Screening processes are crucial in the financial sector, where the stakes are high, and the margin for error is slim. Whether you're a business owner, HR professional, or recruiter, understanding the intricacies of financial sector screening can help you make informed decisions. Plus, for job seekers, knowing what to expect can give you an edge in the competitive job market. This guide will walk you through the importance, methods, and best practices for conducting thorough screenings in the financial sector.

Key Takeaways

- Thorough screening in the financial sector is essential for mitigating risks, ensuring regulatory compliance, and protecting an organization's reputation.

- Key components of effective financial screening include background checks, credit history checks, financial scrutiny, banking verification, and compliance checks.

- Adopting consistent and transparent screening practices, using reliable tools, and regularly updating protocols are crucial for effective screening processes.

- Legal compliance, including adherence to federal and state laws and respecting candidate rights, is a non-negotiable facet of ethical screening.

- A vigilant and contextual approach to screening helps in hiring trustworthy individuals, thereby safeguarding the organization's integrity and fostering a culture of accountability.

Introduction

Financial sector screening isn't just a box to tick; it's the backbone of trust and reliability in the industry. You see, when the stakes are high and the room for error is virtually non-existent, a solid screening process is your first line of defense. It shields you from potential fraud, keeps you compliant with a myriad of regulations, and protects your organization's hard-earned reputation.

This guide is designed for those who find themselves navigating the labyrinth of hiring and compliance in the financial sector. Whether you’re a business owner making pivotal decisions, an HR professional ensuring that your hires are bulletproof, or a recruiter sifting through stacks of resumes, this manual has got you covered. And if you’re a job seeker itching to break into the industry, understanding what goes on behind the curtain can give you that extra edge. Let's dive in.

EXPERT INSIGHT: In finance, every single hire is a high-stakes decision. I've seen firsthand how one mis-screened hire can snowball into damage to our reputation, regulatory headaches, or a loss of client trust. For that reason alone, I treat every background check, credit check, and compliance check not as a mere ceremony—but as a safeguard. We're not hiring resumes—we're hiring stewards of the financial well-being of our clients. In this line of work, trustworthiness is not a decision—it is the only decision. - Charm Paz, CHRP

Importance of Financial Sector Screening

In the financial sector, the margin for error is non-existent, making it imperative to screen potential hires thoroughly. Effective screening serves several critical functions:

Risk Mitigation

First and foremost, effective screening acts as a cornerstone of risk management. The financial sector is a high-stakes environment where errors can lead to catastrophic outcomes. Screening helps mitigate risks like fraud, money laundering, and non-compliance with industry regulations. By ensuring that only qualified, trustworthy individuals are brought on board, organizations can safeguard sensitive financial data and protect their assets. For instance, a misstep in hiring that allows a fraudster into the company can have devastating consequences, costing millions and tarnishing a company’s legacy.

Regulatory Compliance

The financial sector operates under a complex web of regulations and standards, such as those set by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). Adhering to these regulations isn't just a best practice—it's a legal necessity. Screening helps organizations comply with their regulatory requirements by ensuring that employees meet all necessary standards and possess the requisite credentials. This not only helps avoid hefty fines and legal consequences but also adds a layer of accountability and reliability to organizational operations. For further insights, you can consult resources from the Department of Labor and SHRM.

Protecting Reputation

A company’s reputation is its most valuable asset, particularly in the financial sector where trust is currency. Rigorous screening processes ensure that only individuals who align with the organizational values and possess unimpeachable integrity are hired. This not only helps in maintaining but also in enhancing the company's reputation. Clients, partners, and stakeholders can rest assured that the company is committed to maintaining high ethical standards. In an age where news about corporate malfeasance spreads like wildfire, a single bad hire can have far-reaching negative effects on a company’s reputation. Proactive screening can stave off these potential pitfalls and help in building long-term trust.

By emphasizing risk mitigation, regulatory compliance, and reputation protection, financial sector screening becomes a non-negotiable part of any robust hiring strategy. Thorough and effective screening processes are the first line of defense in cultivating a secure, compliant, and trustworthy financial institution.

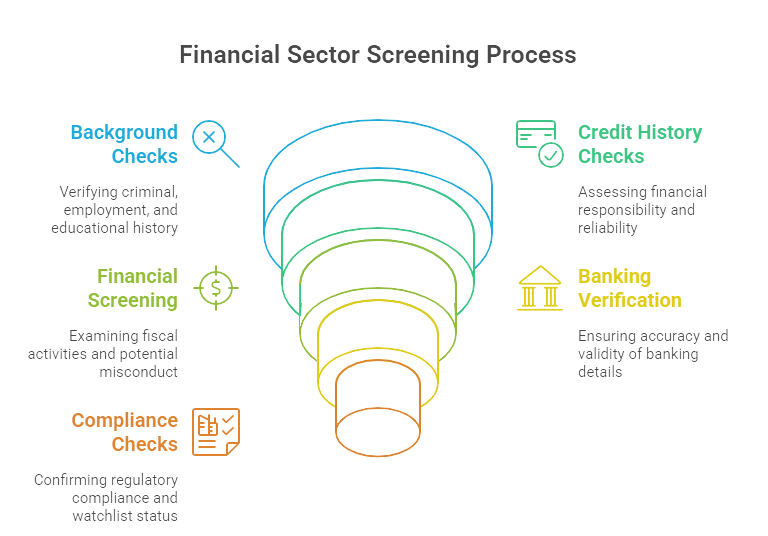

Key Components of Financial Sector Screening

When it comes to financial sector screening, precision is key. This section delves into the core components that make up a robust screening process. Here's what you need to be on the lookout for:

Background Checks

Background checks are the bedrock of financial screenings, covering various aspects like criminal history, employment verification, and educational background. Employers look for discrepancies in job history, criminal records, and false claims related to education. Red flags such as a history of fraud or inconsistent employment records can be deal-breakers. For more insights, Background Check Red Flags is an excellent resource.

Credit History Checks

In the financial sector, credit history goes beyond mere numbers. It reflects financial responsibility and reliability, making it a pivotal part of the screening process. A clean credit history suggests that the candidate manages their finances well, which is crucial for roles involving financial management or access to sensitive data. However, it’s vital to interpret the information with care; a few dings in credit history may not disqualify a great candidate but signal areas to probe during interviews.

Financial Screening

Financial screening zooms in on a candidate’s fiscal activities, such as investments, tax records, and any involvement in bankruptcies. This scrutiny helps identify if the candidate has been involved in any financial misconduct or unethical behavior. For instance, a long-standing unresolved debt could imply potential problems down the road, especially in a trust-centric industry.

Banking Verification

Banking verification is another crucial component, ensuring that the candidate's banking details are accurate and valid. This process often includes checking account histories, confirming bank statements, and ensuring there are no hidden accounts that could pose a compliance risk. It's essential for roles that involve direct management of company funds or client accounts.

Compliance Checks

Compliance checks are about ensuring candidates are not on any watchlists and that they meet all regulatory requirements. Key databases like OFAC (Office of Foreign Assets Control) and AML (Anti-Money Laundering) watchlists are indispensable tools for this step. Ensuring a candidate’s compliance with legal and regulatory standards not only protects your organization but also sustains industry integrity.

By covering these core areas, financial sector screenings become a robust filter that helps in hiring the most reliable and compliant individuals. Keep these components in check, and you’ll safeguard your organization from potential pitfalls and maintain a high standard of trust and reliability.

Steps to Conduct Effective Screening

When it comes to conducting effective screenings in the financial sector, a structured approach is your best ally. Follow these steps to ensure you're covering all bases.

Define Criteria

The first step is to establish clear and specific screening criteria tailored to the job roles and organizational needs. Not every role will have the same requirements, so it's crucial to understand what is essential for each position. Are you hiring for a senior financial analyst? A deep dive into financial history and compliance records might be necessary. For an entry-level position, background checks focusing on educational qualifications and employment history may suffice.

Gather Necessary Personal Information

Collecting the right personal information upfront can make or break your screening process. Be prepared to ask for:

- Full legal name and any aliases

- Social Security Number or equivalent identification

- Date of birth

- Residential history

- Employment and educational history

Having these details will streamline the screening and ensure accurate assessments.

Utilize Reliable Screening Tools

Accuracy is paramount in the financial sector. That's why using reputable and reliable screening tools is non-negotiable. Look for tools and services that have a proven track record in providing detailed and precise reports. Options include specialized financial sector screening services, background check agencies, and compliance-focused databases. Ensure these tools are up-to-date and compliant with current regulations.

Review and Analyze Results

After collecting the data, the next step is interpretation. Screening is not just about gathering information but making sense of it. Here are a few tips to help you interpret and analyze results effectively:

- Context Matters: A single red flag, like a poor credit score, shouldn't be a dealbreaker without understanding the context—maybe there's a valid reason behind it.

- Trends Over Time: Look for patterns or recurring issues rather than isolated incidents.

- Compliance Issues: Pay special attention to any compliance-related red flags, such as prior violations of financial regulations or involvement in fraudulent activities.

- Refer to Standards: Use your predefined criteria as a benchmark for decision-making.

By thoroughly reviewing and analyzing the results, you ensure you're making informed decisions that align with your organizational needs and compliance standards.

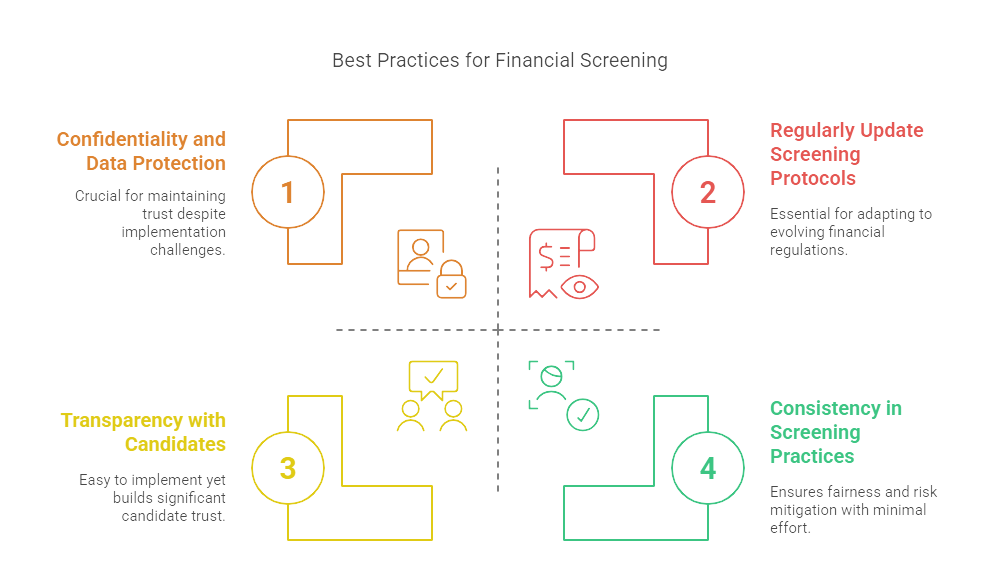

Best Practices for Screening in the Financial Sector

Transparency with Candidates

Open communication goes a long way. Let your candidates know upfront that a comprehensive screening process is part of your hiring protocol. This transparency builds trust and ensures that potential hires understand the importance you place on integrity and compliance in your organization.

Consistency in Screening Practices

One of the most important elements of an effective screening process is consistency. Apply the same rigorous standards and procedures to every candidate, regardless of the position they're applying for. This uniformity not only ensures fairness but also strengthens your organization's defense against risks like fraud and non-compliance.

Regularly Update Screening Protocols

The financial sector is fluid, with regulations and industry standards continually evolving. Make it a habit to review and update your screening practices regularly. Stay informed about new compliance requirements and adapt your processes accordingly to ensure your screenings remain relevant and effective.

Confidentiality and Data Protection

Protecting candidate information should be a top priority. Handle personal data with utmost confidentiality and ensure that your screening process complies with data protection regulations such as GDPR or CCPA. This not only safeguards individuals' privacy but also enhances your organization’s reputation for integrity and trustworthiness.

By integrating these best practices into your financial screening processes, you'll not only mitigate risk but also build a more secure and reputable organization. Remember, a vigilant and consistent approach today can prevent a multitude of problems tomorrow.

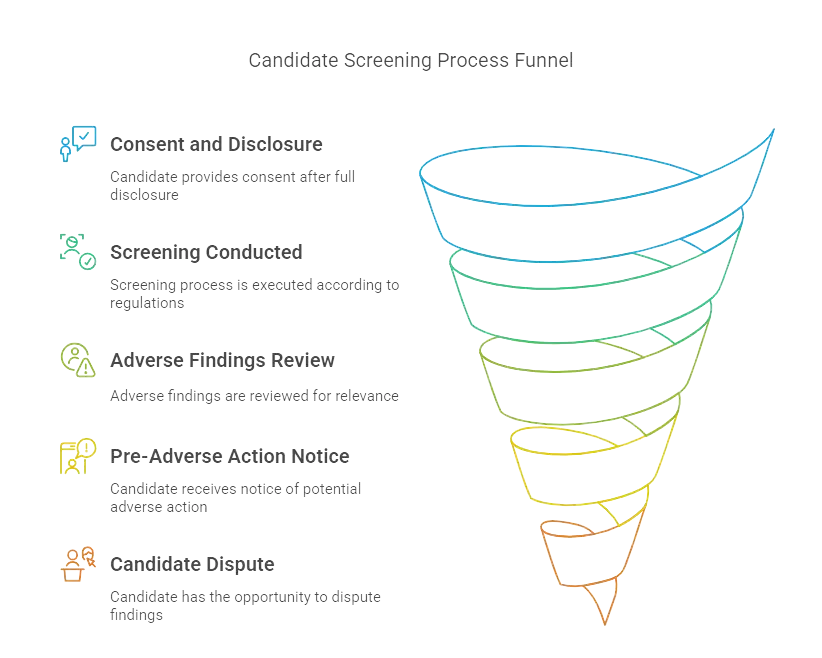

Legal Considerations

In the complex world of financial sector screening, navigating legal waters is non-negotiable. Federal and state laws set forth a framework that organizations must adhere to, ensuring both the protection of candidates' rights and the integrity of the screening process.

Federal and State Laws

First off, several pivotal regulations govern how screenings should be conducted. The Fair Credit Reporting Act (FCRA) is a cornerstone, emphasizing transparency and fairness by obligating employers to disclose screening processes and obtain written consent from candidates. Additionally, the Equal Employment Opportunity Commission (EEOC) guidelines prohibit discriminatory practices based on race, color, national origin, sex, or religion.

State laws, too, can impose their requirements. For instance, some states restrict the use of credit history in employment decisions unless it's demonstrably relevant to the job. Financial institutions operating in multiple states must juggle these variations to maintain compliance, and staying informed about local amendments is crucial.

Candidate Rights

Candidates possess clear rights in the screening process. Besides consenting after full disclosure, they are entitled to know the details of the checks being conducted. Should any adverse decisions stem from screening results, candidates must receive a pre-adverse action notice, a copy of the report, and a summary of their rights under the FCRA.

Moreover, candidates have the right to dispute inaccurate or misleading information. In response, the screening entity must investigate the dispute typically within 30 days. Transparency and open communication here are key to minimizing legal risks and enhancing trust in your screening procedures.

Handling Adverse Findings

Unearthing negative information during a candidate's screening is almost inevitable. The approach to handling such findings must be careful and compliant. Firstly, reevaluate the relevance of the adverse data to the role in question. For example, a minor misdemeanor might be less consequential compared to financial mismanagement for a banking position.

If the decision is to move forward with an adverse action, the candidate must be informed with specifics about the negative findings. This allows them the opportunity to dispute or explain the context, ensuring due process. In every step, written documentation is essential for accountability and legal defense should disputes escalate.

Navigating these legal considerations in financial sector screening requires diligence and a commitment to fair practices. By meticulously adhering to regulations and respecting candidate rights, you build a foundation of trust and legal compliance that fortifies your organization’s hiring protocols.

Case Studies and Examples

Real-world Scenarios

Let’s kick off with Megan, a recruiter at a mid-sized investment firm. Megan’s team recently screened a promising candidate, Jamie, for a senior analyst position. The background check revealed Jamie had a minor criminal record from a decade ago—an underage drinking charge. On digging deeper, the team found Jamie had since maintained a stellar professional track record and strong community involvement. They decided to prioritize recent achievements over past mistakes, and Jamie turned out to be an invaluable team member.

Another case involves an established bank conducting financial screenings for prospective employees. During a routine check, they discovered an applicant, Alex, had a long history of debt issues and missed payments. Given the role’s requirement for handling sensitive financial data, they decided to proceed with caution. An in-depth credit history review and an honest discussion with Alex revealed ongoing financial troubles, which ultimately made the bank choose a more suitable candidate.

Lessons Learned

Two core lessons emerge from these scenarios. First, a screening process isn’t just about uncovering red flags—it’s about context. Megan’s firm showed how revisiting a candidate's history with a balanced viewpoint can sometimes avoid losing out on top talent. On the flip side, Alex’s case underscores the importance of financial prudency when vetting candidates for fiscally-sensitive roles. Both scenarios highlight the essentials: screen thoroughly, weigh your findings with context, and align decisions with organizational risk tolerance.

Screening in the financial sector involves a mix of due diligence, judicious evaluation, and a measured approach to candidate histories, ensuring the right individuals are positioned to uphold your firm's values and integrity.

Frequently Asked Questions (FAQ)

What is financial sector screening?

Financial sector screening is a thorough process used to verify the background and qualifications of potential hires within financial institutions. This includes checking criminal records, employment history, educational credentials, credit history, and compliance with financial regulations. The goal is to ensure candidates are trustworthy and pose no risk to the organization or its clients.

Why is credit history important in financial screening?

In the financial sector, integrity and responsible handling of finances are paramount. A person's credit history provides a window into their financial behavior and reliability. Poor credit can indicate financial distress or irresponsible behavior, which might be a red flag in a role that requires handling sensitive financial information or large sums of money.

What should I do if my credit history is poor?

If your credit history is less than stellar, don't despair. Start by checking your credit report for errors and disputing any inaccuracies. Implement a plan to manage and improve your finances, such as paying down debt and avoiding new delinquencies. Being transparent about your financial situation and the steps you’re taking to improve it can also demonstrate integrity and responsibility to potential employers.

Are financial screenings the same for all financial sector jobs?

Not necessarily. The scope and depth of screenings can vary depending on the role. For example, positions involving high levels of financial authority or access to sensitive information may require more rigorous checks compared to entry-level roles. However, regulatory compliance standards will often dictate certain baseline screening requirements for all positions.

How often should financial screenings be conducted?

It's not a one-and-done deal. Regular financial screenings, often annually or semi-annually, help ensure ongoing compliance and integrity among employees. This is particularly important in a sector where a lapse in judgment or change in financial circumstances can have significant consequences.

By addressing these common questions, you can better prepare yourself for the screening process, whether you're conducting it or undergoing it. Understanding the why and how behind financial sector screening can provide clarity and confidence in navigating the hiring landscape.

Conclusion

Conducting screenings in the financial sector is a crucial step towards maintaining a trustworthy and compliant workplace. By understanding the various components and best practices, you can ensure that your screening processes are effective and aligned with the industry's high standards. Stay vigilant, stay compliant, and safeguard your organization’s integrity.

Summarizing the key takeaways: Invest in thorough screening methods to mitigate risks, ensure regulatory compliance, and protect your organization's reputation. Consistent and transparent practices, backed by reliable tools and updated protocols, are essential for effective screening processes. Adhering to legal guidelines and respecting candidate rights are also non-negotiable facets of ethical screening.

In closing, whether you’re a business owner, HR professional, or job seeker, make it a priority to remain informed and proactive in your approach to screening within the financial sector. This not only fortifies your organization but also fosters a culture of trust and accountability.

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.