In hiring, background checks serve as a critical tool to assess the suitability and integrity of candidates. However, the legal framework governing these background checks in California is particularly intricate. HR professionals are tasked with navigating complex state-specific mandates alongside federal regulations.

Key Takeaways

- Employers with five or more employees must not ask about criminal history during initial applications.

- Arrests without conviction and expunged records cannot influence hiring decisions.

- Credit reports can only be used for specific roles, such as finance-related positions.

- Written consent and clear disclosures are required for conducting background checks.

- Candidates have the right to access and dispute inaccurate background check information.

Federal and State Legal Frameworks

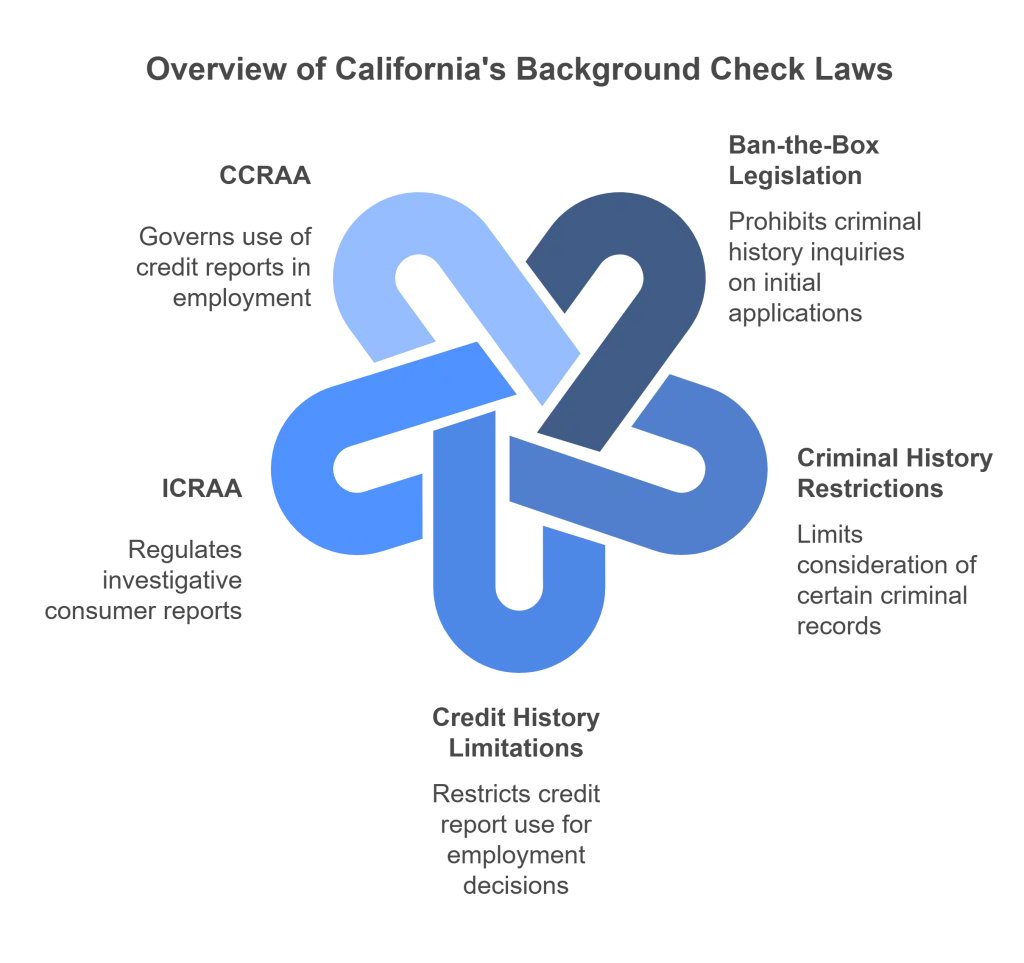

The Fair Credit Reporting Act (FCRA) establishes the baseline for nationwide background checks. Yet, California has augmented these federal stipulations with its statutes: the California Investigative Consumer Reporting Agencies Act (ICRAA) and the Consumer Credit Reporting Agencies Act (CCRAA). These laws intensify the regulatory landscape, offering additional safeguards for consumers.

According to the California Civil Code §§ 1785.1-1785.36, "California law provides additional protections to consumers beyond the federal Fair Credit Reporting Act."

Our goal as HR professionals is to create harmony between legal compliance and fairness in every hiring decision. In some countries like California, this duty is particularly complicated due to an intricate regulatory framework that goes beyond federal mandates. Our work as an HR practitioner doesn't only focus on legal compliance but also puts our heart into it to foster a work environment with fairness and respect at its core. Following the rules and regulations, we help both the organization and the candidates as well.

Principal Aspects of California's Background Check Laws

Ban-the-Box Legislation

The Fair Chance Act mandates that employers with a workforce of five or more refrain from inquiring about criminal history on initial job applications, aiming to foster equitable employment opportunities.

Restrictions on Criminal History

The state limits the consideration of criminal records. The California Labor Code § 432.7 states, "Employers cannot consider arrests that did not lead to conviction or expunged, sealed, or dismissed convictions."

Credit History Limitations

The use of credit reports for making employment decisions is limited. The California Civil Code § 1785.20.6 articulates that "California law restricts the use of consumer credit reports for employment purposes unless the position meets certain criteria," such as roles involving financial responsibilities or access to confidential data.

Understanding the California Investigative Consumer Reporting Agencies Act (ICRAA)

The California Investigative Consumer Reporting Agencies Act (ICRAA) is a key law regulating agencies' activities in compiling investigative consumer reports for employment background checks. These reports may include information on an individual's character, reputation, personal characteristics, or lifestyle gathered through interviews or other methods. The ICRAA ensures the accuracy of these reports and protects the rights of individuals undergoing background checks.

Consent and Disclosure

The ICRAA requires that employers obtain written permission from the candidate before requesting an investigative consumer report. Employers must clearly disclose the purpose and nature of the information sought.

Accuracy and Disputes

The act mandates that investigative consumer reporting agencies take reasonable steps to ensure the accuracy of the information they provide. If a candidate disputes the report's accuracy, the agency must reinvestigate the issue and correct any inaccuracies.

Access to Reports

Candidates have the right to request a copy of their investigative consumer report. They are entitled to know the sources of the information, except in cases where the source is confidential.

Navigating the Consumer Credit Reporting Agencies Act (CCRAA)

The Consumer Credit Reporting Agencies Act (CCRAA) is a vital law in California that governs the use of consumer credit reports in employment decisions. It sets specific rules to ensure the fair treatment of job applicants and employees during background checks, including limitations on when and how employers can use credit reports.

Limited Use of Credit Reports

The CCRAA restricts the use of consumer credit reports for employment purposes. Employers can only request credit reports for roles with financial responsibilities, confidential information access, or significant cash handling.

Notice and Consent

Before obtaining a credit report, employers must notify the candidate in writing and obtain their written consent. The notice must specify the reasons for obtaining the report and inform the candidate of their rights under the CCRAA.

Adverse Action Procedures

Suppose an employer takes adverse action based on information in a credit report. In that case, they must provide the candidate with a pre-adverse action notice, a copy of the report, and a summary of their rights under the CCRAA.

Best Practices for HR Compliance

Written Consent

Obtaining written consent from the applicant before initiating a background check is a fundamental step for compliance and transparency. This consent should be explicit and separate from other employment documents to ensure the applicant understands and agrees. Inform applicants about the background check scope and collected information.

Pre-Adverse Action Procedures:

Employers must follow pre-adverse action procedures if a background check reveals information that could lead to an adverse employment decision (such as not hiring the applicant). This includes providing the applicant with a pre-adverse action notice, a copy of the background check report, and a summary of their rights under the Fair Credit Reporting Act (FCRA) and applicable state laws. The applicant should be given a reasonable amount of time to review the report and dispute any inaccuracies before making a final decision.

Record-Keeping

Maintaining detailed records of background checks and compliance efforts is essential for adhering to legal requirements. This includes documentation of written consent, copies of pre-adverse action notices, and records of any disputes or corrections. It is required by law to store these records securely for a specified period to protect applicant and employee privacy and to be prepared for potential audits or legal challenges.

Regular Training and Updates

Employers should provide regular training for HR staff and anyone involved in the hiring process to ensure they are up-to-date on the latest laws and regulations regarding background checks. This includes understanding the nuances of federal, state, and local laws and how they interact.

Partnering with Reputable Screening Providers

Working with reputable background screening providers can help ensure background checks are conducted legally and ethically. Employers should choose providers that comply with the FCRA and state laws and have a track record of accuracy and reliability.

Navigating Exceptions and Sector-Specific Regulations

There are exceptions to the general rules, particularly for roles in law enforcement or certain financial positions. Moreover, regulations specific to certain industries can impact the background check process. HR professionals must be cognizant of these exceptions and tailor their practices accordingly.

Conclusion

For HR professionals in California, mastering the state's background check laws is vital for ensuring a fair hiring process and safeguarding the organization from legal liabilities. Continuous education and legal consultation are advisable to keep pace with the evolving legal landscape.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.