Let's face it. Hiring mistakes can burn a hole in your wallet and lead to regulatory headaches. That's where employment verification steps in as a crucial piece of the hiring puzzle. Whether you're an HR professional or a job seeker, understanding the employment verification process is vital for navigating today’s job market efficiently.

Key Takeaways

- Employment verification ensures that an applicant's stated work history matches actual records, which is crucial due to the prevalence of resume fraud.

- It reduces risks and potential costs for employers by verifying the accuracy of a candidate's experience and is essential for regulatory compliance.

- Employment verification is used not only in hiring but also in loan applications, housing leases, immigration, government benefits, and salary negotiations.

- Traditional methods of employment verification, such as employer contact and documentation review, are complemented by modern digital solutions like online databases and third-party services.

- The legal framework for employment verification includes federal laws like the Fair Credit Reporting Act and Title VII, as well as various state-specific regulations governing data privacy and permissible inquiries.

What is Employment Verification?

Employment verification is the process of validating a person's employment history, confirming details like job title, dates of employment, and roles held. This step isn't just a box to tick; it's about ensuring accuracy in the hiring process. In today's business setting, this verification helps companies sidestep potential hiring disasters by safeguarding against inflated resumes and untruthful claims. A quick scan of available statistics shows that resume fraud is more prevalent than you might think. This issue spans all levels within an organization. Even C-Suite executives of renowned companies have been found to falsify their educational credentials on their resumes. This behavior undermines the integrity of the hiring process and erodes trust within the organization. It's essential to implement thorough background checks to maintain a transparent and trustworthy workplace culture. By prioritizing honesty and accuracy in employee records, companies can safeguard their reputation and foster a more ethical business environment. Getting verification right isn't just recommended—it's necessary. The stakes are high, and the demand for truthful employment verification is real. Dive into the numbers, and you'll see why it's a critical piece of the hiring puzzle.

"While the background verification process may seem counterintuitive, as it traditionally requires employers to wait for results, potentially delaying the start date of prospective employees, it actually serves to safeguard both the employer's reputation and the safety and well-being of employees. This process ensures that resources are well spent and helps minimize issues related to role fulfillment, morale, and employee load. Furthermore, advancements in technology are expediting this process, reducing the compromise on wait time while delivering efficient and effective results. HR leaders must integrate this process into their policies, ensuring it goes beyond a mere formality. By doing so, they can guarantee that the background verification process truly serves its purpose, fostering transparent communication between HR, the hiring team, and the candidates. This proactive approach not only protects the organization's integrity but also contributes to a safer and more trustworthy work environment."

Why Employment Verification Matters

Employment verification acts like a sieve that helps catch potential issues before they become costly problems. For employers, it’s about protecting the business from hiring the wrong person. It reduces risks by verifying that applicants are who they say they are, and that they have the experience they claim.

Fraud among job applicants is more common than many realize. Some candidates might stretch the truth to gain an advantage. For instance, individuals may claim team achievements as their own, misleadingly attributing collective successes to their personal performance. Additionally, some attempt to obscure employment gaps by extending the duration of their previous roles, presenting an inaccurate employment history. Such actions not only compromise the integrity of the individual's professional narrative but also pose significant risks to the organization's credibility and effectiveness. By verifying employment, businesses can detect false claims and ensure the candidate truly fits the role.

Regulatory compliance is another crucial aspect. Companies need to follow various laws regarding hiring practices, and verification helps keep everything above board. Skipping this step can lead to legal consequences that are best avoided.

Then there's cost. A bad hire affects the bottom line through wasted salaries, wasted time, and the process of finding and training a replacement. Gallup estimates that the replacement of leaders and managers costs around 200% of their salary, the replacement of professionals in technical roles is 80% of their salary, and frontline employees 40% of their salary. Strong verification processes help minimize these kinds of costly errors by confirming that candidates have the qualifications and integrity needed to move the company forward.

Common Uses for Employment Verification

Employment verification isn't just for hiring. It plays a critical role in several areas. Let's break it down.

Pre-Employment Screening: Employers want to make sure they're hiring who they think they are. Verification is part of the toolbox used to confirm a candidate’s work history and experience before bringing them on board.

Loan Applications: When you apply for a loan, lenders want to know you have a steady job. A proven work history reassures them you'll be able to make your payments. They often ask for employment verification to ensure the information on your application is accurate.

Apartment/Housing Leases: Landlords aren't just being nosy when they ask for proof of employment. Knowing a tenant's job status helps them gauge financial stability, which is crucial for timely rental payments.

Immigration Purposes: Employment verification can be an essential piece in the immigration puzzle. Various visa applications require proof that a job offer is legitimate and ongoing, which often involves submitting employment verification.

Government Benefits: If you're applying for things like unemployment benefits, the agencies in charge need to verify your job situation. This ensures benefits reach those who truly qualify.

Salary Negotiations: When negotiating salary or trying to snag a raise, having a letter to confirm your employment status and current job title can support your case. It gives you more leverage when discussing your worth with potential or current employers.

Each situation uses employment verification to confirm stability, legitimacy, or background, making it a versatile tool that's relevant beyond just filing for a new job.

Types of Employment Verification Methods

Traditional Methods

When it comes to verifying employment the old-school way, a few methods stand out. The most straightforward is direct employer contact. This involves picking up the phone and speaking directly with past employers to confirm an employee's work history. It's simple, but it can be time-consuming and often depends on the willingness of companies and their authorized representatives to cooperate.

Then there's phone verification, which operates on a similar principle but often through dedicated departments equipped to handle such inquiries more efficiently. Companies may have policies in place that restrict what's shared over the phone, but this method remains a staple for many.

Written verification letters provide a more formal route. These are documents from previous employers stating the employee's dates of employment and job title, which can be particularly useful for record-keeping and legal purposes.

Pay stubs and W2 forms are crucial for verifying income. These bits of paper provide hard proof of employment status and earnings history, making them invaluable for not just hiring but also for loan applications and lease agreements. In short, while these methods may seem a bit dated, they continue to play a pivotal role in many verification processes.

Modern Solutions

With the digital tech boom, employment verification has shifted into the online realm, offering some slick tools for both employers and employees. Digital verification services lead the charge, slashing time and errors. They use secure online platforms to quickly verify employment details, making it painless for all parties involved.

For those who want a bulletproof process, third-party verification providers stand ready. These firms step in as middlemen, ensuring the information is clean and clear. They specialize in vetting details to filter out any discrepancies or red flags, adding a layer of trust.

Lastly, consumer-permissioned verification platforms introduce a user-based approach. Employees give permission for their data to be accessed, keeping control in their hands while leaving room for a smooth verification path. These platforms make sharing employment data secure and straightforward, adding ease and transparency to the process.

Information Typically Verified

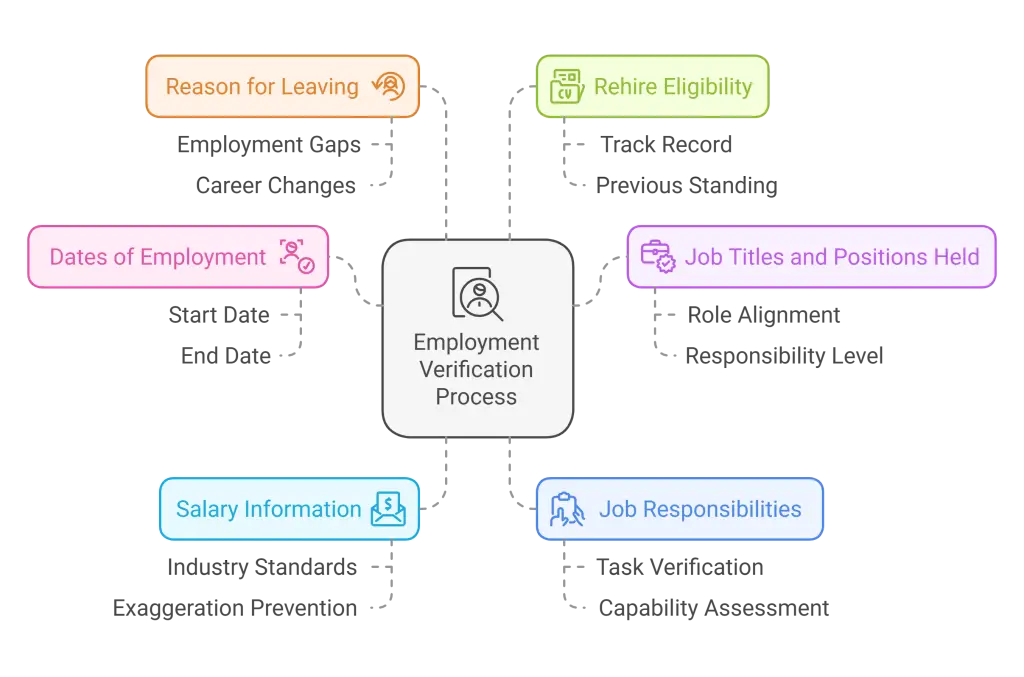

When it comes to verifying employment, certain pieces of information are consistently checked to ensure accuracy and legitimacy. Here's what usually gets verified:

- Dates of Employment: This is about making sure the starting and ending dates a candidate provides line up with records. It's an essential check to confirm the duration of employment and identify any gaps that may raise questions.

- Job Titles and Positions Held: This involves confirming the positions a person has claimed to hold. Titles can offer insights into one's level of responsibility and experience. Employers want to ensure these claims match what's on record.

- Salary Information (Where Legal): In places where it's allowable, checking salary details is common. This helps to see if the roles held align with industry standards and ensures there weren't any exaggerations that might skew benefits or new salary negotiations.

- Job Responsibilities: Verifying the duties and roles within a given job title ensures the candidate actually handled the tasks they're claiming. This provides a fuller picture of their potential capabilities and experience.

- Reason for Leaving: While not always provided, understanding why someone left a previous job can be revealing. It's often checked to construct a narrative around employment gaps or abrupt changes in career paths.

- Rehire Eligibility: Knowing whether a former employer would consider rehiring the individual can be telling. It's a subtle indicator of the employee's track record and standing within their previous roles.

Legal Framework and Compliance

Federal Laws

With employment verification, there are legalities that keep everything honest and above board. The Fair Credit Reporting Act (FCRA) lays out rules for employers, ensuring they handle employment checks properly. For instance, if an employer uses a third party for verification, they must get the employee's consent first and let them know if any adverse action is taken based on the results. It’s about transparency and fairness.

Then there's Title VII of the Civil Rights Act, which underscores the importance of avoiding discrimination during the hiring process. This doesn't only apply to employment verification but it's a good reminder to treat all candidates equally, regardless of race, gender, or other protected characteristics.

Let’s not forget about HIPAA. If any employment verification steps touch on health information—though that’s rare—you need to keep that info private. Mixed up in all this is the necessity to comply with immigration laws, verifying work authorization under regulations like I-9 compliance. Employers better get it right or risk running afoul of the law.

State-Specific Regulations

When it comes to employment verification, the rules can vary significantly depending on the state. In some places, asking for salary history is off-limits. Several states have put laws in place banning inquiries into past pay to promote equal pay. You’ll want to brush up on these rules to avoid running afoul of state laws.

Beyond salary history, states also impose different limits on the kind of information that can be disclosed during verification. Some states restrict the details employers can provide about an employee's job performance or reasons for leaving. This means HR teams must tread carefully when responding to verification requests.

Then there's the matter of privacy. Certain state laws set stringent requirements for protecting candidate information. This can involve getting explicit consent before sharing any personal or employment details. Keeping these privacy rules in mind is crucial, especially when handling sensitive data.

In essence, familiarizing yourself with the specific regulations of your state ensures not just compliance, but also streamlines the verification process by knowing exactly what’s permissible to share and what’s not.

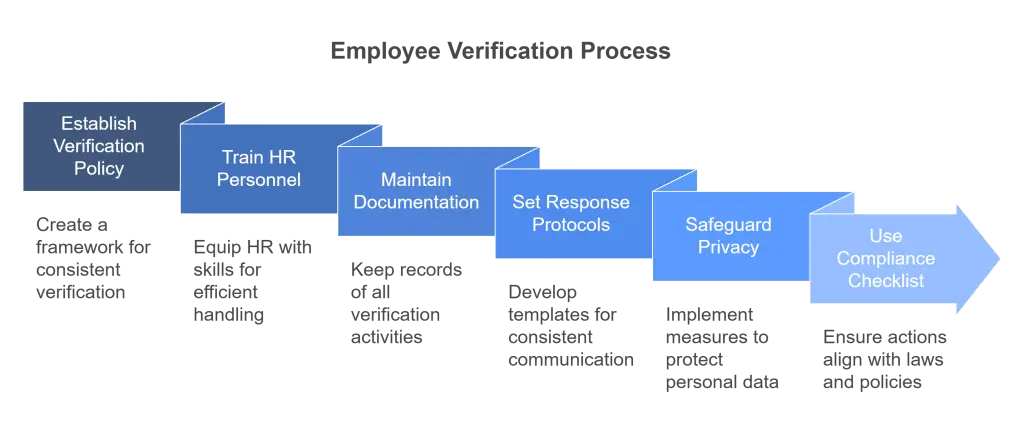

Employee Verification Best Practices for Employers

Creating a clear verification policy is where it all begins. Companies need to establish solid rules about how employment verification is handled. This framework guides HR teams and ensures a consistent approach across the board.

Training HR personnel is a must. Equip your team with the skills to handle verification requests efficiently. This includes understanding what information can be shared and how to maintain the privacy of employee data. Regular training sessions can brush up their knowledge and keep them updated on any legal changes.

Documentation is another cornerstone. Maintain records of all verification activities. This not only helps in auditing but also ensures you have a paper trail in case of disputes or compliance checks. Decide which documents need to be stored and for how long, in line with legal requirements.

Setting up defined response protocols is crucial for consistent communication. Develop templates and scripts for common verification scenarios, so HR staff know exactly what to say and how to say it. This standardization can save time and reduce errors.

Safeguarding privacy is non-negotiable. Personal information must be protected, both when it's being communicated and when it's stored. Encrypt data, use secure channels, and limit access to authorized personnel only. This is not only respectful to your employees but also a legal requirement.

Lastly, keeping a compliance checklist can be your lifesaver. This list acts as a quick reference to ensure all actions align with the latest laws and policies. It should cover federal, state, and industry-specific regulations, making sure nothing slips through the cracks.

Employment Verification Process

For Employers

Getting employment verification right is like threading a needle—precision matters. Employers first encounter verification through incoming requests. Handling these requires diligence and an organized approach to avoid pitfalls. It's crucial to secure the proper authorization before sharing any information. This not only keeps the process lawful but also ensures respect for employee privacy.

Gathering accurate data is the cornerstone. Employers should assemble relevant info, such as job titles and tenure, without venturing into territory that's off-limits, like speculative rehire eligibility. Crafting an appropriate response entails clarity and brevity, ensuring that only necessary details are conveyed.

Once the information is shared, retention of documentation comes into play. Understanding retention periods and regulatory requirements for these documents keeps operations smooth and compliant. Keeping records too long or discarding them prematurely can lead to complications, so a well-defined schedule helps maintain order.

For Employees

Navigating employment verification can feel like trekking through unfamiliar terrain, especially if you don’t know your rights and responsibilities. Let's break it down.

Understanding Their Rights: Employees have certain entitlements when it comes to employment verification. They're permitted to review the information employers are gathering and can expect their privacy to be respected. The Fair Credit Reporting Act (FCRA) offers some protections, such as the right to be informed if verification information is being used against them, and the right to dispute inaccurate or incomplete data.

Preparing for Verification Requests: It’s smart to have a game plan when you know a verification request might land. Collect any documents that back up your employment claims—think pay stubs, offer letters, or employment contracts. These can serve as backup proof if something doesn’t align during verifications.

Handling Discrepancies: Errors can and do happen. If your former employer records something that contradicts your resume, rectify it quickly. Contact the HR department of the concerned company, armed with your documentation, and request a correction. Keep a calm and professional demeanor; it usually yields the best results.

Privacy Protection: With personal data flying through various channels, privacy isn't just a concern—it's non-negotiable. It's crucial to know how your information will be used. Ensure you're comfortable with the authorization forms you sign and inquire how your data will be managed and stored. In an age where data breaches are common, vigilance is your best defense.

Taking control of your employment verification process doesn't just shield you—it's a step toward securing your professional credibility and future opportunities.

Common Challenges and Solutions

Dealing with Closed Companies

When a company goes under, it can be tricky to confirm past employment. The solution? Dig into online business directories or reach out to professional networking sites. Sometimes, former colleagues can serve as unofficial references to piece together employment history.

International Employment Verification

Cross-border checks introduce hurdles like language barriers and varying legal requirements. Here, tapping into global databases or local verification services can work wonders. Also, don’t shy away from hiring multilingual staff or using translation services to read foreign documents accurately.

Self-Employment Verification

For self-employed individuals, traditional employment documents might be scarce. Tax returns, bank statements, or client contracts can serve as alternatives. It’s all about painting a clear picture with what’s available, recognizing the unique nature of running one’s own show.

Handling Discrepancies

When facts don't match up, communication is the first step. Contact the applicant for clarifications. If that's not enough, requesting additional documentation or proof can help—bridging the gap between records and reality.

Time Constraints

Time is of the essence during verification, especially in fast-paced hiring environments. Prioritize tasks by urgency, and consider automated systems to speed things up. If tight deadlines seem impossible, temporary hires or short-term solutions can keep things moving while verification falls into place.

Choosing an Employee Verification Provider

Picking a verification provider can make a big difference in the efficiency and reliability of your employment checks. Start by weighing key factors like cost and service level. This involves looking into the expenses related to each provider's services and what they promise to deliver for that price.

Another important aspect is how well their systems integrate with your existing HR setup. Seamless integration means less hassle with data transfer and better functionality across platforms. On top of that, ensure the provider you choose sticks to all relevant legal standards and compliance measures. This is crucial to avoid any legal issues down the line.

It's also smart to compare what various providers bring to the table. Some may offer specialized features that align better with your industry or specific verification needs. Make an informed choice by considering these elements as you evaluate potential partners in employment verification.

Special Considerations

Self-Employed Individuals

Alternative Verification Methods

For self-employed individuals, traditional employment verification methods don't cut it. Instead, these folks often rely on a different set of documents and proofs. Tax returns are a go-to source, showing income and work continuity. Bank statements can also help, illustrating consistent cash flow to vouch for business activity. Client contracts or agreements offer insight into client relationships and project history, painting a picture of the individual's professional engagement.

Required Documentation

When verifying employment for self-employed workers, gathering the right paperwork is crucial. Start with those tax returns—preferably a couple of years’ worth—to show income trends. Add to that any official business licenses or registrations, indicating legitimacy and operation in regulatory compliance. Profit and loss statements can also be useful, providing a financial overview of the business's performance.

Special Procedures

Special procedures are often needed when verifying self-employment, as each business is unique. Custom letters from clients can serve as references, verifying services rendered and client satisfaction. It's also helpful to compile a portfolio of work; examples or case studies can demonstrate expertise and commitment to quality. For independent contractors, logging time sheets or project completion reports helps build a clear narrative of their working history.

International Employment

Verifying international employment can feel like negotiating a maze. Different countries have their own systems, rules, and practices. Methods that are effective for verifying employment in the U.S. may not necessarily apply to positions held in Europe or Asia. Each region has its own unique set of regulations, cultural norms, and practices that can affect the accuracy and availability of background information. Verifying international employment can feel like negotiating a maze. Different countries have their own systems, rules, and practices. What works for verifying a job in the U.S. might not fly for a position held in Europe or Asia. You need to know your way around these cross-border quirks to get the right info.

First up, you have cross-border verification. It often involves digging through foreign employment records and contacting international employers, which may come with language barriers and different standards of documentation. Reaching out to overseas companies can mean waiting longer for responses, especially if there are time zone gaps or national holidays to consider.

Next, there's document translation. Most often, employment records are in the local language of the employee's previous country. Accurate translation is necessary, not just for understanding but also for ensuring there's no misinterpretation of a role, title, or duration. This step needs a professional translator who understands employment terminology so nothing gets lost in translation.

Finally, tackle legal considerations. Each country has its data protection laws. Some countries have strict rules on sharing employee information, even for verifications. Always ensure you're legally compliant and have the employee's consent before you poke around their employment history. Missteps here can create legal headaches and derail the verification process.

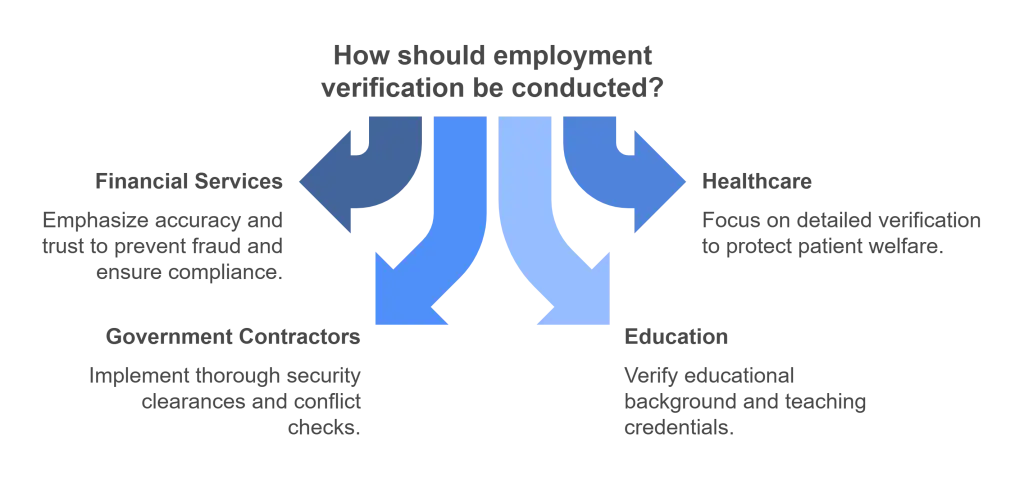

Best Practices for Different Industries

Different industries have varying standards and requirements when it comes to employment verification, and it's important to tailor the process to suit industry-specific needs.

- Financial Services: In finance, accuracy and trust are non-negotiable. Conducting thorough checks helps weed out potentially fraudulent candidates and ensures compliance with strict regulations. Verifying previous roles, credentials, and certifications is crucial to maintaining integrity and trustworthiness in this high-stakes sector.

- Healthcare: The stakes are high, as roles often involve access to sensitive and personal patient information. Detailed verification of medical qualifications, employment history, and background checks are needed to ensure that healthcare professionals meet the stringent standards required to safeguard patient welfare.

- Government Contractors: Working within the public sector demands adherence to specific government norms. This often means conducting deeper security clearances and ensuring candidates have no conflicts of interest. Verification processes often include detailed background checks and validation of government-required certifications.

- Education: Academic institutions need to confirm both credentials and experience carefully. Verifying a candidate's educational background, teaching certificates, and previous positions helps affirm their qualifications and suitability for teaching roles. This also ensures that students receive education from qualified professionals.

- Retail and Service Industries: These sectors typically face high turnover rates, so speed and efficiency in verification are critical. While stringent checks are less common here, basic verification like confirming employment dates and reference checks can help ensure reliability and diminish risks associated with hiring fraud.

Each industry comes with its own set of challenges and demands, so adopting tailored verification strategies can significantly improve hiring accuracy and safety.

Impact of COVID-19 on Employment Verification

The pandemic reshaped how we work and, by extension, how we check employment status. With remote work becoming the norm, verifying work-from-home roles added layers to the usual process. Where face-to-face meetings might have sufficed before, now there's a shift towards more digital proof, like secure emails or online portals, to confirm someone’s work history.

On the tech front, COVID-19 pushed businesses toward digital solutions faster. Many started using automated platforms to handle verifications, minimizing human contact. These systems cut down the time and potential errors in verifications. Challenges still crop up, though. How do you verify a job with a company that's gone remote or even closed its physical offices due to the pandemic? These scenarios forced HR teams to adapt, employing new strategies to deal with fast-evolving work environments.

Procedures underwent necessary tweaks, too. With more people moving across borders, even while working remotely, cross-border verification had to become more efficient. Verifying international remote positions meant dealing with different regulations — a puzzle that many are still piecing together.

Overall, COVID-19 changed the employment verification game, pushing it toward more digital, adaptive methods.

Future Trends

AI is carving out a significant role in employment verification, making the process quicker and more precise. Algorithms can now sift through vast amounts of data, identifying inconsistencies and confirming details with far less human intervention. This tech isn't just making things faster; it's raising the bar for accuracy.

Real-time verification systems are the new frontier. Imagine getting instant confirmation about someone's employment status without waiting days or even hours. This could reshape hiring timelines, making them more efficient.

Privacy is always a worry, but new technologies are promising safer data handling. Cutting-edge encryption methods and privacy-focused innovations are being built into the verification systems, assuring employees that their personal information remains protected.

Frequently Asked Questions

What is employment verification?

Employment verification is the process of confirming an individual's past or current employment status and job details with their employer. This is often done to confirm information provided by a job applicant or for background checks.

What details are checked during employment verification?

During employment verification, employers may check job title, dates of employment, salary history, job responsibilities, and reasons for leaving previous jobs.

What is verification of employment?

Verification of employment refers to the process of confirming an individual's employment history and details with past or current employers.

What is job verification?

Job verification involves confirming the details of a person's employment history, such as the position held, duration of employment, and responsibilities.

How to verify employment?

Employment can be verified by contacting the human resources department or a relevant representative at the previous or current employer and requesting confirmation of employment details.

How does HR verify past employment?

HR typically verifies past employment by contacting previous employers directly, either by phone or email, requesting confirmation of employment dates, job titles, and other related information.

What is proof of employment?

Proof of employment is documentation that verifies an individual's current or past employment, such as a letter from the employer, pay stubs, tax forms, or an employment verification form.

How do employers verify work history?

Employers verify work history by reaching out to previous employers and asking for confirmation of employment details, including job titles, dates of employment, and roles and responsibilities.

How do employers check employment history?

To check employment history, employers may contact previous employers, request employment verification letters, or conduct background checks through third-party services.

What information can be released for employment verification?

Information that can typically be released includes job titles, employment dates, salary, and employment status, provided there is consent from the employee or if legally required.

What is the role of a third-party service in employment verification?

Third-party services handle employment verification by contacting previous employers and confirming details like job title, employment dates, and sometimes salary, which can be more efficient for employers.

Are there legal limitations to employment verification?

Yes, there are privacy laws and regulations that limit what information can be shared without the employee's consent, such as certain personal or confidential job-related information.

Why do employers conduct employment verifications?

Employers conduct employment verifications to confirm an applicant's work history, ensuring that the candidate has the experience and qualifications they claim to possess.

Can employment verification affect job offers?

Yes, discrepancies found during employment verification can affect job offers, with the potential of offers being rescinded if significant differences are found between provided information and verified details.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.