Navigating the complexities of eviction records during a background check can be daunting, especially in a bustling and legally intricate market like New York. Eviction records play a crucial role in various decision-making processes, whether you're a landlord screening a potential tenant or an individual looking to understand your own background profile. With specific requirements and potential legal implications, understanding how these records are managed in New York is essential for making informed decisions.

In this guide, we'll explore the essentials of New York eviction records background checks, providing valuable insights and practical advice for property managers, landlords, and tenants alike. Whether you're new to the process or seeking clarity on the specific regulations in New York, this guide will serve as your roadmap to navigating eviction records background checks effectively.

Key Takeaways

- In New York's housing market, understanding eviction records is essential for landlords and tenants to make informed rental decisions.

- Eviction records outline a tenant's rental history, impacting decisions and requiring legal compliance when accessed by landlords.

- New York laws, such as the Housing Stability and Tenant Protection Act, regulate how eviction records can be used, emphasizing tenant rights and transparency.

- Conducting a background check on eviction records involves gathering detailed tenant information and using reputable services to ensure accuracy.

- Addressing inaccuracies in eviction records is crucial, with legal options available for tenants to dispute errors and safeguard their rights.

EXPERT INSIGHT: As professionals in the human resource department, eviction records represent more than just potential legal consequences; they represent the stories of individuals living through difficult moments of their lives. I've seen how a single record may erase years of stability, but I've also seen how due diligence and fairness in the process of screening may rebuild the lost confidence. The problem is how to balance compliance and protection of the interest of property owners with empathy and the granting of second chances for tenants. When due diligence and compassion come together for a closer examination of eviction records, a housing process not only becomes lawful but also fair. - Charm Paz, CHRP

Introduction

New York presents a unique housing market influenced by its dense population and diverse economic landscape. The legal framework governing housing here is complex, shaped by both state and city regulations. It’s crucial for landlords and tenants to understand eviction records as part of any housing transaction.

Eviction records are a central focus, shaping decisions and influencing property rental dynamics. These records document a tenant's rental history, often the point of contention between property managers and prospective tenants. Knowing how to handle these records can be a decisive factor in making informed decisions.

Complying with legal requirements is non-negotiable. In New York, transparency and adherence to housing laws aren't just recommendations; they're imperatives. Maintaining compliance in background checks builds trust and reduces the risk of legal troubles. For landlords and tenants, understanding these records isn't just about due diligence; it's about fostering a respectful and lawful rental process.

Understanding Eviction Records

Eviction records are valuable pieces of information that detail a tenant's rental history concerning evictions. These records typically include the tenant's name, address of the rented property, the landlord's name, the court's decision, and the date of the case. For landlords, these records provide insights into a potential tenant's past behavior in terms of fulfilling rental agreements. They offer a layer of protection by indicating whether a tenant was previously removed from a property due to non-payment, lease violations, or other reasons.

Eviction records matter because they can influence a landlord's decision-making process. For landlords, these records serve as a red flag when evaluating applications. If a tenant has a history of eviction, it might point to potential rental payment issues, property damage concerns, or behavioral problems. Consequently, the presence of an eviction record can weigh heavily against a prospective tenant.

The creation of an eviction record begins with the legal process of eviction itself. When a landlord initiates an eviction, it generally starts with a notice to the tenant regarding the violation or non-compliance issue. If unresolved, the landlord may file a lawsuit for possession in court. If the court sides with the landlord, a judgment for possession is issued, formalizing the eviction on the tenant's record.

Understanding eviction records involves recognizing their role in rental decision-making. As a stakeholder, keeping informed about the contents and implications of these records can assist in making more balanced and informed decisions—whether you're a landlord assessing applications or a tenant keeping track of your rental history.

New York's Legal Framework

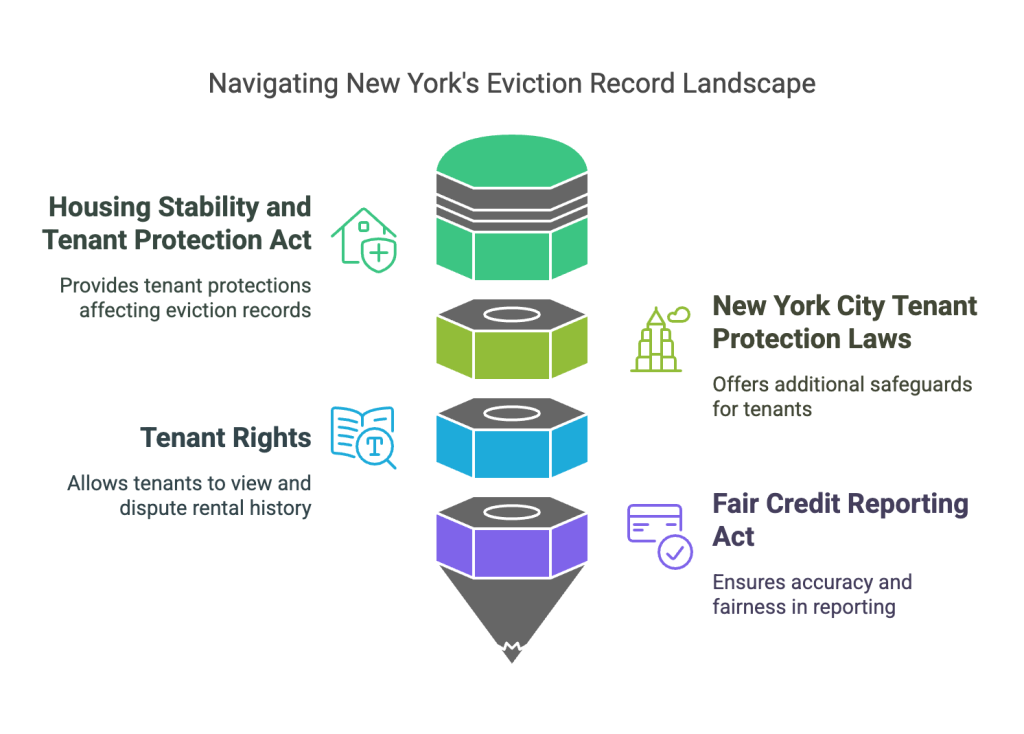

New York has its own set of laws when it comes to eviction records. It's crucial to understand these regulations, as they dictate how records are both created and accessed. The state's Housing Stability and Tenant Protection Act plays a significant role here, providing tenants with protections that impact how eviction records are used in background checks. For example, landlords cannot deny a rental application solely based on past evictions in certain circumstances.

Moreover, the New York City Tenant Protection Laws offer additional safeguards. These laws ensure that landlords provide prospective tenants with information about tenant screening processes, including whether eviction history will factor into the decision.

Tenant rights are a focal point. Tenants in New York have the right to view their rental history and dispute inaccuracies with the courts or through various reporting agencies. Recognizing these rights means you can navigate disputes more effectively, whether you're a tenant facing potential discrimination or a landlord aiming for compliance.

Federal law, like the Fair Credit Reporting Act (FCRA), adds yet another layer. The FCRA requires accuracy and fairness in how eviction records are reported. If you're using such records, you're responsible for ensuring they're correct and up-to-date.

Knowing these laws helps you make informed decisions. Are you aware of how these regulations impact your ability to use eviction records effectively? Understanding the legal landscape is your guide to ensuring a fair and transparent process.

Steps for Conducting a New York Eviction Records Background Check

Conducting a background check for eviction records in New York involves several critical steps. The process might seem complicated, but with a straightforward approach, you can ensure accuracy and compliance. Here's how you can conduct an effective background check:

- Collecting Information: Start by gathering essential details about the individual. You'll need the full name, date of birth, and social security number if possible. This information helps verify identity and ensures you're looking at the right records.

- Selecting Background Check Services: Choose a background check service that specializes in eviction records. It's important to use a reliable and thorough service to avoid missing information. Organizations like the Professional Background Screening Association (PBSA) offer resources on reputable service providers. Verify that the service complies with both state and federal laws, especially the Fair Credit Reporting Act (FCRA).

- Reviewing the Results: Once you obtain the records, examine them carefully. Look for any eviction filings or judgments. Pay attention to the dates, locations, and reasons for eviction. This context is crucial to understanding any patterns or concerns. For instance, a single eviction due to a landlord's foreclosure might differ significantly from multiple evictions due to non-payment.

As you review eviction records, remember that context matters. An eviction from many years ago may hold less relevance than recent ones. Always consider the full picture and use this information as one component of your decision-making process.

Navigating Challenges

Inaccuracies in eviction records can present a significant issue. Errors might result from clerical mistakes or poor data entry. If you find inaccuracies, prompt action is necessary. Start by requesting a copy of your eviction record from the reporting agency. Compare it against your personal records to spot any discrepancies. If discrepancies are found, contact the reporting agency directly. Provide them with any relevant documentation to support your claim.

Disputing records systematically can clear inaccuracies. Under the Fair Credit Reporting Act (FCRA), you have the right to dispute false information. File a dispute with both the reporting agency and the landlord or employer who is using this data. Typically, the reporting agency must investigate within 30 days. Keep detailed records of all communications and documentation during the dispute process.

For tenants facing unfair checks, legal recourse exists. Consult with a lawyer specializing in tenant rights if you believe your eviction background check results were unjust. Some cases might warrant reaching out to local tenant advocacy groups for additional support. Remember, understanding your rights is crucial in taking effective action.

Practical Tips for Landlords and Tenants

When dealing with eviction records, both landlords and tenants need to be proactive and informed. Here are some straightforward steps to follow for each group:

Best Practices for Landlords:

- Standardize Your Process: Use the same criteria and process for every applicant. This consistency protects you from potential discrimination claims and ensures fairness.

- Always Get Written Consent: Before conducting a background check, obtain written permission from the tenant. This keeps you compliant with the Fair Credit Reporting Act.

- Use Reputable Services: Choose background check services that are transparent about their methods. Check their accreditation with organizations like the Professional Background Screening Association.

- Consider the Context: Look at the circumstances surrounding an eviction. An applicant may have faced an unexpected crisis that does not reflect their overall reliability.

- Communicate Clearly: Explain the findings to the tenant if their application is denied due to an eviction record. Provide them with an opportunity to explain or address any inaccuracies.

Preparing for a Background Check as a Tenant:

- Know Your Rights: Familiarize yourself with New York's tenant laws and your rights during the background check process.

- Check Your History: Obtain a copy of your own eviction records and credit report. This allows you to identify and correct any errors before applying.

- Be Honest and Upfront: If you have an eviction in your past, address it in your application. Highlight any positive steps you’ve taken since, like a steady job or paying off debts.

- Prepare Documentation: Gather references, proof of current employment, and any documents that can demonstrate your reliability as a tenant.

- Communicate: Reach out to potential landlords to discuss any concerns and to show your willingness to cooperate.

Conclusion

Understanding eviction records background checks in New York requires grasping the legal, practical, and relational aspects involved. Adhering to New York-specific laws and the Fair Credit Reporting Act ensures transparent and lawful practices for landlords and tenants. Clear communication fosters trust and minimizes disputes. Whether you’re a property manager or a tenant, keeping informed and seeking professional guidance when needed will help navigate this complex process. Explore resources and stay updated to handle background checks effectively, ensuring all parties are treated fairly and within legal boundaries. Records of eviction are real-life matters and not to be taken lightly. Mutually responsible treatment between tenants and proprietors may result in a more transparent and respect-based property market.

Frequently Asked Questions (FAQs)

How long do evictions stay on your record in New York?

Evictions in New York remain on your credit report for up to seven years. This can affect your ability to rent in the future.

Can you do a background check on a tenant in NYC?

Yes, landlords in NYC can perform background checks on potential tenants. This can include checking credit history, criminal records, and eviction history.

What does a NY background check show?

A New York background check typically reveals your credit history, criminal records, eviction history, and possibly your employment and rental history.

Did New York ban evictions in 2024?

As of my last update in October 2023, there is no information about New York banning evictions in 2024. Always check current state laws for up-to-date information.

Are evictions still on hold in NYC?

Eviction moratoriums in NYC ended as of early 2023. You should verify the latest updates from reliable sources for any changes in policy.

How can I remove an eviction from my record?

To remove an eviction, you can attempt to settle the amount owed with your landlord and ask them to withdraw the eviction filing. You might need to petition the court to expunge the record with legal assistance.

What steps can a tenant take to improve their rental application after an eviction?

You can improve your application by providing references, demonstrating steady employment, and explaining the circumstances of the eviction to potential landlords. Offering a larger deposit or a co-signer might also help.

How does an eviction affect my credit score?

Evictions directly don't show up on your credit report. However, unpaid debts sent to collections, related to evictions, can significantly lower your credit score.

What rights do tenants have during an eviction process in New York?

Tenants can receive a written notice before eviction proceedings start. They have the right to appear in court to present their case. Legal aid services are often available to assist tenants through the process.

Definitions

Background Check

A background check is a process used to verify an individual's history, including employment, criminal records, credit history, and eviction records. Employers and landlords often use background checks to assess reliability and financial responsibility. In New York, background checks must comply with legal standards like the Fair Credit Reporting Act (FCRA) to ensure fairness and accuracy.

Compliance

Compliance refers to following legal and regulatory requirements in business or rental transactions. Landlords, employers, and background check companies must adhere to federal and state laws to avoid penalties. In New York, housing regulations require transparency in tenant screenings, including the proper handling of eviction records.

Due Diligence

Due diligence means conducting a thorough review before making decisions. This can include checking references, verifying financial history, or examining legal records. Landlords practice due diligence by reviewing eviction records to identify risks, while tenants do the same by confirming their rental history is accurate.

Tenant Rights

Tenant rights protect individuals renting a home or apartment from unfair treatment. In New York, laws limit how eviction records can be used and give tenants the right to dispute errors. Knowing your rights allows you to challenge inaccurate records and ensures a fair rental process.

Transparency

Transparency means openly sharing information in a clear and honest way. In housing, landlords must disclose how tenant screenings work and what factors influence rental decisions. Clear communication about eviction records helps both landlords and tenants make informed choices.

Based on the search results, I've identified several relevant studies and surveys that can enhance the article. Here are the key additions I would make:

Further Readings

[1]https://localhousingsolutions.org/lab/notes/state-eviction-tracker/

[2] https://council.nyc.gov/data/evictions/

[3] https://www.naacpldf.org/evictions-racial-justice-good-cause-protection-new-york/

Still have questions?

Get in touch with our team today for a personalized demo and discover how our tailored volume pricing and packages can drive results for your business!

How useful was this page?*

Note: your comments are anonymous. We use them to improve the website. Do not include any personal details.

Visit our FCRA Compliance Tool or leave a message here if you need a response.

From the blog Explore the GCheck Content Hub

Navigating the New York Education Background Check Process: A 2026 Operational Guide

28 Jan, 2026 • 18 min read

Florida Education Background Checks: 2026 Compliance Guide for School Districts

27 Jan, 2026 • 19 min read

Texas Construction Background Check Requirements: Compliance and Best Practices for 2026

27 Jan, 2026 • 19 min readThe information provided in this article is for general informational and educational purposes only and should not be construed as legal advice or a substitute for consultation with qualified legal counsel. While we strive to ensure accuracy, employment screening laws and regulations—including but not limited to the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, state and local ban-the-box laws, industry-specific requirements, and other applicable federal, state, and local statutes—are subject to frequent changes, varying interpretations, and jurisdiction-specific applications that may affect their implementation in your organization. Employers and screening decision-makers are solely responsible for ensuring their background check policies, procedures, and practices comply with all applicable laws and regulations relevant to their specific industry, location, and circumstances. We strongly recommend consulting with qualified employment law attorneys and compliance professionals before making hiring, tenant screening, or other decisions based on background check information.