Chapter 7 and Chapter 13 bankruptcies both appear on employment background checks through credit reports and public records searches. However, they impact job seekers differently based on timing, industry, and employer policies. While Chapter 7 cases typically resolve within 3-6 months and remain on credit reports for 10 years, Chapter 13 cases involve 3-5 year repayment plans but are removed from credit reports after 7 years, potentially making Chapter 13 less detrimental for long-term employment prospects in 2025.

Key Takeaways

- Both bankruptcy types appear on background checks through credit reports and public records, but Chapter 13 may be viewed more favorably by employers due to its repayment structure.

- Chapter 7 bankruptcies remain on credit reports for 10 years, while Chapter 13 cases are removed after 7 years, affecting long-term employment screening results.

- Industries with financial responsibilities (banking, insurance, accounting) conduct more thorough bankruptcy screenings than other sectors.

- Active Chapter 13 repayment plans demonstrate financial responsibility to employers, potentially offsetting negative perceptions compared to Chapter 7 discharges.

- State and local laws may limit how employers can use bankruptcy information in hiring decisions, with some jurisdictions prohibiting discrimination based solely on bankruptcy status.

- Timing matters significantly â recent bankruptcies have greater impact on employment screening than older cases, regardless of chapter type.

Understanding Bankruptcy Types in Employment Screening

Chapter 7 and Chapter 13 bankruptcies create different impacts during employment background checks. Chapter 7, known as liquidation bankruptcy, typically concludes within 3-6 months. This process results in the discharge of most unsecured debts. Chapter 13, called reorganization bankruptcy, involves a court-approved repayment plan lasting 3-5 years. This option allows debtors to keep their assets while gradually paying creditors.

Employment background checks detect both bankruptcy types through multiple data sources. Credit reports from Experian, Equifax, and TransUnion contain bankruptcy records as public information. Additionally, specialized background check companies access federal court databases where bankruptcy cases are filed and maintained. The Fair Credit Reporting Act (FCRA) governs how this information can be collected and used in employment decisions. These regulations protect job seekers while allowing employers to make informed hiring choices.

The distinction between Chapter 7 vs Chapter 13 background check results lies primarily in employer interpretation. Chapter 13 cases often reflect a debtor's commitment to repaying obligations. This approach potentially creates a more favorable impression than Chapter 7's asset liquidation method. However, both types appear prominently in comprehensive employment screenings, particularly for positions involving financial responsibilities or security clearances. Modern background check systems in 2025 provide detailed information about bankruptcy status, payment progress, and resolution timelines.

Chapter 7 Bankruptcy Detection and Timeline

Chapter 7 bankruptcy cases appear on employment background checks through multiple detection methods throughout 2025. Credit reporting agencies receive automatic notifications when federal bankruptcy courts file new cases. These updates typically occur within 30-60 days of the initial filing. Background check companies also access PACER (Public Access to Court Electronic Records) and other federal databases. This multi-source approach ensures comprehensive detection of recent bankruptcy activity that may not yet appear on standard credit reports.

The Chapter 7 employment background check timeline follows a predictable pattern throughout the case lifecycle. During the initial filing period, employers may detect the case through court records before credit report updates occur. Once the case concludes with discharge (usually 3-6 months), credit reports reflect the completed bankruptcy status. This information remains visible on credit reports for exactly 10 years from the filing date. The visibility continues regardless of when the actual discharge occurred, making long-term career planning essential for affected individuals.

Chapter 13 Background Check Appearance

Active Case Detection Methods

Chapter 13 bankruptcy cases create unique employment screening scenarios due to their extended timeline and repayment structure. Unlike Chapter 7's quick resolution, Chapter 13 cases remain active for 3-5 years while debtors complete court-approved payment plans. This extended period means that does Chapter 13 show up background check searches will reveal active case status rather than completed discharge. Employers often receive detailed information about payment plan progress, monthly payment amounts, and expected completion dates.

Background check companies provide real-time updates on Chapter 13 case status throughout 2025. These reports typically indicate current payment standing, any missed payments, and overall plan compliance. Advanced screening systems now offer automated monitoring services that alert employers to significant changes in bankruptcy case status. This technology ensures that HR departments receive timely updates about employee financial situations when relevant to job responsibilities.

Employer Perception Advantages

The active repayment aspect of Chapter 13 often works favorably for job seekers during employment screening processes. Employers frequently view ongoing Chapter 13 payments as evidence of financial responsibility and commitment to debt resolution. Background check reports typically show payment plan details, providing context about the debtor's current financial management efforts. This transparency often generates more positive employer responses compared to Chapter 7's complete debt elimination approach.

Chapter 13 cases offer better long-term employment prospects due to their shorter credit reporting period. While Chapter 7 bankruptcies remain on credit reports for 10 years, Chapter 13 cases disappear after 7 years from the filing date. This three-year advantage significantly impacts career opportunities in industries that regularly conduct employment credit checks. Furthermore, many employers appreciate the proactive debt management approach that Chapter 13 represents, viewing it as evidence of problem-solving skills and financial maturity.

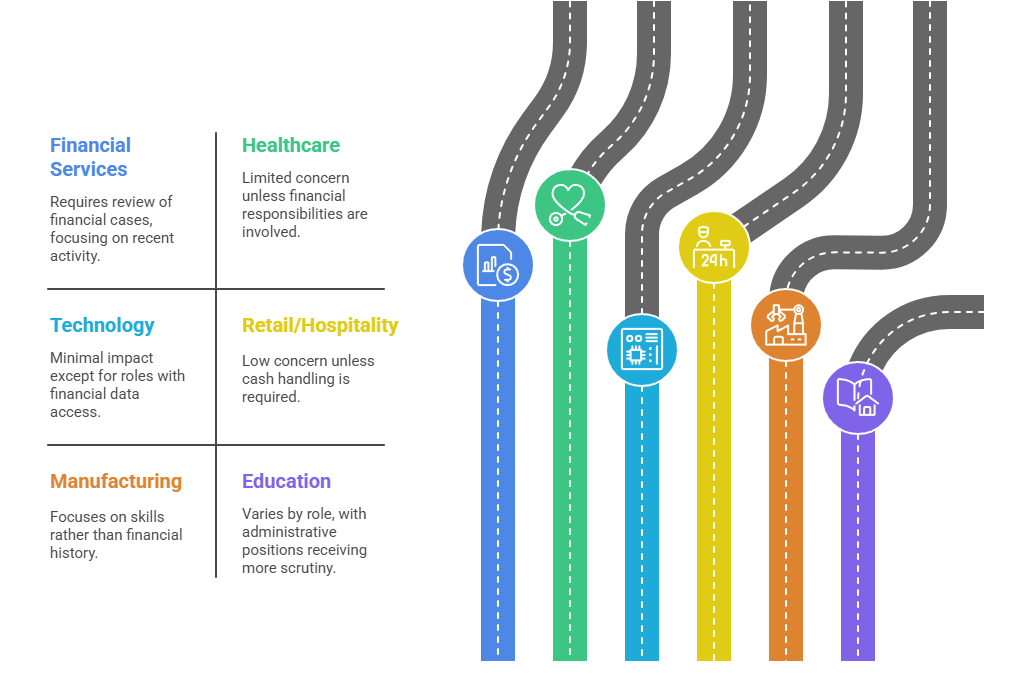

Industry-Specific Bankruptcy Screening Practices

Different industries approach bankruptcy information with varying levels of concern during employment screening in 2025. Financial services, insurance companies, and accounting firms typically view bankruptcy cases as significant considerations. These sectors often have strict policies regarding financial history due to regulatory requirements and fiduciary responsibilities. Government positions, particularly those requiring security clearances, also scrutinize bankruptcy information closely. However, the specific chapter type influences how thoroughly these industries evaluate candidates.

- Financial Services: Comprehensive review of both Chapter 7 and 13 cases with emphasis on recent activity

- Healthcare: Limited concern unless position involves billing, accounting, or financial management responsibilities

- Technology: Minimal impact except for roles involving client financial data or payment processing systems

- Retail/Hospitality: Generally low concern unless position requires cash handling or financial oversight duties

- Manufacturing: Typically focuses on job-relevant skills rather than financial history for most positions

- Education: Varies by institution and role, with administrative positions receiving more scrutiny than teaching roles

The screening intensity also varies based on position level and responsibilities within each industry. Executive positions across all sectors typically undergo more comprehensive background checks that include detailed bankruptcy analysis. Entry-level positions may receive basic credit checks that note bankruptcy presence without extensive investigation. Mid-level management roles often fall somewhere between these extremes, with screening depth depending on specific job duties and company policies.

Side-by-Side Impact Comparison

Chapter 7 and Chapter 13 bankruptcies create distinctly different employment screening profiles that affect job seekers in various ways. The timeline differences alone significantly impact career planning and job search strategies. Chapter 7's quick resolution provides immediate closure but creates longer-lasting credit report visibility. Conversely, Chapter 13's extended timeline demonstrates ongoing financial commitment while offering earlier credit report removal.

| Comparison Factor | Chapter 7 Bankruptcy | Chapter 13 Bankruptcy |

| Credit Report Duration | 10 years from filing | 7 years from filing |

| Case Active Period | 3-6 months typically | 3-5 years payment plan |

| Immediate Employer Perception | Complete debt elimination | Active debt management |

| Long-term Career Impact | Extended visibility period | Earlier record clearing |

| Industry Restrictions | More severe in finance/banking | Fewer long-term limitations |

| Security Clearance Impact | May require detailed explanation | Often viewed as responsible approach |

The employment impact differences extend beyond simple detection timeframes throughout 2025. Chapter 7 cases demonstrate complete debt elimination but may raise concerns about financial judgment and future stability. Chapter 13 cases indicate ongoing financial obligations while showing commitment to repayment and debt resolution. These distinctions become particularly important for positions requiring security clearances, where investigators evaluate both the financial issue and the individual's approach to resolving it.

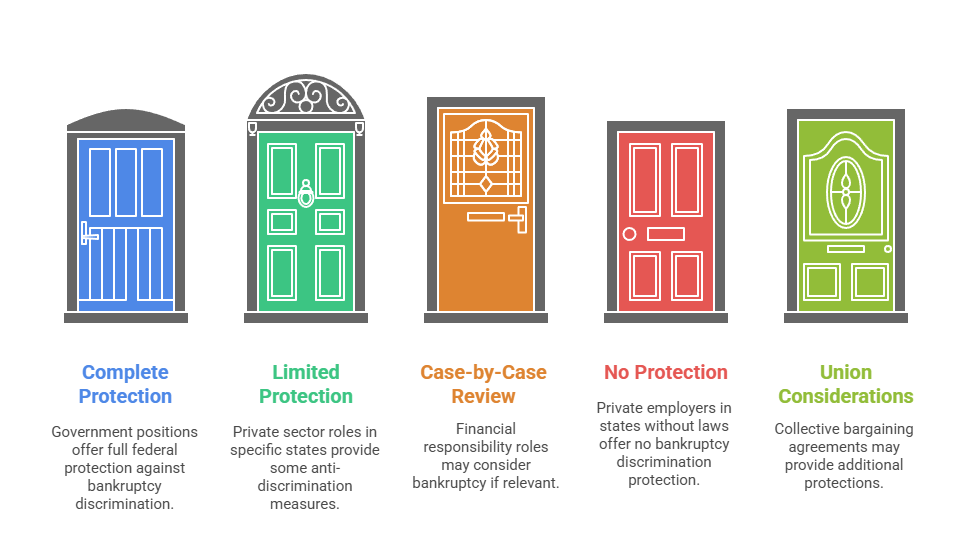

Legal Protections and Discrimination Laws

Federal bankruptcy law provides specific protections against employment discrimination, though these protections have notable limitations in scope and application. Section 525 of the Bankruptcy Code prohibits governmental employers from discriminating against employees or applicants solely because of bankruptcy filing or discharge. However, this protection does not extend to private employers, creating a significant gap in employment protection for most workers. Recent legal developments in 2025 have strengthened some state-level protections, but federal private sector gaps remain.

State and local governments have implemented additional protections in some jurisdictions to address these federal limitations. California, New York, Illinois, and several other states have enacted laws restricting how private employers can use bankruptcy information in hiring decisions. These laws typically prohibit automatic disqualification based solely on bankruptcy status but allow employers to consider bankruptcy when directly related to job responsibilities. The trend toward expanded worker protections continues growing throughout 2025.

- Complete Protection: Government positions at all levels receive full federal bankruptcy discrimination protection

- Limited Protection: Private sector roles in states with specific anti-discrimination statutes

- Case-by-Case Review: Positions requiring financial responsibility may consider bankruptcy when job-relevant

- No Protection: Private employers in states without additional bankruptcy discrimination laws

- Union Considerations: Collective bargaining agreements may provide additional protections beyond legal requirements

FCRA Compliance Requirements for Employers

Background Check Procedures

The Fair Credit Reporting Act establishes strict procedures that employers must follow when using bankruptcy information in employment decisions during 2025. Employers must obtain written consent before conducting background checks that include credit information or public records searches. This consent must be separate from job applications and clearly explain the scope of background investigation. If adverse employment action results from bankruptcy information, employers must provide pre-adverse action notices and final adverse action letters with specific disclosure requirements.

FCRA compliance becomes particularly complex when dealing with Chapter 7 vs Chapter 13 background check scenarios due to different reporting requirements and timelines. Employers must ensure that background check companies provide accurate, up-to-date information about bankruptcy status, payment plan progress, or discharge completion. Outdated or incorrect bankruptcy information can result in FCRA violations and potential legal liability for both employers and screening companies.

Updated Reporting Standards

Recent FCRA enforcement actions have emphasized the importance of accurate bankruptcy reporting throughout 2025. Background check companies must verify bankruptcy case status, ensure proper chapter identification, and provide current payment plan information when applicable. Employers who use outdated or inaccurate bankruptcy information in hiring decisions face increased liability risk. The Consumer Financial Protection Bureau has increased scrutiny of background check accuracy, particularly regarding complex financial situations like Chapter 13 repayment plans.

| FCRA Requirement | Chapter 7 Cases | Chapter 13 Cases |

| Accuracy Verification | Discharge status and date | Current payment plan status |

| Adverse Action Notice | Required if influences decision | Required if influences decision |

| Dispute Process | Standard credit report dispute | May involve court record verification |

| Employer Liability | Moderate for basic reporting errors | Higher for complex payment plan errors |

Job Seeker Strategies for Bankruptcy Disclosure

Job seekers with bankruptcy history should proactively address potential employment screening concerns rather than hoping employers won't discover the information. Preparation includes obtaining current copies of credit reports from all three major bureaus to understand exactly what information appears in background checks. This knowledge allows candidates to prepare accurate explanations and demonstrate awareness of their financial history during interview processes. The approach should emphasize resolution, lessons learned, and improved financial management skills.

Timing disclosure appropriately can significantly impact employer reception of bankruptcy information throughout 2025. While candidates aren't required to volunteer bankruptcy information unless specifically asked, addressing it proactively often generates more positive responses than allowing employers to discover it independently. The key lies in framing bankruptcy as a resolved financial challenge rather than an ongoing concern, particularly for Chapter 13 cases with successful payment plan completion or Chapter 7 cases with demonstrated financial recovery.

Professional development activities can help offset bankruptcy concerns during employment screening processes. Financial literacy courses, credit counseling certificates, and debt management training demonstrate commitment to improved financial responsibility. These credentials become particularly valuable for positions in financial services or other industries where bankruptcy history might otherwise disqualify candidates from consideration. Many employers in 2025 appreciate candidates who show proactive efforts toward financial education and recovery.

Current Bankruptcy Trends Affecting Employment

2025 Filing Statistics and Patterns

Bankruptcy filing patterns in 2025 continue reflecting economic recovery trends and changing consumer debt management approaches. Chapter 13 filings have increased relative to Chapter 7 cases as more debtors seek to preserve assets while managing debt through structured repayment plans. This trend affects employment screening as more background checks reveal active Chapter 13 cases rather than discharged Chapter 7 cases. Employers are adapting their evaluation criteria to better understand these active repayment situations.

The rise in Chapter 13 popularity also stems from improved financial counseling and legal advice that emphasizes long-term credit recovery benefits. More debtors understand that Chapter 13's shorter credit reporting period provides better employment prospects over time. Additionally, increased wages in many sectors make Chapter 13 payment plans more feasible than in previous economic periods.

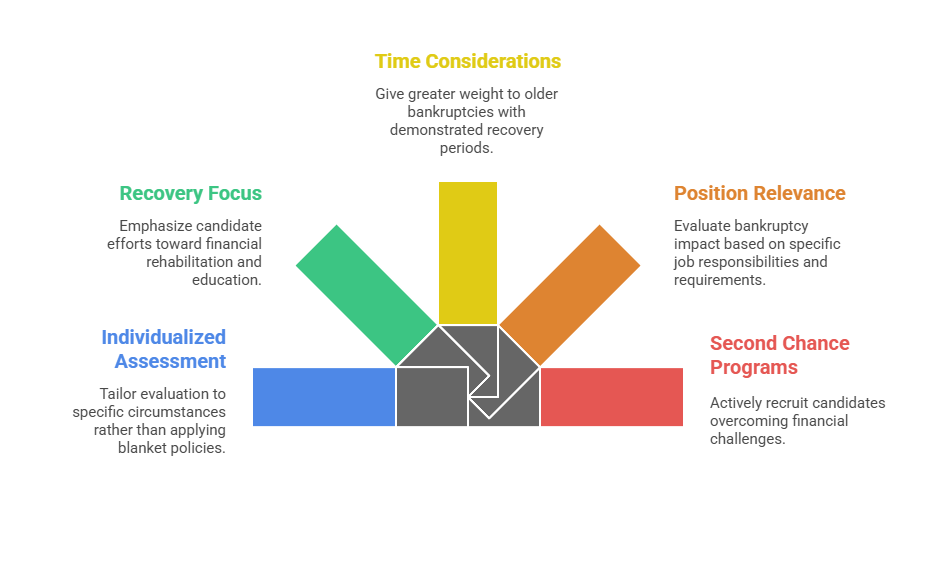

Employer Adaptation Strategies

Forward-thinking employers in 2025 have developed more nuanced approaches to evaluating bankruptcy information during hiring processes. Rather than automatic disqualification, many companies now consider bankruptcy type, timing, circumstances, and recovery efforts when making employment decisions. This evolution reflects tight labor markets and recognition that financial difficulties don't necessarily predict job performance. Companies also realize that blanket bankruptcy discrimination may eliminate qualified candidates unnecessarily.

- Individualized Assessment: Companies evaluate specific circumstances rather than applying blanket policies

- Recovery Focus: Emphasis on candidate efforts toward financial rehabilitation and education

- Time Considerations: Greater weight given to older bankruptcies with demonstrated recovery periods

- Position Relevance: Bankruptcy impact evaluation based on specific job responsibilities and requirements

- Second Chance Programs: Some employers actively recruit candidates overcoming financial challenges

Technology Impact on Bankruptcy Screening

Modern background check technology in 2025 provides more detailed and accurate bankruptcy information than ever before. Real-time database integration ensures that employers receive current information about case status, payment plan progress, and discharge completion. Artificial intelligence systems can now analyze bankruptcy patterns and predict potential employment risks more accurately. However, this technological advancement also means that bankruptcy information is harder to conceal or misrepresent during job application processes.

Automated screening systems now flag discrepancies between candidate disclosures and background check results more effectively. This technology encourages honest disclosure while helping employers identify candidates who attempt to hide relevant financial information. The improved accuracy also reduces false positives and ensures that candidates aren't penalized for outdated or incorrect bankruptcy information.

Advanced reporting capabilities allow employers to customize bankruptcy screening based on position requirements and industry standards. Companies can set parameters for what types of bankruptcy information warrant additional review versus automatic concern flags. This customization helps balance thorough due diligence with fair candidate evaluation, particularly important given the complex differences between Chapter 7 and Chapter 13 cases.

Conclusion

Chapter 7 and Chapter 13 bankruptcies both appear on employment background checks, but their impact varies significantly based on industry, timing, and employer policies in 2025. Chapter 13 cases often receive more favorable consideration due to their repayment structure and shorter credit reporting period, while Chapter 7 cases provide quicker resolution but longer-lasting credit report visibility. Understanding these differences helps job seekers make informed decisions about bankruptcy options and prepare effective strategies for addressing financial history during employment screening processes. Regardless of bankruptcy chapter, proactive disclosure and demonstration of financial recovery efforts typically generate better employer responses than attempting to conceal or minimize bankruptcy history.

Frequently Asked Questions

How long does Chapter 7 vs Chapter 13 stay on background checks?

Chapter 7 bankruptcy remains on credit reports and background checks for 10 years from the filing date, while Chapter 13 bankruptcy is removed after 7 years. Both types appear in public records indefinitely, but most employers focus on credit report information for employment screening purposes. The three-year difference significantly impacts long-term career prospects, making Chapter 13 more attractive for job seekers concerned about future employment opportunities.

Can employers automatically reject applicants with bankruptcy history?

Private employers can generally use bankruptcy information in hiring decisions, except where prohibited by state or local laws. Government employers cannot discriminate based solely on bankruptcy status under federal law. However, employers must follow FCRA procedures if bankruptcy information influences their hiring decisions. The key distinction involves whether bankruptcy directly relates to essential job functions or represents blanket discrimination.

Does Chapter 13 look better than Chapter 7 to employers?

Many employers view Chapter 13 more favorably because it demonstrates commitment to repaying debts through a structured payment plan. Chapter 13 also has a shorter credit reporting period (7 years vs 10 years), making it less impactful for long-term career prospects. The active repayment aspect shows financial responsibility and problem-solving skills that many employers appreciate, particularly in 2025's competitive job market.

Which industries are most concerned about bankruptcy in background checks?

Financial services, banking, insurance, and accounting industries typically have the highest concern about bankruptcy history due to positions involving financial responsibilities. Government positions requiring security clearances also scrutinize bankruptcy information closely. Healthcare, technology, and manufacturing sectors generally show less concern unless specific roles involve financial management or cash handling responsibilities.

Should I disclose bankruptcy before or after a background check?

Proactive disclosure often generates better employer responses than allowing discovery through background checks. Consider disclosing after establishing rapport during interviews but before background check authorization, focusing on resolution and lessons learned. This approach demonstrates honesty while allowing you to control the narrative around your financial recovery efforts and current stability.

Can I get hired in banking or finance with Chapter 7 or Chapter 13 on my record?

While challenging, employment in financial industries is possible with bankruptcy history in 2025. Chapter 13 cases generally receive more favorable consideration, and positions with less direct financial responsibility may be more accessible. Individual circumstances, time elapsed since filing, and demonstration of financial recovery significantly impact hiring decisions. Many financial companies now use individualized assessment rather than blanket disqualification policies.

Additional Resources

- FCRA Compliance Guide for Employment Screening

https://www.ftc.gov/business-guidance/resources/using-consumer-reports-what-employers-need-know - Bankruptcy Discrimination Laws by State

https://www.nolo.com/legal-encyclopedia/bankruptcy-discrimination - Understanding Your Credit Report After Bankruptcy

https://www.consumer.ftc.gov/articles/free-credit-reports - Employment Rights After Bankruptcy Filing

https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics - Background Check Laws and Employee Rights

https://www.eeoc.gov/laws/guidance/background-checks-what-employers-need-know

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.