Georgia's thriving fintech sector requires comprehensive background screening processes that comply with both federal FCRA regulations and state-specific requirements in 2025. Understanding these protocols is essential for employers and job seekers navigating the Atlanta metropolitan area's rapidly expanding financial technology landscape. The state's position as a Southeast regional fintech compliance hub demands rigorous adherence to regulatory standards while balancing efficient hiring practices with thorough risk assessment procedures.

Key Takeaways

- Georgia fintech background check requirements combine federal FCRA compliance with state-specific regulations, creating a comprehensive screening framework for financial technology companies in 2025.

- Georgia financial industry hiring standards mandate thorough background investigations including credit history, criminal records, and regulatory compliance verification for most fintech positions.

- Atlanta's emergence as a Southeast fintech hub has intensified the need for specialized background screening processes that address both traditional banking regulations and innovative technology sector requirements.

- Fintech regulatory compliance screening in Georgia must account for multiple oversight bodies including the Georgia Department of Banking and Finance, FDIC, and FinCEN depending on company activities.

- Job seekers should prepare for comprehensive background checks that may take 2-4 weeks and include verification of employment history, education credentials, and financial responsibility indicators.

- Georgia financial services hiring processes increasingly incorporate AI-driven screening tools while maintaining human oversight to ensure fair and compliant evaluation of candidates.

Understanding Georgia's Fintech Background Check Requirements

Georgia's fintech industry operates under a complex regulatory framework that requires comprehensive background screening for employees handling financial data. Moreover, the state's Department of Banking and Finance mandates specific screening protocols that vary based on job responsibilities. These requirements have evolved significantly as Atlanta has emerged as a major fintech center in 2025.

The state attracts companies like PayPal, Kabbage, and numerous blockchain startups. Additionally, these businesses must comply with both state and federal oversight requirements. Furthermore, Georgia financial industry hiring standards require employers to conduct thorough due diligence on potential employees.

Most positions require specific regulatory clearances that can extend the hiring timeline. However, this ensures compliance with both state and federal oversight requirements. The screening process typically encompasses criminal background checks, credit history reviews, employment verification, and educational credential confirmation.

Georgia's approach to fintech regulatory compliance screening reflects its commitment to maintaining a secure financial services environment. Meanwhile, the state fosters innovation through streamlined processes for legitimate fintech operations. This balance has contributed to the state's reputation as a business-friendly environment for financial technology companies seeking to establish operations in the Southeast region.

Criminal Background Check Components for Georgia Fintech Positions

State and Federal Criminal History Searches

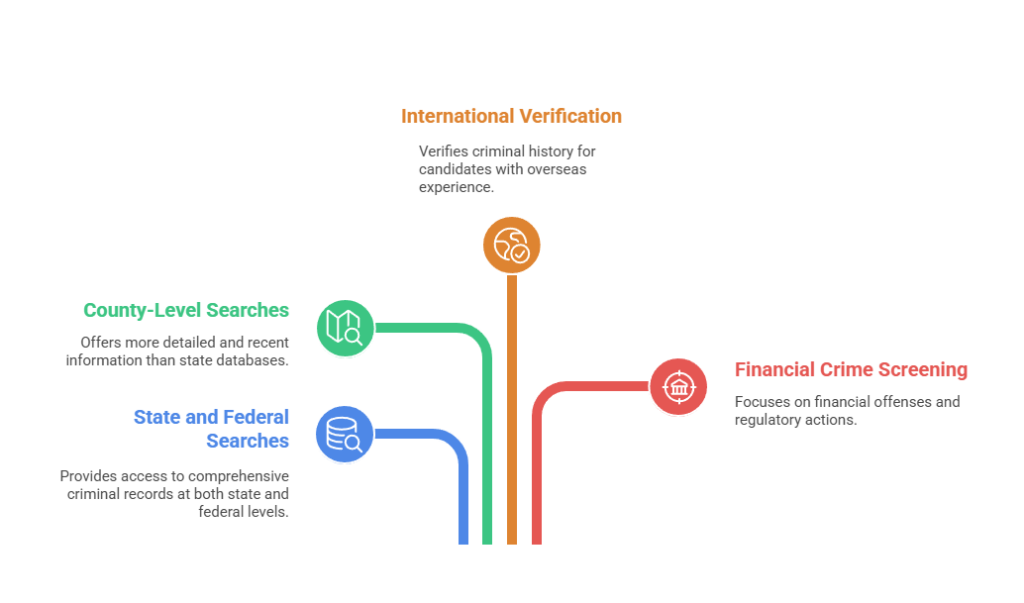

Georgia fintech companies must conduct comprehensive criminal background checks that include both state-level and federal criminal history searches. The Georgia Crime Information Center (GCIC) database provides access to state criminal records. Federal searches through the FBI's database reveal any federal crimes or interstate criminal activity.

Most fintech employers also conduct county-level searches in jurisdictions where candidates have lived or worked. These searches often contain more detailed and recent information than state databases. Additionally, some companies extend searches to include international criminal history verification for candidates with overseas experience.

Financial Crime Screening Requirements

Georgia fintech background check protocols place special emphasis on financial crimes due to the nature of the industry. Employers screen for offenses including fraud, embezzlement, money laundering, identity theft, and securities violations. The screening process also examines any regulatory actions or sanctions imposed by financial oversight bodies.

These searches often extend beyond traditional criminal databases. They include regulatory enforcement databases maintained by agencies like FinCEN, the SEC, and state banking departments. Furthermore, companies may review civil litigation records for financial disputes or business-related lawsuits.

Credit History and Financial Responsibility Verification

Credit history evaluation represents a critical component of Georgia financial services hiring processes in 2025. Financial responsibility directly correlates with job performance in money-handling positions. Georgia law permits employers to conduct credit checks for positions involving financial responsibilities. However, they must comply with FCRA notification requirements and provide adverse action notices when credit history influences hiring decisions.

Fintech regulatory compliance screening often requires more detailed financial background analysis than traditional employment screening. Companies examine candidates' financial stability to assess potential vulnerability to bribery or financial coercion. This analysis includes review of recent financial hardships, unusual financial activities, or patterns that might indicate financial stress or irresponsible money management practices.

| Credit Evaluation Factors | Acceptable Standards |

| Payment History | 90%+ on-time payments over 24 months |

| Debt-to-Income Ratio | Below 40% total monthly obligations |

| Bankruptcy History | 7+ years since discharge completion |

| Collections/Charge-offs | Minimal recent activity, resolved accounts |

| Credit Utilization | Below 30% of available credit limits |

The evaluation focuses on payment history, debt-to-income ratios, bankruptcies, and any accounts in collection status. Most employers also consider the candidate's explanation of any negative credit events and evidence of financial recovery efforts.

Employment and Education Verification Standards

Georgia fintech employers implement rigorous employment verification processes that extend beyond basic position and salary confirmation. Georgia financial industry hiring practices often require verification of employment for the previous 7-10 years. The verification includes performance evaluations, reasons for departure, and eligibility for rehire status. Particular attention is paid to any gaps in employment history or frequent job changes that might indicate instability.

Educational credential verification has become increasingly important as fintech companies seek candidates with specialized technical and financial knowledge. The verification process includes confirmation of degrees, certifications, professional licenses, and continuing education requirements. Many Georgia fintech employers also verify specific coursework related to financial technology, cybersecurity, or regulatory compliance. This is particularly important for positions requiring specialized expertise in these areas.

The rise of remote work and online education has made verification more complex but equally important. Employers now use specialized services to verify credentials from international institutions and online degree programs. Additionally, companies verify professional development courses, industry certifications, and specialized training programs that demonstrate ongoing commitment to skill development.

Regulatory Compliance and Licensing Checks

Professional License Verification

Fintech regulatory compliance screening in Georgia requires verification of professional licenses relevant to financial services. This includes securities licenses, insurance certifications, and specialized fintech credentials. The verification process includes checking license status, any disciplinary actions, continuing education compliance, and renewal requirements.

Employers must also verify that candidates maintain good standing with professional organizations. Additionally, they check regulatory bodies governing their specific areas of expertise. Furthermore, some positions require ongoing monitoring of license status throughout employment.

Regulatory Database Searches

Georgia fintech background checks include comprehensive searches of regulatory databases maintained by various oversight bodies. These searches examine enforcement actions, sanctions, or disciplinary measures imposed by agencies including the Consumer Financial Protection Bureau and Federal Trade Commission. The screening also includes review of any involvement in regulatory investigations, consent orders, or settlement agreements.

Companies utilize specialized database search services that monitor multiple regulatory sources simultaneously. Moreover, these searches often include international regulatory databases for candidates with global experience. The process has become more sophisticated with AI-powered screening tools that can identify potential red flags across multiple databases.

Industry-Specific Background Check Considerations

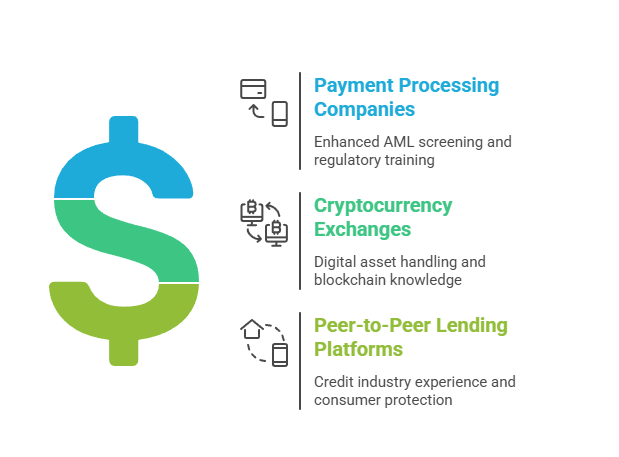

Georgia fintech background check requirements vary significantly based on the specific subsector and regulatory environment of the hiring company. Payment processors face different scrutiny than cryptocurrency exchanges. Traditional banking technology companies may have distinct requirements from peer-to-peer lending platforms. Companies handling international transactions must also consider additional screening requirements related to anti-money laundering (AML) and Know Your Customer (KYC) regulations.

The state's diverse fintech ecosystem includes companies operating under various regulatory frameworks in 2025. These range from state money transmitter licenses to federal banking charters. Each regulatory environment imposes specific employee screening requirements. These may include enhanced background checks, ongoing monitoring obligations, and periodic re-screening protocols. Georgia financial services hiring managers must understand these varying requirements to ensure compliance while maintaining efficient recruitment processes.

- Payment Processing Companies: Enhanced AML screening, transaction monitoring experience verification, and specialized regulatory compliance training requirements

- Cryptocurrency Exchanges: Digital asset handling experience, blockchain technology knowledge verification, and enhanced financial crime screening protocols

- Peer-to-Peer Lending Platforms: Credit industry experience validation, consumer protection regulation knowledge, and debt collection practice compliance screening

These specialized requirements reflect the evolving nature of fintech regulation. Furthermore, emerging technologies create new compliance challenges that require specialized screening protocols.

Timeline and Process Management for Georgia Fintech Hiring

Georgia financial industry hiring timelines typically extend 15-30 business days for comprehensive background screening in 2025. Complex cases or international candidate verification may require additional time. The process begins with candidate consent and disclosure requirements under the Fair Credit Reporting Act. This is followed by systematic verification of each background component.

Effective process management requires coordination between HR departments, background screening vendors, and regulatory compliance teams. Many Georgia fintech companies have implemented automated screening systems that accelerate routine verifications. These systems flag cases requiring additional review while maintaining compliance standards.

Timeline management has become more critical as competition for qualified fintech talent has intensified. Companies must balance thoroughness with time-to-hire considerations. Delayed decisions may result in losing qualified candidates to competitors in Georgia's competitive job market.

- Days 1-3: Initial screening and database searches

- Days 4-10: Employment and education verification

- Days 11-15: Regulatory and professional license confirmation

- Days 16-20: Credit history and financial responsibility review

- Days 21-30: Final compliance review and decision processing

This structured approach helps ensure all requirements are met without unnecessary delays. Furthermore, it improves the candidate experience during the hiring process.

Cost Considerations and Budgeting for Background Screening

Fintech regulatory compliance screening costs vary significantly based on the depth and scope of verification required. Basic background checks may cost $50-100 per candidate. Comprehensive screening for senior positions can exceed $500 per candidate. Companies must budget for these expenses while considering the cost of potential regulatory violations or bad hires.

Many Georgia fintech companies negotiate volume discounts with screening providers. They also implement tiered screening processes based on position level and responsibilities. This approach helps control costs while ensuring appropriate due diligence for all positions. Additionally, companies may use in-house resources for initial screening steps to reduce vendor costs.

The return on investment for thorough background screening typically justifies the expense. Companies that invest in comprehensive screening report lower turnover rates and fewer compliance issues. Additionally, they experience reduced legal liability and improved regulatory relationships. Furthermore, proper screening helps protect company reputation and customer trust.

Legal Compliance and Fair Hiring Practices

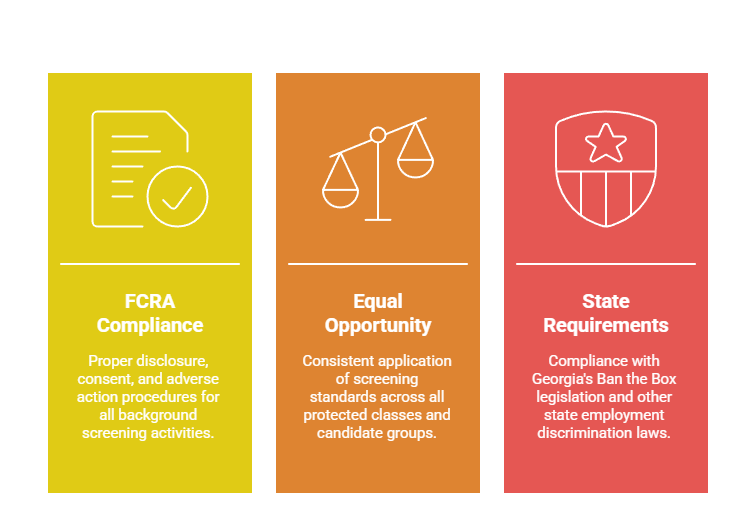

Georgia fintech background check processes must comply with federal and state fair hiring laws. The Fair Credit Reporting Act requires specific disclosure and consent procedures before conducting background checks. Additionally, employers must provide adverse action notices when background check results influence hiring decisions. Companies must also maintain detailed records of their screening processes and decisions.

Georgia's Ban the Box legislation restricts how employers can use criminal history information. Companies cannot inquire about criminal history on initial job applications for most positions. They must wait until after a conditional job offer to conduct criminal background checks. However, exceptions exist for positions involving financial responsibilities or regulatory requirements.

Anti-discrimination laws require employers to apply background check standards consistently across all candidates. They must also consider the relationship between background findings and job requirements. Furthermore, companies must provide candidates with opportunities to explain or dispute negative findings.

- FCRA Compliance: Proper disclosure, consent, and adverse action procedures for all background screening activities

- Equal Employment Opportunity: Consistent application of screening standards across all protected classes and candidate groups

- State-Specific Requirements: Compliance with Georgia's Ban the Box legislation and other state employment discrimination laws

Recent legal developments in 2025 have emphasized the importance of individualized assessments of criminal history. Employers must consider factors such as the nature of the offense, time elapsed, and evidence of rehabilitation.

Best Practices for Employers and Job Seekers

Georgia fintech employers should establish standardized background check procedures that ensure consistent application across all candidates. Fintech regulatory compliance screening protocols should be documented and regularly updated to reflect regulatory changes. Implementation should be handled by trained personnel who understand both legal requirements and industry best practices. Companies should also establish clear communication protocols to keep candidates informed throughout the screening process.

Regular audits of screening procedures help identify potential compliance gaps. They also ensure ongoing effectiveness of background check programs. Additionally, companies should maintain detailed records of all screening decisions and their rationale for potential legal challenges. Training programs for HR staff help ensure proper implementation of screening procedures.

Job seekers preparing for Georgia fintech background check processes should proactively address potential issues. They should obtain copies of their credit reports, criminal background checks, and employment verification records before beginning job applications. Transparency about past issues, coupled with evidence of remediation, often produces better outcomes than attempting to conceal information. Candidates should also research specific companies' screening requirements and prepare appropriate documentation.

Candidates should also ensure all professional licenses and certifications remain current and in good standing. They should organize documentation of employment history and educational credentials to expedite the verification process. Furthermore, they should be prepared to explain any background concerns transparently during the hiring process. Professional references who can speak to character and work performance can also help mitigate minor background issues.

Conclusion

Georgia fintech background check requirements reflect the state's commitment to maintaining a secure and compliant financial services environment in 2025. The comprehensive screening processes protect both employers and consumers while ensuring qualified professionals can access opportunities in Georgia's expanding fintech sector. Success in navigating these requirements depends on understanding the regulatory landscape and implementing thorough screening procedures. Additionally, maintaining transparency throughout the hiring process remains essential. As Georgia continues developing as a Southeast regional fintech hub, background check standards will likely evolve to address new technologies and regulatory challenges while preserving the fundamental principles of thorough due diligence and risk management.

Frequently Asked Questions

How long does a Georgia fintech background check typically take in 2025?

Most Georgia fintech background check processes require 15-30 business days for completion, depending on the complexity of verification requirements and the candidate's background. International candidates or those with extensive work history may require additional time for thorough verification of credentials and employment history.

What criminal history disqualifies candidates from Georgia fintech positions?

Financial crimes including fraud, embezzlement, money laundering, and securities violations typically disqualify candidates from Georgia financial industry hiring consideration. However, employers must evaluate criminal history in relation to job responsibilities and consider factors such as time elapsed, rehabilitation evidence, and the nature of the specific role.

Do Georgia fintech companies check credit history for all positions?

Georgia financial services hiring practices vary by company and position, but most roles involving financial responsibilities, customer data access, or regulatory compliance require credit history verification. Entry-level technical positions may have less stringent credit requirements than senior financial or compliance roles.

Are there specific education requirements for Georgia fintech positions?

While education requirements vary by employer and position, fintech regulatory compliance screening often includes verification of relevant degrees, professional certifications, and specialized training in financial technology, cybersecurity, or regulatory compliance fields.

How can job seekers prepare for Georgia fintech background checks?

Candidates should obtain copies of their credit reports, criminal background checks, and employment records before applying to identify and address potential issues. Maintaining current professional licenses, organizing documentation of employment history and educational credentials, and being prepared to explain any background concerns transparently improves screening outcomes.

Do Georgia fintech background checks include social media screening?

Many Georgia fintech background check processes include limited social media screening to identify potential regulatory compliance risks, though this practice varies by employer and must comply with applicable privacy laws and company policies.

What happens if a candidate fails part of the background check?

Employers must follow FCRA adverse action procedures, providing candidates with notification of negative findings and opportunity to dispute inaccurate information. Georgia financial services hiring decisions should consider the relationship between background findings and job responsibilities while following consistent evaluation criteria.

Are ongoing background checks required for Georgia fintech employees?

Many fintech positions require periodic re-screening, particularly for roles with regulatory oversight requirements. The frequency and scope of ongoing fintech regulatory compliance screening depend on specific job responsibilities and regulatory requirements applicable to the employer's business operations.

Additional Resources

- Georgia Department of Banking and Finance - Licensing and Regulation Guidelines

https://dbf.georgia.gov/ - Fair Credit Reporting Act - Federal Trade Commission Guide

https://www.ftc.gov/legal-library/browse/rules/fair-credit-reporting-act - FinCEN - Financial Crimes Enforcement Network Resources

https://www.fincen.gov/ - Georgia Crime Information Center - Background Check Information

https://gbi.georgia.gov/services/gcic - Consumer Financial Protection Bureau - Employment Screening Guidelines

https://www.consumerfinance.gov/ - Society for Human Resource Management - Background Screening Resources

https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/backgroundchecks.aspx - National Association of Professional Background Screeners - Best Practices

https://www.napbs.com/