Pennsylvania financial sector background checks must comply with both federal FCRA regulations and state-specific laws, including the groundbreaking Clean Slate Law that automatically seals eligible criminal records after 10 years. Financial institutions in Pennsylvania's robust banking ecosystem—spanning Philadelphia's financial district to Pittsburgh's credit unions—face unique screening requirements. These requirements balance regulatory compliance with the state's progressive expungement policies.

Key Takeaways

- Pennsylvania's Clean Slate Law automatically seals certain criminal records after 10 years, fundamentally changing how financial employers screen candidates in 2025.

- Federal FCRA requirements mandate that employers obtain written consent before conducting background checks and provide adverse action notices if declining employment based on screening results.

- Financial sector positions involving access to customer accounts, lending decisions, or regulatory oversight typically require comprehensive seven-year criminal and credit history reviews.

- Philadelphia and Pittsburgh financial institutions must navigate both state Clean Slate provisions and local ban-the-box ordinances when screening applicants.

- Credit checks in Pennsylvania financial sector hiring require explicit written authorization and must demonstrate job-related necessity under FCRA guidelines.

- The Pennsylvania banking background check process typically takes 3-7 business days for standard screenings, with compliance-level checks requiring 10-14 days.

- Employers must provide applicants with pre-adverse action notices including a copy of the background report and a summary of FCRA rights before making final hiring decisions.

- Pennsylvania credit unions and community banks face the same federal screening requirements as major financial institutions, with enhanced scrutiny for FDIC-insured positions.

Understanding Pennsylvania Financial Sector Background Check Requirements

Pennsylvania's financial services industry employs over 285,000 professionals across banking, credit unions, insurance, and investment sectors as of 2025. The state's unique legal landscape combines federal financial sector regulations with progressive criminal record laws. These laws significantly impact hiring practices.

The financial services sector in Pennsylvania operates under heightened scrutiny. Federal agencies including the FDIC, Federal Reserve, and FINRA provide this oversight. These oversight bodies mandate specific screening protocols for positions with access to customer financial data, lending authority, or fiduciary responsibilities.

Pennsylvania employers must simultaneously comply with state laws. These state laws provide some of the nation's most comprehensive criminal record relief provisions. Understanding these layered requirements is essential for both employers conducting Pennsylvania financial sector background checks and job seekers navigating the application process.

Federal vs. State Background Check Regulations

Federal regulations establish the baseline requirements for Pennsylvania banking background checks. The Bank Protection Act, FDIC Section 19, and FINRA Rule 3110 create these requirements. These federal mandates prohibit hiring individuals with specific criminal convictions without obtaining regulatory waivers.

Pennsylvania state law adds additional layers through the Clean Slate Law (Act 56 of 2018, expanded in 2019). This law automatically seals certain criminal records after prescribed periods. This creates a unique dynamic where records that would traditionally appear in Philadelphia financial services screening may be legally sealed and unavailable to employers.

| Regulatory Level | Key Requirements | Impact on Screening |

| Federal (FCRA) | Written consent, adverse action notices, dispute rights | Applies to all background checks nationwide |

| Federal (FDIC Section 19) | Prohibits hiring individuals with specific financial crimes | Requires waiver applications for certain convictions |

| Pennsylvania State | Clean Slate automatic sealing, ban-the-box provisions | Limits access to older records, restricts timing of inquiries |

| Local (Philadelphia/Pittsburgh) | Enhanced ban-the-box ordinances | Additional restrictions on criminal history inquiries |

The interaction between federal banking regulations and Pennsylvania's Clean Slate Law creates complex scenarios. Employers cannot access sealed records even if federal law would otherwise require disclosure.

Industry-Specific Compliance Standards

Different segments within Pennsylvania's financial sector face varying background check requirements. These requirements depend on regulatory oversight and risk profiles. Commercial banks with FDIC insurance operate under the strictest federal oversight.

Pennsylvania credit union background checks follow National Credit Union Administration (NCUA) guidelines. These guidelines mirror FDIC requirements but allow for more flexibility in interpreting "positions of trust." Credit unions must still prohibit individuals with certain criminal histories from covered positions.

The compliance burden varies significantly by institution size and charter type:

- Major commercial banks: Full FDIC Section 19 compliance, continuous monitoring systems, dedicated compliance teams

- Regional banks: Comprehensive screening for management and customer-facing roles, risk-based approaches for back-office positions

- Credit unions: NCUA-aligned protocols with flexibility for member-serving positions

- Insurance companies: State insurance department requirements, focus on positions with claims authority

- Investment firms: FINRA CRD checks, Form U4 disclosures, ongoing regulatory reporting

- Fintech startups: FCRA compliance, state lending license requirements where applicable

Insurance sector employers conducting Pennsylvania financial sector background checks must additionally verify state licensing status. They do this through the Pennsylvania Insurance Department database.

The Impact of Pennsylvania's Clean Slate Law on Financial Hiring

Pennsylvania's Clean Slate Law represents one of the most significant criminal justice reforms affecting employment screening nationwide. Implemented in phases beginning in 2018, the law automatically seals eligible non-conviction records, summary offenses, and certain misdemeanor convictions. It does this after specified periods without requiring individuals to petition the court.

As of 2025, over 1.2 million Pennsylvanians have had records sealed under Clean Slate provisions. This fundamentally changes the landscape for PA Clean Slate Law employment screening. For financial sector employers, Clean Slate creates both opportunities and challenges.

The law enables qualified candidates with minor past offenses to compete for positions. They can do so without the stigma of outdated criminal records. However, employers must understand which records remain accessible and how sealed records affect their ability to assess candidate suitability.

What Records Are Automatically Sealed

Pennsylvania's Clean Slate Law automatically seals specific categories of criminal records. It does so without requiring individual petitions. Summary offenses (Pennsylvania's lowest-level offenses, similar to violations in other states) are sealed after 10 years.

Non-conviction records receive even more favorable treatment under Clean Slate provisions. Arrests that didn't result in convictions, charges that were dismissed, and cases resulting in acquittals are sealed automatically. This happens after the resolution becomes final.

The law specifically excludes certain serious offenses from automatic sealing. Felony convictions carrying maximum sentences exceeding two years cannot be sealed. Offenses requiring Megan's Law registration (sexual offenses) are excluded. Convictions for crimes of violence as defined by Pennsylvania statute remain accessible.

How Sealed Records Affect Employer Screening

When records are sealed under Pennsylvania's Clean Slate Law, they become legally inaccessible to most employers. This applies to employers conducting standard criminal background checks. Commercial background screening companies cannot report sealed information.

Employers cannot ask candidates to disclose sealed information during interviews. Candidates have no legal obligation to mention sealed records even when directly questioned about criminal history. However, important exceptions exist for specific regulated positions.

Important exceptions include positions requiring state licensure, where Pennsylvania licensing boards may still access sealed records. Federal agencies conducting security clearance investigations may access records sealed under state law. FINRA and other SROs may require disclosure of sealed records for registered representatives and principals.

Components of Comprehensive Financial Sector Background Checks

Pennsylvania banking background checks typically include multiple verification components. These components are tailored to the specific position and regulatory requirements. Standard screening packages for financial sector positions go beyond basic criminal history checks.

The depth and breadth of background screening correlates with position risk level and regulatory exposure. Entry-level teller positions typically undergo standard seven-year criminal history checks and employment verification. Executive roles and compliance positions require enhanced screening.

Positions with lending authority, investment discretion, or access to non-public customer information trigger additional screening requirements. These requirements fall under federal regulations. Understanding these components helps both employers design compliant screening programs and job seekers prepare for the vetting process.

Criminal History Verification

Criminal history checks form the foundation of Pennsylvania financial sector background checks. They typically cover seven years of records across all jurisdictions where the candidate has lived or worked. Financial sector employers usually conduct both state-level searches through Pennsylvania State Police records and county-level searches.

Pennsylvania employers must navigate the state's three-tier criminal classification system when evaluating results. Summary offenses (the lowest level) rarely disqualify financial sector candidates. Misdemeanors receive individualized assessment based on job relatedness and recency.

The Clean Slate Law's impact means that Philadelphia financial services screening may not reveal certain older offenses. It may not reveal summary offenses or eligible misdemeanors that occurred more than 10 years ago. Employers should not interpret the absence of older records as necessarily indicating a clean history.

Credit Report Evaluation

Credit history checks represent a controversial but common component of Pennsylvania financial sector background checks. This particularly applies to positions involving cash handling, lending decisions, or customer account access. The FCRA permits employment-related credit checks with written candidate authorization.

Financial institutions must still demonstrate that credit checks serve legitimate business purposes. These purposes must relate to the specific position. Courts and regulators have generally accepted credit screening for roles with financial authority.

Pennsylvania credit union background checks typically include credit history review for specific position categories:

- Executive and senior management roles

- Lending officers and underwriters with approval authority

- Teller and customer service positions with cash handling responsibilities

- Accounting, finance, and audit staff

- IT personnel with access to financial systems or customer data

- Compliance and risk management positions

Employers must provide specific adverse action notices when declining employment based on credit report information.

Employment and Education Verification

Thorough employment history verification helps financial institutions identify resume fraud. It also helps confirm candidates possess represented experience. Pennsylvania banking background checks typically verify the most recent 7-10 years of employment.

Education verification confirms degree attainment, graduation dates, and sometimes GPA. This applies to positions requiring specific educational qualifications. Financial sector roles increasingly require bachelor's degrees in finance, accounting, or business administration.

| Verification Component | Typical Scope | Timeline | Cost Range |

| Criminal History | 7-year national search | 3-5 business days | $25-$75 |

| Credit Report | Complete credit profile | 1-2 business days | $15-$30 |

| Employment Verification | 7-10 year history | 5-7 business days | $10-$25 per employer |

| Education Verification | Degree confirmation | 3-5 business days | $15-$40 per institution |

| Professional License | Current status check | 1-2 business days | $10-$20 per license |

The combined timeline for comprehensive Pennsylvania financial sector background checks typically ranges from 7-14 business days.

Navigating the Background Check Process as a Job Seeker

Job seekers applying for Pennsylvania financial sector positions should approach background screening proactively. They should not approach it anxiously. Understanding what employers will review is important.

Pennsylvania's financial services sector offers numerous opportunities. These opportunities exist for candidates with various experience levels. They range from entry-level teller positions to executive leadership roles.

Each position tier involves different screening intensity. However, all applicants should expect thorough vetting given the industry's regulatory environment. Preparation and honesty remain the best strategies for successfully navigating Pennsylvania banking background checks.

Reviewing Your Own Records Before Applying

Proactive candidates should obtain their own background check reports before applying for financial sector positions. Pennsylvania residents can request criminal history reports through the Pennsylvania Access to Criminal History (PATCH) system. This system provides official state police records for a nominal fee.

For credit history, you're entitled to free annual credit reports from each major credit bureau. Experian, Equifax, and TransUnion provide these reports through AnnualCreditReport.com. Review these reports carefully for accuracy.

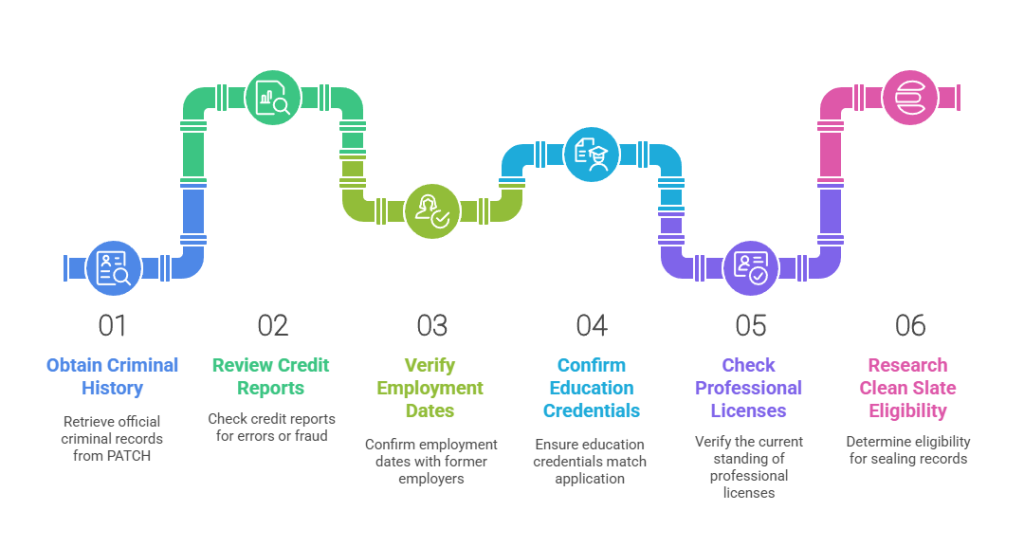

Consider these pre-application screening steps:

- Obtain official Pennsylvania criminal history through PATCH

- Review all three credit reports for errors or fraudulent accounts

- Verify employment dates with former employers

- Confirm education credentials match application materials

- Check professional licenses for current standing

- Research Clean Slate eligibility for potentially sealed records

Addressing discrepancies before employer screening begins demonstrates professionalism.

Understanding Your FCRA Rights

The Fair Credit Reporting Act provides critical protections for job seekers undergoing background checks. This applies to Philadelphia financial services screening and across the nation. Employers must provide clear written disclosure that a background check will be conducted.

If an employer intends to take "adverse action" based on background check information, they must follow specific procedures. Adverse action includes declining to hire, rescinding an offer, or terminating employment. The pre-adverse action process requires providing you with a copy of the background report.

Your FCRA rights during the background check process include several protections. Employers must clearly inform you that a background check will be conducted and obtain written authorization. You have the right to dispute inaccurate or incomplete information. Employers must provide adverse action notices if they decline employment based on background check findings.

Addressing Negative Information Proactively

Candidates with criminal history, poor credit, or employment gaps should address these issues directly. They should not hope employers won't discover them. For Pennsylvania credit union background checks and other financial sector screening, honesty works best.

If you have criminal history that predates Clean Slate eligibility periods, consider whether expungement petitions might clear your record. Pennsylvania allows petitions for expungement or sealing in various circumstances. These go beyond automatic Clean Slate provisions.

When addressing negative background information during the hiring process, be honest but strategic. Disclose issues when legally required. Provide context without excuses by briefly explaining circumstances surrounding negative information. Emphasize recent positive history by highlighting years of clean record or improved credit.

Best Practices for Employers Conducting Background Checks

Financial institutions conducting Pennsylvania financial sector background checks must balance thorough risk assessment with legal compliance. They must also consider fair chance hiring principles. Developing comprehensive screening policies requires satisfying regulatory requirements.

Pennsylvania's financial services sector faces particular complexity. This results from overlapping federal, state, and local regulations. Philadelphia financial institutions must comply with city-specific ordinances.

Statewide, the Clean Slate Law has fundamentally altered screening practices. This requires policy updates and staff education to maintain compliance. Employers who approach background screening strategically gain both protection and access to broader talent pools.

Developing Compliant Screening Policies

Effective background check policies begin with clear definitions. Define which positions require screening. Determine what screening components apply to each role category.

Written screening policies should document the specific background check components for each position level. They should document the disqualifying offenses or credit issues that create ineligibility. They should also document the individualized assessment process for borderline cases.

Position-level screening matrices help maintain consistency and legal defensibility. Executive leadership receives comprehensive 10-year criminal checks and full credit reports. Lending officers receive 7-year financial-focused criminal checks. Tellers and customer service staff receive 7-year standard criminal checks and summary credit reports.

Implementing Individualized Assessments

The EEOC's guidance on arrest and conviction records emphasizes individualized assessment. It emphasizes this over blanket exclusion policies. Financial institutions conducting Pennsylvania banking background checks should evaluate the nature and gravity of offenses.

Individualized assessment processes typically involve several steps. Initial screening uses automated filtering to identify serious disqualifying offenses. Middle-ground review involves HR or compliance staff reviewing borderline cases.

This structured approach satisfies both regulatory expectations and fairness principles. It also protects financial institutions from unsuitable hires. Documentation throughout the process provides evidence of compliance.

Maintaining Ongoing Compliance Monitoring

Background screening doesn't end with the hiring decision. Financial institutions must maintain ongoing monitoring for positions subject to continuous screening requirements. These requirements come from federal regulations.

Continuous monitoring programs typically include several components. Criminal record monitoring provides automated alerts for new criminal charges or convictions. License status verification involves regular checks ensuring professional licenses remain current.

Employers must carefully draft ongoing monitoring policies. They must comply with FCRA requirements for employment-related credit reports. They must also comply with requirements for criminal history checks on current employees.

Special Considerations for Different Financial Sector Segments

Pennsylvania's diverse financial services sector encompasses commercial banks, credit unions, insurance companies, investment firms, and emerging fintech companies. Each faces distinct regulatory environments. These environments affect background check requirements.

The growth of Pennsylvania's fintech sector has added complexity to the state's financial services screening landscape. Technology-driven financial services companies may not face traditional banking regulations. However, they still handle sensitive customer financial data.

Understanding segment-specific compliance obligations helps employers design appropriate screening programs. It also helps job seekers understand what vetting to expect based on position type. While all financial sector employers must comply with basic FCRA requirements, additional screening layers vary significantly by industry segment.

Banking and Credit Union Requirements

Traditional banking institutions conducting Pennsylvania banking background checks operate under FDIC Section 19 requirements. These requirements prohibit employment of individuals convicted of crimes involving dishonesty, breach of trust, or money laundering. This applies within the past seven years.

FDIC Section 19 creates a two-tier system. It includes absolute prohibitions for certain criminal convictions. It also includes discretionary prohibitions requiring waiver applications for covered individuals.

Credit unions face parallel requirements under NCUA regulations. These mirror FDIC provisions. Pennsylvania credit union background checks must identify covered criminal convictions and ensure compliance with federal employment prohibitions.

Investment and Insurance Sector Screening

Investment advisory firms and broker-dealers conducting Philadelphia financial services screening must comply with FINRA requirements. These are in addition to basic FCRA obligations. Registered representatives and principals must complete Form U4 disclosures.

FINRA requirements are notably more comprehensive than traditional background checks. They require disclosure of criminal charges and convictions (not just convictions). They require disclosure of civil litigation involving securities, investment, or financial matters.

Insurance sector employers face Pennsylvania Insurance Department requirements. These apply to licensed producers, adjusters, and other regulated positions. Background checks for insurance positions typically focus on criminal history relating to trustworthiness and financial responsibility.

Fintech and Non-Bank Financial Services

Pennsylvania's growing fintech sector presents unique background check challenges. These companies often fall outside traditional banking regulations. However, they handle sensitive financial data and transactions.

Non-bank financial service providers include payment processors, money services businesses, and alternative lenders. They typically operate under state money transmitter licenses or similar credentials. These credentials require some screening oversight.

Fintech employers should consider several screening components. Criminal history checks should focus on fraud, identity theft, computer crimes, and financial offenses. Credit history checks should evaluate financial responsibility for roles handling customer funds. Cyber crime screening should enhance focus on hacking and unauthorized computer access.

Timeline, Costs, and Process Expectations

Understanding the practical aspects of Pennsylvania financial sector background checks helps both employers and job seekers. Employers can budget appropriately. Job seekers can set realistic expectations for hiring timelines.

Financial sector screening typically takes longer than standard employment background checks. This results from the comprehensive nature of financial services vetting requirements. Candidates should expect 1-3 weeks between conditional offer acceptance and final hiring decisions.

Transparent communication about screening processes reduces candidate anxiety. It also maintains positive employer branding throughout the hiring process. Employers can accelerate timelines through efficient vendor partnerships and streamlined internal review processes.

Typical Screening Timelines

Standard Pennsylvania banking background checks typically require 5-7 business days. These checks cover seven-year criminal history, employment verification, and education confirmation. They complete in this timeframe when searches encounter no complications.

Comprehensive screening packages typically require 10-14 business days. These packages include credit reports, professional license verification, and enhanced criminal searches across multiple states. International education or employment verification can extend timelines significantly.

Timeline factors include position complexity, geographic scope, information source responsiveness, discrepancy investigation, candidate cooperation, and vendor efficiency. Entry-level positions with standard screening take 5-7 days while executive roles requiring comprehensive searches take 14-21 days. Employers should communicate expected timelines to candidates upfront.

Cost Considerations and Budget Planning

Background check costs for Philadelphia financial services screening vary based on comprehensiveness. They also vary based on vendor selection and volume discounts for large employers. Basic criminal history checks typically cost $25-50 per candidate.

Employers should budget for both initial screening costs and ongoing monitoring expenses. This applies to positions subject to continuous review requirements. Annual re-screening programs typically cost less than initial comprehensive checks.

Financial institutions can control screening costs through several strategies. Position-tiered screening applies comprehensive screening only to high-risk positions. Volume discount negotiations help large employers negotiate favorable per-check pricing. Technology integration means automated verification services reduce per-check costs.

Conclusion

Pennsylvania financial sector background checks require careful navigation of federal banking regulations, FCRA compliance obligations, and Pennsylvania's progressive Clean Slate Law provisions. Employers must develop position-specific screening policies that satisfy regulatory requirements while embracing fair chance hiring principles and individualized assessment processes. Job seekers benefit from understanding their rights, proactively reviewing their own records, and addressing potential issues transparently during the hiring process. The intersection of Pennsylvania's Clean Slate automatic sealing provisions with federal banking sector employment prohibitions creates unique compliance challenges that financial institutions must address through careful policy design and legal consultation.

Frequently Asked Questions

How long does a background check take for financial jobs in Pennsylvania?

Standard Pennsylvania financial sector background checks typically take 5-7 business days for basic screening including criminal history and employment verification. Comprehensive checks for higher-level positions requiring credit reports and multi-state criminal searches usually require 10-14 business days. International education or employment verification can extend timelines to 4-6 weeks. Information source responsiveness significantly affects completion times.

Can employers in Pennsylvania see sealed criminal records?

No, Pennsylvania's Clean Slate Law makes automatically sealed records legally unavailable to most employers conducting standard background checks. Sealed records cannot be reported by background screening companies or considered in hiring decisions. Limited exceptions exist for certain state licensing board reviews and federal security clearance investigations. Standard employment screening cannot access sealed records.

Do all Pennsylvania financial sector jobs require credit checks?

Not all financial sector positions require credit checks, but they're common for roles involving cash handling, lending authority, or customer account access. Employers must demonstrate job-related necessity for credit checks and provide specific adverse action notices if declining employment based on credit information. Pennsylvania law permits employment credit checks with proper FCRA authorization. Credit checks are most common for positions with financial responsibility.

What criminal convictions disqualify you from banking jobs in Pennsylvania?

FDIC Section 19 prohibits FDIC-insured institutions from hiring individuals with convictions for crimes involving dishonesty, breach of trust, or money laundering within the past seven years without obtaining regulatory waivers. These offenses include fraud, embezzlement, identity theft, and check fraud. Employers must also comply with Pennsylvania ban-the-box provisions limiting when criminal history can be considered. Serious financial crimes typically create employment barriers.

Does Pennsylvania's ban-the-box law apply to financial sector employers?

Yes, Pennsylvania's ban-the-box law generally prohibits employers from asking about criminal history on initial employment applications. Limited exceptions exist for positions with statutory disqualifications. Financial sector employers can inquire about criminal history later in the hiring process. They must follow individualized assessment protocols when evaluating conviction information.

How far back do Pennsylvania employment background checks go?

Pennsylvania financial sector background checks typically review seven years of criminal history, which is the standard FCRA lookback period. Employment verification usually covers 7-10 years of work history. Education verification confirms degrees regardless of graduation date. Pennsylvania's Clean Slate Law automatically seals eligible records after 10 years.

Can I work in Pennsylvania banking with a misdemeanor conviction?

It depends on the specific misdemeanor, how long ago it occurred, and the position requirements. Pennsylvania's Clean Slate Law seals eligible misdemeanors after 10 years, so older convictions may not appear in background checks. For recent misdemeanors, employers must conduct individualized assessments considering offense nature, job relatedness, and rehabilitation evidence. Financial crimes misdemeanors are more likely to create disqualifications.

What rights do I have if a background check contains errors?

Under FCRA, you have the right to dispute inaccurate information with both the background screening company and the original information source. Employers must provide you with a copy of the background report and a summary of your FCRA rights before taking adverse action. Screening companies must investigate disputes within 30 days and correct or delete inaccurate information. You may be entitled to damages if FCRA violations cause employment loss.

Do Pennsylvania credit unions have different background check requirements than banks?

Pennsylvania credit unions follow NCUA requirements that closely parallel FDIC regulations for banks, including similar prohibitions on hiring individuals with certain criminal convictions. Credit unions sometimes have slightly more flexibility in interpreting which positions constitute "positions of trust" requiring enhanced screening. Both banks and credit unions must comply with Pennsylvania state employment laws. Federal regulatory requirements remain largely consistent.

How do I check my own background before applying for financial sector jobs?

Request your Pennsylvania criminal history through the Pennsylvania Access to Criminal History (PATCH) system, which provides official state police records for a fee. Obtain free annual credit reports from all three major credit bureaus through AnnualCreditReport.com. Verify employment dates with former employers and confirm education credentials with degree-granting institutions. Proactively identifying and addressing issues before employer screening significantly improves hiring outcomes.

Additional Resources

- Pennsylvania Clean Slate Law: Complete Guide and Eligibility Requirements

https://www.pacourts.us/news-and-statistics/cases-of-public-interest/pennsylvania-clean-slate - Federal Trade Commission: Background Checks and Your Rights Under FCRA

https://www.consumer.ftc.gov/articles/employment-background-checks - FDIC Section 19: Employment Background Checks for Banking Institutions

https://www.fdic.gov/regulations/laws/rules/5000-3500.html - Pennsylvania Access to Criminal History (PATCH) System

https://epatch.state.pa.us/ - EEOC Guidance on Arrest and Conviction Records in Employment Decisions

https://www.eeoc.gov/laws/guidance/arrest-and-conviction-records - Pennsylvania Department of Banking and Securities: Financial Services Licensing

https://www.dobs.pa.gov/ - FINRA: Registration and Background Check Requirements for Securities Industry

https://www.finra.org/registration-exams-ce/classic-crd