Ensuring your candidates are thoroughly vetted when hiring for executive positions is crucial. Executive background checks are critical in the hiring process, helping organizations safeguard their reputation and assets. This comprehensive guide will explore why these checks are important and detail the components typically included. If you're an HR professional or recruiter, this guide is tailored for you and packed with valuable insights to make your hiring process solid, transparent, and efficient.

Key Takeaways

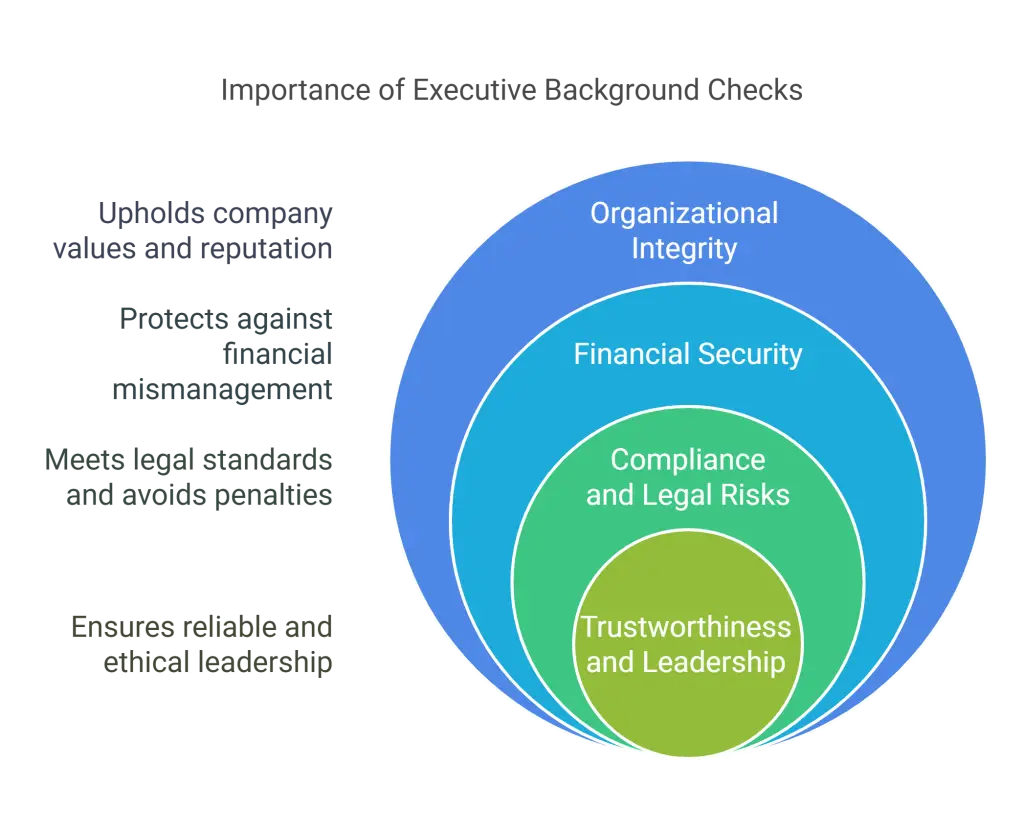

- Executive background checks are crucial to protect organizational integrity, financial security, and ensure compliance with legal standards.

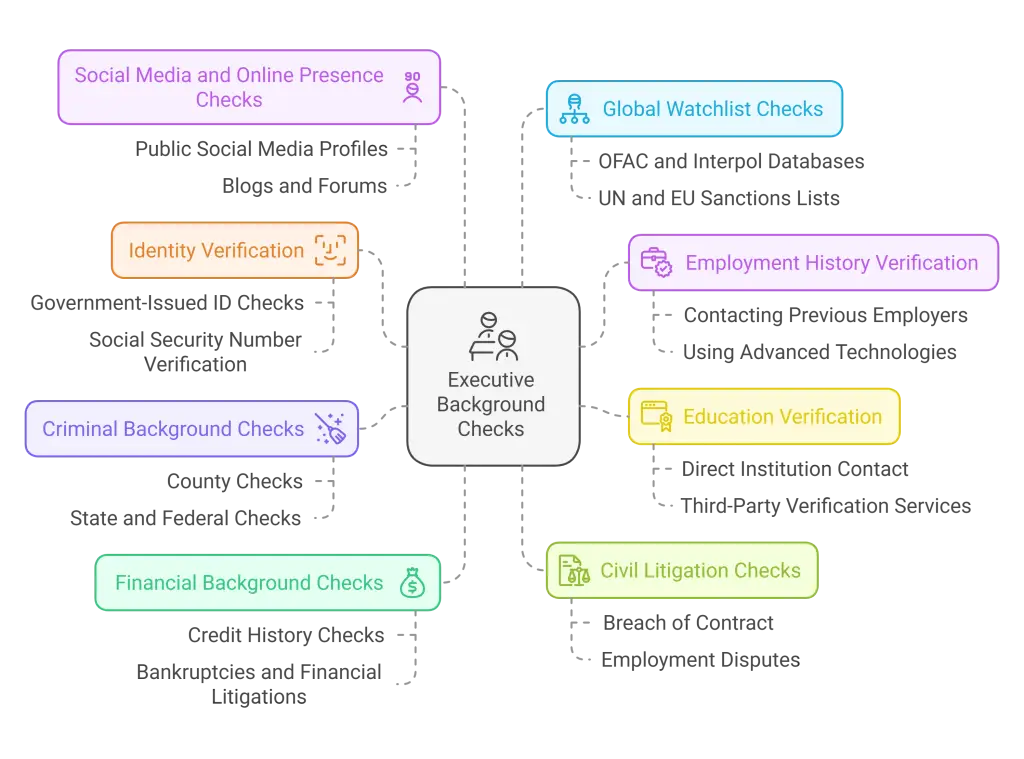

- These checks include identity verification, employment and education history verification, criminal and financial background checks, civil litigation checks, and global watchlist screenings.

- Ensures trustworthy leadership, protects against financial and reputational risks, and promotes a safe and compliant workplace.

- Partner with reputable agencies, leverage advanced technology, and ensure compliance with relevant laws and regulations.

Introduction

Picture this: A global corporation recently appointed a new CEO who seemed like the perfect fit—until it was discovered that key parts of his resume were fabricated. The scandal tarnished the company’s reputation and led to significant financial losses. This scenario underscores the critical need for executive background checks, underscoring their importance in the hiring process.

Executive background checks go beyond standard checks to offer a deeper vetting process tailored for positions of high responsibility and visibility. Unlike basic background checks, which might include a quick scan of criminal records and employment history, executive checks delve into financial stability, civil litigation history, and global watchlists. By doing so, these checks ensure that the candidates entrusted with leading organizations are credible, reliable, and above reproach.

This guide will illuminate the importance of executive background checks and detail the various checks involved. It aims to arm HR professionals and recruiters with the essential knowledge to make responsible hiring decisions.

Employee references are not just a formality—they are a vital tool in the hiring process that provides a deeper understanding of a candidate's background. While resumes and interviews offer a snapshot, references provide a window into a candidate’s real-world performance that's why it is essential to be keen in providing this info. It is our role as HR professionals to conduct a bias-free reference checks to eliminate the risk of costly hiring mistakes. This process fosters a workplace where employees can succeed and make meaningful contributions to the organization.

Why Are Executive Background Checks Important?

Protect Organizational Integrity

When hiring for top-tier positions, safeguarding the integrity of your organization is paramount. Executives aren't just employees; they're the face of the company, driving strategy and culture. A thorough vetting process ensures these leaders uphold the organization's values and standards. By verifying the authenticity of their history and credentials, you minimize the risk of hiring individuals who might compromise your company's reputation through unethical behavior or fraudulent activities.

Financial Security

An executive's influence over company finances is vast, so it is crucial to ensure they're financially stable and responsible. Failing to conduct comprehensive background checks can lead to disastrous financial consequences. Consider the cost of embezzlement, fraud, or poor financial decisions made by an inadequately screened executive—it can run into millions and tarnish your brand's credibility. Through diligent screening, you can safeguard against financial mismanagement, protect the company's assets, and ensure stable stewardship.

Compliance and Legal Risks

Ignoring thorough background checks can lead to significant legal repercussions. Regulations enforced by the EEOC and other compliance guidelines require due diligence during hiring. Skimping on background checks can expose your organization to lawsuits, penalties, and regulatory scrutiny. Adhering to compliance standards fulfills legal obligations and creates a transparent and fair hiring practice, fostering a safer workplace.

Trustworthiness and Leadership

Executives hold the reins of your organization, requiring unwavering trust and strong leadership qualities. An accurate assessment of a candidate's history is indispensable for roles demanding high ethical standards and exemplary leadership. Verifying past performance, behavior, and character ensures that you select someone who can be trusted to lead the company effectively. Trust is the bedrock of any leadership role, and thorough background checks help build that foundation, ensuring you're entrusting your company to the right hands.

Components of Executive Background Checks

Identity Verification

Ensuring the true identity of your executive candidate is the cornerstone of any effective background check. Verifying who the person claims to be is non-negotiable, given the high stakes involved. This step is crucial for preventing fraud and confirming that you are evaluating the correct individual—missteps here could lead to catastrophic decisions.

Purpose: The primary aim of identity verification is straightforward: authenticate the candidate's identity to prevent fraud. Misrepresentation can lead to severe legal and financial consequences, particularly at the executive level. Trust, built on verified identity, forms the foundation of a thriving organization.

Methods:

- Government-Issued ID Checks: This is the most basic form of identity verification. You can ensure the information provided matches up by cross-referencing the candidate’s details with a government-issued document like a passport, driver’s license, or national ID card.

- Social Security Number Verification: This method involves verifying the candidate’s Social Security Number (SSN) against official records. Anomalies in the SSN—like mismatches or records of multiple names associated with a single SSN—serve as red flags. This step is indispensable for detecting identity theft or fraudulent resumes.

By reliably confirming identity through these methods, companies solidify the first step in shielding themselves against fraud and making informed hiring decisions.

Employment History Verification

The purpose of employment history verification is straightforward: ensure the candidate's employment claims are valid and accurate. In executive-level positions, this is particularly critical. An inaccurate or embellished resume can lead to hiring an individual lacking the necessary experience and qualifications, which could have serious repercussions.

Process: Employment history verification typically involves a few key steps. First, the candidate provides a detailed record of their past employment, including job titles, responsibilities, and the duration of each position. The hiring organization or a third-party verification service then meticulously cross-references this information.

Contacting previous employers is a major part of this process. Organizations will contact listed employers to confirm the candidate's tenure, job title, and responsibilities. This step confirms whether the candidate’s reported experience aligns with their former employers' disclosures. Discrepancies between what is reported by the candidate and what is verified by prior employers can be a red flag, potentially indicating falsification or exaggeration of qualifications.

In addition to direct communication with past employers, some organizations utilize advanced technologies and databases to cross-verify information. Automated systems can rapidly compare the candidate’s employment history against a large number of public and proprietary records, ensuring an extra level of scrutiny.

Effective employment history verification confirms a candidate’s professional background and provides deeper insights into their career progression and stability. For executive roles that demand proven leadership, this aspect of the background check helps ensure that prospective hires have the experience needed to steer the company toward its goals.

Education Verification

When it comes to verifying an executive candidate's educational background, the stakes are often higher than for other positions. A falsified degree or exaggerated academic achievement can raise serious questions about a candidate's honesty and qualifications, which are crucial in top leadership roles.

Purpose: The main goal of education verification is to ensure the candidate possesses the academic qualifications they claim. This step is vital for several reasons: it validates the candidate's intellectual foundation for the skills required, establishes their baseline competency, and offers insights into their dedication and perseverance.

Methods: Education verification typically involves contacting educational institutions directly to confirm degrees, certifications, and dates of attendance. This can be done via phone, email, or online verification services. Many organizations also use third-party companies specializing in background checks to streamline this process. These services often have established relationships with a wide network of educational institutions, which can expedite the verification process and increase accuracy.

Regardless of the method used, attention to detail is crucial. Verifiers should ensure that the institution's name matches exactly what the candidate provides, as some might use names similar to those of prestigious schools to deceive. Additionally, checking for institution accreditation can flag diploma mills or unrecognized schools, safeguarding against fraudulent claims.

Criminal Background Checks

Conducting criminal background checks is paramount when considering candidates for executive positions. Executives hold significant influence and decision-making power, making it crucial to ensure they have a clean legal record. An oversight in this area can lead to reputational damage and severe legal and financial repercussions for the organization.

Importance: First and foremost, checking criminal records at both national and international levels assures that your candidate hasn’t been involved in unlawful activities. The footprint of criminal behavior can range from white-collar crimes like embezzlement and fraud to more severe offenses. The stakes are high; an unchecked incident from an executive’s past can derail company operations and harm its image.

Scope: The scope of criminal background checks is quite broad. Here’s a rundown of the types of checks typically included:

- County Checks: These involve searching public records in counties where the candidate has lived, worked, or studied. It is the most immediate and detailed level of scrutiny.

- State Checks: Such checks aggregate criminal records from various counties within a state, offering a more comprehensive view than county-specific checks alone.

- Federal Checks: Federal criminal records pertain to crimes prosecuted in federal courts. These can cover crimes that cross state lines or fall under federal legislation, like tax evasion or insider trading.

- International Checks: International criminal records are indispensable for candidates who have worked or lived abroad. These checks ensure that the candidate hasn’t been involved in criminal activities in other countries.

Resources: Leveraging reliable resources is essential to ensure the thoroughness and accuracy of these checks. The Professional Background Screening Association provides guidelines and accredits companies specializing in these services, ensuring they adhere to high standards of accuracy and compliance. Utilizing credible professionals and databases guarantees that your vetting processes are both exhaustive and efficient.

In summary, the critical nature of criminal background checks can’t be overstated. They provide an indispensable layer of scrutiny, ensuring your executive candidates don’t bring unforeseen risks into your organization.

Financial Background Checks

Purpose: Assessing a candidate's financial stability and responsibility is crucial for executive roles that involve managing company finances and making significant financial decisions. By understanding a candidate's financial history, organizations can gauge their ability to handle fiscal responsibilities and identify potential red flags that might indicate risk.

Components: Assessing these elements provides a more comprehensive understanding of an executive candidate’s financial health, empowering organizations to make well-informed hiring decisions that protect company assets and ensure responsible financial leadership.

- Credit History Checks: Reviewing a candidate's credit report provides insights into their financial behavior, including their ability to manage debts, timely repayment of loans, and overall creditworthiness. This can reveal patterns of financial responsibility or mismanagement.

- Bankruptcies: Identifying past bankruptcies is vital, as it indicates severe financial distress that may impact the candidate’s professional judgment and reliability. Knowledge of past bankruptcies allows the hiring organization to ask informed questions and understand the context behind these financial difficulties.

- Financial Litigations: Investigating any financial litigation the candidate might be involved in, such as lawsuits for unpaid debts or fraud, helps employers understand the candidate's legal and financial reliability. A history of financial litigation might raise concerns about the individual’s suitability for managing significant financial undertakings within the company.

Civil Litigation Checks

Civil litigation checks are crucial to understanding potential risks to an executive candidate. While criminal background checks focus on law violations, civil litigation checks delve into a candidate’s interactions within the judiciary system, where business disputes, contract issues, or personal lawsuits come into play.

Purpose: The primary goal of conducting civil litigation checks is to unearth any past or current legal entanglements that might impact the candidate’s capability to lead or present a risk to the organization’s reputation. For instance, a history of lawsuits involving financial mismanagement or breach of fiduciary duty can be a significant red flag in a potential CFO hire.

Scope: Civil litigation searches typically thoroughly review various court records and legal databases. These checks aren’t confined to local jurisdictions; they extend to state and federal-level courts, depending on the candidate’s residency and employment history. It’s essential to investigate a broad range of potential issues, such as:

- Breach of Contract: Indicates the candidate’s reliability in upholding agreements.

- Employment Disputes: This may reveal issues with past employers or employees, providing insight into the candidate’s managerial style.

- Financial Misconduct: This could indicate poor decision-making or unethical behavior in handling finances.

- Discrimination or Harassment Claims: Similar issues in the candidate’s new role could affect culture and legal standing.

While identifying the existence of civil litigation records, it's equally important to consider the context and outcomes of these cases. Not all lawsuits result in findings of fault, and the nature of the disputes and their resolutions can be insightful. An absence of civil litigation may suggest a candidate has navigated their career without significant legal complications, while a long history of disputes could require closer examination.

Social Media and Online Presence Checks

In today's digital age, a candidate's online presence can offer valuable insights into their character and professional demeanor. Social media and online presence checks aim to review the candidate's online behavior and public persona, ensuring they align with your organization's ethical and cultural standards.

Purpose: The primary goal is to uncover any red flags that may not appear in traditional background checks. This includes inappropriate or unprofessional behavior, controversial opinions, or any online activity that could harm the organization's reputation.

Methods: Conducting a thorough review involves several steps. First, analyze public social media profiles on LinkedIn, Facebook, Twitter, and Instagram. Look for posts, comments, and general activity that reflect the candidate's judgment and professionalism. Additionally, extend your search to blogs, forums, and other online activities where the candidate might have a digital footprint.

These checks are not just about finding damaging information. They also offer a window into the candidate's communication style, networks, and areas of interest, which can be crucial for roles requiring significant external engagement. However, it's essential to approach this methodically and ethically, respecting privacy boundaries and focusing on publicly available information only.

Global Watchlist Checks

Global watchlist checks are an essential part of the executive background screening process. They ensure the candidate hasn't been involved in activities that could jeopardize the organization’s security, reputation, and compliance status globally.

Importance: With the business environment increasingly becoming global, companies must ensure their executives are not associated with international criminal activities such as terrorism, money laundering, or severe sanctions violations. Global watchlist checks help identify whether the candidate appears on international sanction lists, has any known associations with criminal activities, or is flagged by international law enforcement agencies.

Scope: The scope of global watchlist checks is extensive, covering numerous international databases and lists. Key watchlists include:

- Office of Foreign Assets Control (OFAC): This U.S. government agency maintains a list of individuals and entities prohibited from conducting business in the United States due to their association with terrorism, drug trafficking, or other criminal activities.

- Interpol: The International Criminal Police Organization provides databases on criminals and investigations that can signal a candidate's involvement in global crimes.

- United Nations Sanctions List: This list identifies individuals and entities subject to measures imposed by the UN Security Council, such as asset freezes, travel bans, and arms embargoes.

- European Union Sanctions List: Similar to the UN list but specific to the EU, this list details persons and organizations facing restrictive measures in various geopolitical situations.

Methods: Global watchlist checks involve leveraging specialized databases and platforms that compile information from multiple sources worldwide. Here are common methods:

- Subscription to Watchlist Aggregators: Employ services that provide aggregated watchlist data from multiple international sources. Widely used platforms include World-Check and LexisNexis, which streamline access to numerous watchlists in one platform.

- Automated Screening Tools: Utilize software capable of real-time monitoring and screening. These tools use advanced algorithms to match candidate information against updated global watchlists, flagging any potential issues promptly.

- Consulting Legal Experts: For a detailed analysis, especially in complex cases, consult with legal experts who specialize in international compliance and can provide insights into the implications of any findings.

Benefits: Global watchlist checks provide multiple benefits:

- Ensures Compliance: Helps organizations comply with international laws and regulations, avoiding severe penalties and legal issues.

- Protects Reputation: Identifies and eliminates candidates who might harm the organization’s reputation through illicit associations.

- Enhances Security: Prevents the onboarding of individuals who may pose security threats due to their involvement in global criminal activities.

Global watchlist checks are, therefore, not an optional component but a necessary safeguard in the arsenal of executive background checks. By meticulously screening for international risks, organizations secure themselves against potential threats that could impact their operations and standing.

Practical Steps for HR Professionals and Recruiters

Setting Up a Comprehensive Check System

First and foremost, partnering with reputable agencies can save you time and assure thoroughness and accuracy. Background check companies come packed with specialized tools and expertise that enable the seamless execution of comprehensive checks. When choosing an agency, look for those accredited by recognized industry bodies, such as the Professional Background Screening Association (PBSA). This accreditation guarantees adherence to industry standards and legal regulations, ensuring your checks are ethical and thorough.

Turning to technology, leveraging advanced screening software can vastly improve efficiency and accuracy in conducting checks. Automated systems can quickly cross-reference multiple databases and flag inconsistencies, reducing human error. These technologies also often come with robust encryption and security measures, ensuring candidate data remains confidential and secure.

In summary, incorporating established background check agencies and leveraging advanced technologies are paramount in setting up a comprehensive check system. This practice mitigates risks and builds a more transparent and secure hiring process.

Legal Considerations

When conducting executive background checks, it is essential to ensure compliance with all relevant laws and regulations. Non-compliance can lead to significant legal repercussions for your organization.

Compliance with Laws: Different jurisdictions have varying requirements and restrictions regarding background checks. HR professionals must familiarize themselves with these laws to avoid potential legal issues. For example, in the United States, adherence to guidelines from the Equal Employment Opportunity Commission (EEOC) is crucial. The EEOC mandates that background checks must not result in discriminatory practices. It’s important to review their guidelines regularly, accessible at EEOC, to stay current with updates.

Fair Credit Reporting Act (FCRA): Executive background checks often involve accessing credit history and financial information, which is covered by the Fair Credit Reporting Act (FCRA) in the U.S. The FCRA outlines specific procedures for obtaining and using such information, including obtaining explicit consent from the candidate, providing pre-adverse action disclosures if necessary, and allowing the candidate to dispute any incorrect information.

Ban the Box Laws: Ban the Box laws, which remove the checkbox asking if applicants have a criminal record from initial hiring applications, vary by state and city. These laws aim to give candidates a fair chance by delaying criminal history inquiries until later in the hiring process. HR professionals should ensure that their background check practices comply with these local regulations.

Confidentiality: It is imperative to maintain the confidentiality of all information gathered during the background check process. Secure storage and strict access controls are essential to protect candidates’ personal and professional information. Unauthorized disclosure of this information can lead to legal action and damage the company's reputation.

International Regulations: For global organizations, it’s important to be aware of and compliant with international data protection laws such as the General Data Protection Regulation (GDPR) in the European Union. The GDPR imposes strict rules on data processing, consent, and the right to be forgotten, which must be incorporated into multinational background-checking procedures.

Employment Law Compliance: Ensure the entire background check process complies with general employment laws, as unfair practices can lead to lawsuits and penalties. For instance, various states in the U.S. have additional employment laws related to background checks, which should be meticulously followed.

By ensuring strict compliance with legal standards and maintaining rigorous confidentiality, HR professionals and recruiters can conduct executive background checks effectively while avoiding legal pitfalls.

Interpreting the Results

When it comes to interpreting background check results, context is king. The significance of any finding largely depends on the role and responsibilities associated with the executive position. For instance, a credit history check that reveals a past bankruptcy might be more concerning for a CFO candidate than for a CMO.

Context Matters: Evaluating background check results requires a nuanced approach. A minor legal infraction from a decade ago might not be a deal-breaker for most roles but could be pivotal for positions requiring high trust or public visibility. Therefore, always consider the context in which the information was found and its potential impact on the candidate's ability to fulfill their role.

Red Flags must be approached with a balanced view. Common red flags might include unexplained gaps in employment history, significant discrepancies in job titles, or undisclosed financial issues. When a red flag arises, it should trigger a deeper investigation rather than an automatic disqualification. Engaging in a candid conversation with the candidate can often provide clarification and context that paper records can’t fully convey.

By paying attention to context and red flags, HR professionals and recruiters can make informed, balanced judgments that support the organization's best interests.

Frequently Asked Questions (FAQ)

What if a candidate has minor discrepancies in their employment history?

Minor discrepancies in employment history are not uncommon. However, it's crucial to differentiate between harmless inconsistencies and potential red flags. Look at the context: if the discrepancies are minor date overlaps or slight job title variations, it may not be a dealbreaker. Always discuss these findings directly with the candidate for clarification.

How long does a typical executive background check take?

The duration of an executive background check can vary. Typically, the process can take anywhere from a few days to several weeks, depending on the depth of the check and the geographical scope. For a detailed timeline, refer to resources like this GCheck blog post on background check duration.

Can a candidate request a copy of their background check report?

Yes, candidates can request a copy of their background check report. Transparency is key, and providing candidates with their reports can help ensure accuracy and allow them to address any discrepancies.

What actions should be taken if a serious issue is discovered?

If a serious issue is discovered, it's important to approach the situation rationally. Assess the severity of the issue concerning the role's responsibilities and the organization's values. Consult with your legal team and, if necessary, discuss the findings with the candidate before making a final decision.

Are executive background checks different from those for lower-level positions?

Yes, executive background checks are typically more comprehensive than those for lower-level positions. Given the high stakes associated with executive roles, these checks delve deeper into financial history, international criminal records, and global watchlists, ensuring a thorough vetting process.

Conclusion

Executive background checks are not just an add-on to the hiring process but a foundational element that helps ensure an organization's long-term success and integrity. By thoroughly vetting candidates, employers can protect their reputations, secure financial interests, and meet compliance requirements, thus avoiding potential legal pitfalls.

HR professionals and recruiters must prioritize these checks as essential to their hiring strategy. Vigilance in this area helps build competent, trustworthy, and reliable leadership teams.

In conclusion, meticulous and comprehensive background checks contribute significantly to an organization's overall health and success, ensuring the individuals who lead are beyond reproach. By committing to rigorous vetting, companies can confidently trust their executive hires, fostering a trustworthy and secure organizational environment.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.