In the modern era of employment, conducting thorough background checks is a crucial step for businesses of all sizes and sectors. Whether you're a small business owner, an HR professional, a recruiter, or a job seeker, understanding processes like SSN trace and credit checks can significantly affect your employment decisions and opportunities. This guide aims to dispel confusion and provide clear, practical insights into the world of background checks.

Key Takeaways

- Background checks, including SSN trace and credit checks, are vital for employers and landlords to assess identity and financial stability.

- SSN traces help confirm an individual's past residences and aliases, aiding in accurate identity verification.

- Credit checks assess financial responsibility, crucial for job roles handling money and tenant evaluations.

- Small businesses and non-profits must strategically use background checks to balance thoroughness with budget constraints.

- Conducting background checks legally and transparently, with candidate consent and compliance with the Fair Credit Reporting Act, is essential for effective hiring and renting practices.

Introduction

Background checks have become an integral part of the hiring and renting landscapes, serving as a shield for businesses and landlords against potential risks. They dig into an individual's history, surfacing essential details that might impact crucial decisions. Industries like healthcare, transportation, and hospitality lean heavily on these checks to ensure the right people are in the right places, safeguarding their operations and customer interactions.

This guide zeroes in on two significant components of background screening: SSN trace and credit checks. These tools help verify identities and assess financial reliabilities, crucial for informed decision-making. Whether you're navigating these checks as an employer, a landlord, or even as a job seeker keen on understanding what’s being screened, the insights provided will help you move confidently through the process with clarity and assurance.

EXPERT INSIGHT: After years in HR and talent strategy in global teams, I've learned background checks are much more than a box to check on the way to closing a hire, they represent the integrity with which we hold trust. It's not every SSN trace or credit check out of suspicion, but a precaution for the people, culture, and mission we've worked so hard to build. It's too easy to go for what's quick or comfortable, but where the magic lives is where we slow down, ask better questions, and commit to getting it done well. Where background checks are tools of insight, instead of exclusion, we build safer, more inclusive workplaces rooted in open communication and respect. - Charm Paz, CHRP

Understanding SSN Trace

What is an SSN Trace?

An SSN trace, or Social Security Number trace, serves as a foundational element in the background check process. It's the first step in verifying someone’s identity by checking against a database of records tied to their Social Security Number. This tool acts like a roadmap of where an individual has lived down the years. Without complicating it too much, this is important because it gives employers and landlords essential information about an applicant’s history, guiding them in their decision-making process.

How it Works

The mechanics of an SSN trace are straightforward yet effective. Once an SSN is entered into the tracing system, the process scours various public and proprietary databases. These can include credit bureaus, utility companies, and other sources where residency or other related data might be filed. The result is a list of addresses linked to that SSN, which can reveal previous places of residence and any known aliases. Think of it as pulling up the breadcrumbs you've left in all the places you've lived or, in some cases, not lived. What’s handy about this is that it might alert an employer or landlord to name changes or other details the applicant forgot to mention.

Importance in Background Checks

Conducting an SSN trace is a critical step for ensuring accurate and thorough background checks. It is particularly useful for industries requiring detailed historical scrutiny, such as staffing agencies, which cater to sectors with sensitive information access or high security, and tenant screening processes, seeking reliable residents. By verifying residency history and cross-referencing identities, this trace helps in mitigating risks associated with hiring or renting to individuals who might have a less-than-transparent history. Simply put, it ensures everyone knows who’s sitting on the other side of the table.

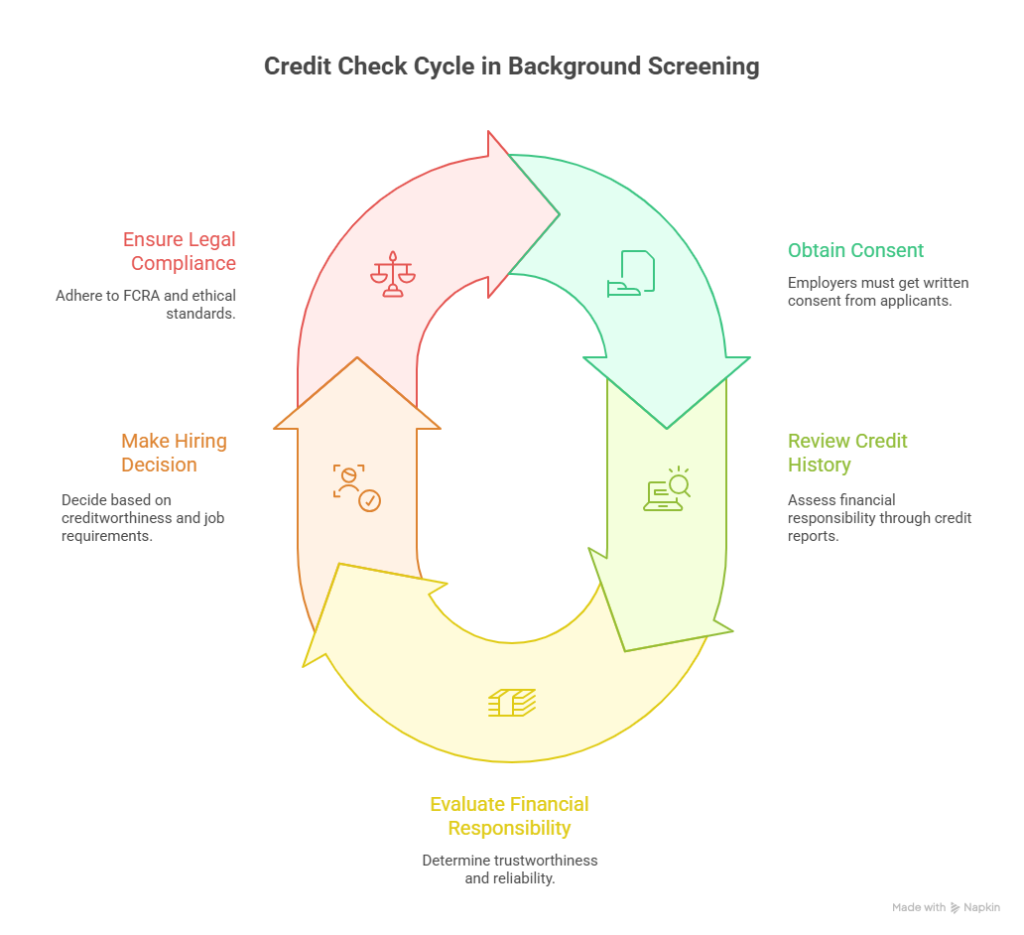

Credit Checks in Background Screening

In the realm of job applications and tenant evaluations, credit checks often serve as a litmus test for assessing financial responsibility. Essentially, a credit check reviews an individual's credit history, highlighting details such as outstanding debts, payment habits, and overall creditworthiness. Employers, particularly in financial roles, use this tool to gauge trustworthiness and predict how well a potential hire might handle financial responsibilities. Similarly, landlords leverage credit checks to assess a tenant's ability to reliably pay rent.

While many sectors make use of credit history, industries like retail and technology pay particular attention. Retail positions involving management of funds or expensive inventory and tech roles with access to sensitive data might prompt a deeper dive into an applicant's financial past. However, it's important to note that credit check practices aren't universally embraced across all fields, as some argue they can unintentionally penalize individuals recovering from financial setbacks unrelated to their professional capabilities.

Legally, the use of credit checks in hiring is governed by the Fair Credit Reporting Act (FCRA), which mandates that employers secure written consent from applicants before accessing credit reports. It's crucial for companies to understand compliance requirements, ensuring transparency and maintaining ethical standards throughout the hiring process. Navigating these checks responsibly not only abides by legal expectations but also fosters a fair and balanced assessment of candidates.

Navigating SSN Trace and Credit Checks in Various Contexts

When it comes to background checks, navigating the nuances of SSN traces and credit checks requires a tailored approach based on the specific needs of your organization. It's more than just ticking boxes; it's a matter of taking decisions that impact the lives and destinies of real people. Every name on a report represents a different story, and as experts we owe them a duty of diligence and of sensitivity in the course we follow.

Background Checks for Small Businesses

Small businesses face unique challenges when it comes to background checks. Limited budgets and resources make it crucial to focus on high-impact checks like SSN traces and credit evaluations when relevant. Start by assessing the roles where financial handling or sensitive information access is involved, as credit checks can provide insight into an individual's responsibility and trustworthiness. Develop a clear process that complies with legal standards, and ensure you have consent before proceeding with checks. This will help mitigate hiring risks without overwhelming your operational capacity.

Specifics for Non-Profit Background Checks

For non-profits, where the workforce often includes a mix of staff and volunteers, background checks ensure safety and integrity. SSN traces are invaluable for verifying identities and uncovering any address discrepancies that might indicate fraud. While non-profits are typically more restricted in budget, prioritizing checks for roles involving vulnerable populations or financial tasks is critical. Customizing the depth of checks according to the role can maintain volunteer engagement while upholding organizational safety standards.

Tenant Screening Considerations

In the realm of tenant screening, SSN traces and credit checks form the backbone of a thorough evaluation process. Landlords use these tools to verify identity, confirm rental history, and assess financial stability. An SSN trace helps uncover aliases that could signal identity fraud efforts, while the credit check provides snapshots of financial habits, like bill payment reliability, crucial for determining rental suitability. Balancing these checks with fair housing laws is essential, ensuring decisions are both informed and equitable.

Beyond SSN Trace and Credit Checks

Background checks aren't just about confirming identity or financial history. Drug tests form another component, serving as a gatekeeper in industries where safety is pivotal. But do they always accompany background checks? It depends. In sectors like transportation, healthcare, and manufacturing, drug tests are routine due to stringent safety standards. Employers in these fields rely on drug testing to prevent liability and ensure a safe working environment.

For non-CDL drivers, a DOT (Department of Transportation) physical might include a drug test. These tests ensure drivers are fit for duty, addressing both health and substance use. Not every employer requires this, but where compliance and safety intersect, you can bet they will. The bottom line: together with SSN traces and credit checks, drug tests form a triad in background screening, each addressing a unique risk but ultimately working towards the same goal—minimizing uncertainties in hiring decisions.

Common Questions About Background Checks

Background Check for Self

If you're curious about what others see when they run a background check on you, consider performing a self-check. This proactive step can help you spot inaccuracies and get ahead of potential issues. Several online services offer self-check options, allowing you to review your criminal records, credit history, and more. By knowing what's on your record, you can address errors and prepare explanations for any blemishes that might concern a future employer or landlord.

What Does Disposition Mean on a Background Check?

You might see the term "disposition" pop up in your background check and wonder what it signifies. Simply put, it refers to the final outcome of a criminal case. This can include results like "convicted," "dismissed," or "not guilty." Understanding these legal lingo nuances is crucial, as they directly impact how an employer perceives your past. If a disposition doesn't reflect what you know to be true, it might be worth digging deeper to ensure your record accurately represents your history.

Will a DUI Come Up on a Background Check?

Worried about a DUI lurking in your past? It's a common concern, and the answer largely depends on the type of background check being run. In general, DUIs will appear on criminal record checks, especially if a position involves driving responsibilities. If you have a DUI on your record, it might help to be upfront about it when appropriate. Employers appreciate honesty and may value your transparency as a sign of trustworthiness, turning a potential red flag into a manageable concern.

Practical Tips for Conducting Effective Background Checks

When you're knee-deep in resumes and interviews, the last thing you want is a cumbersome background check process slowing you down. Here’s how to integrate SSN trace and credit checks without breaking your stride. First, streamline your process by using reliable screening tools. Choose services that will spit out easy-to-read reports without a cryptic manual needed.

Next, keep it legal. Make sure your process complies with the Fair Credit Reporting Act (FCRA). This means getting explicit consent from candidates before diving into their credit history or running traces on their SSN. Remember, sneaky maneuvers lead to legal snafus.

Timing is critical. Run these checks post-interview and pre-job offer to avoid unnecessary expense and delay. Tackling background checks after you've narrowed down your top contenders can save time and energy, ensuring you're not sifting through reports for every Jane and Joe who applied.

Lastly, maintain transparency. Let your candidates know what to expect. If there's a hiccup, like an erroneous credit mark, give them a chance to explain or correct. This fosters goodwill and can reveal character insights valuable to your hiring decision. Keep it swift, legal, and open, and your background checks will serve as a sturdy first line of defense in your hiring arsenal.

Conclusion

Navigating the intricacies of SSN trace and credit checks is crucial for anyone involved in hiring, renting, or job seeking. We've covered the fundamental aspects, from understanding what these checks entail to exploring their role across various industries. For employers, leveraging these tools can help ensure that hiring decisions are both informed and compliant with legal standards. Job seekers should be aware of these processes to better prepare themselves and address any discrepancies proactively.

Ultimately, whether you're a business or an individual, due diligence is key. Thorough background checks foster transparency and trust, reducing risks associated with employment or tenancy decisions. By staying informed and attentive to these practices, you can protect your interests and ensure that every decision is a step toward a secure and successful future.

Additional Resources

- What Does an Employment Background Check Show?

- SSN Trace in Background Checks: What Employers and Applicants Should Know

- SSN Trace Background Checks: How They Work and Why They Matter

- SSN Trace and Credit Checks: Understanding the Connection

- Non-Profit Background Checks: How to Vet Volunteers Safely

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.