Navigating the complex world of background checks can be daunting, especially for those managing the daunting task of hiring. The good news? There are effective ways to keep those background check prices in check. This guide dives into the intricacies of background check costs and equips you with actionable strategies to manage and optimize them. Whether you're concerned about the overall background check price or specific factors influencing it, we've got you covered.

Key Takeaways

- Comprehensive background checks are crucial in avoiding costly hiring mistakes, but understanding their complex pricing structures is critical to efficient budgeting.

- Background check costs vary based on factors such as the type of check, geographic scope, database fees, turnaround time, and the volume of checks ordered.

- Hidden fees, upselling tactics, choosing national over county searches, and complexities in verification are common pitfalls that can unexpectedly inflate costs.

- Optimizing costs involves defining your specific needs, comparing itemized quotes, leveraging technology, and considering bundled packages for better rates.

- Choosing the right background check provider requires evaluating its accuracy, compliance with regulations, customer support, data security, and ability to balance speed with thoroughness.

Introduction

Did you know that the average bad hire can cost an employer up to $240,000 in hiring, compensation, and retention expenses? Comprehensive background checks are critical in safeguarding your business from costly mistakes. Yet, the challenge lies in understanding the labyrinthine pricing structure of background checks. Varying components and opaque fee structures make it difficult to budget effectively. Fear not! This article is your go-to guide for demystifying background check costs and uncovering ways to manage them efficiently. Designed for HR professionals, business owners, and hiring managers eager to optimize their background screening processes, this guide is your roadmap to more innovative, cost-effective hiring. Clearer insight leads to smarter decisions, and that starts with knowing exactly what you're paying for. Let’s break down the numbers—so your next great hire doesn’t come with a hidden price tag.

EXPERT INSIGHT: Behind every successful hire is a decision built on trust, clarity, and due diligence. In HR, I've seen how surprise costs for background checks can significantly affect budgets and reputations if not clearly disclosed up front. That is why I advocate for transparency—not only in what information we gather but also in how we pay for it. When we come to fully understand what our spending is about, we are better able to protect our organizations, those individuals looking for a job, and our hiring processes' integrity. A careful screening goes beyond technicality. - Charm Paz, CHRP

Understanding Background Check Costs

Navigating background check costs can feel like assembling a puzzle without a reference image. The good news is that once you know the key pieces, understanding the cost structure is more straightforward than it seems.

What Factors Influence Pricing?

Several components contribute to the cost of a background check, each influencing the bottom line in different ways:

- Types of Checks: Think of this like ordering off a menu. Are you after a basic criminal check, or do you need employment, education, and credit checks, too? Each adds to the tab and has its own price point.

- Geographic Scope: Local, state, national, or international—each level adds complexity and cost. County searches might be budget-friendly, but broaden the scope, and you'll see prices rise.

- Database Access Fees: Imagine each database as a toll booth. Want access to influential records? It’ll cost you, depending on exclusivity and the comprehensiveness of the data.

- Turnaround Time: Do you need it fast? Speed often comes at a price. Express results cost more, while waiting longer can save some cash.

- Volume of Checks: Bulk requests can be your friend. Ordering in high volume may unlock discounts and favorable rates.

- Provider Fees: Different providers have different price tags. Expect charges for setup, ongoing service, and per-check costs. Knowing these helps prevent sticker shock.

Typical Price Ranges

Are you curious about specific numbers? Here’s a quick breakdown of typical costs:

- Basic Criminal Check: Expect to spend anywhere from $20 to $50.

- Standard Employment Verification: Typically runs you about $10 to $25.

- Comprehensive Background Check Package: These bundles can range from $75 to upwards of $200.

Free vs. Paid Options

The allure of free resources can be strong but beware of limitations. Free checks might serve basic needs but lack depth and reliability. Investing in paid services is often a wise choice for robust, compliant checks. For more on legal standards, check out the EEOC's guidance on background checks.

Understanding these factors helps you anticipate costs and better plan your budget. This knowledge empowers you to select the correct checks for your business needs while keeping expenses in check.

Common Background Check Pricing Pitfalls

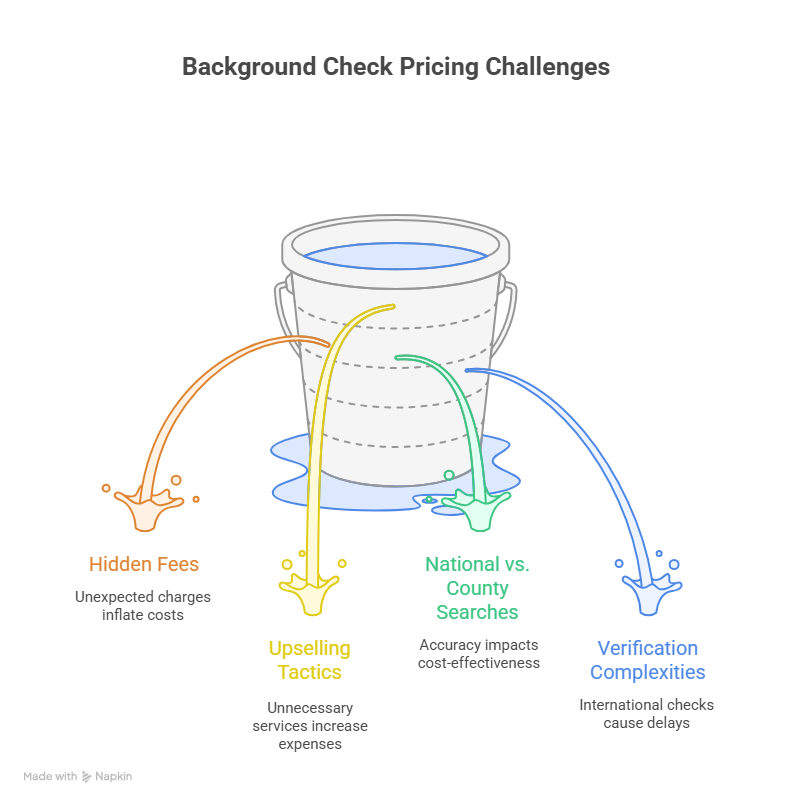

Navigating the background check landscape can feel like walking through a minefield of costs where each step could trigger an unexpected expense. Let's break down some common pitfalls to watch out for:

Hidden Fees

When you think you've nailed down a deal, hidden fees can blindside you. These might sneak up in the form of access fees to specific databases, sudden setup charges, or even pesky cancellation fees should you choose to change providers. Constantly scrutinize the fine print and ask upfront about potential hidden costs to avoid unpleasant surprise charges.

Upselling Tactics

Background check providers are no strangers to upselling, often nudging clients toward additional services. While it might seem like a good idea, overloading your package with unnecessary checks can quickly balloon expenses with minimal gain. Maintain a clear vision of your essential needs and resist the allure of fluff that doesn't add value.

National vs. County Searches

It’s tempting to rely solely on national databases for their apparent convenience and comprehensive reach. However, these databases are not always up-to-date or exhaustive. Although potentially more costly and time-consuming, county searches tend to provide more detailed and current information. Understanding this trade-off is crucial to ensure both accuracy and cost-effectiveness.

Verification Complexities

Verifying past employment and education can be straightforward—until it isn’t. International checks, language barriers, and defunct businesses create verification headaches and can lead to delays or additional fees. Anticipate these challenges and discuss them with your provider to evaluate any potential impact on costs or timelines, ensuring you are neither caught off guard nor paying more than necessary.

Strategies for Optimizing Background Check Costs

Efficient management of background check expenses starts with understanding your specific needs. Instead of a one-size-fits-all approach, tailor your checks to match the requirements of each position. Break down the job's key responsibilities and necessary qualifications and focus on checks that align with these criteria. For example, financial checks are more relevant for positions involving fiscal responsibilities, while driving record checks might be crucial for roles that require operating a company vehicle.

Once you pinpoint what's essential, contact various providers and request detailed, itemized quotes. This transparency allows you to compare apples to apples—or find out if someone is sneaking in an extra fee labeled "fruit inspection." Understanding each line item and its necessity can facilitate negotiation with providers to obtain better rates, especially if your hiring volume is substantial. Don’t avoid playing the volume card; providers often offer discounts for bulk requests.

Bundled packages are another area to explore. Many providers offer comprehensive packages at lower rates than purchasing each check separately. Make sure to analyze whether these packages meet your needs or include unnecessary checks.

Technology is your friend. Implementing automated systems and online platforms can streamline the background check process, leading to lower costs in both time and money. These tools often speed up the procedure and reduce errors, ensuring you only pay for the most relevant checks without redoing them due to inaccuracies.

By clearly defining your needs, scrutinizing quotes, and leveraging technology, you'll be well on your way to keeping background check costs in check.

Choosing the Right Background Check Provider

When selecting a background check provider, looking beyond just the price tag is crucial. Here’s what to keep an eye on:

- Accuracy and Reliability: Ensure the provider delivers precise and trustworthy information. A cheap service isn’t a bargain if the data is incorrect or outdated. Always ask how often their databases are updated and what sources they use.

- Compliance with FCRA Regulations: The Fair Credit Reporting Act (FCRA) sets strict guidelines for background checks. Verify the provider complies with these legal standards to avoid potential lawsuits and penalties.

- Customer Support: Assess the quality of their customer service. Good providers offer robust support and can assist you with any questions or issues during the screening process.

- Data Security: With sensitive data at play, ensuring a provider has robust security measures is non-negotiable. Inquire about their data protection protocols to safeguard the applicant's personal information.

- Turnaround Time: Speed matters but shouldn’t compromise quality. Find out how quickly they can turn around a report without cutting corners, balancing urgency and thoroughness.

When you’ve narrowed down options, arm yourself with a checklist of essential questions to ask potential providers:

- What is your error rate?

- How do you ensure data accuracy and up-to-date records?

- Can you detail your compliance practices with FCRA and other relevant laws?

- What layers of data protection do you have in place?

- How do you handle customer inquiries and support?

- Can you provide case studies or references from similar clients?

Choosing the right provider is more than ticking boxes—it involves finding a trustworthy partner who can reliably, legally, and securely deliver crucial information.

Conclusion

We've navigated the intricate world of background check costs and uncovered strategies to help you manage them effectively. From understanding pricing structures to choosing the right provider, you've gained insight into preventing unnecessary expenses while ensuring thorough screenings.

It's time to implement these tips. Define your specific needs, request detailed quotes, and don't hesitate to negotiate terms. Consider bundled packages and leverage technology to streamline your processes. By doing so, you'll not only save money but also improve your hiring efficiency.

Start implementing these strategies today and transform how your organization handles background checks. Every smart move you make is a step towards safeguarding your business against costly hiring mistakes.

Frequently Asked Questions

How much does a US background check cost?

The cost of a US background check can vary widely depending on the type and depth of the check. Basic checks can range from $10 to $50, while more comprehensive checks can cost anywhere from $100 to $200.

How much does a level 2 background check cost?

A level 2 background check, typically includes fingerprinting and a more thorough review, can cost between $50 and $100. Prices may vary depending on the state and the service provider.

How much is the most expensive background check?

The most expensive background checks are usually international checks or highly comprehensive investigations that can include in-depth criminal records, financial history, and other detailed personal information. Depending on the scope and complexity, these can cost $500 or more.

What are the different types of background checks?

Standard background checks include criminal history checks, employment verification, education verification, credit history checks, and driving record checks. The type of check conducted often depends on the purpose, such as employment or housing.

How long does it take to complete a background check?

The time it takes to complete a background check can range from a few minutes to several weeks. Basic checks may be completed almost instantly, while more thorough checks, including international ones, may take days or weeks to process.

Why are background checks necessary?

Background checks are essential because they help employers, landlords, and others verify individuals' identities and credibility. They can reveal potential risks and help make informed decisions, protecting people and assets.

Are background checks always accurate?

While background checks are generally accurate, errors can occur due to outdated information, identity confusion, or clerical mistakes. Individuals need to review their background check reports and dispute any inaccuracies.

Can someone perform a background check on themselves?

Yes, individuals can perform a background check on themselves. Doing so can help them prepare for what potential employers or other entities might find and allow them to address any discrepancies or inaccuracies in advance.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.