New York sits at the financial frontier, housing 40% of the United States' fintech firms (Tech:NYC, 2025; Built In NYC, 2024). With so many companies present, New York fintech firms often need to perform thorough background checks. It stands as a mecca for innovation, yet brings with it the challenge of navigating the strictest financial background screening laws in the nation. If you're part of this ecosystem, understanding New York’s regulatory landscape is essential.

Key Takeaways

- New York's fintech companies must navigate strict background check regulations from entities like the DFS and FINRA, focusing on cybersecurity and customer trust.

- New York's unique focus on cybersecurity, exemplified by the 23 NYCRR 500 regulation, mandates comprehensive screenings for cybersecurity roles to prevent financial crimes.

- Federal guidelines from agencies like the OCC, FDIC, and Federal Reserve impose rigorous background checks on bank personnel, prioritizing integrity and safety.

- Compliance in the fintech sector benefits from automated screening technologies that enhance speed, accuracy, and real-time monitoring, ensuring continued adherence to regulations.

- Future regulatory trends indicate potential tightening of cybersecurity laws, necessitating that organizations remain adaptable and proactive in their compliance strategies.

EXPERT INSIGHT: At the center of New York's financial-techno scene, where innovation and the nation's toughest regulations coexist, I have learned that hiring becomes more than the mere process of choosing the brightest stars; it becomes the search for the most reliable individual. Under such circumstances, background checks become more than formalities; they become the insurance policy for client trust and corporate reputation. I have witnessed the way a wrong step can ripple through teams, through products, and through reputations. But when compliance becomes the very bedrock of culture—not just a checkpoint—it becomes a source of certainty and confidence behind each hiring choice. In a city characterized by speed and accuracy, thorough vetting becomes not only wise; it becomes a survival strategy. - Charm Paz, CHRP

Introduction

What sets New York apart? The state has a patchwork of regulations for fintech, banking, and cybersecurity. You'll deal with the New York Department of Financial Services (DFS) 23 NYCRR 500 cybersecurity laws, FINRA's Form U-4 requirements, and a host of state banking rules. These rules extend to every facet of employee screening—from those designing secure systems to advisers talking money.

Many find themselves caught between overlapping guidelines. Compliance costs can spiral, and hiring the right talent becomes a complex task. Do you feel the pressure? You're not alone.

This article will demystify the screening requirements for those operating in New York. We'll break down the essentials of compliance, ticket you through the maze, and arm you with the insight to minimize costly errors. Whether you're an HR specialist, compliance officer, or fintech leader, you'll be better prepared to tackle these regulations with a clear viewpoint.

New York Financial Services Regulatory Framework

Understanding the New York financial services regulatory framework is essential for anyone involved in fintech and banking. It involves various regulatory bodies ensuring that financial institutions operate within the law. Here's what's at play.

Key Regulatory Bodies

The New York Department of Financial Services (DFS) oversees state-level banking and insurance. It's known for its stringent standards, which fintech companies need to heed. Meanwhile, the Financial Industry Regulatory Authority (FINRA) focuses on securities. It makes sure that brokers and firms comply with financial market regulations.

At the federal level, entities like the Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve play crucial roles. They ensure national banks adhere to safety and soundness standards. For those involved in trading derivatives and securities, the Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) are pivotal.

Why NY FinTech Background Checks Are Unique

New York fintech background checks stand out due to their intense focus on cybersecurity, driven by the state's 23 NYCRR 500 regulation. This regulation mandates thorough personnel screening to protect sensitive financial data and systems. It requires that employees in key cybersecurity roles undergo detailed background checks. For example, if your company appoints a new Chief Information Security Officer (CISO), extensive checks ensure this individual has no history of data breaches or security violations.

Navigating compliance involves understanding both state and federal laws, leading to the complexity of dual jurisdiction. A fintech company in New York must ensure it adheres not only to state regulations but also to federal requirements. This means staying informed about New York State Department of Financial Services (DFS) mandates while also complying with federal agencies like the SEC.

The financial industry is high-risk by nature. Preventing financial crimes and securing data are critical. New York regulations demand rigorous screening processes to identify individuals who might pose a threat. Failure to do so can result in financial losses and damage to reputation. Public trust is essential in finance; your company cannot afford to be seen as reckless or negligent.

Regulatory scrutiny in New York is no joke. With real-world consequences for failing to meet standards, businesses need to be diligent. Consider how your company addresses these challenges. Is your background screening process robust enough to handle the scrutiny? Are you prepared to face the reputational consequences if you're not?

Regulatory Evolution Post-2008

The 2008 financial crisis shook the foundations of global finance. In response, the Dodd-Frank Act came into play, putting a spotlight on enhanced screening for financial institutions. If you're in the fintech or banking sector in New York, you know this act upped the ante on background checks. The aim was to prevent a repeat of the reckless behaviors that led to the collapse.

Fast forward to 2017, and we see the creation of the DFS's 23 NYCRR 500 regulation. This rule pushed the cybersecurity envelope, mandating rigorous background checks for key personnel. It requires entities to arm themselves against cyber threats by scrutinizing the individuals at the helm of cybersecurity defenses.

However, balancing growth with security isn't straightforward. FinTech companies must innovate while staying compliant with shifting regulations. It's a constant juggle to foster innovation without falling foul of security requirements.

Recent enforcement actions remind us that the DFS isn't shy about penalties. Non-compliance can lead to significant fines, making compliance not just a legal necessity but a financial priority. Have you thought about what your compliance strategy needs to keep pace with these evolving standards? Staying agile amid this regulatory evolution is crucial for survival and success in New York's tight fintech arena.

DFS 23 NYCRR 500 Cybersecurity Background Check Requirements

The DFS 23 NYCRR 500 regulation is crucial for financial institutions in New York. This framework requires background checks for cybersecurity roles. The aim is to protect sensitive data and prevent breaches.

Covered Entities and Scope

Banks and credit unions are front and center. They handle vast amounts of personal and financial data. Insurance companies, covering various sectors like life and health, also fall under this regulation. Money transmitters, including popular platforms like PayPal and Venmo, are included, as are fintech companies like lending platforms and robo-advisors.

Cybersecurity Personnel Screening Requirements

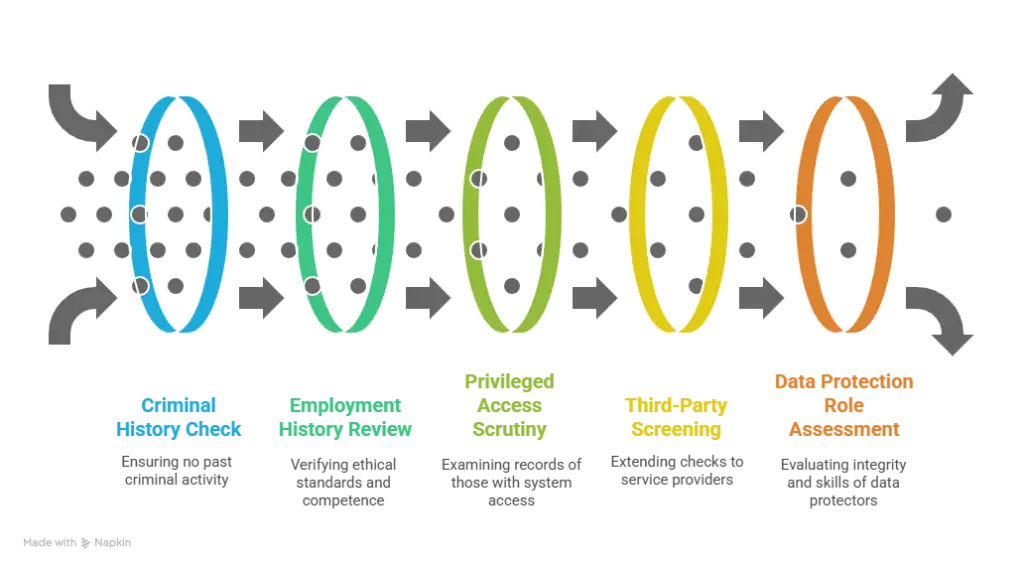

In the world of financial services, the importance of top-tier cybersecurity can't be overstated. The DFS 23 NYCRR 500 regulations make it clear: hiring the right people is crucial. For those overseeing these regulations, the role of a Chief Information Security Officer (CISO) carries weighty responsibilities. Your job is to ensure that the person you hire for this position has been through an exhaustive background check.

Start by examining their criminal history and past employment, ensuring no stone is left unturned. You're looking for a history that aligns with high ethical standards, free from any negligence or security breaches. Similarly, focus on those with privileged access—individuals who can modify or control your systems. Scrutinize their records carefully.

The buck doesn’t stop with your direct hires. Third-party service providers and their staff matter too. If they have access to your systems or data, their backgrounds should be as clean as your own employees'. This may seem tedious, but it's necessary for protecting your organization.

Consider those in data protection roles, tasked with securing nonpublic information. Confirm their track records reflect integrity and competence. This isn't just about what's on paper; practical skills and a proven history of ethical conduct should take precedence.

Ask yourself: is your current screening process thorough enough to catch potential risks? If there's any doubt, it's worth revisiting your procedures. Ensuring trust in personnel is key to mitigating threats before they become crises, keeping your organization secure and compliant.

23 NYCRR 500.10 Personnel and Access Controls

Background checks must form the backbone of your cybersecurity personnel strategy. They start with verifying criminal history, employment, and education. This process helps ensure your staff meets high ethical standards. But checking once isn't enough. Annual re-screenings and continuous monitoring keep you aware of any changes.

When an employee leaves, access termination should be immediate. Delay can result in unwanted access to sensitive data. Keep clear records of these checks. They will be critical if regulators examine your compliance efforts.

These practices protect against both internal threats and regulatory penalties. Is your organization prepared for this level of scrutiny? Regular updates and consistent practices will build a robust security framework.

Risk-Based Approach Implementation

A risk-based approach tailors background check requirements to the specific cybersecurity risks associated with different positions. This means high-risk positions demand more rigorous screening. So, how do you determine which roles are high-risk?

| Component | Description and Key Actions |

|---|---|

| High-Risk Position Identification | Analyze roles with access to sensitive data or critical systems (CISO, network administrators). Evaluate responsibilities and potential security impact to identify high-risk positions. |

| Tiered Screening Protocols | Develop differentiated screening based on access levels (junior IT technician vs. senior cybersecurity analyst). Balance thoroughness with efficiency, focusing resources on highest-risk roles. |

| Vendor Risk Assessment | Ensure third-party providers have adequate employee screening measures. Regularly evaluate vendor screening processes to mitigate breach risks from poorly vetted vendor employees. |

| Incident Response Integration | Connect background checks to broader incident response strategy. Use background information to provide insights into breach origins and inform response actions. |

By implementing a risk-based approach, you can focus your efforts where they make the most difference, protect sensitive information effectively, and streamline the background screening process. Are your background checks aligned with your cybersecurity risks?

FINRA Form U-4 Registration Requirements

Who Must File Form U-4

If you're entering the securities industry, chances are you'll need to fill out a Form U-4. This form, required by FINRA, is a gateway to becoming a registered representative. It covers anyone involved in securities sales or investment advice. Essentially, if you’re helping clients with their investments, this is your starting point.

Investment adviser representatives also fall under this requirement. If you're guiding clients on asset management or financial planning, expect to file a U-4. Principals and supervisors, such as branch managers and compliance officers, are also part of the group. Their roles in overseeing registered activities demand transparency and accountability.

Even those who don't directly sell or advise on securities but have certain job functions might need to file. This includes back-office staff with access to customer information or those influencing business operations. Making sure all relevant personnel are registered ensures that your firm remains compliant and upholds the integrity of the financial markets.

Why is this important to you? Well, failing to register or complete this process accurately can stall your career plans. It can also lead to penalties for your employer. Ensuring your U-4 is complete and truthful is a crucial step in starting your path in the financial services industry. What aspects of your role might require you to file a Form U-4?

Form U-4 Background Disclosure Requirements

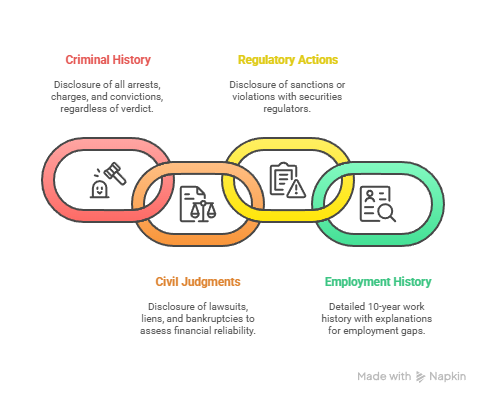

Form U-4 is the foundation of transparency for financial professionals. It’s a comprehensive look into your history and is crucial for gaining registration to work in the securities industry. Here’s what's covered and why it matters:

- Criminal History: You must disclose every arrest, charge, or conviction—this includes the ones not resulting in a guilty verdict. Even if you think it's minor or in the past, it's relevant. It's about trustworthiness and integrity. Are you prepared to explain past mistakes and demonstrate they won’t interfere with your current role?

- Civil Judgments: Lawsuits, liens, and bankruptcies may haunt your application. It’s not just about financial acumen; your financial behavior reflects your decision-making skills. These details paint a picture of your financial reliability.

- Regulatory Actions: Any previous run-ins with securities regulators must be on the table. If you’ve been sanctioned or violated rules, the regulators need to know. This information answers whether past non-compliance might repeat itself.

- Employment History: A detailed 10-year work history is mandatory. Any gaps? You’ll need reasons for them. It’s about providing a complete career narrative and proving continuous development without hiding any setbacks.

Are you ready for this level of scrutiny? Transparency can be daunting, but it's necessary in building a trustworthy relationship with your employer and clients. Missing or misleading information can lead to costly delays, so ensuring accuracy is vital.

Form U-4 Processing and Approval

When filing the Form U-4, you engage with the Central Registration Depository (CRD). This system serves as the electronic registry for all registration filings within the securities industry. It's where you submit your Form U-4, detailing your qualifications and disclosures. This database increases transparency and simplifies tracking your registration status.

Your registration isn't just a one-stop process. The Form U-4 requires coordination with the New York Department of State, ensuring compliance with state-specific requirements alongside national standards. This dual approach safeguards consistency across different regulatory landscapes.

Fingerprinting plays a crucial role in your background check process. The FBI processes these prints to verify any criminal history. This step is non-negotiable; it reinforces trust in your professional integrity. Even when your fingers are ink-free, remember that this stage forms the cornerstone of your application's credibility.

Approval times for the Form U-4 generally range from 30 to 60 days. Several factors can influence this period, such as the complexity of your background and the thoroughness of your disclosures. Quick and complete submissions usually lead to faster processing. If your role requires you to hit the ground running, ensure you start this process promptly to avoid unnecessary delays.

How does waiting a month or two for approval impact your plans? Time your registration process with foresight, balancing urgency with thoroughness.Your submitted Form U-4 will enter the Central Registration Depository (CRD), an electronic filing system. If you're in New York, you'll also coordinate with the NY Department of State. You'll need your fingerprints taken for an FBI background check. After filing, approvals generally take 30 to 60 days for standard applications.

Ongoing U-4 Maintenance Obligations

Amendments to Form U-4 are not optional. You must report any material changes within 30 days. This requirement keeps your records current, reducing the risk of compliance issues. Picture this scenario: you've moved to a new address, switched jobs, or got entangled in a legal matter. Each of these is a material change. Ignoring this could lead to disciplinary action.

Annual updates are also a must. You'll need to revisit past disclosures and verify employment details yearly. It feels like a chore, but it ensures your professional history aligns with regulatory expectations. Trust but verify is the standard here.

Disciplinary events can't be swept under the rug. Immediate notification is required when new issues arise. Whether it's a lawsuit, regulatory action, or any other problem, transparency can mitigate larger issues down the line. Use this approach to maintain trust with your regulatory body.

Preparation is critical for audits. Maintaining comprehensive documentation supports your due diligence. Keep records of amendments, correspondence, and submissions. This isn't only for regulatory peace of mind but also boosts your own confidence. Are you ready for your next audit? Being prepared means you have nothing to hide.

Banking Industry Specific Requirements

Federal Banking Agency Guidelines

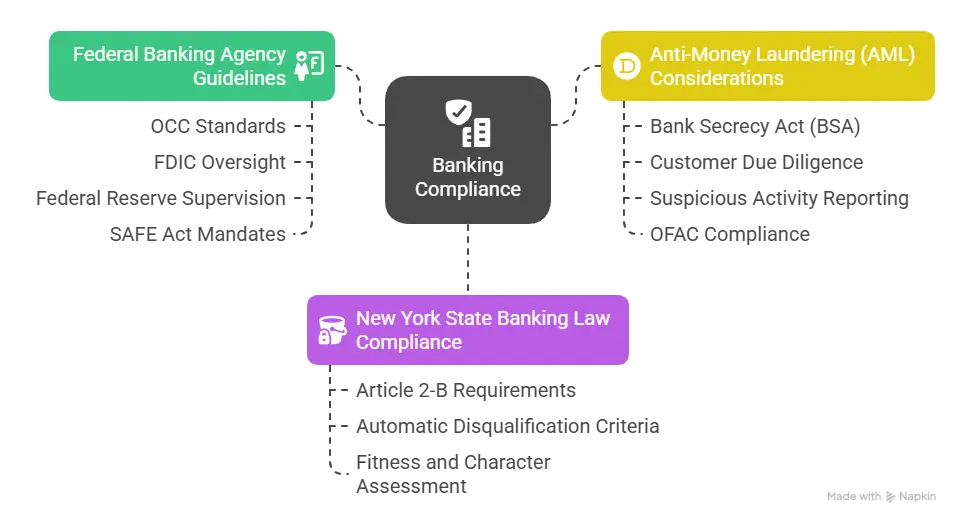

Understanding federal banking guidelines is essential for compliance in the banking industry. The Office of the Comptroller of the Currency (OCC) has set standards for national bank personnel screenings. They focus on ensuring that individuals in control positions are qualified to uphold financial integrity. The Federal Deposit Insurance Corporation (FDIC) oversees deposit insurance, requiring banks to screen personnel responsible for safeguarding customer deposits and managing risks. The Federal Reserve provides supervision for bank holding companies, emphasizing sound management and financial stability. The SAFE Act mandates rigorous background checks and licensing for mortgage loan originators to prevent fraud and promote responsible lending practices.

New York State Banking Law Compliance

State laws can be more stringent than federal regulations, emphasizing the need for thorough background checks. Article 2-B of New York State Banking Law outlines requirements for those working at state-chartered banks, scrutinizing an individual's qualifications closely. It spells out automatic disqualification criteria that include felony convictions and breaches of trust. In addition to checking past behavior, there's an assessment of the individual's fitness and character. This involves a subjective evaluation and regular scrutiny to ensure compliance and integrity in bank operations.

Anti-Money Laundering (AML) Considerations

AML efforts are vital in combating financial crimes. The Bank Secrecy Act (BSA) plays a crucial role here, highlighting the necessity of thorough screenings for personnel in roles related to AML compliance. Employees tasked with customer due diligence must have their backgrounds verified to adequately identify potential risks. Those involved in suspicious activity reporting need a clear background, as they handle sensitive investigations. Further, compliance with the Office of Foreign Assets Control (OFAC) entails rigorous sanctions screening and monitoring to prevent illegal financial activities. These steps collectively bolster the industry’s defenses against money laundering and related offenses.

FinTech-Specific Compliance Challenges

Cryptocurrency and Digital Assets

Navigating the regulatory environment for cryptocurrency in New York can feel daunting. If you're operating in this space or planning to, understanding the BitLicense requirements is non-negotiable. New York mandates robust background checks for cryptocurrency business personnel. The process isn’t just a box to check. It demands thorough vetting of employees who handle sensitive financial transactions.

Cryptocurrency roles often involve enhanced due diligence. The decentralized nature of virtual currencies attracts bad actors, so your team must be vetted for any past financial misconduct. Comprehensive checks become crucial in preventing financial crimes and protecting your business’s reputation.

When hiring for blockchain technology roles, screening is a critical step. This technology underpins cryptocurrency and requires high trust. An employee's background could impact trust and security. Devoting resources to ensure their history aligns with a clean slate is important.

DeFi, or Decentralized Finance, adds another layer of complexity. Unlike traditional finance, regulatory parameters are still forming. What's certain is that as DeFi grows, scrutiny will follow. Ensuring you're ahead in your employee checks will keep you compliant and safe from potential penalties.

Are you prepared to meet these rigorous requirements? Your business's future might depend on how well you adapt to evolving crypto regulations. Engage in regular reviews of your hiring and screening practices to keep pace with the rapidly changing landscape.

Lending and Payment Processing

Operating in alternative lending and payment processing? You face compliance hurdles different from traditional finance sectors. Online lending platforms, for instance, must conduct detailed background screenings to verify roles that pose risks to financial integrity. This process guards against data leaks and fraud.

Payment service providers carry privacy and security expectations too. Whether you're facilitating domestic money transfers or handling cross-border payments, stringent screening helps maintain compliance and builds a secure foundation for financial transactions.

Peer-to-peer platforms, like those supporting marketplace lending, rely on sturdy personnel oversight. Your ability to ensure regular personnel check-ups can stave off illegal activity and uphold trust. The same goes for mobile payment applications; you must focus on consumer protection through targeted role reviews.

Employer Compliance Implementation Guide

For FinTech Companies

Creating comprehensive screening policies is your first task. These policies should outline the types of background checks you'll conduct and at what stages of employment they'll occur. For instance, all employees might undergo criminal background checks, but those in more sensitive roles might require additional scrutiny, such as credit checks or cybersecurity assessments.

Risk assessment involves identifying high-risk positions within your organization. Think about roles with access to sensitive financial data or customer information. For these positions, you might require more rigorous checks. This could include ongoing monitoring to spot any red flags that might arise during employment.

Vendor management is crucial. You need to select reliable third-party screening providers. Look for those with a strong track record in handling fintech-specific requirements. Their systems should integrate smoothly with yours, minimizing disruption while ensuring thorough evaluations of candidates and current staff.

Technology integration is another piece of the puzzle. Automating your screening processes can save time and cut down on human error. Implement systems that track the progress of background checks and flag any issues promptly. This keeps everything transparent and helps you stay compliant with regulations.

For HR Teams and Compliance Officers

Cross-functional coordination between legal, compliance, and HR teams ensures everyone sees eye to eye on screening protocols. This alignment helps avoid bottlenecks and keeps the hiring process running smoothly. Work together to design workflows that incorporate necessary checks without slowing down hiring.

Documentation standards should be high. Keep detailed records of all screenings, including completed forms, authorization from candidates, and any exceptions granted. These records are indispensable during regulatory examinations and audits.

Training programs for hiring managers can’t be overlooked. They need clear guidance on how to handle sensitive information and make decisions compliant with legal mandates. Regular refreshers ensure they stay updated on any regulatory changes.

Multi-Jurisdictional Compliance

Interstate operations require coordinating New York’s stringent requirements with those of other states where you operate. Each state might have unique stipulations, so tailoring your approach is vital.

Federal vs. state conflicts can arise. When they do, working through these inconsistencies demands a clear understanding of which laws take precedence. Consult with legal advisors to navigate these complexities.

International considerations come into play if you hire foreign nationals. Understand the specific challenges relating to screening across borders and ensure compliance with local regulations in each relevant jurisdiction.

Regulatory change management should be proactive. Stay informed about evolving requirements and adapt your policies and processes accordingly. This adaptability is your safeguard against falling out of compliance.

Common Disqualifying Factors and Risk Assessment

Automatic Disqualifiers

Certain past actions can bar you from working in fintech and banking—no questions asked. Financial crimes like fraud, embezzlement, and money laundering top the list. These crimes strike at the heart of trust and integrity, traits critical in finance. Cybersecurity violations are another no-go. Getting caught for hacking, data theft, or any form of computer fraud can instantly end your career aspirations in this field. Violating securities laws, such as insider trading or market manipulation, disqualifies you as well. Also, any history of regulatory sanctions, whether from DFS, FINRA, or the SEC, can close doors quickly.

Risk-Based Evaluation Factors

Not every past mistake leads to a disqualification. The timing of an incident plays a role. A checkered past doesn't necessarily define you, especially if enough time has passed and you can show genuine change. The severity and circumstances of an infraction matter too. Minor infractions may be forgivable, while major breaches often are not. Relevance is key as well. A background issue unrelated to your job might not carry as much weight. Mitigation measures can help, such as increased supervision or additional training. These can tip the scales in your favor.

Appeals and Waiver Processes

Sometimes, overcoming disqualification is possible. Consider exploring waiver applications with DFS. If you're hit with a FINRA statutory disqualification, you could appeal or negotiate a consent procedure. Character and fitness hearings allow you to present evidence of rehabilitation. Providing proof of corrective actions can make a difference. You might also benefit from engaging legal representation, especially if navigating complex appeal processes. Specialized financial services attorneys can provide valuable guidance and improve your chances of a successful outcome.

Job Seeker Navigation Guide

Preparing for FinTech Background Screening

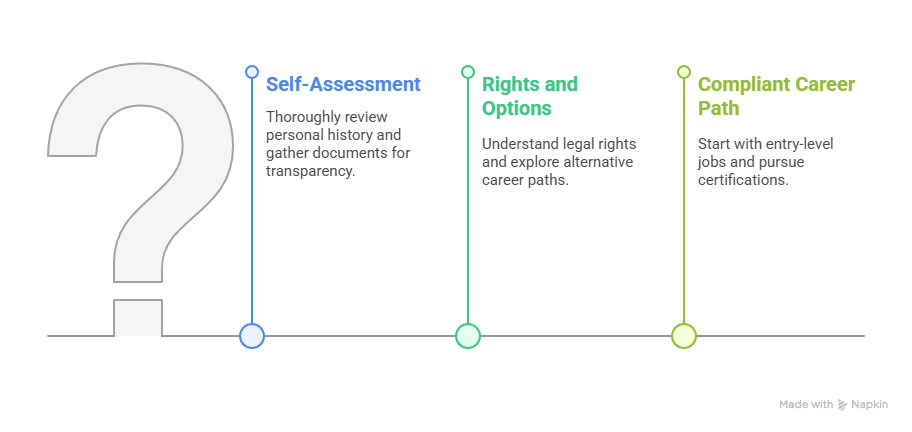

Getting ready for a background check in the New York fintech industry may look daunting at first, but a clear approach can ease the process. Start with a thorough self-assessment. Make sure you have a complete understanding of your background history. This includes any past criminal records, employment stints, or educational achievements. Accuracy is crucial, so cross-check details against official documents.

Gather necessary documentation early. Collect court records if applicable, employment verification letters, and relevant education credentials. Being proactive in organizing these papers not only saves time but also avoids stress when the screening begins.

Consider assembling professional references. Choose former supervisors, especially those familiar with financial services, who can vouch for your work ethic and character. Personal endorsements add a significant layer to your profile that paperwork sometimes cannot convey.

Think about your disclosure strategy. If your history contains any blemishes, be upfront about them. Employers appreciate transparency. Frame any challenges in a constructive manner, focusing on what you’ve learned and how you’ve grown since then. Proper preparation and earnest communication can make a significant difference in how you're perceived. Are you ready to present your best self to your potential employers?

Understanding Your Rights and Options

When you're preparing for a background check, it's vital to understand your rights. The Fair Credit Reporting Act (FCRA) is your shield. It mandates that employers must obtain your consent before conducting a background check. If they make an adverse decision based on your report, they must inform you and provide a copy of the report along with a “Summary of Your Rights.”

In New York, privacy laws bolster these protections. You have the right to access your screening results and dispute any inaccuracies. If you spot errors in your background check, dispute them promptly with both the screening agency and your potential employer. This can prevent unnecessary roadblocks in your job search.

Professional licensing and background checks often go hand in hand. If you're pursuing positions that require state registration, you'll need to align the timing and requirements of both processes. This can help you avoid delays in starting your new role.

Consider planning your career path around your background. If you have a record, look for roles where those issues are less of a barrier. Some positions may not require extensive background checks, while others might offer opportunities to prove your reliability over time.

Understanding these rights and planning accordingly can smooth your path through the often daunting world of fintech background checks. It's not just about finding a job—it's about finding the right job that fits your background and aspirations.

Building a Compliant Career Path

For smooth sailing, target entry-level jobs with lenient screening. Gain experience and move up from there. Alongside, build your skills. Certifications are great for showcasing dedication and competence.

Networking plays a pivotal role. Engage with professionals who operate within compliant frameworks. They might offer valuable insights or open doors to new opportunities.

Legal remedies aren’t out of reach, either. Explore options like expungement to clean up your record. Correcting inaccuracies or understanding sealing processes could offer a fresh start. Your goal is not just any job, but one that aligns with both your qualifications and character.

Cost and Timeline Management

Understanding both the cost and timeline of background checks in the New York fintech sector is crucial for efficient hiring and compliance. Let's break it down.

| Category | Details |

|---|---|

| Typical Processing Timeframes | DFS 23 NYCRR 500 screenings: 2-4 weeks. FINRA U-4 registrations: 30-60 days (includes fingerprint processing). Banking industry background checks: 1-3 weeks. Rush processing available but limited and costly |

| Cost Analysis by Screening Type | Basic financial services background check: $75-$150 per candidate. Enhanced cybersecurity screenings: $200-$400 each. FINRA U-4 registration: $85 initial + $30 annual renewal. Technology automation solutions: $50-$200 per employee annually |

| ROI and Compliance Value | Regulatory penalties for non-compliance: $1,000-$1,000,000. Reduces operational risks (fraud, cybersecurity incidents). Protects firm reputation and maintains customer/investor trust. Competitive advantage through faster, compliant hiring process |

Efficient background checks not only keep you within the bounds of regulation but also offer significant strategic benefits to your organization. Are you prepared to optimize your processes for better compliance and cost savings?

Technology and Automation Solutions

Screening Technology Platforms

Screening technology platforms are reshaping the way background checks are conducted. Integrated HRIS systems enable your team to automate the workflow, reducing the room for human error and speeding up the process. With these systems in place, you can manage screenings effortlessly from start to finish. Continuous monitoring is another key feature. It keeps you in the loop by sending real-time alerts in case of any new criminal activity related to your employees. This ongoing vigilance ensures no surprises during regulatory checks.

API integration allows these platforms to mesh with your existing internal systems. This means seamless data flow and less manual intervention in screening processes. Compliance dashboards are the cherry on top. They provide you with a snapshot of compliance status and reporting in real-time, keeping you and your auditors happy.

Emerging Technologies

Artificial Intelligence is inching its way into background checks. Automated risk assessments and decision support systems can sift through data much faster than a person can, flagging potential issues before they become actual problems. Then there's blockchain verification—a game-changer for maintaining immutable records of background checks. This adds an extra layer of security, making it difficult for records to be tampered with.

Biometric authentication is becoming more common too. These tools enhance identity verification processes, making them more foolproof. They help in ensuring that the person you're screening is exactly who they claim to be. RegTech solutions are also blossoming. They automate regulatory reporting and monitoring, saving time and reducing the risk of non-compliance. In short, these technologies aren't just innovations; they are practical tools that can simplify compliance tasks significantly.

Conclusion

Navigating DFS 23 NYCRR 500 and Form U-4 compliance in the New York FinTech sector requires precision. Ensuring your organization adheres to stringent screening protocols is not just a regulatory necessity, but a keystone of trust with clients and investors. By understanding the essentials of cybersecurity personnel checks and maintaining accurate U-4 filings, you're building a solid foundation for compliance.

Being proactive in your approach means integrating sustainable compliance programs that grow with your business. This involves setting clear policies, conducting regular training, and staying updated on regulatory changes. Leverage industry associations and consult with legal experts when needed. These resources can provide clarity and guidance in an ever-evolving landscape.

Ultimately, strategic implementation is about finding the right balance between meeting regulatory expectations and advancing your business objectives. By aligning compliance efforts with your operational goals, you protect your organization and gain a competitive edge in the market. Stay committed to this path, and you'll not only master New York FinTech compliance but also drive your business forward with integrity.

Frequently Asked Questions

What is the background check policy in New York?

In New York, background checks are conducted in compliance with state and federal laws. Employers must obtain written consent from you before conducting a background check. They are also required to provide you with a copy of the report and inform you of any decisions based on it.

How to get a New York state background check?

To obtain a background check in New York, you can request your own criminal history record from the New York State Office of Court Administration. There is a fee for this service, and you will need to submit a completed application form.

What is the 7-year rule for background checks in NY?

The 7-year rule limits how far back certain information, like arrests or convictions, can be reported on a background check. In New York, non-conviction information older than seven years cannot be used in employment decisions.

How far back do employment background checks go in New York?

Typically, employment background checks in New York can go back up to seven years, though some positions may require longer look-back periods. Convictions can be reported indefinitely if they are relevant to the job.

What is a level 2 background check in NY?

A level 2 background check in New York includes a review of criminal history, records of arrest, court records, and possibly a national sex offender registry. It is often used for positions involving work with vulnerable populations.

Can you run a background check before an offer is made in NY?

In New York, employers generally should not conduct a background check until after making a conditional offer of employment, in adherence to the Fair Chance Act.

What jobs don't do background checks in NYC?

Jobs in NYC that may not require background checks include certain freelance positions, gig economy roles, and some entry-level jobs in small businesses. However, this can vary widely by industry and employer.

Do arrests show up on background checks in New York?

Arrests that did not result in a conviction should not appear on a background check in New York if they are older than seven years. Convictions, however, generally do appear.

Can a potential employer in NY ask about my salary history?

No, employers in New York cannot ask you about your salary history. This law aims to promote fair pay by preventing salary history discrimination.

Are there specific protections for individuals with criminal records in NY?

Yes, New York law provides protections for individuals with criminal records. Employers cannot discriminate based solely on a conviction unless it is directly related to the job or poses a risk.

What information cannot be included in a NY background check?

In New York, background checks cannot include sealed records, juvenile records, or non-criminal offenses. Non-conviction information over seven years old is also typically excluded.

Additional Resources

- 23 NYCRR 500: Understanding the NYDFS Cybersecurity Regulation

https://hyperproof.io/23-nycrr-500-cybersecurity-regulation/ - Understanding NYDFS Cybersecurity Regulation

https://www.legitsecurity.com/aspm-knowledge-base/understanding-nydfs-cybersecurity-regulation - NYDFS Cybersecurity Regulation Explained: What You Need to Know About 23 NYCRR 500

https://secureframe.com/blog/nydfs-nycrr-500

References

Tech:NYC. (2025). NYC Tech Snapshot 2025. https://www.technyc.org/nyc-tech-snapshot-2025

Built In NYC. (2024). 27 NYC fintech companies redefining the financial industry. https://www.builtinnyc.com/articles/fintech-startups-nyc

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

How to Perform OIG Exclusion Screening: Step-by-Step Guide

20 Nov, 2025 • 24 min read

Illinois Tenant Screening Laws: Chicago & Cook County Compliance Guide for Landlords

19 Nov, 2025 • 20 min read

FCRA Penalties for Small Businesses: 2025 Compliance Costs & Violation Fines

12 Nov, 2025 • 20 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.