Navigating the complex landscape of hiring compliance is a critical challenge for staffing recruiters. At the heart of this issue is FCRA compliance staffing, a mandate that requires recruiters to adhere to strict guidelines when conducting background checks on prospective employees. With regulations set forth by the Fair Credit Reporting Act (FCRA), recruiters must ensure that their practices, from obtaining candidate consent to conducting the screening process, meet federal and state legal standards. This comprehensive guide explores the intricacies of FCRA compliance, essential consent forms, and actionable strategies for staffing recruiters.

Key Takeaways

- FCRA ensures that candidates' personal credit information is used accurately, fairly, and lawfully in hiring.

- You need to obtain clear consent from candidates before conducting background checks.

- If you decide not to hire someone based on a report, inform them and allow them to contest errors.

- Ignoring FCRA regulations can result in financial penalties and damage your agency's reputation.

- Using NAPBS-accredited providers and keeping up with state laws enhances compliance and builds trust with candidates.

Understanding FCRA Compliance in Staffing

When you delve into the Fair Credit Reporting Act (FCRA) in staffing, it's about ensuring trust, fairness, and legality during the hiring process. With over two decades in this field, I can affirm that understanding the FCRA is more than a legal obligationâit's about building a transparent relationship with candidates.

What is the FCRA?

The Fair Credit Reporting Act (FCRA) is a federal statute enacted in 1970. Its purpose is to govern the collection, dissemination, and use of consumer information, particularly in credit reports. The FCRA aims to protect consumer privacy and ensure the information used in consumer reports is accurate and fair.

The FCRA impacts any business that utilizes consumer reports for employment decisions. This includes staffing agencies, which must comply with FCRA regulations when performing background checks on job candidates. By adhering to these rules, staffing agencies protect both themselves and the consumer, mitigating risk and promoting transparency.

The law outlines specific requirements that agencies must follow, such as obtaining a candidateâs consent before accessing their consumer report. When you engage in hiring practices, considering these regulations ensures smoother operations and legal compliance. Failure to do so can expose your agency to significant liabilities and erode trust with potential hires.

As someone navigating the staffing landscape, are your current practices aligned with FCRA guidelines? Ensure your team is informed about the FCRA's mandates and the implications of non-compliance. Itâs more than a legal box to checkâitâs about fostering trust and integrity in the hiring process.

Key FCRA Requirements for Recruiters

Consent is the foundation of FCRA compliance. Before you run a background check, you need clear consent from the candidate. This isn't just a checkbox exercise. You must provide a standalone disclosure, not buried in fine print or mixed with other applicant information. Keep it simple and straightforward.

Accuracy is the next pillar. Reports must reflect the most current and correct data available. Outdated or erroneous records can lead to incorrect hiring decisions and possible legal repercussions. Itâs your responsibility to ensure the information youâre using is precise and up-to-date.

If the report leads you to make a negative hiring decision, the FCRA mandates an adverse action process. You must first let the candidate know that their report might affect them adversely. Give them a copy of the report and a summary of their rights. They should also have a chance to address or correct any issues in the report before the final decision is made.

Handling these requirements properly isn't just about compliance. Itâs about respect for candidate rights and fairness in the hiring process. It's worth asking: how robust are your procedures for managing these obligations? Taking these steps seriously builds trust and secures your recruitment process against potential pitfalls.

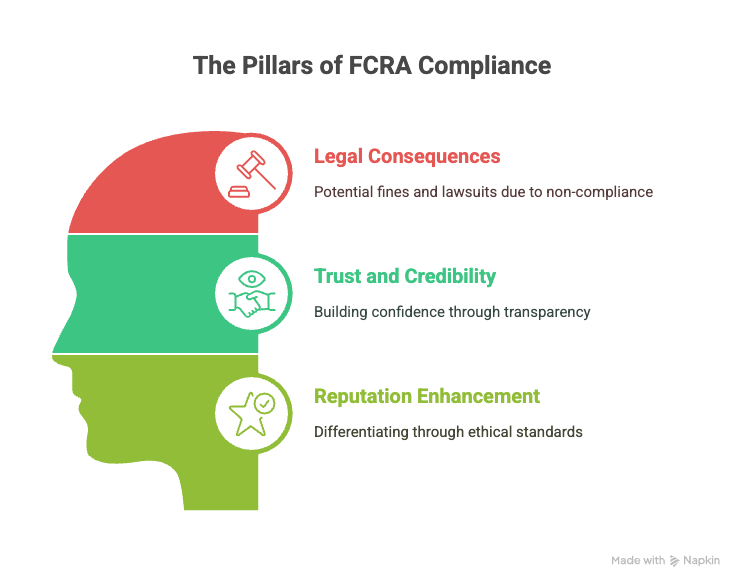

Importance of FCRA Compliance

Adhering to FCRA compliance is essential for several reasons that impact both the legal standing and the reputation of staffing agencies.

Non-compliance with the FCRA can lead to serious legal consequences. Companies face hefty fines and potential lawsuits if they ignore these federal requirements. For instance, there have been cases where agencies incurred significant costs due to improper background check procedures. Lawsuits related to FCRA violations are steadily increasing, creating a financial burden and negatively impacting business operations.

Maintaining FCRA compliance is not just about avoiding legal troubles; it also plays a crucial role in building trust and credibility. Candidates expect transparency in the hiring process. When they know their rights are respected, confidence in the recruitment process increases. This trust is vital for attracting top talent who value a fair and lawful hiring environment.

Complying with FCRA enhances your agencyâs reputation. It shows youâre committed to ethical standards and care for candidate rights, which can differentiate you from competitors. Companies respected for their compliance practices are more likely to attract clients and candidates who prioritize legal and ethical business dealings.

Have you considered how your agencyâs FCRA compliance practices influence client and candidate perceptions? Making FCRA compliance an integral part of your recruiting process is crucial for sustaining and growing your business.

Consent: The Bedrock of FCRA Compliance

Getting consent is not just a formalityâit's your safeguard. The FCRA mandates that you inform candidates when you plan to conduct a background check. This is where the standalone disclosure form comes into play. Keep it simple and unambiguous. The form should solely state your intent to seek a consumer report and must not be cluttered with any other information.

Be mindful of state laws as well. While the FCRA provides the federal framework, states like California and New York have additional rules. These may require extra disclosures or specific compliance steps. Staying updated with these variations is crucial to avoid legal pitfalls.

When choosing a background screening agency, consider one accredited by the Professional Background Screening Association (PBSA). These organizations adhere to strict standards, ensuring accuracy and compliance. This reduces your risk and gives you peace of mind.

Understanding and respecting the consent process builds trust with candidates. It shows potential employees that your agency values privacy and fairness, making it an integral part of your compliance strategy.

Standalone Disclosure Form

A standalone disclosure form is a crucial part of the FCRA compliance process. This form must clearly inform the candidate that a consumer report may be obtained for employment purposes. It's important that this disclosure is provided separately from other application materials to prevent any confusion. The goal is transparencyâbe straightforward and brief.

Ensure the language is simple and direct. Avoid adding unnecessary details or information about other policies. These extras can muddle the message and potentially lead to non-compliance. For example, mixing this disclosure with an employment application or waiver could invalidate it.

A practical tip: review your disclosure forms regularly. Legal standards and best practices evolve, and staying updated helps you prevent costly mistakes. Consider legal counsel to ensure your documentation meets current requirements. Missteps in this area could lead to lawsuits, damaging both your finances and reputation.

When was the last time you checked if your forms align with FCRA specifics? Regular checks can save you from future legal hassles. Remember, clarity is your ally in compliance.

State Consent Laws

State laws can add layers to the federal FCRA requirements, and it's crucial to stay informed. Some states demand more meticulous disclosure practices, offering additional protections for candidates. California, for instance, requires that employers provide a copy of the candidate's report at no charge and include a checkbox on the consent form for candidates to request this. New York mandates that applicants receive a copy of Article 23-A of the New York Correction Law, which discusses employment rights for people with criminal convictions. Understanding and implementing these state-specific guidelines can ensure compliance and build candidate trust. Are you updating your methods regularly to meet these geographical nuances?

PBSA-Accredited Providers

Choosing the right background screening provider can make a significant difference in your compliance efforts. The National Association of Professional Background Screeners (NAPBS), now known as the Professional Background Screening Association (PBSA), accredits providers who adhere to high standards of accuracy and compliance.

These accredited providers undergo rigorous evaluation. This includes a review of their information security, legal compliance, client education, researcher and data standards, and verification services. Working with PBSA-accredited providers ensures that the background checks you conduct are reliable and meet all necessary legal requirements.

For example, when using a PBSA-accredited provider, you can be more confident in the precision of the reports. Errors in background checks can lead to legal challenges, so choosing a provider that prioritizes accuracy can prevent costly mistakes. Moreover, these providers are more likely to stay updated with the latest changes in federal and state laws, ensuring your practices remain compliant.

Partnering with accredited providers also reflects well on your agency's commitment. Candidates often feel more secure knowing their information is handled responsibly. This can enhance your agencyâs reputation and make it easier to attract quality talent. When you prioritize compliance and accuracy, you not only meet legal standards but also build trust with potential employees.

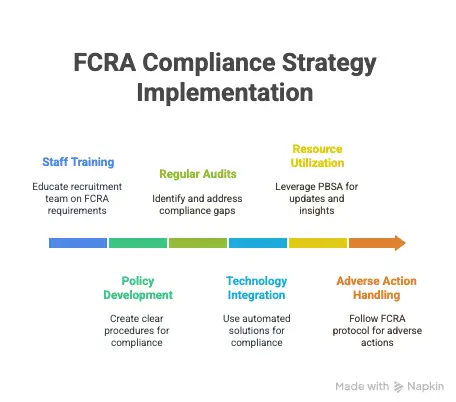

Implementing FCRA Compliance Practices

Building an effective FCRA compliance strategy calls for a commitment to detail. Start with staff training. Educate your recruitment team regularly about FCRA requirements. Keeping your team informed minimizes the risk of errors.

Develop well-documented policies. Clear procedures for obtaining consent and maintaining compliance are vital. This documentation should be accessible and reviewed often to ensure it stays up-to-date with legal changes.

Regular audits are crucial. They help identify compliance gaps, allowing you to address them promptly. This proactive approach reduces potential legal consequences.

Consider using technology to your advantage. Automated solutions can streamline consent management and monitor updates in compliance laws. Record-keeping must be secure and accessible only to authorized staff, ensuring that sensitive information is protected.

One common challenge is adapting to evolving legal requirements. To manage this, leverage resources from organizations like the Professional Background Screening Association (PBSA). They provide valuable updates and insights into industry standards.

Handling adverse actions correctly is another hurdle. Follow the FCRAâs protocol meticulously. Inform candidates transparently if a report influences hiring decisions, and give them a chance to dispute errors.

Challenges and How to Overcome Them

Legal changes happen often. Keeping up can be tough. You need current information to avoid compliance pitfalls. Subscribe to updates from trusted sources like the Professional Background Screening Association (PBSA). Engage legal experts to review your practices.

Handling adverse actions is another hurdle. If you must take action based on a report, follow the FCRA protocol. First, provide a pre-adverse action notice. Include the report and âA Summary of Your Rights Under the FCRA.â Allow time for candidates to dispute inaccuracies.

Communication matters. Notify candidates of any final decisions. Explain your reasons. Transparency builds trust and minimizes misunderstandings.

Do you have a process for background checks? Examine it closely. Adjust as needed when laws change. An efficient system supports compliance and reduces errors. Be proactive. Plan and maintain a strong defense against legal issues.

FCRA Compliance in Numbers

Non-compliance with FCRA requirements is costly. Recent statistics reveal an increase in lawsuits related to non-compliance, with settlements often exceeding millions of dollars. Employers pay hefty fines, not to mention the legal expenses involved. For example, a notable retail chain faced fines of nearly $3 million due to improper disclosure and authorization processes.

On the candidate side, FCRA compliance impacts perception significantly. A large percentage of candidates prefer to work with companies they believe are transparent and fair in their hiring practices. Surveys suggest candidates are 60% more likely to join a company that is clear about its background check policies. This means adhering to FCRA not only protects you legally but also enhances your appeal as an employer.

To maintain compliance, regular staff training is vital. Keep your team informed about the latest FCRA updates. Utilize NAPBS-accredited providers for your background checks, reducing errors and minimizing legal risks. Embrace technology that can help automate compliance tasks. This investment in tech ensures your records are accurate and up-to-date, providing a robust defense against legal challenges.

Actionable Takeaways for Staffing Recruiters

Equip yourself and your team with regular training sessions on the latest FCRA updates. This keeps everyone informed and prepared to handle the nuances of compliance effectively. Keeping knowledge current helps avoid costly mistakes and enhances your agency's efficiency.

Always choose background check providers accredited by organizations like PBSA. These providers meet specific standards that ensure accuracy and legality, reducing the risk of errors that could lead to non-compliance.

Invest in technology to manage FCRA compliance effortlessly. Automated solutions can help track consent forms, keep digital records, and alert you to changes in related laws. This streamlines processes and ensures that your compliance framework remains robust and adaptable.

By taking these steps, you not only safeguard your agency against potential legal challenges but also build trust with candidates through transparent and fair hiring practices.

Conclusion

FCRA compliance isn't just about rules and regulations; it's about trust and transparency. As staffing recruiters, your role is pivotal in ensuring fair hiring practices. Consent is the foundationâmake sure you obtain clear permission before any background checks. Choose your partners wisely; PBSA-accredited providers bring reliability to the table. Technology is your ally in managing consent forms and keeping pace with ever-changing laws. Regular training keeps your team sharp and informed.

Non-compliance can cost you, financially and reputationally. Lawsuits are on the rise, and candidates are watching. When you uphold FCRA standards, youâre not just following the law; youâre sending a message of integrity. This approach doesn't just keep your agency safe from legal trouble. It creates a reputation of fairness and integrity, attracting candidates and clients alike. Focus on these methods, and FCRA compliance becomes a natural part of your operations, securing your agencyâs position in the industry.

Frequently Asked Questions (FAQs)

What are the FCRA requirements for staffing agencies?

The Fair Credit Reporting Act (FCRA) mandates that staffing agencies must obtain written consent from candidates before conducting a background check. Agencies must also inform candidates if the information from the check will be used to make employment decisions.

Can staffing agencies conduct background checks without consent?

No, staffing agencies cannot conduct background checks without the candidate's consent. Written authorization is required to proceed with any screening.

How long must staffing agencies keep consent forms?

Staffing agencies should retain consent forms for at least five years from the date of the background check. This ensures compliance if there's an audit or inquiry.

What's the difference between pre-adverse and adverse action?

Pre-adverse action occurs when an employer notifies a candidate of potential negative impact based on the background check, offering them a chance to respond. Adverse action is when the employer finalizes the decision to deny employment after considering the candidate's response.

Do state laws override FCRA for staffing recruiters?

State laws can provide more protections than the FCRA, but they cannot offer less. Staffing agencies must comply with both federal and applicable state laws in their recruitment process.

What steps should staffing agencies take if a candidate disputes a background check?

Agencies should investigate the claim promptly, usually within 30 days. They must communicate findings to the candidate and credit reporting agency and correct any errors.

Are there specific notices or forms agencies must use under the FCRA?

Yes, agencies must use a "Summary of Your Rights Under the FCRA" form, which informs candidates of their rights related to background checks.

Can staffing agencies share background check information with clients?

Agencies can share background check information with their clients, but only when candidates have provided consent. It's crucial to ensure data is shared securely.

What types of checks are commonly included in staffing agency screenings?

Typical background checks may include criminal history, employment verification, education verification, and credit history, depending on the job position.

How often should staffing agencies review and update their compliance processes?

Agencies should review and update compliance processes annually or whenever there are changes in federal or state regulations affecting background checks.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.