Florida government contractor background check requirements encompass multi-tiered federal screening protocols mandated by agencies including the DoD, GSA, and DHS. These range from basic Public Trust to Top Secret/SCI investigations. Contractors operating near Florida's 21 military installations must navigate complex compliance frameworks including NISPOM standards, DCAA auditing requirements, and continuous vetting obligations.

Key Takeaways

- Federal contractors in Florida must comply with Executive Order 13467 and SEAD-16 guidelines, which establish standardized background investigation protocols across all government agencies.

- Tampa federal contractor background checks typically require SF-85 or SF-86 forms depending on clearance level, with processing times ranging from 30 days for basic checks to 12+ months for Top Secret clearances.

- Florida's proximity to CENTCOM, SOCOM, and MacDill AFB creates heightened security requirements for Orlando government contractor screening, particularly for defense-adjacent businesses.

- Miami defense contractor background investigations must address continuous evaluation programs (CEP) implemented in 2021, requiring ongoing monitoring rather than periodic reinvestigations.

- Jacksonville federal contractor compliance screening involves coordinating with the Defense Counterintelligence and Security Agency (DCSA), which processes over 95% of federal clearance investigations.

- Non-compliance with Florida contractor security clearance eligibility requirements can result in contract termination, debarment proceedings, and penalties exceeding $500,000 per incident.

- Florida-based contractors benefit from streamlined processing through regional DCSA field offices in Tampa and Jacksonville, reducing average clearance processing times by 15-20%.

- Government contractors must maintain facility clearance (FCL) in addition to personnel clearances when handling classified information, requiring separate DD Form 441 applications and regular security audits.

Understanding Federal Background Check Tiers for Florida Contractors

Federal background check requirements for government contractors operate on a tiered system. This system directly correlates to the sensitivity level of information accessed and the nature of contract work performed. The investigative depth, timeline, and documentation requirements escalate significantly as clearance levels increase.

Florida contractors must understand these distinctions because the state hosts numerous facilities requiring varying clearance levels. These range from NASA's Kennedy Space Center operations to Special Operations Command assignments. The specific tier determines investigation scope, adjudication criteria, and ongoing monitoring obligations that directly impact operational capabilities and contract eligibility.

Position Risk Designation Levels

The federal government categorizes contractor positions into six risk levels under the Position Designation System. This system was established by SEAD-6 guidance. Each designation corresponds to specific investigative requirements and determines the appropriate background check depth.

| Risk Level | Investigation Type | Processing Time |

| Low Risk (Public Trust) | NACLC/Tier 1 | 30-60 days |

| Moderate Risk | MBI/Tier 3 | 4-6 months |

| High Risk | BI/Tier 5 | 8-12 months |

| Confidential | NACLC | 3-5 months |

| Secret | SSBI-PR/Tier 3 | 6-9 months |

| Top Secret/SCI | SSBI/Tier 5 | 12-18 months |

Position designations must align with contract requirements specified in Section C of government solicitations. Florida contractors should review DD Form 254 provisions during the proposal phase to accurately forecast clearance costs and timelines.

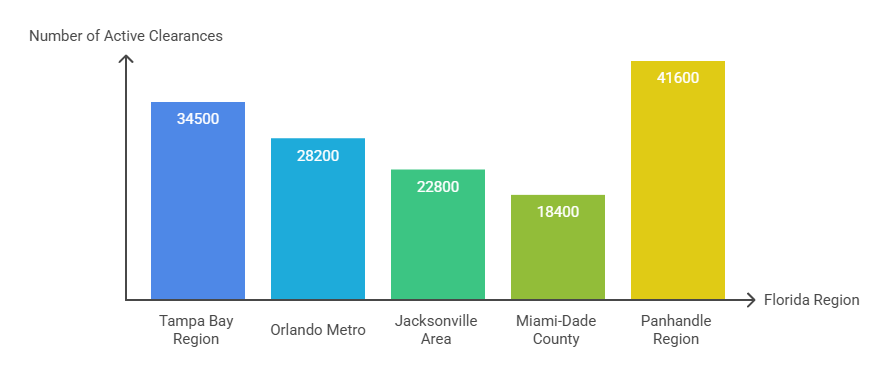

Florida-Specific Clearance Volume Statistics

Florida ranks seventh nationally in active security clearance holders. The state maintains approximately 187,000 cleared personnel as of 2025. This concentration creates both competitive advantages and unique compliance challenges for Tampa federal contractor background checks.

The state's clearance distribution reflects military-civilian workforce integration:

- Tampa Bay Region: 34,500 active clearances concentrated around MacDill AFB and CENTCOM

- Orlando Metro: 28,200 clearances supporting simulation, training, and aerospace contracts

- Jacksonville Area: 22,800 clearances for Naval Station Mayport and cybersecurity operations

- Miami-Dade County: 18,400 clearances for Southern Command and maritime security

- Panhandle Region: 41,600 clearances across Eglin AFB, Tyndall AFB, and Hurlburt Field

These figures demonstrate Florida's strategic importance in federal contracting ecosystems. Contractors establishing operations near these clearance clusters benefit from reduced recruitment challenges and faster contract mobilization.

Continuous Vetting vs. Periodic Reinvestigation

The federal government transitioned from periodic reinvestigation to Continuous Vetting (CV) programs starting in 2021. This fundamentally changed how Miami defense contractor background investigations function. CV leverages automated record checks across 13+ federal databases to identify security-relevant information in real-time.

Under Trusted Workforce 2.0 initiatives, enrolled clearance holders undergo automated checks of financial records, criminal databases, travel patterns, social media, and employment verification. Florida contractors must update security protocols to accommodate CV requirements. This includes implementing insider threat programs and establishing reporting procedures for security-relevant changes. Jacksonville federal contractor compliance screening now requires documented policies addressing CV findings within 5 business days of notification.

Mandatory Compliance Frameworks for Florida Government Contractors

Florida government contractor background check requirements exist within overlapping regulatory frameworks. These vary by contracting agency, information sensitivity, and contract performance location. Understanding these intersecting compliance obligations prevents costly violations and contract disputes.

Contractors must simultaneously satisfy federal acquisition regulations (FAR), agency-specific supplements, and national security directives. They must also maintain consistency with Florida employment law. This multi-layered compliance environment requires systematic policy development and continuous monitoring.

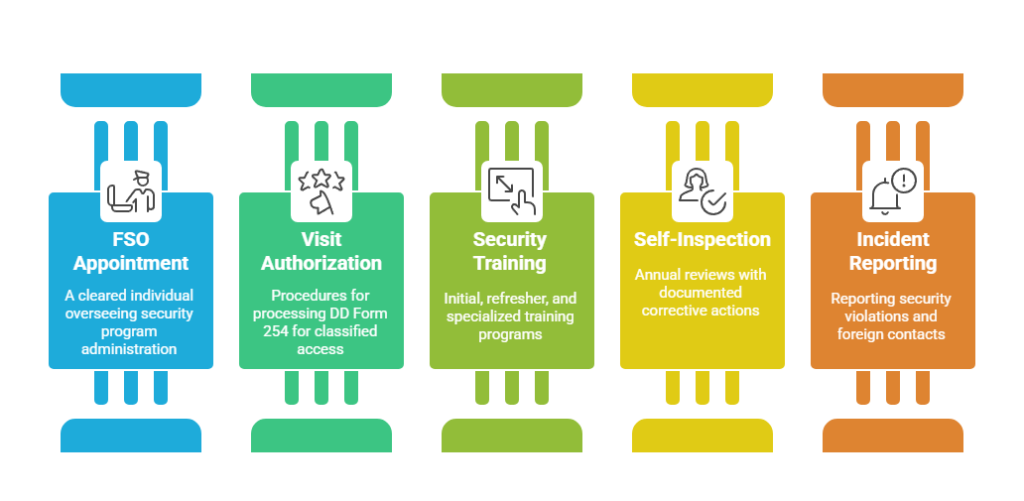

NISPOM and SEAD Requirements Integration

The National Industrial Security Program Operating Manual (NISPOM) is now codified as 32 CFR Part 117. It establishes baseline security requirements for contractors accessing classified information. Florida defense contractors must implement NISPOM Chapter 2 personnel security provisions covering initial clearance processing, insider threat programs, and security training requirements.

Key NISPOM obligations for Florida contractors include:

- Facility Security Officer (FSO) appointment: A cleared individual responsible for security program administration

- Visit authorization procedures: DD Form 254 processing for classified meetings or site access

- Security training: Initial, refresher, and specialized programs documented in training records

- Self-inspection programs: Annual comprehensive reviews with documented corrective actions

- Incident reporting: Security violations and foreign contact reporting within prescribed timeframes

DCSA conducts vulnerability assessments of cleared facilities every 12-18 months. Florida contractors average 2.3 minor findings per assessment according to 2024 industry data.

DCAA Auditing and Personnel Cost Compliance

Defense Contract Audit Agency (DCAA) audits scrutinize contractor accounting systems. This includes personnel costs associated with background investigations and security clearance maintenance. Orlando government contractor screening requirements must align with FAR 31.205-47 cost principles governing allowable security costs.

Florida contractors can generally recover costs for background investigation fees directly required by contract specifications, security officer salaries proportional to cleared employee ratio, and required security training programs. However, investigations exceeding contract requirements, clearance processing for business development purposes, and penalties from security violations are unallowable. DCAA auditors examine Jacksonville federal contractor compliance screening expenditures during incurred cost audits. Contractors should maintain detailed cost segregation records linking security expenditures to specific contract line items.

Foreign Ownership, Control, or Influence (FOCI) Mitigation

Florida's international business environment creates unique FOCI considerations for Miami defense contractor background investigations. FOCI exists when foreign interests have the power to direct or decide matters affecting a cleared contractor's management or operations. DCSA evaluates FOCI through SF 328 submissions and may require mitigation instruments.

| FOCI Mitigation | Application | Processing Time |

| Board Resolution | Minimal foreign interest (<5%) | 2-4 months |

| Security Control Agreement (SCA) | Moderate foreign influence | 6-12 months |

| Special Security Agreement (SSA) | Significant foreign ownership | 12-18 months |

| Proxy Agreement (PA) | Complete separation required | 18-24 months |

| Voting Trust Agreement (VTA) | Ownership transfer needed | 18-24 months |

Florida contractors with FOCI situations face extended facility clearance processing times. Companies should address FOCI early in contract pursuit phases to avoid disqualification from competitions.

Investigation Process and Timeline Management

The background investigation process for Florida government contractor background check requirements follows standardized protocols. These are managed primarily by DCSA, though some agencies maintain independent investigative capabilities. Understanding process mechanics, expected timelines, and acceleration strategies enables better resource planning.

Florida contractors benefit from regional DCSA processing infrastructure. Field offices in Tampa and Jacksonville provide direct support for investigation coordination and adjudication liaison. However, process duration remains the most significant challenge in contractor workforce development.

SF-85 and SF-86 Form Preparation

Electronic Questionnaires for Investigations Processing (e-QIP) system submissions initiate the investigation process. These use SF-85 for Public Trust positions or SF-86 for National Security positions. Form completeness and accuracy directly impact processing speed, with incomplete submissions adding 30-60 days to average timelines.

Critical form sections requiring detailed attention include residence history covering ten years with exact dates, employment history with comprehensive coverage of all employment periods, and foreign contacts disclosure. Tampa federal contractor background checks involving CENTCOM-related work receive heightened scrutiny in foreign contact areas. Financial records covering seven years of issues and criminal history including all arrests require complete disclosure. Florida's complex expungement laws create confusion, but federal investigations access original records regardless of state sealing orders.

Orlando government contractor screening applications average 47 pages for Secret clearances and 65+ pages for Top Secret submissions. Contractors should allocate 8-12 hours of candidate time for initial form completion plus 2-4 hours for FSO quality review.

Field Investigation and Interview Phases

Once e-QIP submission occurs, DCSA assigns investigations to field investigators or contracted investigation service providers. The investigation depth varies by clearance tier but generally includes credit checks, criminal record searches, employment verification, and subject interviews. For Tier 3 and Tier 5 investigations, investigators conduct in-person interviews with references, employers, neighbors, and cohabitants.

Typical investigation components include subject interviews lasting 45-90 minutes, reference interviews with 3-5 developed references, record checks including FBI fingerprint results and credit reports, employment verification, and residence verification. Miami defense contractor background investigations involving candidates with extensive international travel may require expanded investigations. These include overseas record checks that add 90-180 days to standard timelines.

Adjudication and Appeals Process

Following investigation completion, DCSA adjudicators review findings against the 13 adjudicative guidelines established in SEAD-4. Adjudication applies "whole-person concept" analysis, weighing security concerns against mitigating factors and demonstrated rehabilitation. Common adjudicative issues affecting Florida contractors include financial considerations, foreign influence, criminal conduct, and drug involvement.

Financial considerations arise from Florida's high cost of living in metro areas creating financial strain. Foreign influence issues stem from South Florida's international population creating frequent foreign family member concerns. DUI arrests are the most common criminal issue in Florida investigations. Federal clearance adjudication regarding marijuana use remains unaffected by state law changes—any marijuana use remains disqualifying for federal positions.

Clearance denials trigger appeal rights through DCSA's Office of Hearings and Appeals. Jacksonville federal contractor compliance screening appeals average 8-12 months from denial to final determination. This creates significant workforce planning challenges for time-sensitive contracts.

Florida-Specific Regulatory Considerations

Florida government contractor background check requirements intersect with state employment laws, local workforce characteristics, and regional security priorities. These create distinct compliance considerations beyond federal baseline standards. Contractors must harmonize federal mandates with Florida legal frameworks.

The state's unique demographic composition, international business connections, and military community concentration generate investigation patterns differing from national norms. Understanding these Florida-specific factors enables proactive risk management and more accurate clearance success forecasting.

State Employment Law Intersections

Florida employment laws impact how contractors conduct pre-employment screening and manage clearance-related adverse actions. The state's "employment-at-will" doctrine provides flexibility in termination decisions. However, federal contractor obligations create additional considerations beyond typical private sector employment.

While Florida has no statewide ban-the-box law, several counties and municipalities restrict when employers can inquire about criminal history. Federal contractors remain exempt from most restrictions when criminal checks are contract-required. Florida Statute § 768.095 requires written consent before obtaining consumer reports. When clearance denials prevent employment or cause termination, contractors must follow FCRA adverse action protocols.

Tampa federal contractor background checks triggering adverse actions require these procedures even though government adjudication isn't technically a "consumer report." Orlando government contractor screening policies should explicitly address state-federal law conflicts. This documentation proves essential during wrongful termination claims or discrimination challenges.

Regional Military Installation Impact

Florida hosts 21 active military installations spanning all service branches. This creates concentrated demand for cleared contractors and generates regional security requirements. Proximity to these installations influences investigation scope, facility clearance requirements, and ongoing security obligations.

MacDill Air Force Base in Tampa is home to CENTCOM and SOCOM, driving intensive Secret and Top Secret clearance demand. Naval Station Mayport in Jacksonville supports Atlantic Fleet operations creating demand for shipyard contractors. Eglin Air Force Base serves as the Air Force's largest installation supporting test and evaluation missions. Cape Canaveral Space Force Station combines DoD and NASA badging protocols. Naval Air Station Pensacola focuses on training missions requiring aviation-specific investigation elements.

Miami defense contractor background investigations supporting Southern Command operations emphasize Latin American regional expertise. This creates enhanced foreign influence scrutiny for candidates with familial or business connections to countries within SOUTHCOM's area of responsibility.

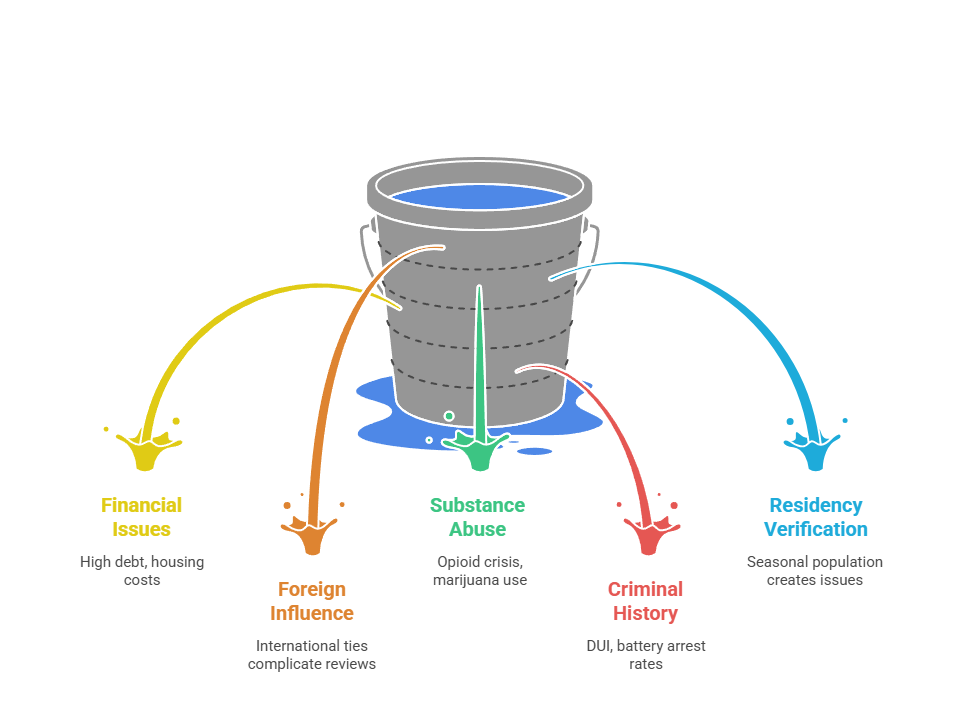

Common Clearance Disqualifiers in Florida Populations

Florida's demographic and economic characteristics create predictable clearance adjudication challenges that contractors must anticipate during workforce planning. Understanding common disqualification patterns enables more effective recruiting strategies and realistic clearance success forecasting. Frequent disqualification factors in Florida investigations require proactive candidate screening to avoid wasted processing resources.

- Financial Issues: Florida's lack of income tax doesn't prevent federal tax problems, which appear in 8-12% of clearance applications. The state's high housing costs create mortgage delinquencies, particularly for candidates relocating from lower-cost regions. Credit card debt averages $7,200 per Florida resident versus $6,500 nationally.

- Foreign Influence: South Florida's international population creates foreign family member concerns in approximately 18% of Miami-area investigations versus 6% nationally. Cuban family connections generate particularly complex adjudications given ongoing bilateral tensions. Latin American business connections require careful documentation and disclosure.

- Substance Abuse: Florida's opioid epidemic creates elevated prescription drug abuse issues in background investigations. Marijuana use remains problematic despite state medical authorization. Federal adjudicators maintain zero-tolerance policies regardless of state legal status.

- Criminal History: Florida DUI arrest rates exceed national averages, appearing in 4-7% of clearance investigations. Multiple DUIs or recent arrests significantly complicate adjudication. Battery charges from domestic incidents also appear frequently given Florida's mandatory arrest laws.

- Residency Verification Challenges: Florida's substantial seasonal population creates investigation complications. Snowbird residency patterns and extended foreign travel delay verification processes. Hurricane-driven relocations generate residence pattern questions requiring additional documentation.

Orlando government contractor screening should implement enhanced candidate pre-screening addressing these common issues to identify potential disqualifiers early. Pre-screening interviews should specifically address financial status, foreign contacts, substance use history, and criminal records before initiating formal e-QIP submissions.

Cost Analysis and Budgeting for Clearance Programs

Understanding comprehensive costs associated with Florida government contractor background check requirements enables accurate proposal development. Clearance-related expenses extend beyond investigation fees to encompass processing infrastructure, personnel time, compliance maintenance, and opportunity costs from clearance delays.

Florida contractors must develop sophisticated cost models accounting for clearance success rates, processing timelines, and ongoing maintenance obligations. These models directly impact competitive positioning, as clearance costs significantly affect labor rates and contract pricing strategies.

Direct Investigation and Processing Costs

DCSA charges standardized investigation fees based on clearance tier. As of 2025, costs are invoiced to sponsoring contractors through the Personnel Security and Assurance directorate. Standard investigation costs range from $230 for Tier 1 to $5,596 for Tier 5.

These direct costs represent only 15-25% of total clearance expenses for Jacksonville federal contractor compliance screening programs. Additional cost components include internal processing labor where FSO time averages 12-18 hours per clearance at fully-burdened rates of $75-125/hour. Candidate time investment represents 15-25 hours at their billing rate. Contractors often implement segregated work areas allowing uncleared personnel to perform unclassified work while awaiting final clearance.

Orlando government contractor screening programs should budget $6,500-12,000 total cost per Secret clearance and $12,000-22,000 per Top Secret clearance. These figures account for all direct and indirect expense categories.

Continuous Vetting and Maintenance Costs

The transition to Continuous Vetting creates ongoing cost obligations beyond traditional periodic reinvestigation models. While CV eliminates expensive reinvestigation fees for enrolled populations, it introduces technology, monitoring, and response costs. Florida contractors must budget these systematically.

CV program cost components include enrollment processing at $45 per enrolled clearance holder, annual monitoring costs of $85-150 per clearance holder, security infrastructure ranging from $25,000-150,000 initial investment, and response protocols consuming 4-8 hours per alert. Miami defense contractor background investigations transitioning to CV should anticipate 18-24 month payback periods. Long-term savings emerge after this initial period as ongoing monitoring costs remain substantially below periodic reinvestigation fees.

Proposal Development and Contract Pricing Strategies

Accurate clearance cost capture in government contract proposals requires sophisticated labor rate development. This accounts for security program overhead. Contractors must decide whether to treat clearance costs as direct charges or indirect overhead distributed across all contracts.

Most Florida contractors absorb clearance costs through overhead pools. Typical loading percentages range from 0.8-2.5% of total overhead depending on cleared workforce percentage. For Jacksonville federal contractor compliance screening costs, contractors should apply 12-18% rate premiums for Secret-cleared positions and 22-35% premiums for Top Secret positions.

Build 60-90 day delay buffers into contract start-up schedules for positions requiring new clearances. When proposing on recompete contracts, emphasize cleared incumbent workforce value. Tampa federal contractor background checks should be positioned as value-added investments demonstrating commitment to security excellence.

Best Practices for Florida Contractor Compliance Programs

Implementing comprehensive compliance programs addressing Florida government contractor background check requirements creates competitive advantages. These reduce security violations, audit findings, and clearance processing delays. Mature security programs demonstrate organizational commitment to protecting classified information and personnel security standards.

Leading Florida contractors implement systematic approaches covering policy development, training programs, continuous monitoring, and proactive risk management. These programs require dedicated resources but generate substantial returns through reduced compliance costs.

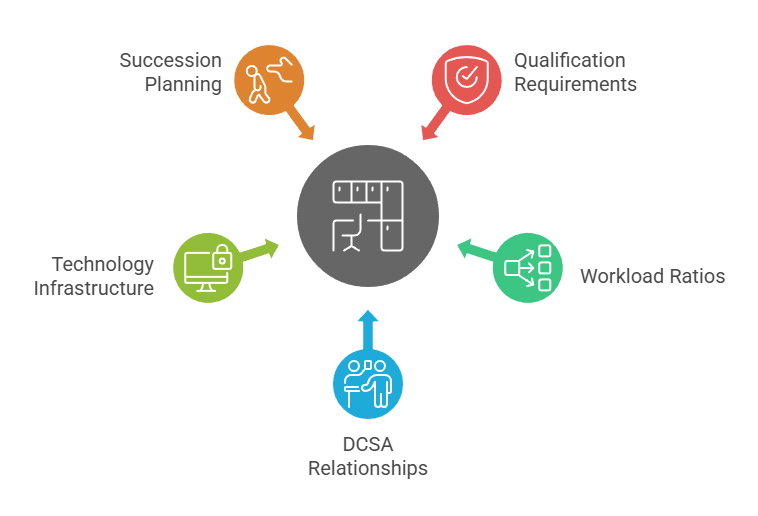

Facility Security Officer Program Development

Successful Jacksonville federal contractor compliance screening programs center on qualified, empowered Facility Security Officers supported by adequate resources and management commitment. The FSO role extends beyond administrative clearance processing to encompass comprehensive security program management, counterintelligence awareness, and organizational security culture development. Effective FSO programs in Florida incorporate multiple critical components that ensure program success.

Key FSO program elements include:

- Qualification Requirements: FSOs should maintain active Top Secret clearances regardless of facility classification to enable unrestricted communication with DCSA and cleared contractor colleagues

- Workload Ratios: Industry standards suggest 1.0 FTE FSO per 50-75 cleared employees for Secret facilities and 1.0 FTE per 35-50 cleared employees for Top Secret facilities

- DCSA Field Office Relationships: Tampa and Jacksonville FSOs should establish regular communication with local DCSA Industrial Security Representatives, scheduling quarterly coordination meetings

- Technology Infrastructure: Modern FSO programs require robust tools including case management systems, visit authorization databases, training administration platforms, and secure communication systems

- Succession Planning: Contractors should develop assistant FSO positions and cross-training programs preventing capability gaps during FSO transitions

Miami defense contractor background investigations benefit significantly from experienced FSO management, with data suggesting facilities with tenured FSOs (3+ years) experience 25-35% faster clearance processing. These facilities also show 40% fewer vulnerability assessment findings compared to facilities with frequent FSO turnover.

Insider Threat Program Implementation

NISPOM Rule 1-202 mandates insider threat programs for contractors with facility clearances, requiring systematic approaches to detecting, deterring, and mitigating threats from cleared personnel. Florida contractors must implement programs proportional to classification levels and contract sensitivity. Comprehensive insider threat programs incorporate multiple integrated components that work together to identify and address potential security risks.

Core insider threat program components include:

- Gathering and Integration: Centralized collection of security-relevant information from sources including security violations, workplace violence reports, foreign travel debriefs, suspicious contact reports, and financial disclosure anomalies

- Analysis and Monitoring: Designated insider threat personnel analyze gathered information against behavioral indicators of potential compromise, including physical security logs, IT system access patterns, and after-hours facility use

- Response Protocols: Documented procedures for escalating concerns through management chains, conducting enhanced monitoring, and implementing threat mitigation strategies while balancing security requirements with employee rights

- Training and Awareness: Initial and annual training programs educating cleared employees about insider threat indicators, reporting obligations, and organizational commitment to protecting classified information

- Florida-Specific Considerations: Enhanced monitoring of travel to countries with aggressive intelligence operations, financial stress indicators from high living costs, and unauthorized foreign contacts in diverse populations

Tampa federal contractor background checks should feed into insider threat databases enabling pattern analysis across multiple information sources. Orlando government contractor screening programs should implement graduated insider threat responses proportional to concern severity, ranging from enhanced training for minor issues to clearance suspension for serious violations.

Security Training and Culture Development

Beyond mandatory initial and refresher security training required by NISPOM, leading Florida contractors implement comprehensive security education programs fostering organizational cultures where security awareness becomes embedded in daily operations. These programs address specific threats relevant to Jacksonville federal contractor compliance screening environments. Effective security training programs create lasting behavioral changes rather than mere checkbox compliance.

Essential security training program elements include:

- Role-Based Curricula: Differentiated training addressing specific security responsibilities for executives, program managers, cleared employees, and FSOs with content tailored to each role's unique requirements

- Scenario-Based Learning: Florida-specific scenarios addressing realistic situations including foreign business partner security issues, social engineering attempts at industry conferences, and suspicious contacts during international travel

- Counterintelligence Awareness: Regular briefings on threat actor tactics, current targeting methods, and regional intelligence concerns emphasizing Chinese economic espionage, Russian intelligence operations, and Cuban intelligence presence

- Continuous Reinforcement: Brief security reminders through multiple channels including email campaigns, poster programs, staff meeting discussions, and annual security days featuring guest speakers from DCSA or FBI

- Measurement and Assessment: Regular testing of security knowledge through quizzes, practical exercises, and annual certification programs ensuring training effectiveness and knowledge retention

Tampa federal contractor background checks often identify candidates with prior military security experience, creating opportunities to leverage veteran populations as security culture champions. These veterans reinforce training concepts through peer influence and operational credibility that resonates with contractor workforces.Add to Conversation

Conclusion

Navigating Florida government contractor background check requirements demands comprehensive understanding of federal clearance tiers, regulatory frameworks, and state-specific compliance considerations. Success requires systematic approaches to clearance processing, cost management, and security program development that position contractors competitively. Florida's strategic military installation concentration and substantial cleared workforce create unique advantages for contractors willing to invest in mature personnel security programs. Implementing these compliance frameworks, best practices, and risk management strategies enables Florida contractors to build sustainable competitive advantages through security excellence.

Frequently Asked Questions

How long does it take to obtain a Secret clearance for Tampa federal contractor positions?

Secret clearance processing for Tampa federal contractor background checks currently averages 6-9 months from e-QIP submission to final adjudication. Timelines vary based on investigation complexity, candidate background factors, and current DCSA workload. Contractors can expedite processing by ensuring complete, accurate e-QIP submissions. Maintaining responsive communication with investigators during field work phases also helps.

What disqualifies candidates from obtaining Florida contractor security clearances?

Common disqualifiers include unmitigated financial problems such as recent bankruptcies and substantial delinquent debt. Unreported or concerning foreign contacts, recent illegal drug use, and serious criminal history also disqualify candidates. Dishonesty during the investigation process is particularly problematic. Many issues can be mitigated through demonstrated rehabilitation, financial counseling, and time passage since problematic conduct.

Do Orlando government contractors need facility clearances in addition to personnel clearances?

Yes, contractors accessing, storing, or handling classified information on-site must obtain facility clearances through DD Form 441 applications. Facility clearances require separate processing including security plan approvals, physical security inspections, and information system accreditations. This typically takes 6-12 months beyond personnel clearance timelines.

Can Jacksonville federal contractors hire candidates before clearance processing completes?

Contractors can hire candidates before final clearances adjudicate but must implement segregated work areas preventing classified information access. Some contracts allow interim clearances after favorable initial investigation phases, enabling earlier assignment to classified work. Interim eligibility varies by agency and classification level.

How do Miami defense contractors handle employees with foreign family members?

Foreign family members don't automatically disqualify clearance applicants but require detailed disclosure and enhanced investigation. Applicants must demonstrate that foreign relationships don't create unacceptable risks of foreign influence or coercion. This often involves documented reporting of contacts and travel patterns.

What costs should Florida contractors budget for Secret clearance processing?

Comprehensive costs including DCSA investigation fees, internal FSO processing time, candidate time investment, and infrastructure expenses total $6,500-12,000 per Secret clearance. Contractors should additionally budget for 1-3% clearance failure rates. Replacement candidate costs must also be included when forecasting total security program expenses.

Are Continuous Vetting programs mandatory for all Florida government contractors?

Continuous Vetting enrollment expanded to all Secret and Top Secret clearance holders during 2024-2025. This makes participation effectively mandatory for contractors with active clearances. CV replaces periodic reinvestigations with automated monitoring, creating ongoing alert response obligations but eliminating traditional reinvestigation costs.

How does Florida's medical marijuana law affect federal contractor clearances?

Federal clearance adjudication follows federal law exclusively, making marijuana use automatically disqualifying regardless of state legal status. Florida contractors cannot accommodate medical marijuana cardholders in cleared positions despite state employment protections. Federal drug-free workplace requirements and clearance eligibility standards override state law.

Additional Resources

- Defense Counterintelligence and Security Agency - Industrial Security Program

https://www.dcsa.mil/is/nispom/ - National Industrial Security Program Operating Manual (NISPOM) - 32 CFR Part 117

https://www.ecfr.gov/current/title-32/subtitle-A/chapter-I/subchapter-D/part-117 - Security Executive Agent Directive 4 - National Security Adjudicative Guidelines

https://www.dni.gov/files/NCSC/documents/Regulations/SEAD-4-Adjudicative-Guidelines-U.pdf - Defense Contract Audit Agency - Accounting and Compliance Guidance

https://www.dcaa.mil/ - Federal Acquisition Regulation (FAR) Part 31 - Contract Cost Principles

https://www.acquisition.gov/far/part-31 - Trusted Workforce 2.0 Initiative - Personnel Vetting Transformation

https://www.performance.gov/pma/workforce/tw2.0/

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.