Illinois fintech background checks in 2025 operate under strengthened employment laws that balance financial sector security requirements with expanded worker protections, particularly regarding cannabis use and criminal history considerations. The state's evolving regulatory framework requires employers to navigate complex compliance requirements while maintaining thorough screening processes essential for financial services operations.

Key Takeaways

- Illinois Cannabis Protection Act significantly limits employers' ability to discriminate against cannabis users in background screening processes, with specific exceptions for safety-sensitive fintech positions.

- Chicago Fair Chance Ordinance and Illinois Human Rights Act require "ban-the-box" compliance, delaying criminal history inquiries until after conditional job offers in most fintech roles.

- Financial sector regulatory requirements still mandate comprehensive background checks for positions involving access to customer financial data, trading systems, or regulatory oversight functions.

- Employment verification laws in Illinois require written consent for all background checks and provide specific timeframes for adverse action notifications to job candidates.

- Biometric privacy regulations under BIPA (Biometric Information Privacy Act) restrict how fintech employers can collect and use fingerprints or other biometric data during screening.

- Multi-layered compliance approach is essential, as fintech companies must satisfy both state employment laws and federal financial regulations simultaneously.

Illinois Fintech Employment Landscape in 2025

The Illinois financial technology sector continues expanding rapidly, with Chicago maintaining its position as the Midwest's primary fintech hub. Major financial institutions, emerging startups, and established technology companies are driving unprecedented job growth across the state. However, this expansion coincides with increasingly complex employment screening regulations that significantly impact hiring practices.

Illinois fintech background checks must now navigate a regulatory environment that prioritizes worker rights while maintaining the security standards essential to financial services. The state's approach reflects a broader trend toward employment equity, particularly affecting how companies screen for criminal history and substance use. These changes create both opportunities and challenges for job seekers and employers in the competitive fintech marketplace.

Key Industry Sectors Affected

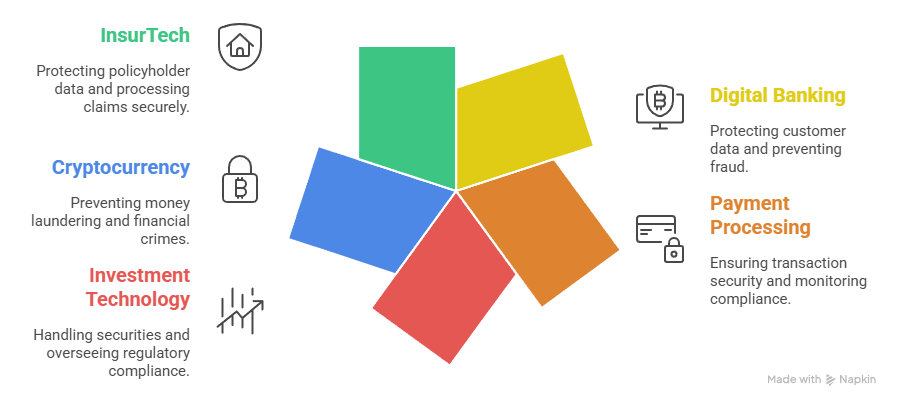

Illinois fintech employment screening impacts multiple specialized areas within the financial technology ecosystem. Payment processing companies, digital banking platforms, cryptocurrency exchanges, and financial data analytics firms each face unique screening requirements. Traditional banking institutions with technology divisions also must adapt their hiring practices to meet evolving state regulations.

Sector-Specific Screening Focus:

- Digital Banking: Customer data protection, fraud prevention systems

- Payment Processing: Transaction security, compliance monitoring

- Investment Technology: Securities handling, regulatory oversight

- Cryptocurrency: Anti-money laundering, financial crimes prevention

- InsurTech: Policyholder data, claims processing systems

Cannabis Laws Impact on Illinois Fintech Hiring

Illinois legalized recreational cannabis in 2020, fundamentally altering how employers can consider cannabis use in employment decisions. The Cannabis Regulation and Tax Act, strengthened by subsequent legislation, provides significant protections for employees while allowing exceptions for safety-sensitive positions. Fintech companies must carefully evaluate which roles qualify for these exceptions.

The Illinois Cannabis Protection Act, effective January 2025, further restricts employer actions regarding cannabis use. Employers cannot refuse to hire, discipline, or terminate employees solely based on cannabis use outside of work hours, unless specific safety or federal regulatory requirements apply. This creates a complex landscape for fintech employers who must balance state employment protections with federal financial regulations.

| Cannabis Screening Allowances | Restrictions |

| Safety-sensitive positions with federal oversight | General software development roles |

| Roles requiring federal security clearances | Administrative and support positions |

| Positions involving heavy machinery operation | Marketing and sales functions |

Financial institutions subject to federal banking regulations often maintain stricter policies due to federal requirements. However, they must demonstrate legitimate business necessity for any cannabis-related employment restrictions. This burden of proof has increased significantly under 2025 Illinois employment law updates.

Criminal History Screening Requirements

Illinois employment background screening laws prioritize rehabilitation and second chances while maintaining necessary security protections. The Illinois Human Rights Act amendments, effective throughout 2024 and strengthened in 2025, establish clear guidelines for criminal history inquiries. Chicago's Fair Chance Ordinance provides additional protections for workers in the city's substantial fintech sector.

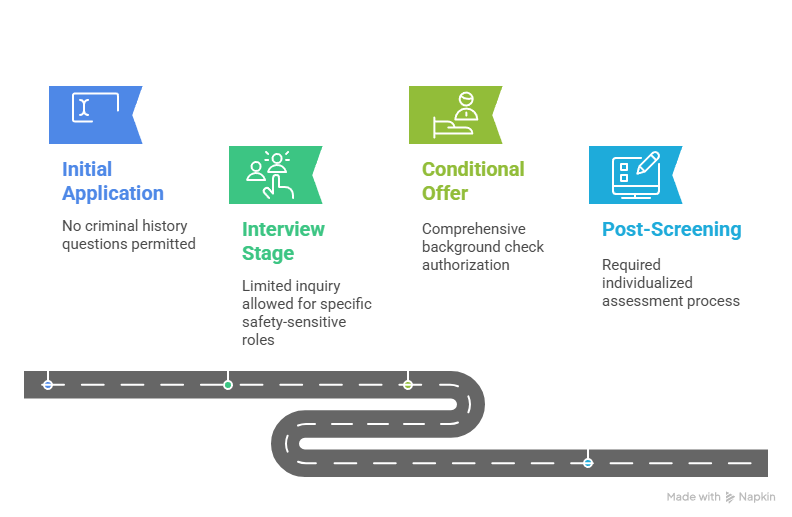

Ban-the-Box Compliance Timeline:

- Initial Application: No criminal history questions permitted

- Interview Stage: Limited inquiry allowed for specific safety-sensitive roles

- Conditional Offer: Comprehensive background check authorization

- Post-Screening: Required individualized assessment process

Fintech employers must conduct individualized assessments when criminal history appears relevant to job responsibilities. This assessment considers the nature of the offense, time elapsed, and relationship to job duties. Simple possession of cannabis charges, for example, cannot typically disqualify candidates from most fintech positions under current Illinois law.

Adverse Action Procedures

Illinois employment verification laws establish specific procedures when background check results may lead to adverse employment actions. Employers must provide written notice including the specific background check information considered, opportunity for candidate response, and clear appeals process. The timeframe for these procedures extends to 5 business days for most positions, with expedited 2-day processes available for time-sensitive roles.

Required Adverse Action Elements:

- Pre-adverse action notice with copy of background report

- Summary of rights under Illinois and federal law

- Reasonable time period for candidate response and correction

- Final adverse action notice with specific reasons and appeal rights

Financial Sector Regulatory Compliance

Illinois fintech regulatory compliance hiring requires balancing state employment laws with federal financial regulations. The Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), and Securities and Exchange Commission (SEC) maintain specific background check requirements that can supersede some state employment protections. Understanding these overlapping jurisdictions is crucial for compliant hiring practices.

Fintech companies operating under federal banking charters face particularly complex requirements. Section 19 of the Federal Deposit Insurance Act prohibits employing individuals with certain criminal convictions without regulatory approval. However, Illinois fair chance employment laws still require individualized assessments and proper notice procedures, even when federal restrictions apply.

Federal vs. State Compliance Matrix:

| Requirement Type | Federal Standard | Illinois Standard | Compliance Approach |

| Criminal History Timing | Varies by regulation | Post-conditional offer | Follow Illinois timing, note federal restrictions |

| Cannabis Use | Generally prohibited | Protected activity | Case-by-case federal review |

| Adverse Action Notice | 3-5 days typical | 5 days minimum | Use Illinois standard |

The Consumer Financial Protection Bureau (CFPB) has indicated increased scrutiny of employment practices in 2025. Fintech companies should document their compliance procedures thoroughly, particularly when federal requirements necessitate different treatment than Illinois employment laws would typically allow.

Documentation and Record-Keeping

Comprehensive documentation proves essential for defending employment decisions under both federal and Illinois regulations. Companies must maintain detailed records showing compliance with state fair chance requirements while meeting federal safety and security standards. These records become particularly important during regulatory examinations or employment discrimination investigations.

Illinois employment background screening requires specific retention periods for different document types. Background check authorizations must be maintained for three years, while adverse action documentation requires five-year retention. Federal regulations may impose longer retention requirements for certain financial sector positions.

Biometric Privacy and Data Protection

The Illinois Biometric Information Privacy Act (BIPA) significantly impacts fintech background check procedures involving fingerprints, facial recognition, or other biometric identifiers. BIPA requires written consent, disclosure of storage and destruction timelines, and specific data protection measures. Violations can result in substantial monetary penalties, making compliance essential for fintech employers.

Many traditional background check processes relied on fingerprinting for criminal history searches. Under BIPA, employers must provide detailed written policies explaining biometric data collection, storage, and destruction procedures. The consent process must be separate from general employment applications and cannot be bundled with other authorization requests.

BIPA Compliance Requirements:

- Separate written consent for each biometric identifier type

- Detailed retention schedule with maximum storage periods

- Data security protocols meeting industry standards

- Destruction procedures with verification and documentation

- Third-party vendor agreements ensuring BIPA compliance

Fintech companies increasingly utilize identity verification technologies that may trigger BIPA requirements. Facial recognition systems, voice biometrics, and advanced authentication methods require careful legal review before implementation in hiring processes.

Employment Verification and Reference Checks

Illinois employment verification laws establish specific parameters for reference checks and employment history verification during background screening processes. Employers can generally verify job titles, employment dates, salary information, and eligibility for rehire, but cannot inquire about protected characteristics or medical information. The state's approach balances legitimate business needs with comprehensive privacy protections.

Reference check procedures must comply with Illinois employment screening requirements, particularly regarding documentation and candidate notification. When reference information might negatively impact hiring decisions, employers must follow similar adverse action procedures as required for criminal background checks. This ensures consistent application of fair chance principles across all screening components.

Permissible Reference Inquiries:

- Employment dates and job titles

- Salary and compensation history (with restrictions)

- Job performance and work quality

- Attendance and punctuality records

- Eligibility for rehire status

Prohibited Reference Topics:

- Disability or medical conditions

- Workers' compensation claims

- Pregnancy or family planning

- Political affiliations or activities

- Off-duty cannabis use (with exceptions)

Third-Party Screening Vendors

Illinois fintech companies frequently utilize third-party background screening vendors to manage complex compliance requirements. These vendors must demonstrate compliance with both Illinois employment laws and federal Fair Credit Reporting Act (FCRA) requirements. Vendor agreements should specify compliance responsibilities and liability allocation for regulatory violations.

Screening vendors operating in Illinois must maintain proper licensing and certification for services provided. The state requires specific disclosures when third-party vendors conduct background checks, including clear identification of the screening company and candidate rights under state and federal law. Regular vendor compliance audits help ensure continued adherence to evolving regulatory requirements.

Best Practices for Compliant Screening

Implementing compliant Illinois fintech background checks requires comprehensive policies addressing both state employment laws and federal financial regulations. Successful programs typically feature standardized procedures, regular training updates, and clear documentation protocols. The complexity of overlapping requirements makes systematic approaches essential for consistent compliance.

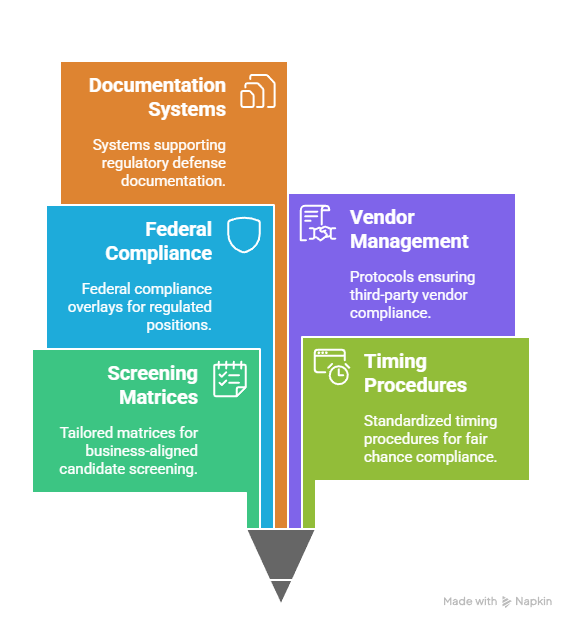

Policy Development Framework:

- Position-specific screening matrices aligned with business necessity

- Standardized timing procedures meeting Illinois fair chance requirements

- Federal compliance overlays for regulated positions

- Vendor management protocols ensuring third-party compliance

- Documentation systems supporting regulatory defense

Regular policy reviews ensure continued compliance as regulations evolve. Illinois employment laws have changed significantly in recent years, with additional modifications expected as the state continues prioritizing worker protections. Staying current requires ongoing legal consultation and industry participation.

Training programs for hiring managers and HR professionals should address both legal requirements and practical implementation challenges. Mock scenarios help staff understand how to apply complex regulations to real hiring situations. Documentation of training completion also demonstrates good faith compliance efforts.

Future Regulatory Trends and Considerations

The Illinois regulatory environment continues evolving, with several proposed changes potentially affecting fintech background checks in 2025 and beyond. Pending legislation addresses salary history inquiries, expanded criminal history protections, and enhanced data privacy requirements. Staying informed about these developments helps companies prepare for changing compliance obligations.

Federal financial regulations also continue adapting to technological changes and evolving security threats. The intersection of state employment protections and federal security requirements will likely become increasingly complex. Fintech companies should monitor both regulatory environments and adjust policies proactively.

Anticipated Regulatory Changes:

- Enhanced cannabis protections limiting employer restrictions further

- Expanded biometric privacy requirements covering additional data types

- Strengthened salary history prohibitions affecting compensation discussions

- Additional criminal history protections for specific offense categories

- Federal cryptocurrency regulations potentially affecting screening requirements

Industry collaboration through professional associations helps companies stay current on regulatory developments. Sharing best practices and compliance approaches benefits the entire Illinois fintech ecosystem while supporting continued industry growth.

Conclusion

Illinois fintech background checks in 2025 require sophisticated compliance strategies balancing state employment protections with federal financial regulations. The state's progressive approach to cannabis rights, criminal history screening, and data privacy creates both opportunities for job seekers and challenges for employers. Success requires understanding complex overlapping requirements, implementing systematic compliance procedures, and maintaining current knowledge of evolving regulations. Companies that invest in comprehensive compliance programs position themselves for sustainable growth while supporting Illinois' commitment to employment equity and economic opportunity.

Frequently Asked Questions

Can Illinois fintech companies still test for cannabis use?

Illinois fintech companies have limited ability to test for cannabis use, primarily restricted to safety-sensitive positions or roles requiring federal security clearances. Most general fintech positions cannot use cannabis testing as a hiring criterion under current Illinois law, though federal banking regulations may create exceptions for certain regulated positions.

How long must employers wait before conducting criminal background checks?

Illinois employers must wait until after making a conditional job offer before conducting comprehensive criminal background checks. Limited safety-related inquiries may be permitted earlier for specific high-security positions, but general criminal history screening cannot occur during initial application or interview stages.

What criminal convictions can disqualify fintech job candidates?

Criminal convictions that directly relate to job responsibilities and pose unreasonable safety risks may disqualify candidates after individualized assessment. However, employers must demonstrate clear business necessity and cannot use blanket exclusions. Cannabis possession charges typically cannot disqualify candidates from most fintech positions.

Are background check requirements different for remote Illinois workers?

Remote Illinois workers are subject to the same state employment protections regardless of work location, provided they are Illinois residents or the company has Illinois operations. Federal regulations may apply differently based on the employer's regulatory status rather than employee location.

How do federal banking regulations affect Illinois employment laws?

Federal banking regulations can supersede some Illinois employment protections for specific regulated positions, particularly regarding criminal history and substance use restrictions. However, Illinois procedural requirements for notice, individualized assessment, and adverse action procedures typically still apply even when federal restrictions limit hiring decisions.

What documentation is required for compliant background checks?

Illinois requires written authorization for all background checks, separate biometric consent when applicable, detailed adverse action notices, and comprehensive record-keeping for 3-5 years depending on document type. Documentation must demonstrate compliance with both state employment laws and applicable federal regulations.

Additional Resources

- Illinois Department of Human Rights Employment Guidance

https://www2.illinois.gov/dhr/Pages/default.aspx - Chicago Commission on Human Relations Fair Chance Ordinance

https://www.chicago.gov/city/en/depts/cchr.html - Illinois Biometric Information Privacy Act Compliance Guide

https://www.illinoisattorneygeneral.gov/consumers/general_2.html - Federal Financial Institution Examination Council Background Check Guidelines

https://www.ffiec.gov/ - Consumer Financial Protection Bureau Employment Screening Requirements

https://www.consumerfinance.gov/ - Illinois Cannabis Regulation and Tax Act Employment Provisions

https://www2.illinois.gov/Pages/government/marijuana-laws.aspx - National Association of Professional Background Screeners Illinois Resources

https://www.napbs.com/ - Illinois Employment Law Updates and Compliance Calendar

https://www2.illinois.gov/idol/Pages/default.aspx

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

How Long Does a Background Check Take? A Complete 2025 Guide

13 Dec, 2023 • 14 min read

The Ultimate Background Check Guide

13 Dec, 2023 • 4 min read

The Ultimate Guide to Employment Background Checks

13 Dec, 2023 • 10 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.