Background check compliance training has become mission-critical for HR professionals as employment screening laws evolve rapidly across federal, state, and local jurisdictions in 2024. Non-compliance with FCRA, EEOC guidelines, and emerging state regulations can result in costly lawsuits, regulatory fines, and damaged employer brands.

Key Takeaways

- FCRA compliance training requires understanding disclosure requirements, adverse action procedures, and proper record retention practices to avoid federal violations.

- EEOC background check guidelines mandate individualized assessments considering job relevance, business necessity, and disparate impact on protected classes.

- Ban the box compliance varies significantly by state and municipality, with some jurisdictions prohibiting criminal history inquiries until conditional job offers.

- State-specific employment screening laws create complex compliance matrices requiring ongoing legal updates and jurisdiction-specific training modules.

- HR compliance training programs must include practical scenarios, documentation requirements, and escalation procedures for challenging screening situations.

- Regular compliance audits and quarterly legal updates help organizations maintain current practices and reduce litigation risks in employment screening.

Understanding Federal Background Check Compliance Requirements

The Fair Credit Reporting Act (FCRA) serves as the foundation for all employment screening compliance programs. This federal law, administered by the Federal Trade Commission and Consumer Financial Protection Bureau, establishes strict requirements for employers who use third-party background check companies. HR professionals must understand that FCRA compliance isn't optionalâviolations can result in statutory damages ranging from $100 to $1,000 per violation, plus attorney fees and punitive damages.

Furthermore, the Equal Employment Opportunity Commission adds another layer of complexity through its enforcement guidance on arrest and conviction records. The EEOC's Green factors require individualized assessments considering the nature of the offense, time elapsed, and job relevance. Consequently, HR teams cannot rely solely on automated screening decisions but must implement nuanced evaluation processes.

Additionally, federal compliance requirements create a baseline that applies across all jurisdictions. However, state and local laws often add more restrictive requirements that employers must follow. Therefore, effective background check compliance training must address both federal foundations and jurisdiction-specific variations to ensure comprehensive protection against legal violations.

FCRA Disclosure and Authorization Best Practices

Proper FCRA disclosures represent the most common compliance failure point for employers. The disclosure must appear on a standalone document without extraneous information like employment policies or general application language. Many organizations struggle with this requirement because they want to include additional legal protections or explanatory text.

| Disclosure Element | Required Content |

| Clear Header | "DISCLOSURE REGARDING BACKGROUND INVESTIGATION" |

| Plain Language | Avoid legal jargon and complex sentence structures |

| Specific Scope | Detail what types of background checks will be conducted |

| Consumer Rights | Include summary of rights under FCRA |

| Contact Information | Provide screening company details for candidate inquiries |

Authorization forms must be separate from disclosures and cannot include liability waivers or indemnification clauses. The Federal Trade Commission has specifically warned against combining authorizations with other employment documents.

Adverse Action Procedures and Timeline Compliance

The adverse action process requires precise timing and documentation to maintain FCRA compliance. Employers must provide pre-adverse action notices when they intend to take negative employment actions based on background check results. This notice must include a copy of the background report and the FTC's "Summary of Your Rights Under the Fair Credit Reporting Act."

After providing pre-adverse action notices, employers must wait a reasonable period, typically 3-5 business days, before taking final adverse action. This waiting period allows candidates to dispute inaccurate information or provide additional context. Meanwhile, final adverse action notices must include specific information about the screening company and candidate rights to dispute results.

EEOC Guidelines for Employment Screening Compliance

The Equal Employment Opportunity Commission's enforcement guidance creates a complex framework for evaluating criminal history in employment decisions. Published in 2012 and reinforced through subsequent enforcement actions, these guidelines require employers to demonstrate business necessity and job relevance when excluding candidates based on criminal records. HR compliance training must address both the legal requirements and practical implementation challenges.

Employment screening compliance becomes particularly challenging when organizations operate across multiple states with varying criminal history laws. Some jurisdictions completely prohibit certain types of criminal history inquiries, while others allow comprehensive background checks with specific procedural requirements. The EEOC has increased enforcement actions against employers with blanket exclusion policies. Recent settlements have exceeded $1 million, demonstrating the financial risks of non-compliance.

Moreover, HR professionals need training on individualized assessment procedures and documentation requirements to defend employment decisions. The three-factor analysis requires structured evaluation processes that consider the nature and gravity of the offense, time elapsed since conviction, and relevance to job duties. These assessments must be documented thoroughly to withstand regulatory scrutiny and potential litigation challenges.

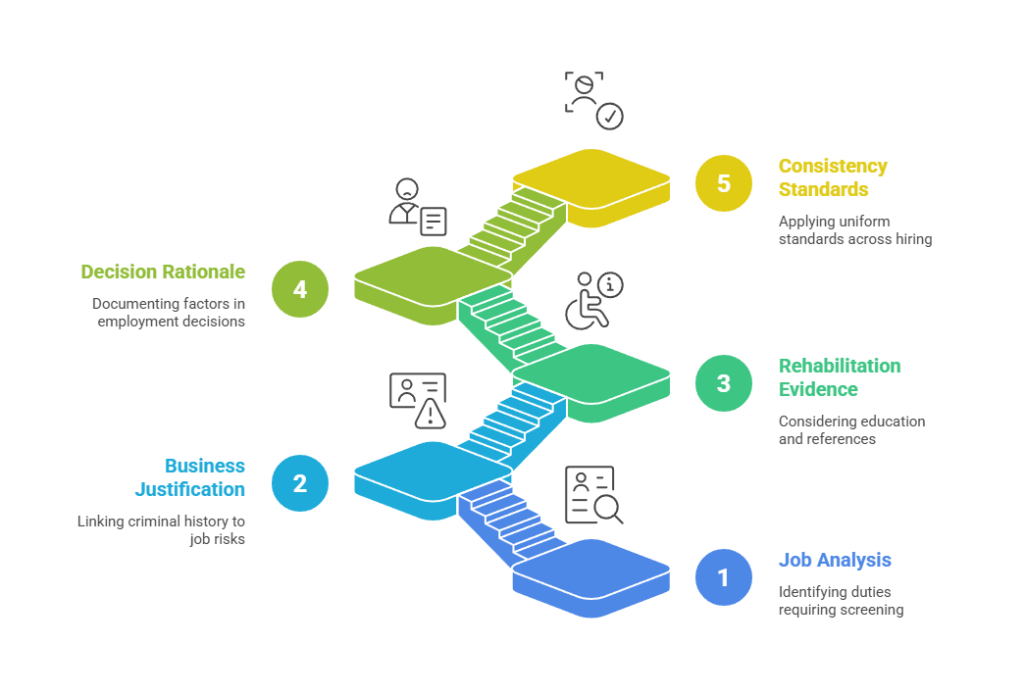

Implementing Individualized Assessment Procedures

Individualized assessments require structured processes that go beyond automated screening decisions. HR teams must evaluate each case considering job-specific factors, rehabilitation evidence, and business necessity justifications. This approach requires significant training and clear escalation procedures for complex situations.

- Job Analysis: Specific duties and responsibilities requiring background screening

- Business Justification: Clear connection between criminal history and job performance risks

- Rehabilitation Evidence: Consideration of education, employment history, and character references

- Decision Rationale: Written explanation of final employment decision factors

- Consistency Standards: Uniform application across hiring managers and locations

Many organizations struggle with consistency in individualized assessments. Training programs must include practical scenarios and decision-making frameworks to ensure uniform application across hiring managers and locations.

Green Factors Implementation Strategy

The Green factors provide a framework for legally defensible criminal history evaluations. However, implementation requires careful attention to documentation and business justification standards. HR teams must understand how to apply these factors consistently while avoiding discriminatory practices.

Nature and gravity assessments should focus on specific criminal conduct rather than broad categories. Time elapsed evaluations must consider rehabilitation evidence and demonstrate individualized review. Job relevance requires clear connections between criminal history and essential job functions rather than speculative concerns about character or trustworthiness.

State and Local Ban the Box Laws

Ban the box compliance represents one of the most complex areas of employment screening regulation. These laws, which now exist in over 35 states and 150+ municipalities, generally prohibit criminal history inquiries during initial application phases. However, the specific requirements, covered employers, and enforcement mechanisms vary significantly across jurisdictions. The complexity increases when considering local ordinances that may be more restrictive than state laws.

- California: Applies to employers with 5+ employees, prohibits inquiries until after conditional offer, penalties range $500-$1,000 per violation

- New York: Covers all employers, restricts inquiries until after conditional offer, penalties up to $1,000 per violation

- Illinois: Applies to employers with 15+ employees, allows inquiries during interview process, penalties range $500-$2,500 per violation

- Texas: Limited local ordinances in major cities, state-level protections for certain occupations only

- Florida: Preemption law prohibits local ban the box ordinances, limited state-level protections

Cities like San Francisco, Seattle, and Chicago have implemented comprehensive fair chance hiring requirements that exceed state-level protections. Organizations with multi-state operations need comprehensive compliance matrices to navigate these requirements effectively.

Multi-Jurisdiction Compliance Strategies

Managing ban the box compliance across multiple jurisdictions requires systematic approaches and regular legal updates. Many organizations implement the most restrictive standards across all locations to simplify compliance, though this approach may limit screening capabilities in more permissive jurisdictions. Technology solutions can help manage multi-jurisdiction compliance by automating timing restrictions and documentation requirements.

However, these systems require regular updates and careful configuration to address evolving legal requirements. Legal monitoring services provide quarterly updates on new legislation and enforcement actions affecting employment screening practices.

Timing Restriction Management

Effective compliance management requires clear protocols for when criminal history inquiries can occur. Some jurisdictions allow inquiries after initial interviews, while others prohibit questions until conditional job offers. Additionally, certain positions may have exemptions based on job duties or regulatory requirements.

HR teams need training on jurisdiction-specific timing rules and exception criteria. Documentation requirements also vary, with some locations requiring specific forms or notice language. Therefore, compliance training must address these procedural variations to prevent inadvertent violations during the hiring process.

Industry-Specific Compliance Considerations

Certain industries face additional background check compliance requirements beyond general FCRA and EEOC guidelines. Healthcare, financial services, transportation, and education sectors have specific regulatory frameworks that create unique training needs. HR professionals in these industries must understand both general employment screening laws and industry-specific requirements. These industry-specific requirements often have different timing, scope, and documentation requirements compared to standard employment screening.

Healthcare Sector Compliance Requirements

Healthcare employers face some of the most complex background check compliance requirements due to patient safety concerns and regulatory oversight. The Office of Inspector General exclusion list checking is mandatory for all healthcare employers receiving federal payments, while state-specific requirements add additional layers of complexity. Most healthcare background check programs include criminal history, professional license verification, OIG exclusion list checking, and state-specific abuse registry searches.

Some states require ongoing monitoring rather than point-in-time screening, creating continuous compliance obligations. Training programs must address both initial screening requirements and ongoing monitoring responsibilities. Additionally, healthcare employers must navigate CMS requirements, state health departments, and professional licensing boards in addition to standard employment law compliance.

Financial Services Regulatory Framework

Financial services employers must navigate FINRA requirements, state licensing obligations, and federal banking regulations when conducting background checks. The Secure and Fair Enforcement for Mortgage Licensing Act creates specific requirements for mortgage industry professionals, while traditional banking regulations address different risk factors. FINRA background investigations have specific disclosure requirements and ongoing update obligations that differ from standard employment screening.

| Regulatory Body | Coverage | Key Requirements |

| FINRA | Securities industry | Background investigations, ongoing monitoring |

| NMLS | Mortgage professionals | Criminal history, credit checks, continuous monitoring |

| FDIC | Insured banks | Section 19 prohibitions, character assessments |

HR professionals in financial services need specialized training on regulatory reporting requirements and their interaction with standard FCRA procedures. These requirements often override general employment screening timelines and procedures.

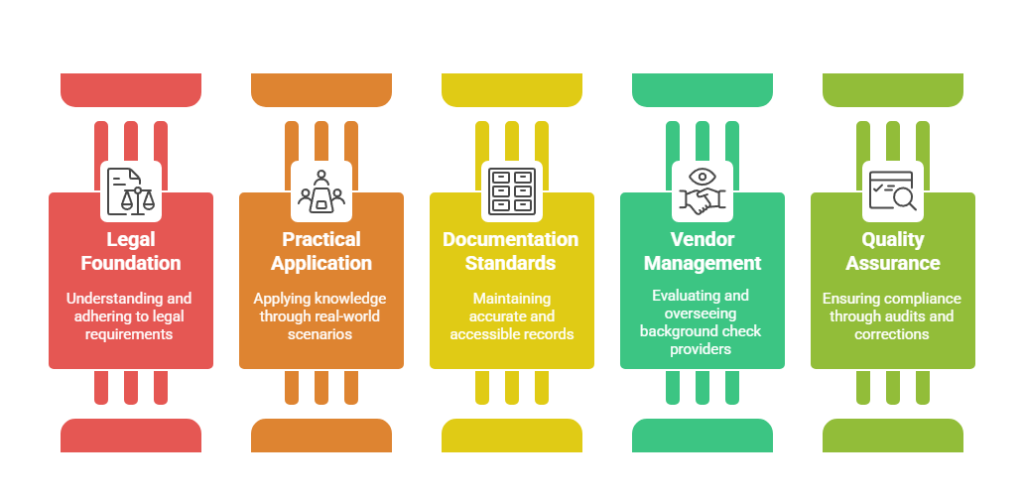

Building Effective Compliance Training Programs

Successful background check compliance training programs require ongoing education rather than one-time orientation sessions. The rapidly evolving legal landscape demands quarterly updates, practical scenario training, and clear escalation procedures for complex situations. Organizations must invest in comprehensive training infrastructure to maintain compliance across all hiring stakeholders. Training effectiveness requires measuring comprehension and practical application rather than simple completion rates.

Many organizations implement competency assessments and periodic refresher training to ensure ongoing compliance capability. The most effective HR compliance training programs include input from legal counsel, background screening vendors, and experienced HR practitioners. This collaborative approach ensures training content addresses both theoretical compliance requirements and practical implementation challenges. Modern compliance training increasingly leverages technology platforms that can deliver customized content based on employee roles, locations, and industry requirements.

Training Content Development Strategy

Effective compliance training content must balance legal accuracy with practical application. Legal updates should be translated into actionable guidance that HR professionals can implement immediately. Case studies and real-world scenarios help reinforce theoretical concepts and demonstrate proper decision-making processes.

- Legal Foundation Modules: FCRA requirements, EEOC guidelines, and applicable state laws

- Practical Application Scenarios: Real-world situations and decision-making frameworks

- Documentation Standards: Proper record-keeping and audit trail maintenance procedures

- Vendor Management Protocols: Background check provider evaluation and oversight procedures

- Quality Assurance Processes: Regular compliance audits and corrective action implementation

Training materials should be updated quarterly to reflect legal changes and enforcement trends. Additionally, role-specific training ensures that different stakeholders receive relevant guidance for their responsibilities.

Measuring Training Effectiveness

Effective compliance training measurement goes beyond completion tracking to assess actual behavior change and risk reduction. Organizations should implement pre- and post-training assessments, practical scenario evaluations, and ongoing compliance monitoring to measure program effectiveness. Regular training program evaluation helps identify gaps and opportunities for improvement.

Key performance indicators include compliance audit results, legal risk metrics, process efficiency measures, and stakeholder satisfaction scores. Many organizations conduct annual compliance training assessments that inform program updates and resource allocation decisions. Furthermore, correlation analysis between training participation and compliance outcomes helps demonstrate program value and identify improvement opportunities.

Technology Solutions for Compliance Management

Modern background check compliance increasingly relies on technology solutions that automate complex legal requirements and provide audit trails for regulatory reviews. Applicant tracking systems, compliance management platforms, and integrated screening solutions can significantly reduce manual compliance risks while improving process efficiency.

However, technology solutions require careful evaluation to ensure they address specific compliance requirements rather than generic workflow automation. HR professionals need training on system capabilities, limitations, and proper configuration for their specific legal requirements. The most sophisticated compliance technology platforms provide real-time legal updates, automated policy adjustments, and predictive analytics for compliance risk management.

Organizations should evaluate technology solutions based on their specific compliance needs rather than generic feature comparisons. A thorough vendor evaluation process should include legal review, pilot testing, and comprehensive implementation planning to ensure successful deployment. Additionally, ongoing vendor management ensures that technology solutions remain current with evolving legal requirements and organizational needs.

Platform Selection Criteria

Technology platform evaluation requires understanding both current compliance needs and future scalability requirements. Integration capabilities with existing HR systems affect implementation complexity and user adoption rates. Vendor stability and support capabilities impact long-term compliance effectiveness and cost management.

| Evaluation Factor | Key Considerations |

| FCRA Compliance | Automated disclosure delivery, adverse action timing, documentation retention |

| Multi-Jurisdiction Support | State and local law compliance across operational footprint |

| Integration Capabilities | Seamless workflow with existing HR systems and processes |

| Audit Trail Functions | Comprehensive documentation for compliance reviews and legal defense |

| Update Management | Regular legal updates and system configuration changes |

Vendor evaluation should include reference checks with similar organizations and pilot testing with realistic compliance scenarios. Implementation planning must address data migration, user training, and change management requirements.

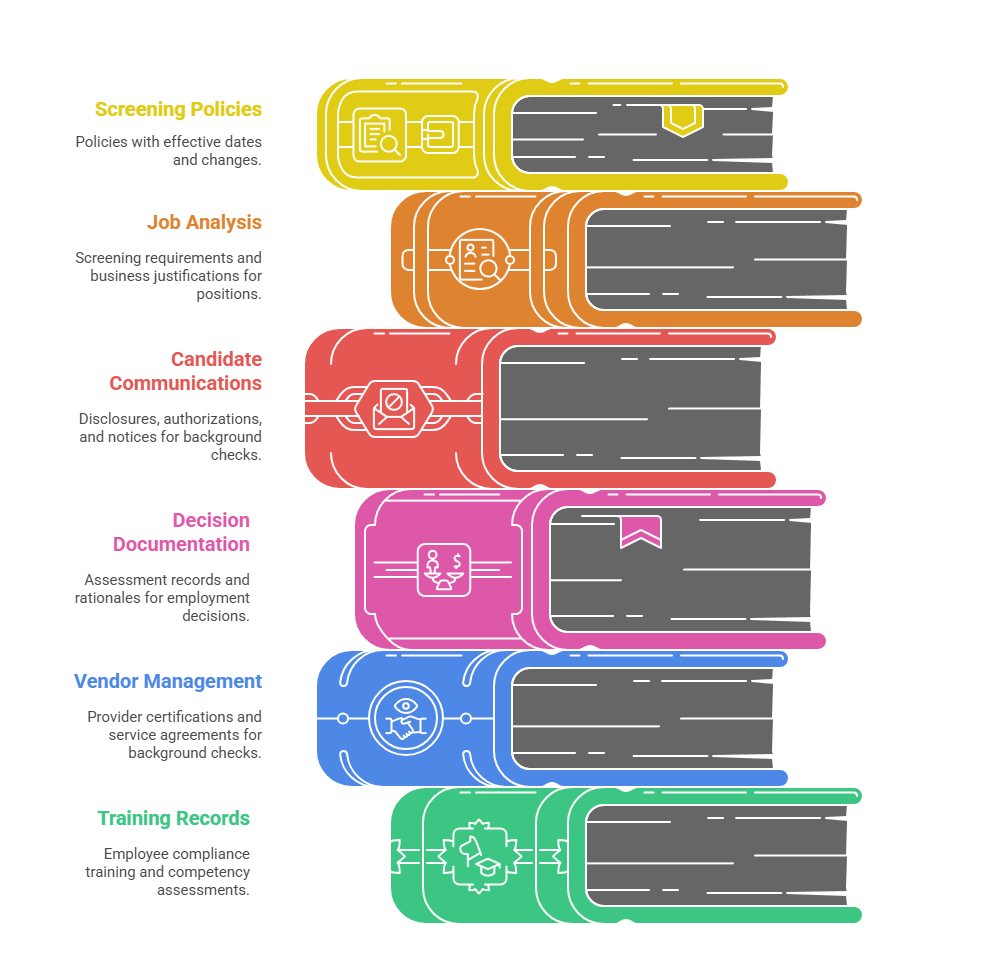

Documentation and Record Retention Requirements

Proper documentation serves as the foundation for defending employment screening decisions and demonstrating compliance with applicable laws. FCRA requires retention of background check documentation for specific periods, while EEOC background check guidelines emphasize the importance of documenting individualized assessment decisions. State and local laws may impose additional documentation requirements that exceed federal standards. HR compliance training must address both the content and retention requirements for employment screening documentation.

Record retention policies should specify what documents must be maintained, how long they must be kept, and who has access to sensitive information. Digital storage systems offer advantages for organization and retrieval, but they must include appropriate security measures and access controls. Additionally, documentation standards should address both successful hires and rejected candidates to ensure consistent compliance practices.

Audit preparation requires organized documentation that can be quickly retrieved and reviewed by regulatory agencies or legal counsel. Training programs should include practical exercises in documentation review and compliance assessment to prepare HR teams for potential audits or litigation discovery processes.

Essential Documentation Categories

Compliance documentation falls into several categories, each with specific retention requirements and legal significance. Job-related documentation must demonstrate the business necessity for background screening and the relevance of specific screening components to job duties. Candidate interaction records should include all communications regarding background checks, adverse action notices, and dispute resolution processes.

- Screening Policies and Procedures: Current versions and historical changes with effective dates

- Job Analysis Documentation: Position-specific screening requirements and business justifications

- Candidate Communications: All background check disclosures, authorizations, and notices

- Decision Documentation: Individualized assessment records and employment decision rationales

- Vendor Management Records: Background check provider certifications and service agreements

- Training Records: Employee compliance training completion and competency assessments

Documentation should be organized by employee and include clear dates and responsible parties. Electronic systems should include version control and audit trails to track document changes and access.

Vendor Management and Oversight Requirements

Background check compliance extends beyond internal processes to include oversight of third-party screening providers. FCRA requires that employers ensure their background check vendors maintain proper certifications and follow compliant procedures. Vendor management includes initial evaluation, ongoing monitoring, and regular performance assessments to maintain compliance standards. HR compliance training must address vendor oversight responsibilities and escalation procedures for compliance issues.

Vendor contracts should specify compliance requirements, service level agreements, and liability allocation for regulatory violations. Regular vendor assessments should evaluate compliance capabilities, accuracy standards, and customer service quality. Additionally, vendor management processes should include contingency planning for service disruptions or compliance failures that could impact hiring operations.

Due diligence requirements include verification of vendor FCRA compliance, data security measures, and insurance coverage for potential violations. Training programs should address vendor evaluation criteria and ongoing oversight procedures to ensure consistent compliance across all screening activities.

Vendor Evaluation Framework

Comprehensive vendor evaluation requires assessment of compliance capabilities, operational performance, and long-term stability. FCRA certification verification ensures that vendors understand their legal obligations and maintain appropriate procedures. Technology capabilities affect integration complexity and ongoing operational efficiency.

Service level agreements should specify turnaround times, accuracy standards, and dispute resolution procedures. Regular performance monitoring helps identify issues before they impact compliance or hiring effectiveness. Contract terms should address liability allocation, indemnification provisions, and termination procedures to protect organizational interests.

Conclusion

Background check compliance training represents a critical investment for modern HR organizations facing increasingly complex legal requirements. The intersection of federal FCRA regulations, EEOC enforcement guidance, and diverse state and local laws creates compliance challenges that require ongoing education and systematic approaches. Effective training programs must address both theoretical legal requirements and practical implementation strategies while accommodating industry-specific needs and multi-jurisdiction operations. Organizations that invest in comprehensive compliance training, supported by appropriate technology solutions and regular legal updates, can significantly reduce litigation risks while maintaining effective employment screening programs.

Frequently Asked Questions

What are the most common FCRA compliance mistakes in background check procedures?

The most frequent FCRA violations include combining disclosures with other employment documents, failing to provide proper pre-adverse action notices, and inadequate record retention practices. Many employers also struggle with timing requirements for adverse action procedures and proper vendor management oversight.

How often should HR teams receive background check compliance training updates?

HR professionals should receive quarterly compliance updates due to the rapidly evolving nature of employment screening laws. Annual comprehensive training should be supplemented with immediate updates when significant legal changes occur in operational jurisdictions.

Do small employers have different background check compliance requirements than large corporations?

While FCRA requirements apply to all employers using third-party screening companies regardless of size, many state and local ban the box laws have employee count thresholds. Small employers must still comply with applicable laws but may have fewer regulatory obligations in some jurisdictions.

What documentation is required to demonstrate individualized assessment compliance under EEOC guidelines?

Employers should maintain job analyses connecting background screening to specific job duties, written rationales for employment decisions, evidence of rehabilitation consideration, and documentation of any candidate interactions regarding criminal history. This documentation is essential for defending employment decisions in EEOC investigations.

How do industry-specific background check requirements interact with general employment screening laws?

Industry-specific requirements typically add additional screening elements and regulatory oversight rather than replacing general employment law compliance. Healthcare, financial services, and other regulated industries must comply with both standard FCRA/EEOC requirements and their specific regulatory frameworks.

What are the financial penalties for background check compliance violations?

FCRA violations can result in statutory damages of $100-$1,000 per violation plus attorney fees and punitive damages. EEOC settlements often exceed $1 million for systemic violations, while state and local penalties vary by jurisdiction but can include fines of $500-$2,500 per violation.

Additional Resources

GCheck Editorial Team

Meet the GCheck Editorial Team, your trusted source for insightful and up-to-date information in the world of employment background checks. Committed to delivering the latest trends, best practices, and industry insights, our team is dedicated to keeping you informed.

With a passion for ensuring accuracy, compliance, and efficiency in background screening, we are your go-to experts in the field. Stay tuned for our comprehensive articles, guides, and analysis, designed to empower businesses and individuals with the knowledge they need to make informed decisions.

At GCheck, we're here to guide you through the complexities of background checks, every step of the way.