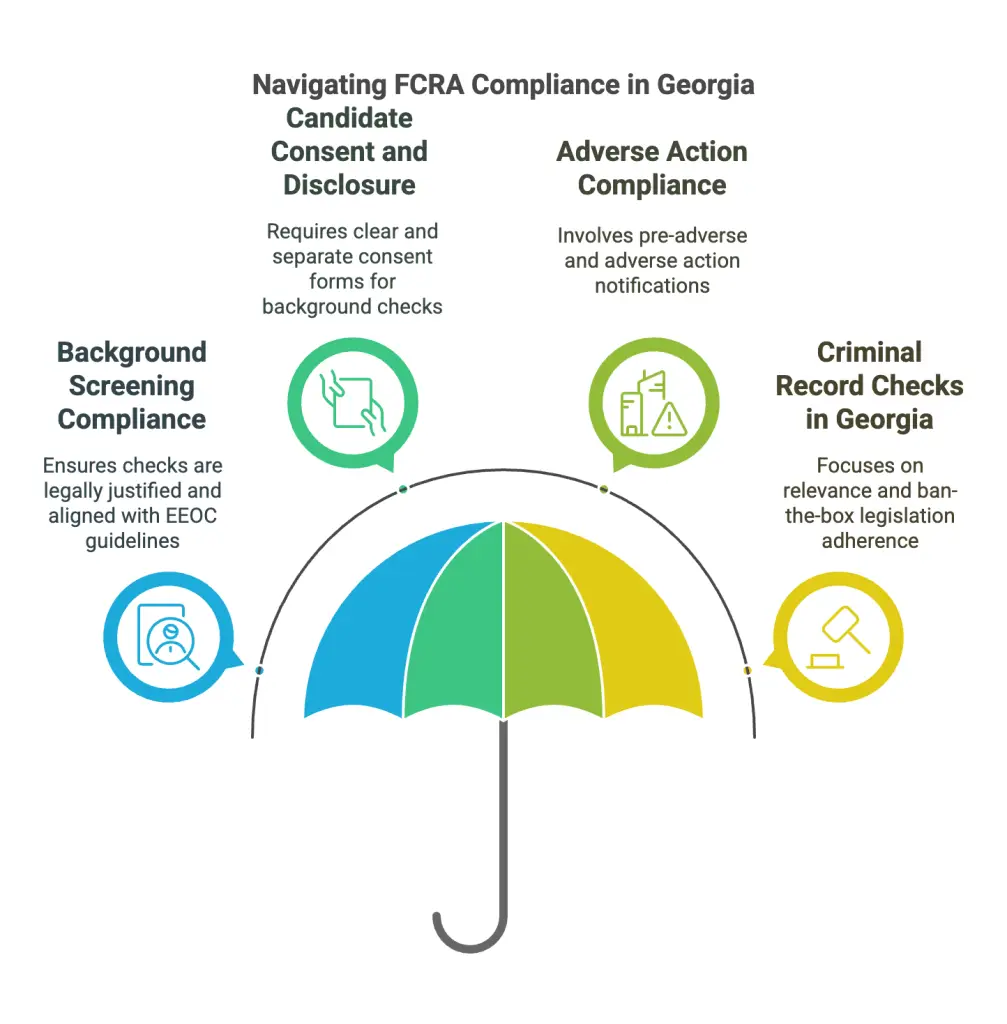

Key Components of FCRA Compliance for Georgia Employers

Navigating the Fair Credit Reporting Act (FCRA) is crucial for Georgia employers during hiring. Here are some key components that can help your business stay compliant.

Background Screening Compliance

Background checks are a staple in the hiring process. They verify candidate qualifications and character. However, they need to be conducted within legal boundaries.

First, establish the permissible purpose of the background check. Under the FCRA, you must have a valid reason for conducting these checks. Employment purposes count, but ensure you're not fishing for data without a clear hiring-related rationale.

The Equal Employment Opportunity Commission (EEOC) offers guidelines on background checks. Familiarize yourself with these to align your practices with federal expectations.

Candidate Consent and Disclosure

Before diving into a background check, seek candidate consent. Consent forms should be clear, separate from other documents, and straightforward. Make the process transparent. Your candidates should know what you are checking and why.

When disclosing your intention to perform a background check, language clarity is paramount. Inform candidates simply and clearly, so there are no misunderstandings.

Adverse Action Compliance

Should a background check lead to an adverse hiring decision, the process involves two distinct notifications.

First, issue a pre-adverse action notice. This allows the candidate to review the report and point out inaccuracies, if any.

Only after this step should you send an adverse action notice, confirming the decision based on the report. This gives candidates a fair chance to address errors in their reports.

Criminal Record Checks in Georgia

Georgia has its own take on criminal background checks due to ban-the-box legislation. This law prohibits employers from asking about a candidate’s criminal history on the initial job application.

Balance is crucial—ensure workplace safety without sidelining fair hiring. Focus on the relevance of a candidate's criminal history to the job responsibilities.

These components form the backbone of FCRA compliance in Georgia. Pay attention to these details to ensure your hiring process respects both legal standards and the rights of prospective employees.

Candidate Consent and Disclosure

Getting consent from candidates for background checks is not just a formality. It's the bedrock of compliance with FCRA rules. You need to be clear and straightforward. Ensure that consent forms are separate from other application materials. This makes it easier for candidates to understand what they're signing.

Deliver these forms in a format that's simple and direct. Electronic delivery is common, but make sure it's accessible. It should be easy for candidates to opt-in.

Best practices suggest using plain language. Don't cram the form with legal jargon. Spell out what information will be checked and how it will be used. This reduces confusion and builds trust right from the start.

Disclosure is equally critical. You must inform candidates that you'll conduct a background check. State this intention clearly, without embedding it in fine print.

Communication should be simple and honest. This transparency is not just about compliance—it's about treating candidates fairly. Think of it as setting the right tone for your hiring process.

Adverse Action Compliance

The adverse action process is crucial when using consumer reports for hiring decisions. If a report leads to a decision that impacts a candidate negatively, follow specific steps to stay compliant.

Start with a pre-adverse action notice. This informs the candidate of potential negative outcomes from the report. Include a copy of the report and the "Summary of Your Rights Under the FCRA." This gives them a chance to review the report and address any errors.

The timing between pre-adverse and final adverse action is critical. Give candidates reasonable time to dispute the report. This usually means a few business days. Some take five to seven days as a practical standard, but check local guidelines.

If the candidate does not contest or if there's no change in your decision, proceed with the adverse action notice. This final notice should state the decision, inform them of the reporting agency's role, and include their rights to contest inaccurate information.

Providing a clear path for candidates to respond isn't just about fairness. It's also about building trust in your hiring process. Nobody likes surprises in job applications, and this process helps manage expectations.

Consider the implications of not following this process. An incomplete adverse action process can lead to legal trouble and tarnish your reputation. Avoid shortcuts here. They're not worth the risk.

Have you structured your adverse action process to be both compliant and candidate-friendly? Review and refine regularly to match current laws. Your diligence can protect both your company and prospective employees.

Criminal Record Checks in Georgia

Criminal background checks can be tricky for employers in Georgia. The state’s ban-the-box legislation means you can’t ask about criminal history on initial job applications. This law aims to give those with criminal records a fair shot at employment by delaying questions about criminal history until later in the hiring process.

When you conduct a criminal background check, timing and necessity are key. Make sure it’s relevant to the job. For example, if the position involves handling money or sensitive information, a background check makes sense. But doing one for a position where criminal history is not pertinent might be overreaching.

Balance workplace safety with offering opportunities. Think about whether past convictions genuinely impact job duties. For instance, a decade-old non-violent offense may not be relevant. This approach not only aligns with fair chance principles but also widens your talent pool.

When considering results, give candidates a chance to explain their records. People can change, and context matters. This isn't just about avoiding legal pitfalls; it's about evaluating character. You might find a perfect fit if you look beyond a record.

By being mindful in criminal background checks and complying with state laws, you respect candidates’ rights and promote a fair hiring process. This approach benefits both your company and the community by maintaining safety while supporting rehabilitation and opportunity for all.

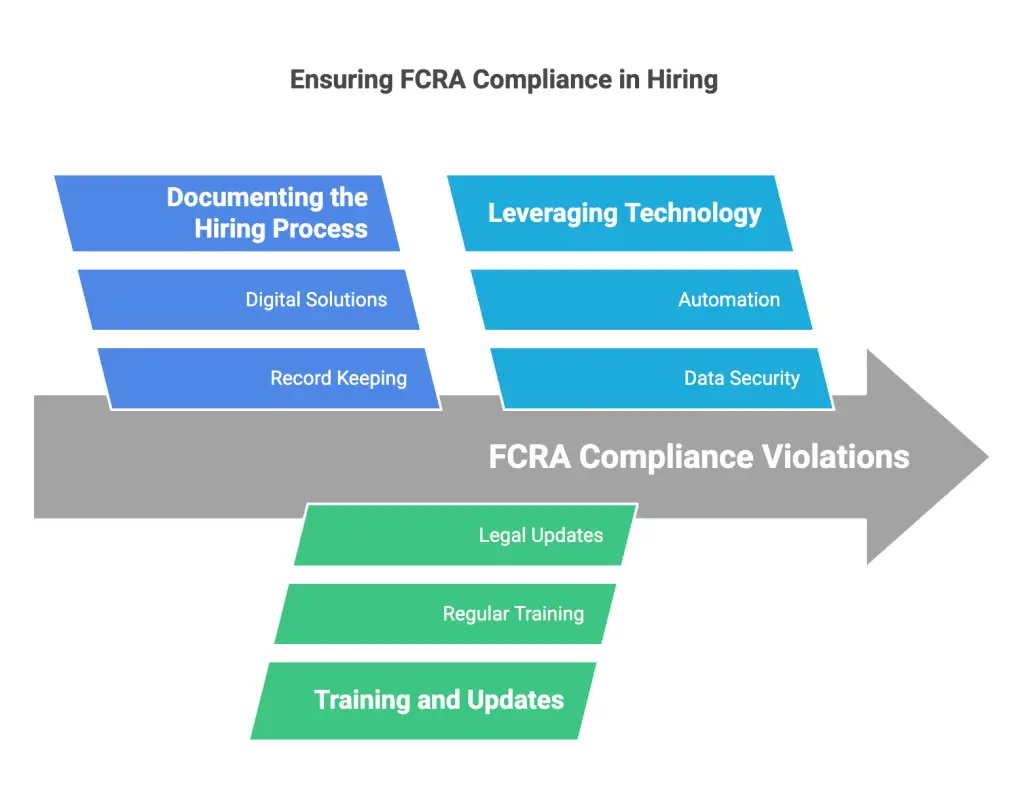

HR Best Practices for Ensuring FCRA Compliance

To stay compliant with FCRA regulations, Georgia employers need a set of actionable HR practices. These practices ensure not only adherence to legal requirements but also promote a fair hiring process.

Documenting the Hiring Process

You should keep clear records of every step in the hiring process. This includes background checks, consents, and all communications with candidates. Detailed records protect you during audits and disputes. They also help maintain consistency in hiring practices.

Consider using digital solutions for documentation. These tools help organize records efficiently and make retrieval straightforward. Software platforms can automate much of this, minimizing human error and ensuring compliance with FCRA requirements.

Training and Continuous Updates

Training your HR team regularly on FCRA compliance is not just advisable—it's essential. Frequent training sessions ensure that your team understands the latest regulations and can apply them correctly.

It’s also crucial to stay updated on any legal changes. Laws can shift, requiring quick adaptation in your hiring processes. Utilize legal newsletters, webinars, and professional networks to keep your knowledge current.

Leveraging Technology for Compliance

Automation can significantly aid compliance efforts. Implementing software that automates parts of the hiring process—such as sending notification emails or flagging compliance lapses—streamlines operations. This automation reduces the risk of human error and ensures deadlines for notifications are met promptly.

Data privacy and security should also remain a priority. Protect candidates' personal information with secure systems and practices. Regular audits of your technology's security settings can reveal vulnerabilities and keep candidate information safe.

By following these best practices, you protect your organization from FCRA violations and create a more efficient and fair hiring process.

Data-Driven Insights into FCRA Compliance Trends

Analyzing Current Compliance Trends in Georgia

Start by considering the numbers. Recent data shows that a significant portion of FCRA violations among Georgia employers stem from two main issues: improper disclosure and failing to follow the adverse action process. According to a study, nearly 30% of violations are due to incorrect or unclear consent forms. Employers often skip the requirement to use a standalone document for disclosures, leaving them vulnerable to lawsuits.

Now, let's look at what happens when adverse action isn’t handled correctly. More than 20% of violations relate to improper handling of pre-adverse and adverse action notices. Employers too often send notifications out of sequence or miss crucial details candidates need to understand the decision.

What can you learn from these pitfalls? Ensure your consent forms are straightforward and comply with FCRA sections on clarity. When it comes to adverse action, stick strictly to the two-step process, providing candidates ample time and information to dispute inaccuracies.

Employer Case Studies

Let's turn to examples. A small tech firm in Atlanta revamped its hiring practices by implementing FCRA-compliant automated systems. By using a specialized software, they cut their error rate in processing background checks by 40%. Their commitment to regular HR training on FCRA requirements also played a key role in maintaining compliance, significantly reducing legal risks.

On the other hand, a retail chain faced a class-action lawsuit due to non-compliant background check practices. They learned the hard way that skipping pre-adverse actions can cost millions. What saved them eventually was a shift in their hiring protocol, emphasizing meticulous documentation and transparency.

What can these stories teach you? Investing in technology and training yields tangible compliance benefits. It's about building an internal structure that supports ongoing adherence to FCRA regulations.

Future Outlook for FCRA Compliance

Looking ahead, you must stay vigilant. FCRA-related laws may evolve, incorporating new privacy concerns tied to technological advances. For instance, AI-driven background checks might emerge, presenting new compliance challenges. Keeping an eye on legislative updates and technological shifts will be crucial.

Ask yourself: how equipped is your company to adapt to these changes? Is your HR team prepared to implement new tech while maintaining legal compliance? These questions could shape your strategy in adhering to future FCRA regulations.

By understanding current trends and preparing for what's next, you position your company as a responsible, compliant employer in Georgia.

Analyzing Current Compliance Trends in Georgia

FCRA violations are costly. Georgia employers have been learning this the hard way. Data from the past few years indicate a troubling rise in non-compliance cases. In 2022, over 15% of background check-related lawsuits in the state involved FCRA issues.

Common pitfalls include failing to provide clear disclosure to candidates and not following the two-step adverse action process. A survey of small and mid-sized companies revealed over 30% admitted confusion over FCRA requirements.

Understanding these trends can guide corrective actions. Large companies like Coca-Cola set examples. They prioritize structured compliance programs and continuous employee training. These efforts result in fewer violations and better hiring practices.

Look at your processes. Are you confident they meet FCRA standards? Consider periodic audits, much like Home Depot's approach, to preemptively address potential gaps.

Success comes from being informed and prepared. Learn from leaders in your industry. Build a culture of compliance, not just adherence to rules.

Future Outlook for FCRA Compliance

Regulatory landscapes never stand still, and the FCRA is no exception. As we edge closer to 2025, changes in both Georgia and federal regulations could be on the horizon. To stay ahead, consider what these shifts might look like and how they could impact your hiring processes.

Expect stricter consumer privacy laws. With data breaches becoming more frequent, lawmakers may push for stronger protections for personal information within background checks. It's crucial to align your processes with these potential changes to avoid penalties.

The push for fair chance hiring is likely to grow stronger. Expect more detailed legislation around criminal background checks, particularly in light of Georgia's current ban-the-box laws. Start preparing for how you'll balance compliance with social responsibility.

Embrace technology, but tread carefully. Automation and AI tools for background checks promise efficiency, yet they raise questions about accuracy and bias. Stay informed about technological advancements while ensuring they align with FCRA requirements.

Adaptability will be your ally. Regulatory changes may demand new policies or alterations to existing ones. Regularly review your procedures and train your staff accordingly. Consider consulting with an employment law expert to navigate these shifts proficiently.

What are you doing today to prepare for tomorrow? Secure your compliance strategy now to avoid scrambling when changes arrive. Stay informed, stay prepared, and ensure your hiring practices remain both lawful and fair.

Actionable Takeaways for Employers

First, start with a compliance checklist. Make it systematic. Break down the hiring process into clear steps focused on adhering to FCRA rules. This includes ensuring all consent forms are properly executed and disclosures are clear. Double-check that adverse action procedures align with FCRA requirements.

Engage legal counsel regularly. Labor laws can change without much notice. Staying in touch with an employment law expert ensures you're up to date and compliant. This proactive approach can prevent costly legal mistakes.

Promote fair hiring practices. Fairness doesn't just protect you legally; it builds trust with candidates. Consider how your practices affect diverse groups and aim for inclusivity. Balancing compliance and fair opportunity strengthens your company’s reputation and fosters a positive work environment.

Remaining compliant with the FCRA in Georgia isn't just about knowing the rules—it's about taking active steps to integrate this knowledge into your hiring practices.

Start by creating strong compliance strategies that meet both federal and state requirements. Use technology to your advantage to automate tasks and minimize risks, such as ensuring that disclosure forms and consent communications are timely and accurate.

Stay informed about changes in laws and regulations. Regularly update your processes to reflect the latest legal requirements. Consider consulting with employment law experts as a standard practice. Their insights can help tailor your approach and avoid potential pitfalls. Prioritize building fair and transparent hiring practices. Engage with candidates openly and ensure they understand their rights throughout the screening process.

Finally, reinforce your HR team's knowledge with regular training sessions focused on FCRA provisions and compliance standards. Keeping your team up-to-date is crucial in adapting to an ever-evolving legal landscape.

By following these steps, you'll not only protect your company from violations but also foster a positive reputation in the eyes of job seekers and employees.

Frequently Asked Questions (FAQs)

What are the most common FCRA violations in Georgia?

Common violations include not obtaining proper consent before conducting background checks, failing to provide required disclosures, and not following appropriate procedures when taking adverse actions based on report findings.

Are FCRA rules different for small businesses in Georgia?

FCRA rules apply universally, regardless of the size of the business. Every employer must comply with the same regulations when conducting background checks.

How can Georgia employers obtain proper consent for background checks?

Employers need to present a clear and separate disclosure document explaining the intention to run a background check. The document should not be a part of the employment application.

What steps must Georgia employers take for adverse action notices?

Employers must first give a pre-adverse action notice to the employee, along with a copy of the background check report and a summary of their rights. If adverse action is taken, a final notice should be given, clearly stating the decision.

Are job seekers in Georgia protected from inaccurate background reports?

Yes, job seekers are protected. The FCRA mandates that background reports be accurate and gives individuals the right to dispute incomplete or inaccurate information in their reports.

What happens if an employer violates FCRA in Georgia?

Employers who violate FCRA can face legal consequences, including fines and lawsuits. Affected individuals may seek damages for the violations.

How can employees dispute inaccuracies in their background checks?

Employees can contact the reporting agency to dispute inaccuracies. The agency is required to investigate and correct any errors found within a set timeframe.

Can Georgia employers make hiring decisions based solely on background checks?

Employers can consider background information, but they should ensure decisions comply with established employment laws, such as avoiding discrimination.

Are there any state-specific requirements for background checks in Georgia?

While the FCRA provides federal guidelines, employers should also be aware of any state-specific laws or regulations that might apply.

What rights do consumers have under the FCRA when it comes to background checks?

Consumers have the right to know if a background check has been used against them and to receive a copy of their report. They also have the right to dispute any incorrect or incomplete information and to receive timely corrections.

Definitions

1. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how employers use consumer reports, such as credit histories and background checks, in the hiring process. It requires employers to inform candidates before obtaining these reports and to get written permission. If an employer takes adverse action based on a report, they must provide notice and allow the candidate to dispute any inaccuracies.

2. Candidate Consent

Candidate consent is the written authorization an employer must obtain before conducting a background check. This document should be clear, separate from other paperwork, and outline what information will be collected and how it will be used. Without this consent, performing a background check may violate federal and state laws.

3. Adverse Action Notice

An adverse action notice is a required notification sent to a job applicant when an employer decides not to hire them based on information from a background check. The process involves two steps: a pre-adverse action notice, which gives the candidate time to dispute errors, and a final adverse action notice if the decision remains unchanged.

4. Background Screening Compliance

Background screening compliance ensures that employers follow legal guidelines when conducting checks on job candidates. This includes obtaining proper consent, using background checks only for valid employment reasons, and following the correct steps if a report negatively impacts a hiring decision. Failure to comply can lead to penalties and legal issues.

5. Ban the Box

Ban the box is a law that prevents employers from asking about a candidate's criminal history on an initial job application. In Georgia, this law applies to public employers and delays background checks until later in the hiring process. The goal is to give individuals with criminal records a fair chance at employment based on qualifications rather than past mistakes.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.