Hiring the right employees is crucial for any business, but it holds even more significance for small businesses, where each member plays a pivotal role. Employee background checks are a powerful tool in ensuring that you hire trustworthy and competent individuals. This guide will walk you through the process of conducting background checks, address common concerns job seekers might have, and highlight useful resources to make the process smoother.

Key Takeaways

- Risk Mitigation: Employee background checks help identify potential risks such as criminal history and falsified credentials.

- Enhanced Workplace Safety: Insights from background checks can prevent hiring individuals who may pose safety risks to the team.

- Regulatory Compliance: Background checks are often legally required in certain industries to meet regulatory standards.

- Improved Hiring Decisions: Valuable information from background checks aids in making informed hiring decisions, reducing turnover and fostering reliability.

- Thorough Candidate Profiling: Comprehensive background checks build detailed profiles of candidates to ensure they are suitable for the role and minimize risks for the business.

Why Are Employee Background Checks Important for Small Businesses?

Employee background checks play a crucial role in the hiring process for small businesses. Here’s why they are essential:

- Risk Mitigation: They help identify any potential risks, such as criminal history or falsified credentials.

- Enhanced Workplace Safety: Having insights into your employees’ backgrounds can prevent hiring individuals who might pose a safety risk to your team.

- Regulatory Compliance: For certain industries, background checks are legally required to meet regulatory standards.

- Improved Hiring Decisions: They provide valuable information that aids in making informed hiring choices, reducing employee turnover and fostering a more reliable workforce.

Making the hiring selection is one of several elements that will determine a small business's destiny. As an HR professional, I have personally witnessed how employee background checks are an essential part of creating a reliable, capable team. In today's fast-paced corporate world, they help reduce risks, improve worker safety, and make sure that you are in compliance with the law. Above all, these checks serve as a means of ensuring that you are hiring individuals who share your company's values and objectives, creating an environment where everyone can grow and succeed.

What Are Employee Background Checks?

Employee background checks comprehensively review a candidate's history and qualifications. They typically include:

- Criminal Record Check: This part of the background check reveals past convictions or criminal behavior. It's essential for maintaining workplace safety and avoiding potential liabilities.

- Employment Verification: This step confirms the candidate’s past employment history and job roles. It's crucial for validating the experience and competencies mentioned on the resume.

- Education Verification: Here, the candidate's educational qualifications and degrees are verified. This ensures that the person has the necessary academic credentials for the role.

- Credit Check: Sometimes used for roles that involve financial responsibilities, credit checks can highlight fiscal reliability and any potential issues that might be relevant to the job.

- Reference Checks: Contacting previous employers or personal references offers insights into the candidate’s reliability and performance. These references can provide a more personal evaluation of a candidate's work ethic and character.

Each component aims to construct a detailed profile of the candidate, establishing their suitability for the role and minimizing risks for your business.

How to Conduct Employee Background Checks for Your Small Business

Step 1: Define the Scope of the Background Check

Your first move is to determine exactly which types of background checks are relevant for the role you're hiring for. A broad scope might not always be necessary, and a targeted approach can help you focus on what's important.

- Criminal Records: Essential for roles involving security, financial duties, or working with vulnerable populations.

- Credit History: Important for positions with financial responsibilities, such as handling cash or managing accounts.

- Employment Verification: Critical for verifying past job roles and durations, ensuring the candidate's experience matches their resume.

- Education Verification: Necessary for roles that require specific degrees or certifications.

- Reference Checks: Useful for gaining insights into a candidate’s work ethics and reliability.

Before proceeding, consult with legal counsel or an HR professional. This ensures you stay compliant with local, state, and federal regulations. Being well-versed in laws like the Fair Credit Reporting Act (FCRA) can save you from legal pitfalls and reinforces a transparent hiring process. Keep in mind that overreaching in your background checks can lead to privacy issues or accusations of discrimination. By clearly defining the scope, you respect the candidate's rights while still protecting your business interests.

Step 2: Obtain Consent from the Candidate

Before diving into someone’s history, it’s crucial to get their permission. Inform your candidate upfront that a background check is part of your hiring process. Be straightforward and clear about what you’re going to check and why you’re checking it.

Here’s how to do it:

- Communicate Transparently: As soon as the candidate reaches the interview stage, let them know that you’ll be conducting a background check. Ensure they understand which aspects (like criminal records or employment history) you’ll be reviewing.

- Written Consent: Obtain a signed consent form. This isn’t just a courtesy; it’s a legal requirement under the Fair Credit Reporting Act (FCRA). The form should specify the types of checks and the purpose behind them. Clear language is key: avoid legal jargon that might confuse the candidate.

- Answer Questions: Candidates might have concerns or questions about the process. Be ready to explain and reassure them that the information will be treated confidentially and used solely for hiring purposes.

By obtaining consent, you respect the candidate’s privacy and keep your hiring process transparent, efficient, and compliant.

Step 3: Choose a Reliable Background Check Service

- Research and Compare: Begin by researching various background check services. Read reviews, check for accreditations, and compare their offerings. Key aspects to look for include the range of checks they provide, turnaround time, pricing, and customer support.

- Look for Comprehensive Services: Opt for a service that offers comprehensive checks, including criminal record checks, employment and education verification, credit history, and reference checks. A thorough service will save time and provide a more detailed understanding of your candidates.

- Evaluate Cost vs. Quality: While it's essential to consider cost, don't sacrifice quality for a lower price. Reliable background checks can prevent future issues that may arise from hiring the wrong person. Find a balance where the service is cost-effective but also thorough and accurate.

- Check Compliance: Ensure the service adheres to the Fair Credit Reporting Act (FCRA) and other relevant laws. This compliance is crucial to avoid legal issues and ensure the background checks are performed legally and ethically.

- User-Friendly Interface: Select a service with an easy-to-use platform. A user-friendly interface can streamline the process and make it easier for you to request and review checks.

- Customer Support: Reliable customer support ensures you can address any issues or questions swiftly. Opt for services known for responsive and helpful customer support, as this can be invaluable in navigating any difficulties.

Choosing the right background check service sets the foundation for a smooth, compliant, and thorough screening process. This step is critical in making informed hiring decisions, so invest the time and resources to select the best service for your small business needs.

Step 4: Conduct the Background Check

- Use the Background Check Service: Once you've selected a reliable background check service, initiate the process. Provide the necessary information about the candidate, ensuring that all data entered is accurate and complete. This will facilitate a smoother and quicker background check.

- Monitor the Process: Keep an eye on the progress through the service’s platform. Most services offer a dashboard where you can track which checks have been completed and which are still pending. Timely follow-up can help expedite the process.

- Review the Results Carefully: When the results come in, go through them meticulously. Look for any discrepancies or red flags such as inconsistencies in employment history, unverified education credentials, or a criminal record. These findings should be weighed carefully, keeping in mind the nature of the job and the level of risk the candidate might pose.

- Contextualize Red Flags: Not all red flags are deal-breakers. For instance, a minor criminal offense from a decade ago may not be relevant, especially if the candidate has shown a stable work history since then. On the other hand, recent or relevant issues, like a financial fraud conviction for an accounting role, should be taken more seriously.

- Document Your Review Process: Make notes on what was found and the conclusions you draw. This can be crucial for transparency and for making an informed decision later on. Ensure that this documentation complies with privacy laws and is securely stored.

Taking these steps will help you conduct thorough and fair background checks, guiding you to make well-informed hiring decisions for your small business.

Step 5: Make an Informed Hiring Decision

Once you've gathered all the background check results, it's time to weigh them against your hiring criteria. Remember, a background check is one piece of the puzzle—it should complement your assessments from interviews, skills tests, and reference checks.

Analyze any red flags or discrepancies meticulously. For instance, a minor legal issue from years ago might not be relevant to the role, but consistent discrepancies in employment history can signal a reliability issue.

If you find something concerning, consider the context. Was it a one-time incident or part of a pattern? Does it have a direct impact on job performance or safety? Make sure your decision is fair and consistent. Document your rationale, especially if deciding not to proceed with a hire based on the background check results.

Consistency is key to avoiding any discrimination claims. Apply the same criteria and standards to all candidates. An organized and transparent hiring process will not only help you find the best fit but also protect you legally.

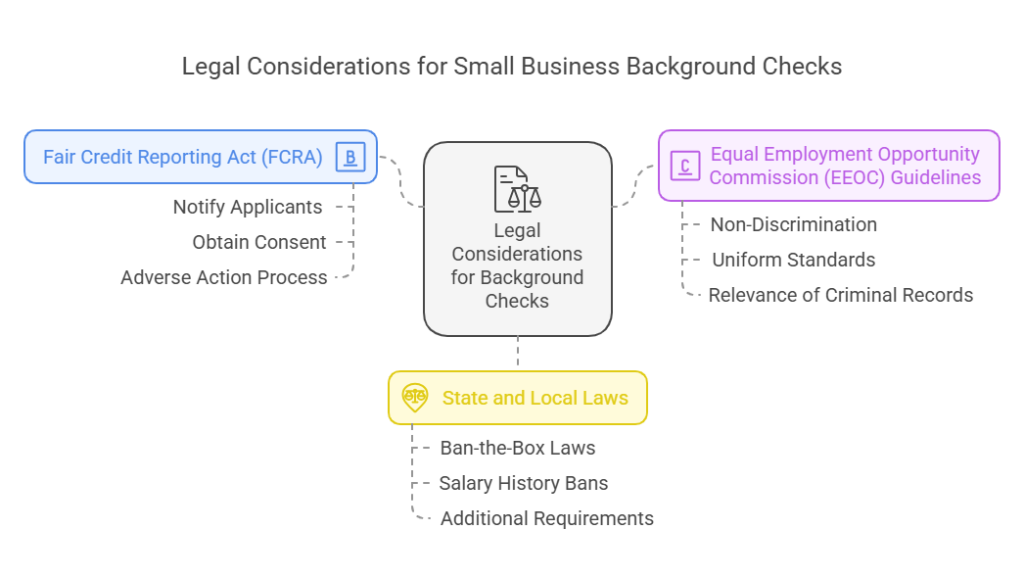

Legal Considerations for Small Business Background Checks

When conducting background checks, small business owners must navigate a web of legal requirements to ensure compliance and avoid potential pitfalls. Here’s a breakdown of key legal considerations:

Fair Credit Reporting Act (FCRA)

The FCRA governs the use of consumer reports, including background checks. As an employer, you must:

- Notify applicants in writing that a background check will be conducted.

- Obtain explicit, written consent from the candidate.

- If you decide not to hire based on the background check, provide the candidate with a copy of the report and a summary of their rights under the FCRA.

- Follow a specific process for adverse action decisions, which includes giving candidates a chance to dispute any inaccuracies in the report.

Equal Employment Opportunity Commission (EEOC) Guidelines

The EEOC enforces federal laws that make it illegal to discriminate against a job applicant. Employers must:

- Ensure that background checks do not disproportionately affect certain groups based on race, color, national origin, sex, or religion.

- Apply the same standards for background checks to all applicants, regardless of their background.

- According to EEOC guidelines, avoid blanket policies that exclude candidates with criminal records and instead consider the nature of the crime, the time that has passed, and its relevance to the job.

State and Local Laws

Regulations can vary significantly by state and locality. Key points include:

- Ban-the-Box Laws: Some jurisdictions prohibit employers from asking about criminal history on job applications. These laws are designed to ensure that candidates have a fair chance to present their qualifications before being judged on their criminal records.

- Salary History Bans: In certain areas, it’s illegal to inquire about a candidate’s previous salaries. This aims to promote fair wages by preventing historical pay disparities from influencing new compensation offers.

- Additional Requirements: Be attentive to other state-specific mandates, such as additional disclosures or consent forms, and specific timeframes for conducting certain types of checks.

Navigating these legal waters requires due diligence. Consulting legal counsel or an HR professional can be invaluable in ensuring your background check processes are legally sound. Ignoring these considerations can expose your business to lawsuits, penalties, and damage to your reputation. Make compliance a cornerstone of your hiring strategy to build a trustworthy and legally compliant workforce.

Common Questions Job Seekers Have About Background Checks

What Information Will Employers Look For?

Employers typically delve into various aspects of your past to gauge your suitability for the job. Common checks include:

- Criminal Records: Whether you've had any convictions or legal issues.

- Employment History: Verification of past job titles, companies, and duration of employment.

- Education Verification: Confirmation of your academic qualifications and degrees.

- Credit History: This can be especially relevant for roles involving financial responsibilities.

- References: Employer or personal recommendations to provide insight into your work ethic and reliability.

Can Background Checks Affect Job Offers?

Absolutely. The influence of a background check on a job offer hinges on the type of job and the nature of the findings. For instance, a criminal record might not matter much for a desk job but could be a dealbreaker for positions in childcare or finance. The key is context and the relevance of the findings.

What Can Job Seekers Do To Prepare?

Preparation is your best defense. Here are some steps to take:

- Be Honest: Always represent your qualifications and history accurately. Lying can be more detrimental than any negative findings.

- Review Your Records: Check your own employment records, and ensure your credit report is accurate.

- Inform References: Give your references a heads-up that they might be contacted. This helps them prepare thoughtful responses.

How Long Does a Background Check Take?

The duration of a background check can vary. Typically, it takes anywhere from a few days to a week. However, more detailed checks may extend this timeframe.

Frequently Asked Questions (FAQs)

How do small businesses handle background checks?

Small businesses typically handle background checks by hiring third-party services that specialize in screening candidates. These services conduct comprehensive checks, including criminal history, employment verification, and educational background. Alternatively, some small businesses might use online platforms that offer quick and affordable background check solutions.

What type of background checks should small businesses use?

Small businesses should use a combination of the following background checks:

- Criminal history: Verifies past criminal records.

- Employment verification: Confirms previous job history.

- Education verification: Ensures academic credentials are valid.

- Credit history: Useful for financial positions.

- Reference checks: Contacts previous employers or references.

- Social media checks: Reviews public online presence.

How much does a background check cost for small businesses?

Background check costs for small businesses vary based on the depth of the screening. Prices can range from $20 to $100 per check. Basic checks are cheaper, while more comprehensive checks that include multiple screenings (criminal, employment, education) can be more expensive. Some services offer bulk pricing discounts for small businesses.

Can a small business do background checks in-house?

Yes, a small business can perform background checks in-house, but it requires compliance with legal regulations such as the Fair Credit Reporting Act (FCRA). In-house checks may involve:

- Criminal records: Accessing public databases.

- Employment verification: Contacting past employers.

- Education verification: Confirming with educational institutions.

However, using a third-party service can be more reliable and time-saving.

What is included in a pre-employment background check?

A pre-employment background check typically includes:

- Criminal history: Searches for any past criminal activities.

- Employment verification: Confirms job titles, dates of employment, and reasons for leaving.

- Education verification: Verifies degrees and certifications.

- Credit history: Reviews financial behavior and credit score.

- Reference checks: Gathers insights from professional references.

- Social media review: Assesses the candidate's public online activity.

Conclusion

Professional Background Check Services

When navigating the background check process, professional services can be a vital ally. These services specialize in conducting thorough, legally compliant background checks, offering a range of options from criminal record searches to education verification. Using a reputable service ensures that all necessary checks are covered and done accurately.

Legal Consultants

Small businesses might not have the in-house expertise to fully understand the complex legal landscape surrounding background checks. That's where legal consultants like GCheck can come in. They can provide advice on compliance with federal laws like the Fair Credit Reporting Act (FCRA) and Equal Employment Opportunity Commission (EEOC) guidelines, as well as the specific regulations applicable in your state or locality. Engaging a legal consultant helps integrate background checks smoothly into your hiring process while mitigating the risk of legal pitfalls.

HR Software with Background Check Integration

Many modern HR software platforms, such as BambooHR, Workable, or Gusto, offer integrated background check functionalities. This can simplify the hiring process by consolidating all candidate information in one place and ensuring that background checks are a seamless part of your workflow.

Local Business Resources

Sometimes, the best resources are within your community. Local business associations, chambers of commerce, and small business development centers often provide workshops, webinars, and guides on best hiring practices, including how to conduct background checks.

By leveraging these resources, small businesses can navigate the complexities of employee background checks more effectively, ensuring they build a reliable and competent team.

Successfully conducting employee background checks for small businesses helps mitigate risks, ensures regulatory compliance, and promotes a safe and productive workplace. By understanding the process, legal considerations, and preparing adequately, small business owners can make informed decisions, and job seekers can better understand what to expect.

Background checks are a tool for better hiring, not a hurdle. Use them wisely to build a trustworthy, competent team that contributes positively to your small business. Taking the time to thoroughly vet potential employees can save your business from a host of issues, from legal troubles to workplace disruptions.

At the end of the day, a methodical approach to background checks can pave the way for a harmonious work environment and sustained business success.

Resources

- U.S. Equal Employment Opportunity Commission. (n.d.). Background Checks: What Employers Need to Know. Retrieved from https://www.eeoc.gov/laws/guidance/background-checks-what-employers-need-know

- Federal Trade Commission. (n.d.). Using Consumer Reports: What Employers Need to Know. Retrieved from https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know

- Society for Human Resource Management. (2020). Best Practices for Conducting Pre-Employment Background Checks. Retrieved from https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/preemploymentbackgroundchecks.aspx

- National Conference of State Legislatures. (2020). The Use of Background Checks in Hiring Decisions. Retrieved from https://www.ncsl.org/research/labor-and-employment/background-checks-in-hiring.aspx

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.