Navigating the real estate market in New York can be a daunting task, especially when it comes to securing a rental property. One critical step in this process is the rental background check. This guide is designed to provide professionals and prospective tenants with a thorough understanding of how rental background checks work in New York, and how they differ from employment background checks.

We will explore why landlords conduct these checks, what information they typically seek, the legal landscape surrounding the process, and tips for preparation. We'll also delve into common concerns and questions potential renters might have. By the end of this guide, you'll be well-equipped to handle rental background checks with confidence.

Key Takeaways

- Rental background checks are essential tools for landlords to evaluate the reliability of potential tenants by reviewing credit, rental history, and sometimes employment details.

- Landlords conduct these checks to ensure financial security, property protection, and community safety by predicting tenant behavior based on past actions.

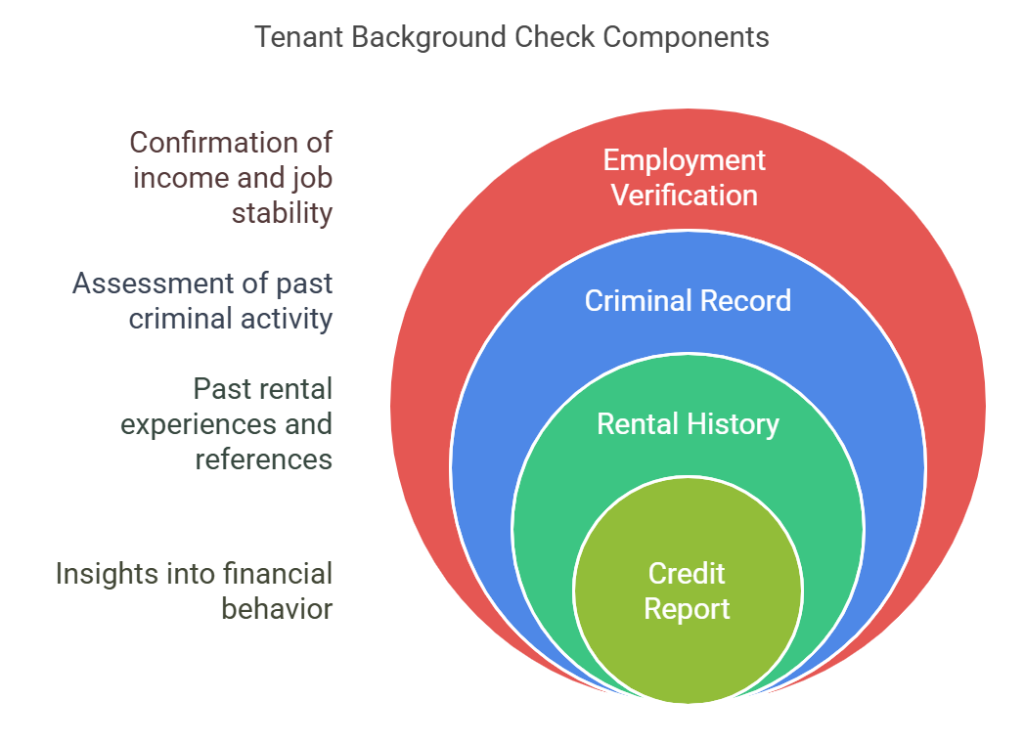

- Key components of a rental background check include a credit report, rental history, criminal record, and occasionally, employment verification to assess tenant reliability.

- Understanding your rights as a tenant in New York can protect you from discrimination and ensure fair treatment under federal and state laws.

- Preparing for a rental background check involves checking your credit score, gathering references, reviewing any criminal records, and ensuring your employment information is accurate.

Understanding Rental Background Checks

Navigating the rental market in New York involves several hurdles, and a rental background check is one of the key steps in that journey. But what exactly does this process entail, and why is it so crucial for landlords?

What Is a Rental Background Check?

In simple terms, a rental background check is a tool used by landlords to get a sense of who they might be renting to. It's like a security blanket for them—a way to peek into your rental history, creditworthiness, and sometimes even your employment background. The goal here is straightforward: landlords aim to ensure their property is in the hands of someone reliable and responsible. They want to predict if you'll pay the rent on time and care for their property. Past behaviors, as seen through these checks, are the best indicators of future actions.

Why Landlords Conduct Rental Background Checks?

Landlords aren't just being nosy when they ask for a background check; there are real, practical reasons behind it. First up is financial security. By examining a prospective tenant's credit score, landlords can gauge financial responsibility. They want reassurance that you won’t suddenly skip a payment. Then there’s property protection. Knowing what's happened in your past rentals helps them avoid potential issues, whether that’s property damage or disputes with neighbors. Finally, there's the aspect of ensuring a safe community. Criminal background checks are not just a formality—they help keep all tenants safe from potential threats.

Key Components of a Rental Background Check

When landlords conduct a rental background check, they focus on several components to gauge the reliability of a prospective tenant. Here's what they typically review:

- Credit Report: Your financial history says a lot about you. Landlords look at your credit report for insights into your bill payment habits and current levels of debt. A good credit score can signal responsible financial behavior, while a low score might raise concerns.

- Rental History: Landlords want to know about your past rental experiences. They'll check for previous addresses, feedback from former landlords, and any eviction records. Consistent payments and positive landlord feedback can boost your application, whereas past evictions might raise red flags.

- Criminal Record: This part of the check helps assess any past criminal activity that could affect your suitability as a tenant. While not all criminal records will be a dealbreaker, serious offenses might lead landlords to think twice.

- Employment Verification: Some landlords include this in their checks to confirm your income and job stability. Knowing that you have a steady income gives them confidence in your ability to pay rent consistently.

Understanding these components can help you better prepare for a rental background check. Having your financial, rental, and employment information in good order can improve your chances during this crucial part of the rental process.

The Legal Landscape of Rental Background Checks in New York

Navigating the legal landscape of rental background checks in New York requires understanding specific regulations and tenant rights. One of the primary legal frameworks is the Fair Housing Act, which prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. Any landlord conducting background checks must ensure their practices align with these federal standards.

New York also imposes additional tenant protections. For instance, the state's Human Rights Law extends discrimination protections, including age and sexual orientation. Landlords need to be aware of these laws to avoid legal pitfalls.

Consent is another critical component. Landlords must get written permission from tenants before carrying out any checks. This consent is not just a formality—it is a legal requirement. Ensuring transparency and obtaining proper consent help maintain trust and avoid any disputes later on.

Privacy concerns are also vital. Any sensitive information gathered during these checks must be handled with care. This includes limiting access to the data and ensuring secure storage. Mismanagement of such data can lead to legal actions and penalties.

In summary, understanding and adhering to these legal aspects is non-negotiable. It protects both tenant rights and mitigates risks for landlords, ensuring a fair and compliant process.

Tenant Rights and Legal Considerations

Navigating rental background checks in New York requires understanding tenant rights under federal and state laws. The Fair Housing Act is a federal mandate that prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. This means landlords must apply their criteria consistently to all applicants.

New York laws add another layer, offering further tenant protections. State-specific regulations restrict what landlords can scrutinize in a background check. For example, New York limits the power of landlords to consider past evictions or certain arrests without convictions. Landlords need to avoid any practices that could lead to discrimination, intentional or not. This compliance helps ensure fair evaluations and safeguards against potential legal issues.

Understanding these regulations isn't just for landlords; tenants should know their rights to protect themselves from unfair practices. Being informed can make a significant difference in how tenants approach rental applications.

Consent and Privacy

Before landlords dig into your background, they need your written consent. It's not just a courtesy—it's required by law. This goes hand-in-hand with your right to privacy. Sensitive info gathered during the check needs proper handling. Only the right folks should see it, and it has to be stored securely. Slacking on this front isn't an option, as data breaches and unauthorized access can have serious legal repercussions. Landlords must stay on their toes, ensuring compliance with privacy laws and regulations. For tenants, understanding this part of the process can offer peace of mind, knowing there's a layer of protection around their personal data.

Preparing for a Rental Background Check

Tips for Prospective Tenants

Navigating rental background checks doesn't have to be stressful if you come prepared. Begin by checking your credit score. Understanding your financial standing is crucial, as a low score might signal potential risk to landlords. If your score isn't up to par, consider steps to improve it such as paying off outstanding debts or disputing any inaccuracies.

Next, gather references. Previous landlords and other reliable contacts who can vouch for your character and reliability should be ready to speak on your behalf. Keep their contact details organized and accessible, as some landlords may want to talk to them directly.

Reviewing your criminal record is also wise. Knowing what's on your record helps you address any concerns a landlord might have before it's even brought up. If there are inaccuracies or old charges that should be expunged, take action to correct them. Honest disclosure coupled with an explanation tends to work better than leaving landlords to draw their own conclusions.

Employment verification is another piece of the puzzle. Ensure that all job-related information you provide is current and correct. This might include pay stubs, offer letters, or direct contact details of your employer. A stable job history can assure landlords of your ability to pay rent consistently.

Frequently Asked Questions (FAQs)

Can a bad credit score ruin my rental chances?

A bad credit score can pose challenges when securing a rental. Landlords use it as a gauge for financial reliability, so a lower score might raise red flags about your ability to pay rent. If your score is subpar, consider mitigating this with a co-signer who has a stronger credit history. Another route is to provide additional assurances, like offering a larger security deposit to ease the landlord's concerns.

What if there’s an error in my background check?

Mistakes in background reports can occur, and they can impact your chances of securing a rental. If you spot an error, contact the screening company immediately to dispute the information. Provide documentation to support your claim and request a corrected report. This proactive approach can help resolve issues and present a more accurate picture to prospective landlords.

How far back do these checks go?

Rental background checks typically focus on the last seven to ten years. This timeframe covers recent credit, rental, and criminal records. If an older issue has surfaced that might concern landlords, it’s beneficial to explain the circumstances upfront. Transparency can go a long way in addressing potential worries a landlord might have about historical issues.

Comparing Rental and Employment Background Checks

Similarities

Both rental and employment background checks serve to evaluate reliability and identify potential risks. They share several components, such as financial checks and assessments of past behavior, which help in making informed decisions about prospective tenants or employees.

Differences

While there are common threads, the focus and legal frameworks differ substantially between the two types of checks. Rental background checks zoom in on tenancy history and financial stability. Landlords prioritize understanding rental behavior, such as past evictions or late payments, to gauge whether a tenant will be a reliable occupant. On the other hand, employment checks focus on verifying a person’s professional history, qualifications, and integrity at work. Here, the spotlight is on job performance, credentials, and any prior workplace issues.

The legal context also shifts. Rental checks often abide by housing-specific regulations, which can include fair housing laws and privacy stipulations tailored for tenant protection. Employment background checks must comply with employment laws, such as the Fair Credit Reporting Act (FCRA), which governs how personal information is collected and can be used in hiring processes.

Incorporating Employment Considerations

Understanding both rental and employment checks offers a fuller picture of an individual's reliability. Businesses in New York benefit from knowing these processes for both hiring and housing contexts. This additional layer of understanding can ensure comprehensive evaluations of potential employees who may also be tenants. For detailed insights on conducting background checks across different domains, the SHRM Toolkit is a valuable resource.

Conclusion

Getting a grip on rental background checks in New York means fewer surprises and smoother renting. Whether you're a tenant or a landlord, clear understanding and preparation transform a complicated process into a straightforward one. From legalities to practical steps, knowing what to expect helps you make decisions that are both informed and confident. So, approach your next rental situation equipped with the knowledge and assurance that come with proper groundwork—it's the smart move for all involved.

Definitions

Employment Verification: Employment verification is the process by which landlords or employers confirm an individual's current job status and income. This check typically involves reviewing pay stubs, offer letters, or direct communication with an employer to ensure that the individual has a steady and reliable source of income, which helps demonstrate their ability to meet financial obligations such as rent or salary requirements.

Credit Report: A credit report is a detailed financial document that outlines an individual's credit history, including bill payment habits, outstanding debts, and overall creditworthiness. Landlords and employers use this report to assess whether a person is financially responsible, as it offers insights into their ability to manage financial commitments like rent or debt repayment.

Rental History: Rental history refers to the record of an individual's previous tenancies, including past addresses, payment consistency, and interactions with former landlords. This information helps landlords evaluate a potential tenant's reliability by indicating whether they have a history of paying rent on time and maintaining good relationships during prior leases.

New York State Laws: Official state laws regarding tenant screening can be found on the New York State Legislature website.

Federal Fair Housing Act: The U.S. Department of Housing and Urban Development (HUD) provides guidelines on fair housing practices that include tenant screening.

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

FACIS Background Check: 2026 Healthcare Compliance Guide

18 Dec, 2025 • 20 min read

Food Delivery Driver Background Check: Complete Compliance Guide for Restaurant Operators

17 Dec, 2025 • 17 min read

Texas Education Background Checks: 2026 TEA Compliance Guide for Schools & Districts

17 Dec, 2025 • 23 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.