Introduction

In today's fast-paced hiring landscape, background checks are no longer just a formality—they are a cornerstone of risk management, compliance, and talent acquisition. Employers rely on background screening to verify credentials, prevent workplace violence, and maintain legal standing under complex frameworks like the Fair Credit Reporting Act (FCRA) and Equal Employment Opportunity Commission (EEOC) guidelines.

In addition to compliance, background checks also define candidate experience—slow, imprecise processing can alienate candidates and harm employer reputation. A good provider doesn't only safeguard your business; it enables you to compete for best talent in an ever-increasingly competitive labor market.

But not all background check providers are created equal. An unreliable provider can delay your hiring timelines, expose you to compliance risks, and even harm your company’s reputation. If you're experiencing persistent issues with your current vendor, it might be time to consider making a change.

Here are five critical signs that indicate it’s time to switch your background check provider—along with expert tips on finding a partner that truly supports your business goals.

Are Delays Hurting Your Hiring Process?

Sign: Your background checks are taking days—or worse, weeks—to complete.

EXPERT INSIGHT: In HR, I've come to know one thing to be absolutely critical to your hiring process: the quality of your background check provider. It's not just check-boxes for compliance—it's preventing harm, ensuring trust, and guaranteeing an easy candidate experience. When reports are sluggish or error-ridden, it doesn't just freeze hiring, it undermines faith in your whole process. Getting it right means safety, integrity, and celerity without compromise of empathy. Doesn't every responsible employer—and every candidate—deserve this? - Charm Paz, CHRP

Why It Matters

In competitive job markets, time is of the essence. A delay of even a few days can mean losing top-tier candidates to faster-moving competitors. Prolonged vacancies also disrupt operations and frustrate hiring managers.

According to industry benchmarks, most standard background checks (criminal history, identity, and employment verification) should be completed within 24 to 72 hours. Here's a snapshot of typical turnaround times:

| Check Type | Industry Standard Turnaround |

|---|---|

| Criminal Record Check | 24–48 hours |

| Employment Verification | 2–3 business days |

| Education Verification | 2–3 business days |

| Credit Check | Same day |

| Drug Testing | 1–3 business days |

📌 Pro Tip: If your current provider consistently misses these benchmarks, it’s a strong signal to audit their performance—and compare with modern alternatives offering real-time or same-day processing.

Are Inaccuracies Putting Your Business at Risk?

Sign: You’ve encountered errors in candidate reports—like incorrect criminal records or unverified credentials.

Why It Matters

Inaccurate reports not only lead to poor hiring decisions, but also open the door to legal liabilities such as wrongful termination suits or negligent hiring claims.

A well-publicized case from 2020 involved a tech firm that declined a candidate based on a background report falsely indicating a felony conviction. The company later settled a negligent hiring lawsuit after the candidate sued for reputational damage.

And it’s not just criminal data. According to HireRight’s 2023 Employment Screening Benchmark Report, 56% of candidates admit to inflating their resumes—which underscores the need for accurate education and employment verification.

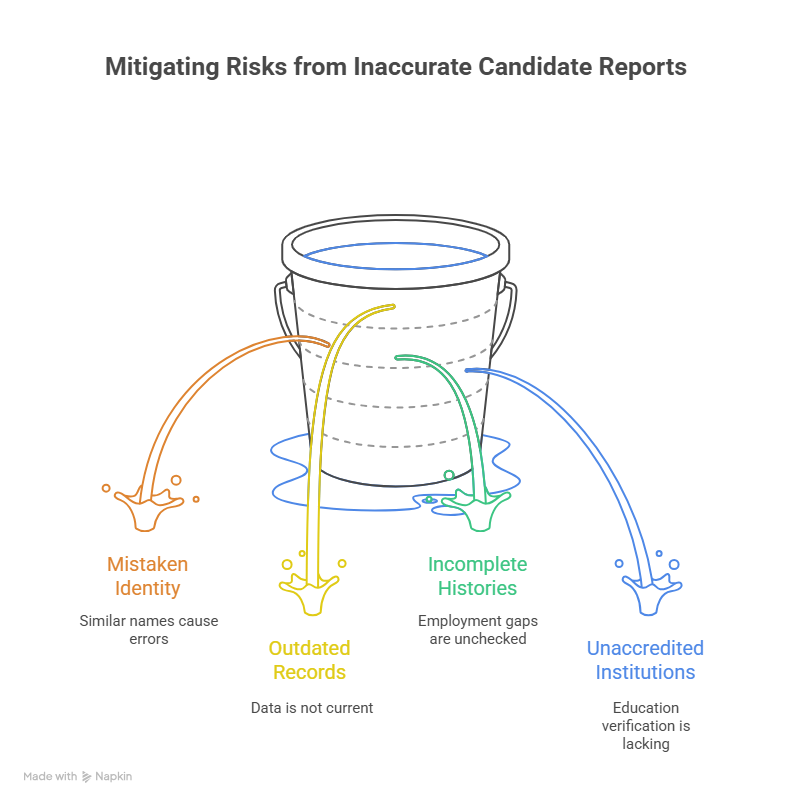

Common Accuracy Issues to Watch For:

- Mistaken identity due to similar names

- Outdated or unverified records

- Incomplete employment histories

- Education degrees from unaccredited institutions

✅ Best Practice: Choose a provider that uses manual review teams and has built-in safeguards like multiple identity verification checkpoints and cross-source validation.

Is Poor Customer Support Leaving You Stranded?

Sign: You rarely hear back from your account rep—if you even have one. Support is slow, unhelpful, or only available via chatbots.

Why It Matters

When you’re in the middle of hiring a critical role or facing a compliance deadline, you need responsive, expert support. Poor service can lead to bottlenecks, frustrated HR teams, and lost candidates.

Red Flags:

- No dedicated account manager

- Limited support hours (e.g., 9–5 EST only)

- No escalation protocol for urgent issues

- Auto-responses or canned replies without real resolution

What to Look For Instead:

| Feature | Ideal Support Model |

|---|---|

| Availability | 24/7 support (chat, email, phone) |

| Account Management | Dedicated rep or team |

| Service-Level Agreements (SLAs) | Guaranteed response times |

| Escalation Procedures | Clear and fast-tracked |

🔍 Evaluate: Call or email your current provider’s support line with a complex question. How fast and helpful is the response?

Are Hidden Fees Blowing Your Budget?

Sign: Your invoice has grown—and you’re not sure why.

Why It Matters

Many background check providers operate on à la carte pricing models, which can quickly spiral out of control. Charges for re-scans, international checks, or supplementary reports can significantly inflate your HR budget.

Worse, some providers bury these fees in legalese within contract addendums or monthly statements, making cost forecasting nearly impossible.

Hidden Fee Examples:

| Service | Possible Hidden Fees |

|---|---|

| International Checks | Currency conversion, translation, local taxes |

| Drug Screening | Retesting or no-show penalties |

| Re-verifications | Extra charges per attempt |

| Reporting Add-ons | Fee per additional county searched |

💡 Tip: Conduct a quarterly audit of your invoices and request a transparent pricing breakdown from your provider. Look for vendors who offer flat-rate pricing or tiered subscription plans with no hidden surprises.

Is Your Provider Falling Behind on Compliance?

Sign: You’re not sure if your provider is FCRA-compliant—or if their reports meet EEOC and state regulations.

Why It Matters

Compliance isn’t optional. Your organization is legally responsible for how background checks are used—even if you rely on a third-party vendor. Failure to adhere to federal and local laws can result in lawsuits, penalties, and reputational harm.

Notable legal frameworks include:

- FCRA (Fair Credit Reporting Act): Requires consent, pre-adverse/adverse action protocols, and dispute rights.

- EEOC Guidelines: Prevent discrimination through individualized assessments.

- Ban the Box: Prohibits criminal history questions on initial applications in many states.

- State-Specific Laws: California, New York, and Illinois have their own background check requirements.

🧭 Solution: Ensure your vendor offers compliance automation, customizable workflows, and up-to-date audit trails for every report.

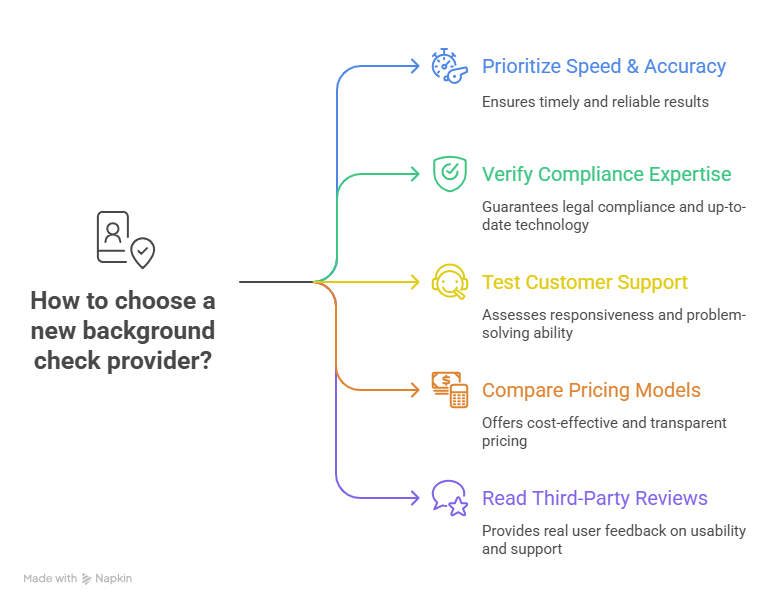

How to Choose a New Background Check Provider

If you’ve identified one or more of the red flags above, it's time to find a provider that can actually support your team. Here’s how to make the switch:

1. Prioritize Speed, Accuracy, and Transparency

Ask for sample reports and SLAs. Review their average turnaround times.

2. Verify Compliance Expertise

Check whether their team includes FCRA-certified professionals and whether their tech is updated for EEOC and state laws.

3. Test Customer Support Responsiveness

Send a support ticket or call them to evaluate response times and problem-solving ability.

4. Compare Pricing Models

Look for clear, all-inclusive packages or volume-based discounts rather than unpredictable per-check charges.

5. Read Third-Party Reviews

Check out platforms like G2 and Capterra to see real user feedback on usability, pricing, and support.

FAQs (People Also Asked)

How often should I review my background check provider?

At minimum, conduct an annual audit, or after major hiring surges, to ensure they’re still meeting speed, accuracy, and compliance requirements.

What are red flags in a background check report?

Red flags include missing information, inconsistent formatting, vague or outdated records, and poor documentation of data sources.

Can I switch providers mid-contract?

Yes, but check your contract for termination clauses or early-exit penalties. If needed, negotiate prorated terms or prepare for a switch at renewal.

How do I balance cost and quality?

Choose providers with scalable plans that allow you to adjust based on hiring volume—while ensuring they meet minimum compliance and support standards.

What compliance laws apply to background checks?

- FCRA (Fair Credit Reporting Act)

- EEOC Guidelines

- Ban the Box Laws

- State-specific regulations (e.g., California’s ICRAA)

Conclusion

Background checks should be a powerful tool—not a liability. If your current provider is slow, inaccurate, unresponsive, overpriced, or out of compliance, you're putting your business at risk.

Evaluate your vendor using the five signs outlined in this guide. And if you recognize more than one of them, it’s probably time to switch.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.